JAPAN NRG

WEEKLY

FEBRUARY

8

, 2021

JAPAN NRG

WEEKLY

February 8, 2021

NEWS

TOP

- Japan Govt. to put ¥1 trillion into battery development; Toyota’s doubts about EV future is all bluff – it’s ready to go electric

- OPINION: What was behind the energy crisis? Not the cold snap or solar panels; Business model of new electricity retailers blamed for crisis; METI to bail out retailers; Minister in charge of reforms pushes METI to improve power market info transparency

- FGE’s Feshariki tells forum: 2024-28 will be golden age for oil

ENERGY TRANSITION & POLICY

- NEDO to run government’s ¥2 trillion Green Innovation Fund

- TEPCO joins European trial of floating wind farm for know-how

- Group develops tech to ship hydrogen at room temperature

- Funds, consultants vie for ¥3 quadrillion green market

- Diesel engines are not evil – their role in energy transition

- Hitachi Zosen, JAXA to trial lithium battery in space

- ENEOS, partners to develop waste heat capture and generation

- Blind spots plague hydrogen policy: shortage of young brains

- 350,000 Japan homes to have batteries by 2030 … [MORE]

ELECTRICITY MARKETS

- Japan to ease rules for buying green power certificates

- Incumbent utilities are losing grip on industry, but still play METI’s nuclear energy games

- METI minister confirms commitment to nuclear power and lends support to Takahama city for reactor restart promotion

- Work begins to remove deformed Fukushima fuel rods; TEPCO starts building reactor coffin; Waste issue around the site

- Osaka Gas and ENEOS plan new wind farm projects … [MORE]

OIL, GAS & MINING

- Mitsubishi, Mitsui say LNG has a future despite transition

- LNG price weakens as shortages ease

- Sumitomo sells out of U.S. oil sector

- INPEX buys Exxon stake in Gulf of Mexico; accident at Ichthys

ANALYSIS

HIGH COSTS AND GEOGRAPHY HINDER

JAPAN’S CARBON CAPTURE TECH AMBITIONS

In a bid to realize carbon neutrality by 2050, Japan’s Green Growth Strategy spelled out highly ambitious targets in the field of Carbon Capture and Storage (CCS), describing the technology as a game-changer. The Strategy even laid out a vision of gaining 30% of the global CCS market, which may be worth ¥10 trillion ($95.5 billion) by mid-century. The introduction of CCS would help allay the government’s unease with making Japan too reliant on renewable energy. Such concerns grew this January. But what is the current status of this technology and when will it be applied?

HYDRO, GEOTHERMAL, AND BIOMASS TO BE

MOVED INTO THE NEW FIP PRICING SCHEME

Hydro, geothermal and biomass power sources are able to move to the new Feed-in-Premium (FIP) electricity pricing scheme from April 2022, according to a key expert panel advising METI. The shift to FIP indicates that the levelized cost of production from those sources is starting to drop in Japan and, in some cases, approach spot market prices. The change will also prove to be a divisive moment in renewables, making it harder for the small operators to survive.

GLOBAL VIEW

Daily wind power generation in the U.S. hit an all-time high of 17% of the total and the country added record wind capacity – as did China. South Korea plans to build an 8.2 GW wind farm. Oil consumption is due to hit pre-Covid levels by August. U.S. rare earths firm plans to list.

EVENT REVIEW

The Renewable Energy Institute held its annual summit.

2021 EVENT CALENDAR

Industry / political events related to Japan energy.

DATA Gas, power, and oil stats

JAPAN NRG WEEKLY

PUBLISHER

K. K. Yuri Group

Editorial Team

Yuriy Humber (Editor-in-Chief)

Tom O’Sullivan (Japan, Middle East, Africa)

John Varoli (Americas)

Regular Contributors

Mayumi Watanabe (Japan)

Daniel Shulman (Japan)

Damon Evans (Indonesia)

Art & Design

22 Graphics Inc.

Sponsored

SUBSCRIPTIONS & ADVERTISING

Japan NRG offers individual, corporate and academic subscription plans. Basic details are our website or write to subscriptions@japan-nrg.com

For marketing, advertising, or collaboration opportunities, contact sales@japan-nrg.com For all other inquiries, write to info@japan-nrg.com

Disclaimer

This communication has been prepared for information purposes only, is confidential and may be legally privileged. This is a subscription-only service and is directed at those who have expressly asked K.K. Yuri Group or one of its representatives to be added to the mailing list. This document may not be onwardly circulated or reproduced without prior written consent from Yuri Group, which retains all copyright to the content of this report.

Yuri Group is not registered as an investment advisor in any jurisdiction. Our research and all the content express our opinions, which are generally based on available public information, field studies and own analysis. Content is limited to general comment upon general political, economic and market issues, asset classes and types of investments. The report and all of its content does not constitute a recommendation or solicitation to buy, sell, subscribe for or underwrite any product or physical commodity, or a financial instrument.

The information contained in this report is obtained from sources believed to be reliable and in good faith. No representation or warranty is made that it is accurate or complete. Opinions and views expressed are subject to change without notice, as are prices and availability, which are indicative only. There is no obligation to notify recipients of any changes to this data or to do so in the future. No responsibility is accepted for the use of or reliance on the information provided. In no circumstances will Yuri Group be liable for any indirect or direct loss, or consequential loss or damages arising from the use of, any inability to use, or any inaccuracy in the information.

K.K. Yuri Group: Oonoya Building 8F, Yotsuya 1-18, Shinjuku-ku, Tokyo, Japan, 160-0004.

NEWS:

ENERGY TRANSITION & POLICY

Government could plough ¥1 trillion into battery development

(Diamond Online, Feb. 1)

- Amid a global shift to a zero-carbon economy, METI is considering providing grants in the order of ¥1 trillion to the likes of Toyota and Panasonic to develop batteries for electric vehicles.

- This is ¥ to ensure Japanese battery technology remains competitive internationally, thus avoiding a repeat of the misfortune suffered by Japan’s semiconductor industry.

- METI now views a global shift to electric vehicles as unavoidable, and is concerned that Japanese battery manufacturers are lagging behind their Chinese and South Korean counterparts.

- For their part, Japan’s manufacturers have demanded the government fully fund the cost of manufacturing facilities, saying this is essential if they are to compete with Tesla and their highly subsidized Chinese and European rivals.

- The grants will be paid out of the government’s Green Innovation Fund.

- Grant recipients include Prime Planet Energy and Solutions, a joint venture between Toyota and Panasonic dedicated to battery manufacture.

- SIDE DEVELOPMENT:

- Toyota’s doubts about EV future is bluff and bluster: It’s ready to go electric

- (FACTA, February 2021 edition)

- About 8% of all workers in Japan are involved in the automobile industry. If the EV shift speeds up, it will change the employment structures and will lead to a lot of job losses.

- Although Toyota shows concerns, the company is desperate to secure its own survival. Toyota is preparing for a massive shift to EVs. It has delayed a full commercialization for now due to low profit rates in EVs and not having infrastructure in place, but the company is building up cash and staff for the transition.

- Toyota believes it can easily transform its HV technologies to EV.

NEDO to run government’s ¥2 trillion Green Innovation Fund

(Japan NRG, Feb. 4)

- Japan’s New Energy and Industrial Technology Development Organization (NEDO) will be put in charge of operating the ¥2 trillion Green Innovation Fund from March, according to an update on the government website. NEDO is updating its internal functions this month to allow it to run the fund.

- The fund is one of the centerpieces of Prime Minister Suga’s government climate change action policy, and it will provide financial support to the private sector to help develop decarbonization technologies, especially in the fields of carbon-neutral generation, hydrogen, and carbon capture and recycling.

- The fund was included in the third supplementary budget for the fiscal year ending in March, which the parliament approved on Jan. 28. Once the budget is approved, possibly by the end of March, NEDO will set up guidelines for evaluating which projects it will finance. Applicants are expected to provide plans on how they’ll address the performance levels of their technology, target market prices, and commercial production goals.

- NEDO plans to provide funding for up to 10 years.

Tepco joins Scandinavian trial to bring floating wind farms to Japan

(Asia Nikkei, Feb. 5)

- Tokyo Electric Power Renewables (RP), a unit of Tepco Holdings, said Feb. 4 that it will take part in a demonstration project for a floating offshore wind farm in Scandinavia.

- Tepco RP took a 30% stake in the project via an investment in Danish project developer TetraSpar Demonstrator. It’s now the No.2 shareholder after Shell. The investment amount is not disclosed. RWE is another investor in the project.

- The floating structure, consisting of steel pipes and a suspension keel, will be anchored roughly 10km off the coast of Norway. The floating structure does not require welding for assembly, is easy to set up and cost-competitive. A 3.6-megawatt wind turbine will be mounted on the structure this summer.

- CONTEXT: TEPCO seeks to build similar facilities in Japan in the late 2020s and this is a chance to learn the trade elsewhere.

TAKEAWAY: Japan’s waters are known to be deeper than offshore wind areas utilized in Europe, which makes similar developments around Japan costly and more technologically challenging. Floating wind technology is seen as a long-term answer, though the Japanese government’s Green Energy Strategy does not envisage floating wind becoming a part of the nation’s energy mix until the 2040s. The Denmark project may suggest that the govt.’s timeline is conservative.

Government to set a consumption target of 3 million tons of ammonia by 2030

(Nikkei Shimbun, Feb. 7)

- The 3m tons target by 2030 is created to push ammonia use in power generation, in addition to the fertilizer industry that uses the gas. Ammonia does not emit carbon when burned.

- The ammonia target will be announced at a public-private council on Feb. 8, with manu companies set to attend.

- CONTEXT: Japan plans initially to use ammonia as a second fuel in coal-fired power plants, with 20% of the fuel mix given to the gas.

- JERA plans to start trialing ammonia-fired generation at a coal plant in Aichi prefecture from FY2021 (which starts in April.)

- Japan plans to import most of its ammonia needs. It imported blue ammonia from Saudi Aramco last year and signed an accord with UAE in January to do the same.

TAKEAWAY: Ammonia is 30% more expensive than LNG and 50% more expensive than coal. Japan hopes that higher import volumes will help to push down the cost of ammonia level with LNG by 2030.

Chiyoda-led group develops technology to transport hydrogen at room temperature

(Nikkei, Feb 1)

- Engineering firm Chiyoda Corp, together with shipper Nippon Yusen, and trading houses Mitsubishi Corp. and Mitsui & Co., are due to start a feasibility study for technology that can transport hydrogen at ambient temperature and pressure.

- The technology centers on combining hydrogen with toluene to form a compound known as MCH (methylcyclohexane). This compound can be stored for two years and carried by oil tankers.

- The group hopes to bring the technology to market by the mid-2020s, helping to deliver the fuel to power plants and chemical production facilities.

- The group is part of a consortium known as the Advanced Hydrogen Energy Chain Association for Technology Development.

- Chiyoda and Mitsubishi also have MoUs with five Singapore companies to commercialize the technologies locally by 2030.

- CONTEXT: The ability to transport hydrogen without freezing it to less than -250 degrees Celsius would greatly speed up the adoption of the fuel, at least in power generation.

TAKEAWAY: The Japanese group has been testing MCH as a carrier for hydrogen for about a year with trial shipments of MCH coming from Brunei. The delivered hydrogen was then tested in gas turbines in Japan. While this seems like a breakthrough, the use of MCH as a carrier has been known about for some time, and the real breakthrough will be in the economics of the scheme. The challenge for the Chiyoda-led group will be to show that ships carrying mostly toluene and some hydrogen are not expending more energy in transit than they’re delivering.

Investment funds, consultants vie for ¥3 quadrillion green market

(Diamond Online, Feb. 1)

- As corporations plough surpluses and state subsidies into initiatives aimed at achieving social development goals and improving their environmental and social governance, an enormous new market has emerged, and “green” consultants are keen for a piece of the action.

- Consultants are charging as much as ¥20 million to assess a corporation’s ESG scores.

- The boom is in part the result of the Japanese government’s pledge to become carbon neutral by 2050.

Diesel engines are not evil and have a big role to play in energy transition

(FACTA, February 2021 edition)

- The article argues that it does not make sense to move all transport to EV and it’s worth considering diesel engines as part of the solution. Especially, this is the case for agricultural machinery and trucks.

- The scandal around Volkswagen caused distrust in diesel. However, diesel engines have a higher thermal efficiency (30-34%) than gasoline ones (24-28%), and would be more efficient than EVs, especially if deployed in tandem with hybrid technology. Bio-diesel, or diesel and methane combinations in which methane is the primary fuel and diesel is a backup, could play a key role in lowering emissions for the heavy machinery sector.

- According to Japan Automobile Manufacturers Association, or JAMA, if Japan’s 62 million domestic passenger cars were all switched to EV, demand for power capacity would jump by 10 GW, or the equivalent of about 10 regular nuclear reactors.

Hitachi Zosen sign contract with Japan’s JAXA to use lithium battery in space

(New Business News, Feb. 2)

- Hitachi Zosen signed a joint research agreement with the Japan Aerospace Exploration Agency (JAXA) on a demonstration experiment for the world’s first practical application of an all-solid-state lithium-ion battery (LIB) in space.

- The two will develop a battery that will go up to the International Space Station (ISS) from autumn 2021 and undergo tests for half a year. Future use of the battery will be on lunar and Mars probes.

- Hitachi Zosen’s battery prototype was developed in 2016 and JAXA has worked with the company since then. The current battery size is 65mm × 52mm × 2.7 mm; its weight is 25g, and capacity – 140mAh. The power supply from a 15-cell parallel connection is 2.1 AH. It can operate stably even in an environment of -40° C to 120° C.

ENEOS partners with E-thermo and JX Nippon Oil & Gas on waste heat capture

(Kabushiki Shimbun, Feb. 3)

- ENEOS Holdings said on Feb. 2 that it had signed an agreement with Kyoto-based E-thermotech and JX Nippon Oil & Gas Exploration regarding joint development of a system for generating electricity from waste heat.

- The technology will put waste heat generated at factories to good use by converting it into electricity that can be used onsite.

- The system offers not only traditional, flat heat-capture modules but also curved modules which can be fitted directly to heat pipes. This allows it to capture the difference between hot piping and outdoor temperatures.

- Waste heat capture systems contrasts with solar generation systems in that they tend to generate the most electricity at night and in winter. Initial tests of the system will take place at the Nakajo oil works.

Blind spots plague hydrogen policy as shortage of young engineers bites

(Toyo Keizai Plus, Feb. 6)

- Yamanashi is a major hub for Japanese fuel cell development, characterized by tie-ups between industry and academia.

- The involvement of the University of Yamanashi has been credited with helping manufacturers like Toyota greatly improve the durability and cost-effectiveness of their automotive fuel cells.

- However, the number of students who study fuel cell technology to doctoral level has started declining, and is projected to fall further in the near future.

- The decline is attributed to a lack of job security at the Fuel Cell Nanomaterials Center, a dedicated research institution at the University. Students are reluctant to move into fields with poor job prospects.

- In 2018, the University unveiled a hydrogen energy roadmap that aims to grow Yamanashi’s hydrogen and fuel cell sector into a ¥100 billion industry employing 5,000 people by 2030. So far, however, only 55 local companies have joined the initiative, far short of the target of 200.

METI wants cheaper power storage as 350,000 homes expected to have battery by 2030

(Denki Shimbun, Feb 3)

- The ANRE released its report on household power storage systems on Feb. 2. The Agency forecasts that by 2030 nearly 350,000 Japanese households will have storage batteries.

- These batteries remain expensive, however. The Agency says it will implement initiatives to reduce the cost to the consumer, including the repurposing of electric vehicle batteries for use in household units.

- The Agency says it will also work on reducing retail margins and installation costs.

TAKEAWAY: At this point, it still seems optimistic to consider that households covering close to 1% of the population will have power storage within 10 years. And yet, development in batteries, as highlighted in other news items, is coming faster than forecast and the switch to renewables and power storage could come all at once. In fact, by 2040, Japan may have renewables account for 70% of its installed power capacity, according to estimates from Rystad Energy. While renewable energy has traditionally suffered from low utilization rates due to its intermittency, if the battery storage side of the equation moves quickly, Rystad’s estimate will mean that well over 50% of the country’s electricity will also be coming from renewable sources by 2040.

Mitsubishi Heavy restructures turbine operation, focuses on marketing

(Nikkei, Feb. 1)

- Mitsubishi Heavy Industries said on Feb. 1 that it had established a new joint venture with Danish wind giant Vestas that would market wind turbines to Japanese and Asian markets.

- Mitsubishi holds the majority stake in the new entity, with Vestas contributing 30% of equity.

- Previously, Mitsubishi and Vestas manufactured and marketed turbines via a 50/50 joint venture, but Mitsubishi divested its stake in December, deciding it wanted to concentrate on marketing rather than manufacture.

- SIDE DEVELOPMENT

Mitsubishi wins contract for 30 MW geothermal power plant in Indonesia - (New Energy Business News, Feb. 5)

- Mitsubishi Heavy Industry, Mitsubishi Power, and Italian-based Turboden have won a contract to construct a 30MW binary-cycle geothermal power station in Palayan, Indonesia.

- The power station will enable Indonesia to reduce its annual CO2 emissions by 72,000 metric tons. A portion of these carbon credits can be claimed by Japan

J-Power to produce hydrogen from lignite

(New Energy Business News, Feb. 4)

- J-Power has begun evaluating the logistics of extracting hydrogen from Australian lignite and then transporting it to Japan.

- In an initiative sponsored by NEDO and the Australian government, HySTRA (the CO2-Free Hydrogen Energy Supply Chain Technology Research Association) will join forces with an Australian consortium to explore the feasibility of building an Australia-Japan hydrogen supply chain.

- J-Power is a stakeholder in both HySTRA and the Australian consortium.

- The goal is to ultimately capture and store the CO2 generated during hydrogen collection to make the process carbon neutral.

INPEX begins testing of a solar-powered hydrogen production facility in Australia

(Company statement, Jan. 27)

- INPEX built a solar hydrogen production test facility in Darwin in the Northern Territory of Australia, and begun its performance validation.

- This initiative is a segment of the Japan Technological Research Association of Artificial Photosynthetic Chemical Process (ARPChem), a project sanctioned by Japan’s New Energy and Industrial Technology Development Organization (NEDO) in which the company has been participating since 2012.

- INPEX completed the installation of the panels and commenced performance validation tests in December 2020. The tests are scheduled to run until December 2021 and their results are expected to contribute to the scaling up of the facility.

Teijin ties up with UK fuel cell maker, IE, to sell products in Japan

(New Business News, Feb. 3)

- Teijin signed a sales agency contract for Japan with UK fuel cell manufacturer, “Intelligent Energy”. The two see potential Japan sales of ¥1 billion a year by 2030, catering to the ITC, construction and manufacturing industries.

- Japan Filcon is already conducting demonstration tests of IE’s hydrogen fuel cells, which have outputs of 1.2kW, 2.5kW, and 4.0kW. The weight of each unit is as little as 10 to 20 kg, and they are highly compact, which means they can be used together with power generation equipment.

NEWS:

POWER MARKETS

|

No. of operable nuclear reactors |

33 | |||

|

of which |

applied for restart |

25 | ||

|

approved by regulator |

16 | |||

|

restarted |

9 | |||

|

in operation today |

4 | |||

|

|

able to use MOX fuel |

4 | ||

|

No. of nuclear reactors under construction |

3 | |||

|

No. of reactors slated for decommissioning |

27 | |||

|

of which |

completed work |

1 | ||

|

started process |

4 | |||

|

|

yet to start / not known |

22 | ||

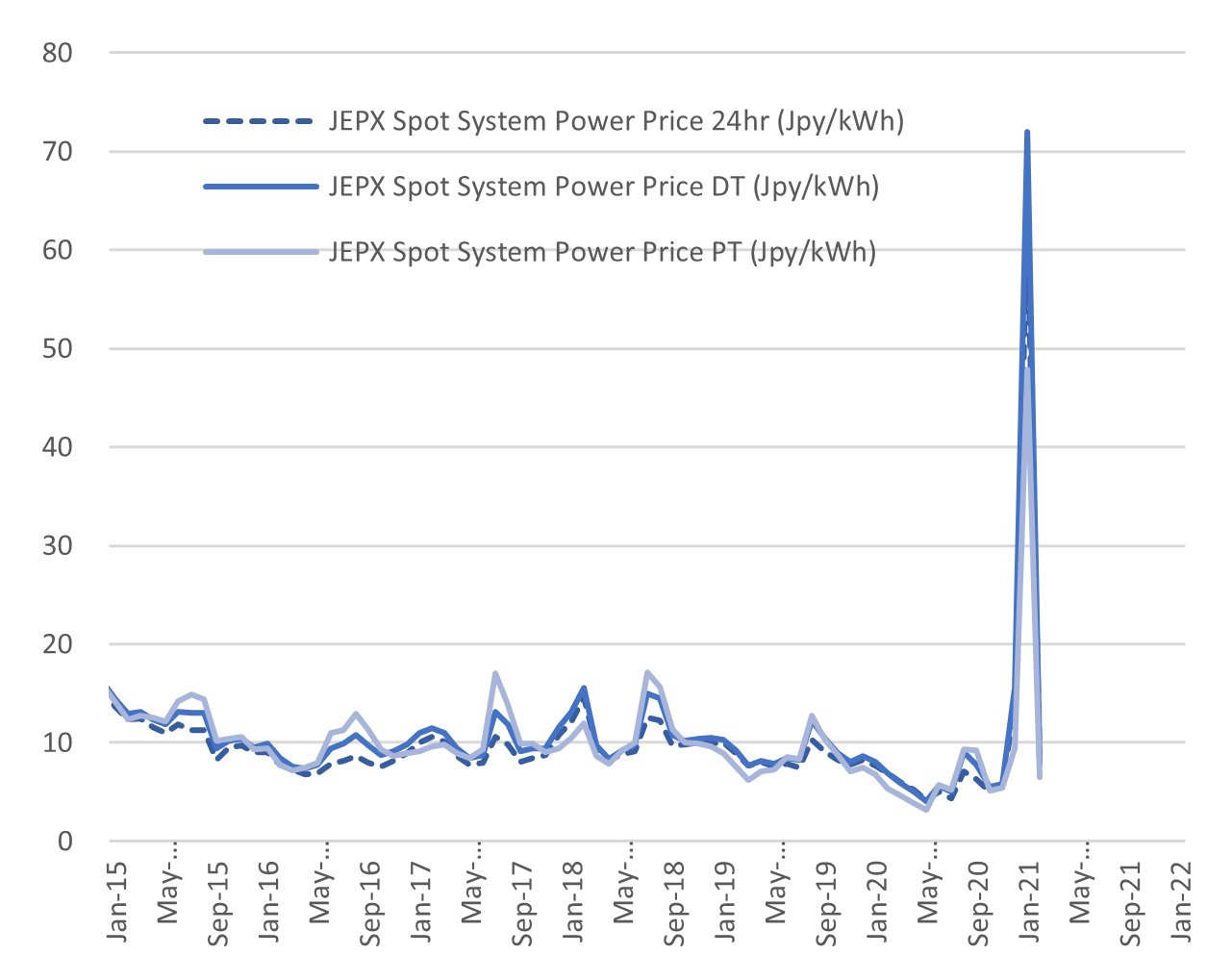

Spot Electricity Prices

Source: Company websites, JANSI and JAIF, as of Feb. 1, 2021

Japan to make it easier to buy certificates proving use of non-fossil fuel electricity

(NHK, Feb. 5)

- METI minister Kajiyama said Japan will put together measures soon to make it easier for companies to buy directly certifications that prove that the electricity they buy comes from non-fossil fuel sources.

- The hope is that this will also help make the certificates cheaper.

- At the moment, such certificates have to be bought via a dedicated market and from power retail companies.

OPINION: What was behind the energy crisis in Japan? Not the cold or solar power

(JB Press, Feb. 6)

- CONTEXT: This is a column by Hara Eiji, a former METI official who now runs his own policy consultancy and sits on the Cabinet Office’s Renewable Energy Regulation Overhaul Task Force.

- The column notes that solar generation volume was higher this January than a year earlier and that the unusually cold weather was a regular and known occurrence. The author thus rules out the common explanations for the energy crisis earlier this year – including those presented by the big utilities to the government.

- The author suggests that poor planning on gas procurement by the big electricity companies was partly to blame, as well as the lack of transparency around the LNG inventory and procurement of the regional power utilities (EPCOs).

- The author argues that the electricity market structure needs to change because the big power companies still control too much of the market and their opacity is a burden on the entire system.

- SIDE DEVELOPMENT:

Business model of new electricity companies blamed for energy crisis

(Sankei Shimbun, Feb. 5)- The article relates several market participant and government officials’ views on what is the cause of the earlier energy crisis.

- Matsuyama Yasuhiro, the GM of the Electricity and Gas Division at ANRE, hinted at a recent hearing that the new power retailers may be to blame because they buy the vast majority of their power from the wholesale market.

- Some of the retailers are now asking for govt. bailout of some form, which has other power market participants angry that they are paying for the business “mistakes” of their peers.

- The “protectionist” measures towards the new electricity companies is creating a distorted market.

- The article author questions what value the new electricity retailers are really adding to the Japanese electricity industry.

- SIDE DEVELOPMENT:

METI to bail out power retailers

(Nikkei, Jan. 28)- The Ministry of Economy, Trade and Industry is offering additional assistance to electricity retailers that are experiencing cashflow difficulties after a spike in wholesale electricity prices.In order to be eligible for assistance power companies need to provide subscribers hit by large power bills with flexible payment options and the option to switch plans.

- SIDE DEVELOPMENT:

- Minister in charge of reforms pushes METI to improve power market information

- (Jiji Press, Feb. 3)

- Kono Taro, the minister in charge of regulatory reform, told METI that “the electricity market is not mature and there is room for reform” in light of the surge in electricity wholesale prices earlier this year.

- He urged METI to reform the electricity market when speaking at a meeting of the Renewable Energy Task Force (Working Group), which he also set up.

- Experts at the meeting called for thorough disclosure of information related to fuel used by major power utilities, and the introduction of circuit breakers to temporarily suspend trading in order to stabilize the market.

TAKEAWAY: This is a fraction of the many debates that are currently taking place inside Japan about who is to blame for the events in early January, when there was a shortage of LNG stocks in and prices of both LNG and electricity jumped to historic levels. The aim of the big power utilities, which are supported by the “traditional” energy block inside METI, is to show that these companies are focused on security of power supply and deliver no matter what. The deeper aim is to cast doubt on electricity market liberalization and to paint the renewables power providers as incapable of standing up to the plate when it counts.

In Japan, security of supply is valued highly enough for clients to accept higher costs. However, the arguments of the transitional energy lobby and the Keidanren-affiliated economists and talking heads do not seem to add up. While it is true that some solar and hydro power was down on several days, the main difference this year compared to last year and other previous years is that: A) there was little nuclear capacity online this January, and B) a surprisingly high number of gas-fired plants were offline at the start of the year. The latter may be due to the big electricity utilities misjudging demand during a pandemic-induced lockdown, or planning based on a higher nuclear component. Either way, the big power companies should not be exempt from the scrutiny.

Incumbent power utilities losing grip on industry, but still playing METI’s nuclear game

(Zaiten, March edition)

- The stronghold of the incumbent electricity utilities, the Federation of Electric Power Companies (FEPC), is starting to crumble. Once, FEPC has the ear of the ruling LDP lawmakers. Since the unbundling of the utilities, the FEPC lobbying power is starting to weaken. Last fall, the Transmission & Distribution Grid Council (TDGC) was created, taking in the power distribution businesses separated from the nine utilities (EPCOs). This downsized FEPC to a group only representing the generation assets and retail departments of the EPCOs.

- This segregation of the industry is fostering intense competition, with the bigger power companies busy looking after their own needs. They no longer send much manpower to FEPC to help retain the group’s influence.

- FEPC has little ability to lead or influence national energy policy nowadays, and its main job has become to protect the nuclear industry on behalf of METI, an industry insider said.

- One example is the situation around the Mutsu City nuclear waste facility, which was built for the sole use of TEPCO and Japan Atomic Power. METI wanted to help Kansai Electric solve its nuclear waste issues by having the facility open up to all FEPC members. However, METI dressed this up as a request from FEPC, hiding in the background to protect itself from public criticism.

- METI would like Kansai Electric to be involved in the restart of the nuclear assets owned by TEPCO, which would see the Kansai company get involved in the completion of construction of TEPCO’s Higashidori nuclear station.

- However, the link between METI and FEPC is weakening and the latter’s lower clout is starting to show.

METI Minister confirms commitment to nuclear energy in Japan

(FT, Feb. 2)

- METI minister Kajiyama said in an interview that nuclear power is crucial to hitting the country’s net zero goal by 2050, and that January’s energy crisis and power crunch showed how indispensable nuclear is for Japan.

- Kajiyama reiterated that renewables will be a top priority, but stressed that Japan’s geography means that other energy sources including nuclear, imported hydrogen and CCS will need to be deployed.

- SIDE DEVELOPMENT:

- METI Minister Kajiyama vows to lend support to Takahama city mayor for nuclear restarts

- (Asahi Shimbun, Jan. 7)

- Minister Kajiyama had a virtual meeting with Takahama city mayor and pledged that the national government will take the lead in helping to promote citizens’ understanding (and approval) for the restart of the local Takahama Nuclear Power Plant, which is owned by Kansai Electric.

Work begins to remove deformed Fukushima fuel rods

(BS 1-BS News, Feb. 5)

- TEPCO has begun using special equipment to remove fuel rods in the Unit 3 spent fuel pool at the Fukushima Dai-Ichi nuclear power plant that were previously unable to be removed due to deformation.

- TEPCO expects the task to be finished by March.

- SIDE DEVELOPMENT:

- TEPCO to begin work on reactor coffin

- (Kensetsu Shimbun, Feb. 5)

- TEPCO plans to begin work on a gigantic “coffin” to cover the Unit 1 reactor at the Fukushima Dai-Ichi nuclear power station in 2021/22.

- TEPCO says it will file the relevant applications with the authorities in April.

- The structure will be 68 meters high, and the roof will measure 66 by 50 meters. The structure will be attached to the existing reactor building with anchors.

- SIDE DEVELOPMENT:

- Ten years on, Fukushima reactor site is a rubbish dump with space running out

- (Tokyo Shimbun, Feb. 3)

- In the 10 years since the Fukushima disaster, large swathes of forest around the reactor site have been cleared to make way for the storage of contaminated waste.

- Waste storage containers are now at 75% of capacity, and contain some 310,000 cubic meters of contaminated rubble and debris. Discarded protective suits alone take up another 31,000 cubic meters.

- At the current rate, the dump will reach capacity in 2032, even when debris from the reactor itself is not figured in.

Idemitsu launches carbon-free electricity plan

(New Energy Business News, Feb. 5)

- Idemitsu is now accepting applications for its “Green Plus” domestic electricity plan that allows subscribers to be supplied with 100% carbon-neutral electricity for an addition ¥2 per kWh.

Osaka Gas may build wind farm in Hokkaido

(Nikkei, Feb. 3)

- Osaka Gas subsidiary Daigas Gas and Power Solution is considering building a 38 MW wind farm comprising 10 turbines in Hokkaido. Daigas’ proposal is currently undergoing an environmental assessment.

- Construction would begin in 2024 and the farm would begin generating electricity in 2026.

- SIDE DEVELOPMENT:

- Osaka Gas signs power purchase agreement with West for 200MW of solar

- (New Energy Business News, Feb. 2)

- Osaka Gas has signed a long-term contract to procure 200 MW worth of renewable energy from thousands of small-scale solar power plants to be developed by West Holdings in fiscal 2021.

- The solar projects will be developed nationwide, but mainly in western Japan.

- SIDE DEVELOPMENT:

- Osaka Gas Cuts FY Operating Income Forecast, Misses Estimates

- (Bloomberg, Feb. 1)

ENEOS to participate in Yamagata wind project

(Kensetsu Shimbun, Feb. 5)

- ENEOS has said it will participate in a project led by MUFG subsidiary, MUL Energy Investment, to build a wind farm in Yamagata.

- The 17 MW land-based wind farm is scheduled to start supplying the grid in 2026.

NEWS:

OIL, GAS & MINING

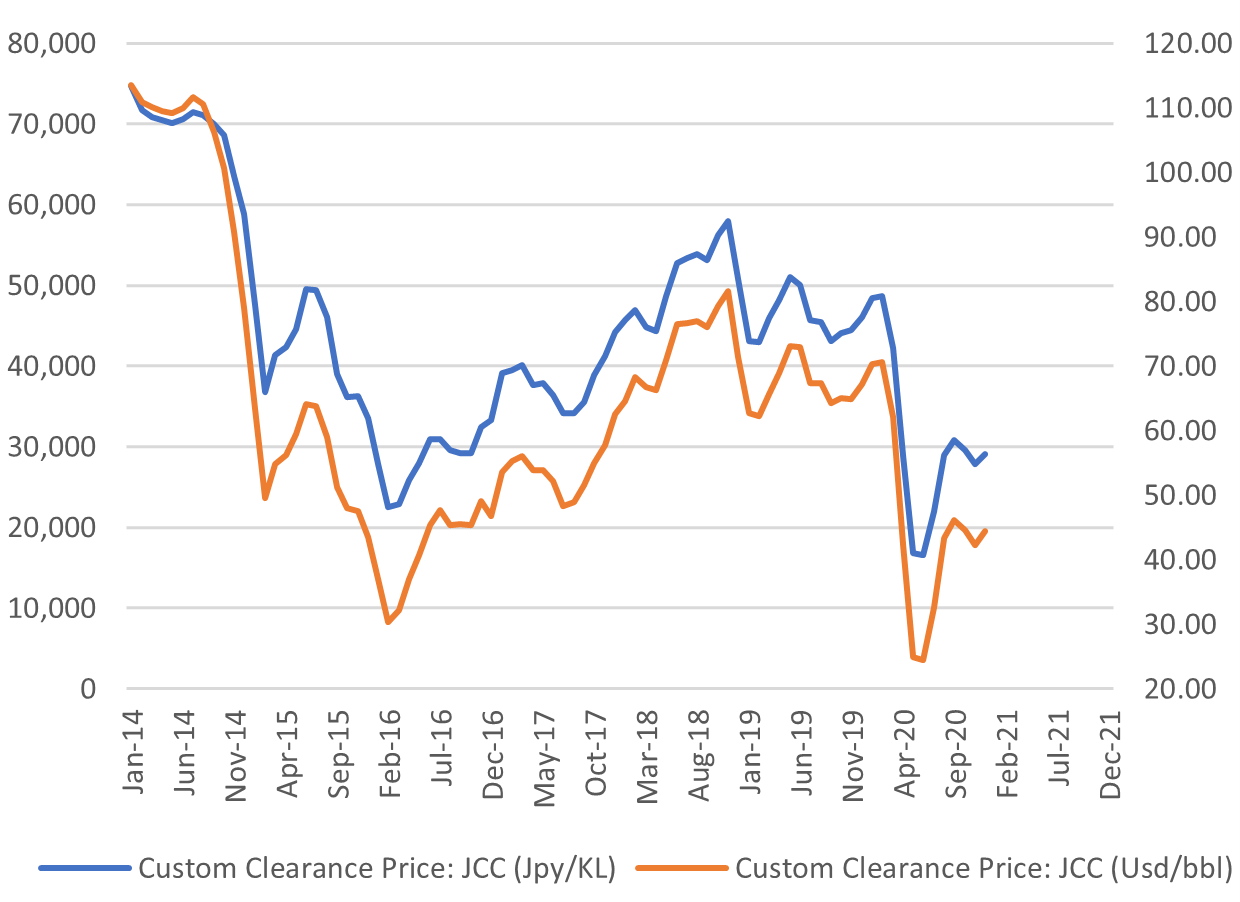

Japan Oil Price:

$44.46

/ barrel

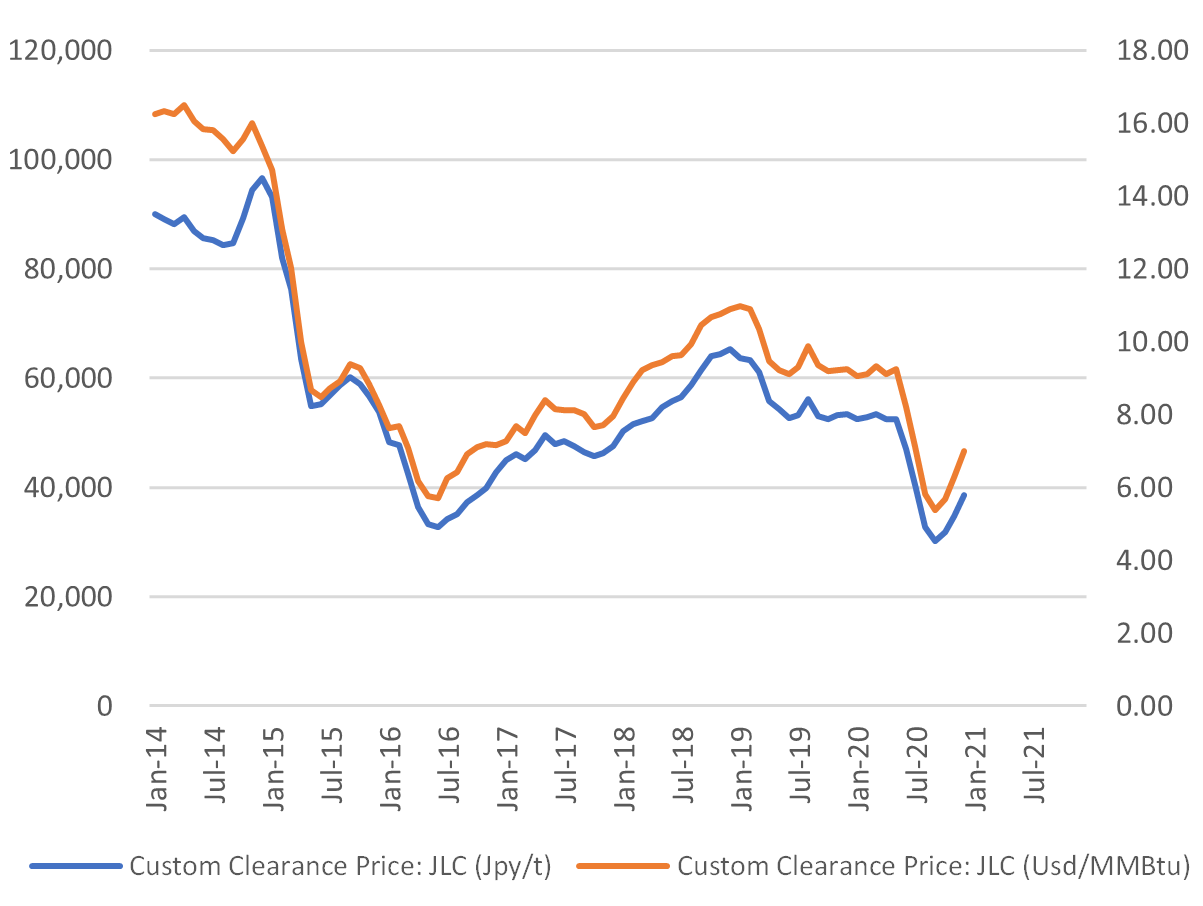

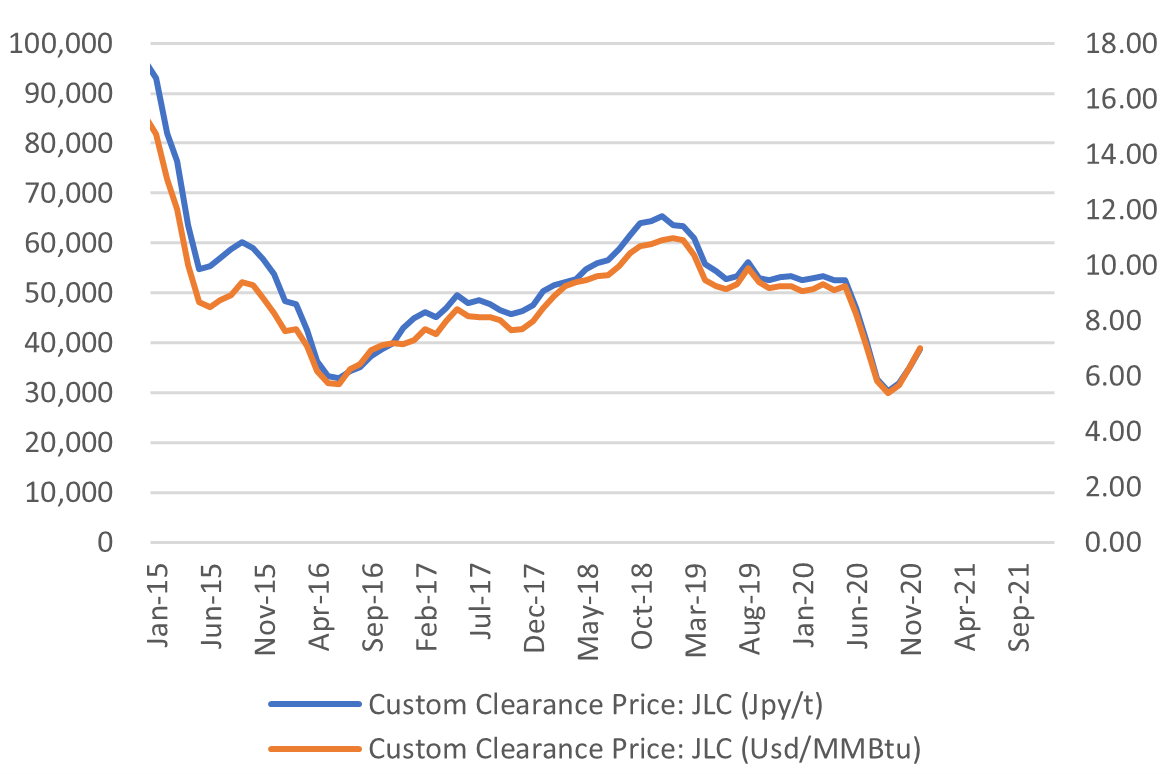

Japan (JLC) LNG Price:

$7.00

/ mmbtu

ENEOS forum: FGE’s Feshariki says “2024-28” to be golden age for oil

(Sekiyu Shimbun, Feb. 5)

- ENEOS and the Institute of Energy Economics hosted the 30th annual panel discussion on Feb. 4. Overseas participants, including FGE head Fereidan Feshariki, joined the discussion remotely.

- Referencing the recent spike in LNG prices in Asia, IEE chair Toyoda Masakazu argued more investment is required in petrochemical exploration.

- Feshariki projected demand for petrochemicals would normalize in 2022, followed by a “golden age” for the industry between 2024 and 2028. Gasoline will eventually be phased out by 2034, Feshariki said.

Mitsubishi, Mitsui executives say LNG has a future despite energy transition

(Diamond, Feb. 3)

- The exodus from coal has seen many generators switch to LNG-fired generation. However, LNG is also a source of greenhouse gas emissions. We asked executives from Mitsui & Co and Mitsubishi Corporation whether LNG power stations have a future.

- LNG is currently a cash cow for both trading companies, but many SDG analysts have already relegated LNG-fired power stations to liability status.

- Mitsui takes the position that LNG, with its lower emissions profile, is an important “bridging fuel” on the path to carbon neutrality. Mitsui will not divest from LNG, says the executive interviewed.

- Mitsubishi has no plans to divest from LNG either. The executive interviewed said that while in the current environment corporations that do not pursue renewable initiatives risk exclusion, that does not mean to say that trading in LNG is inherently wrong. Sourcing 100% of energy needs from renewable sources would be impossible, he said.

LNG price weakens as shortages ease

(Nikkei, Feb. 1)

- Spot prices for LNG in markets in Asia are coming back down from year-end highs as shortages of the commodity ease. LNG is trading at around $8.40 per MBTU, its lowest level in two months.

- Analysts say that while domestic LNG reserves remain low, Japan now has enough for the immediate future.

Sumitomo sells out of U.S. oil sector

(Asia Nikkei, Feb. 4)

- Trading house has sold the last of its interests in shale operations in Texas, completing Sumitomo Corp.’s exit from the oil industry in the U.S. Sumitomo had stakes in both Eagle Ford and Marcellus shale areas. Last week, it announced plans to stop new investments in oil developments.

INPEX expands interest in U.S. Gulf of Mexico oil fields

(Company statement, Feb. 2)

- INPEX, via its subsidiary, INPEX Americas, acquired 2.35% in the Lucius and Hadrian North fields, a stake that used to be held by ExxonMobil. The purchase lifts INPEX’s participating interest to about 10.11%.

- CONTEXT: With Occidental as the operator, INPEX and project partners are jointly developing, producing and marketing crude oil and natural gas from the Lucius Field located in the U.S. Gulf of Mexico.

- SIDE DEVELOPMENT:

- INPEX surges on U.S. drilling rights

- (DHZ Financial Research, Feb. 3)

- INPEX’s share price has continued to appreciate on news that its U.S. subsidiary had acquired 2.3% of Exxon Mobil’s stake in the Julius oil project in the Gulf of Mexico.

- SIDE DEVELOPMENT:

- Serious accident at INPEX drilling rig in Australia

- (Various, Feb. 4)

- A probe has been launched into a serious accident on board a semi-submersible during drilling at the Ichthys project, which INPEX operates. Several heavy parts were accidentally released on the drill floor.

COSMO to join bio-jet fuel trial

(New Energy Business News, Feb. 5)

- COSMO Energy says it will participate in a project to establish a domestic supply chain for sustainable aviation fuel. COSMO will join JGC, JAPEX, and Revo International, who have been working on the project for over a year. COSMO hopes that its expertise in jet fuel manufacture, storage and transport will help the project achieve its goal of a commercial viability by 2025.

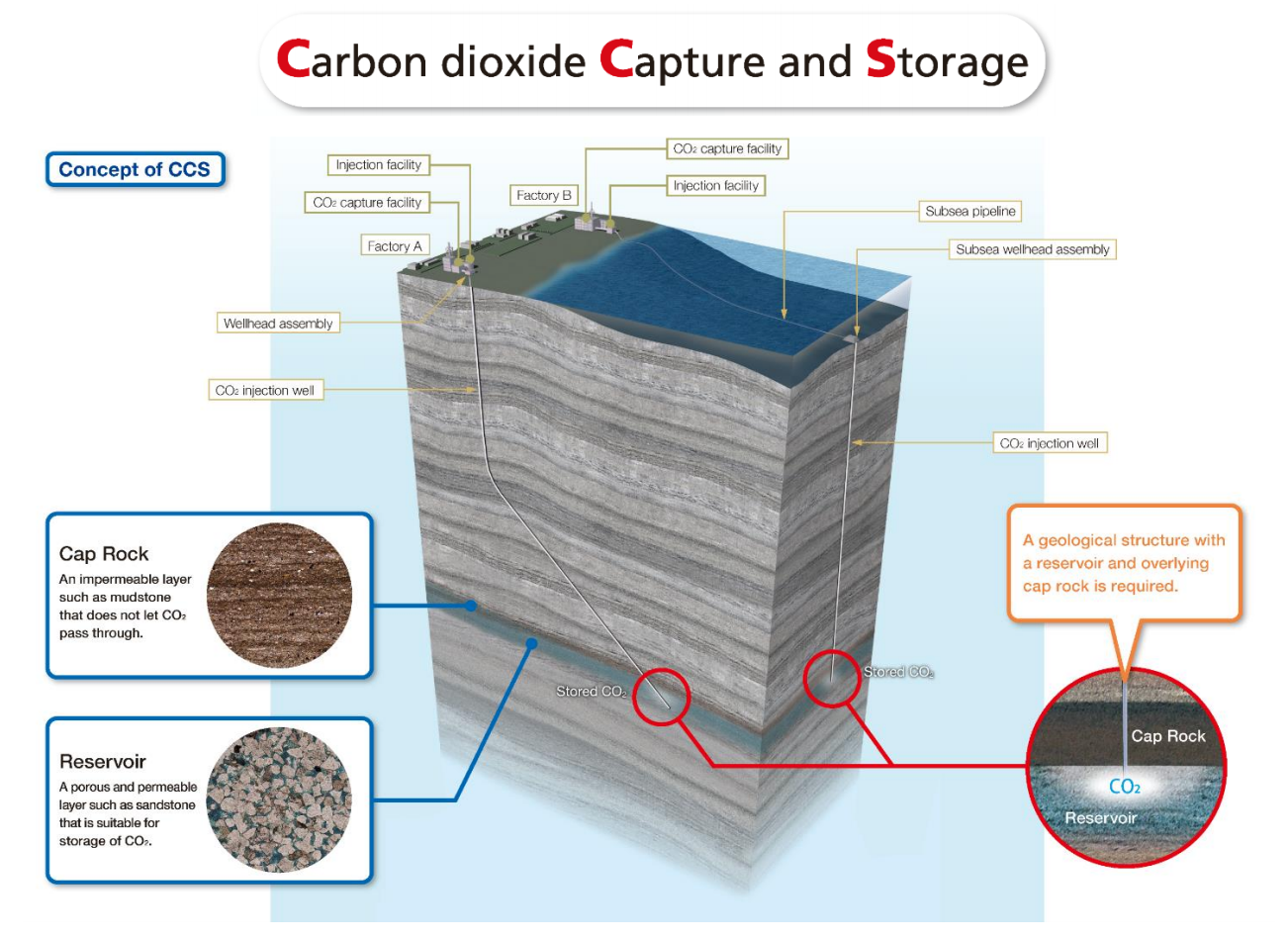

ANALYSIS

BY TAKEHIRO MASUTOMO

High Costs and Geographical Disadvantage

Hinder Japan’s CCS Ambitions

In a bid to realize carbon neutrality by 2050, Japan’s Green Growth Strategy has spelled out highly ambitious targets in the field of Carbon Capture and Storage (CCS), describing the technology as a game-changer. The Strategy even laid out a vision of gaining 30% of the global CCS market, which may be worth ¥10 trillion ($95.5 billion) by mid-century.

What’s more, the introduction of CCS would allay the government’s unease with making Japan too reliant on renewable energy. Such concerns grew during this January’s energy crunch, which saw output from solar and hydro plants struggle to meet demand. It’s hoped that CCS can help keep some of Japan’s thermal power plants and industry in operation while still meeting CO2 reduction targets.

The Strategy envisions development of highly efficient CO2 capture technology by 2030. Yet for despite the ambitious talk Japan’s development of CCS is at a precarious stage. We take a look at the latest developments.

Source: Japan CCS Co.

Source: Japan CCS Co.

How things stand

In January 2021, during his first policy address to Parliament, Prime Minister Suga vowed to accelerate the development of carbon recycling, a process related to CCS, while promising to work on carbon pricing. Two key ministries driving the process are METI and the Ministry of Environment (MOE).

Japan has a strong foundation in the field. Its companies have built facilities to separate and capture highly-concentrated CO2 – at least for the purpose of extracting crude oil (a process known as enhanced oil recovery, EOR) and chemical application. Japan has the top share in terms of building carbon capture plants, and its scientific academia and industry have registered the most CCS-relevant patents worldwide, according to the Strategy, released on Dec. 25.

However, unlike other early movers in CCS, such as the U.S., Canada and Norway, Japan has yet to implement the technology to commercial scale outside of EOR.

Many of the country’s efforts in this technology are led by an entity known as Japan CCS Co., which is owned by more than 30 local energy firms, including Japan Petroleum Exploration Co. (JAPEX), Mitsubishi Corp, and ENEOS. The entity was set up in 2008 to combine the public-private development process and set up the largest-scale demonstration project for carbon capture.

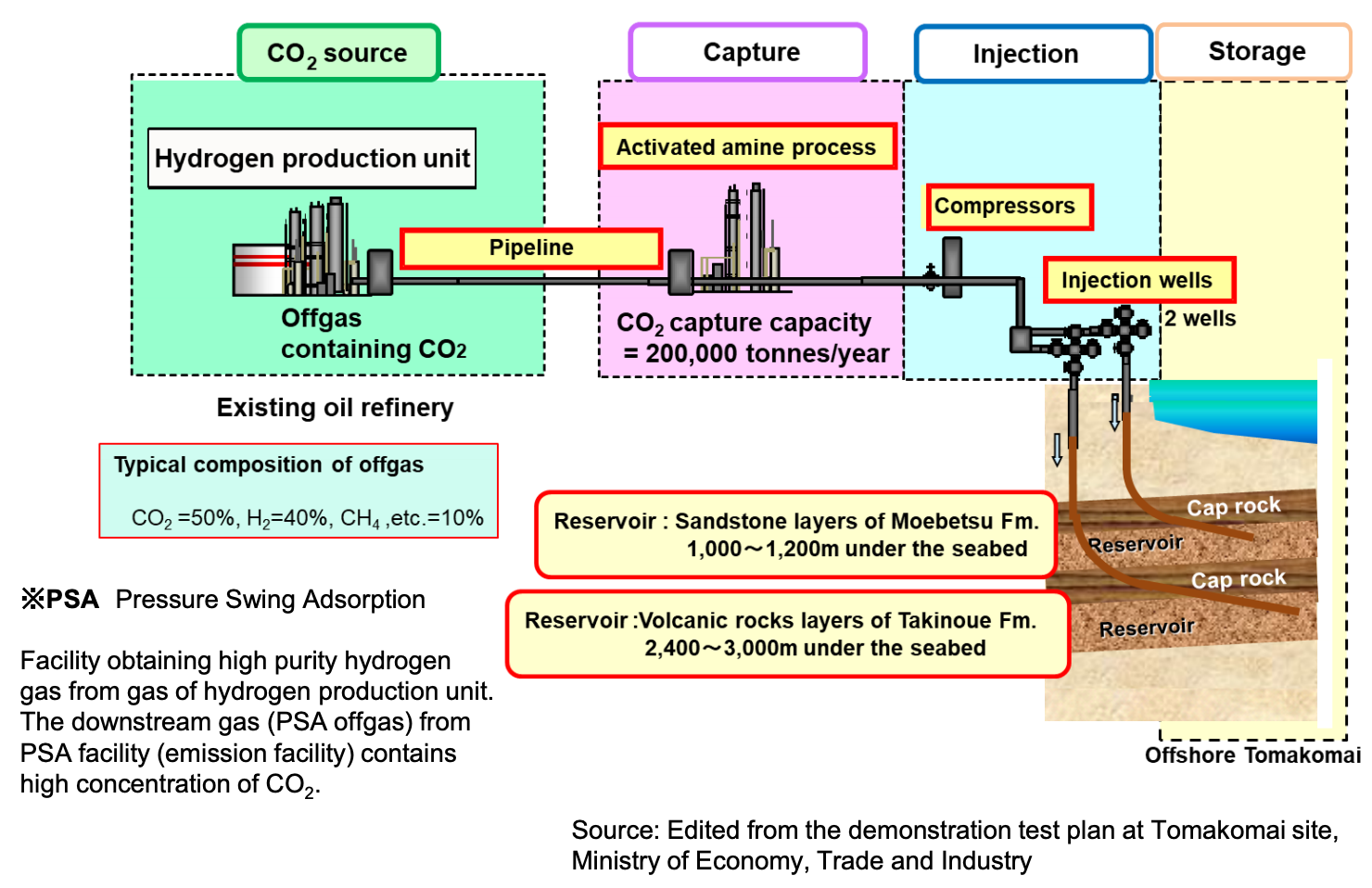

Between April 2016 and November 2020, Japan CCS injected just over 300,000 tons of CO2 derived from industrial sources into two underwater reservoirs that lie 1,100 meters and 2,400 meters below the seabed off the coast of Tomakomai, a town on the south coast of Hokkaido. With the injections completed, the JGC Corp-designed facilities are now monitored for micro-seismicity, marine environment and the movement of the CO2 inside the reservoirs.

Outline of the Tomakomai CCS Project

Source: Japan CCS Co and METI

Source: Japan CCS Co and METI

While risk of CO2 leaks in the seabed is considered to be low, the MOE has started to consider what should be done to better detect leaks, implement appropriate countermeasures and what to do in case of emergencies.

Once these are in place, Japan is expected to choose three best candidate sites for future large-scale CO2 storage. An early announcement may come later this year, with candidates including sites off the coast of Ishikawa and Akita prefectures. Approval from local communities will also be part of the process.

Increasing number of domestic players in CCS

Armed with findings from the early Japan CCS Co. project, a number of Japanese firms have recently instigated their own initiatives.

In September 2020, Kawasaki Heavy Industry revealed that it will install a pilot-scale test facility with a CO2 capture capacity of 40 tons/ day at Kansai Electric’s coal-fired Maizuru power plant in Kyoto. The project is supported by the influential Research Institute of Innovative Technology for the Earth (RITE), which is known for its CCS studies.

Last October, Toshiba announced that its subsidiary commenced operations of a large-scale CCS facility at a thermal power plant in Fukuoka. Sponsored by MOE, the plant uses palm kernel shells as the primary fuel source, making it the first bioenergy with carbon capture and storage (BECCS) facility in the country. Mitsubishi Heavy Industries (MHI) launched a BECCS pilot project in the U.K., at a Drax Group plant, at a similar time.

MHI, one of Japan’s largest creators of energy technology, is hoping to make carbon capture a cornerstone of its shift to new energy amid its struggle to penetrate the market for wind turbines. The company has already built 14 carbon capture facilities globally, including what it claims to be the world’s largest CO2 capture system at Petra Nova Parish’s coal-fired power plant in Texas, which was launched in 2017.

Meanwhile, J-Power is due to start developing a new CO2 storage method, which would enable CO2 storage in shallower ground. Other CCS significant research in Japan is conducted by the state research body, NEDO, and companies such as INPEX, Kawasaki Kisen Kaisha, and trading house Marubeni. Chemicals and textiles giant, Toray Industries, is working on the development of high-performance membranes for more efficient CO2 capture.

Further down the line, Japanese developments hope to commercialize Direct Air Capture technology, which draws CO2 from the atmosphere for sequestration or use in manufacturing. That technology is not expected to be in practical use until about 2050 after costs drop substantially.

The challenges

While the number of companies and research projects related to CSS has proliferated, the industry is still struggling to bring down the cost of the technology. With current systems, it costs at least ¥8,400/ per ton of CO2. If installed at a coal-fired power plant, the electricity cost would jump above that of solar power. METI is aiming for at least ¥7,000/ ton or less.

The second obstacle faced by Japan is geography and geology. The Japanese archipelago stands on four tectonic plates, which causes frequent earthquakes and therefore limits the number of areas suitable for storage. Unlike the U.S., which utilizes land-based sites, Japan is following the less common Norwegian approach by focusing on undersea storage.

Japanese sites have an underground CO2 storage capacity of 148 billion tons, according to RITE’s calculations. That would be enough to store over a century of Japanese emissions at current rates.

An additional issue for Japan is transport of CO2. In countries like the U.S., the gas is transported by pipeline due to the proximity between emitter and storage site. In Japan, surveys show that while most CO2 emissions originate on the Pacific Ocean side, most suitable storage sites are on the Sea of Japan side. This has persuaded Japan to think seriously about shipping the carbon.

As reported in Japan NRG last week, MHI plans to develop the world’s first commercial carrier of liquid CO2 by 2025. A year earlier, Japan scheduled a test shipment to carry CO2 captured at a coal plant in Kyoto to a facility in Hokkaido, 1,000 kilometers away. This would be a world first and considered to be an edge in export of Japanese technologies abroad.

Potential for Asia exports

Seeing the synergy between CCS and thermal power plants, Japan has eyes on Asian markets. In November 2020, Japan, the U.S., Australia and ASEAN members announced plans to partner in CCS development, an effort that Japan has actively promoted.

Many Asian economies are still largely dependent on thermal power plants. Under emission trading mechanism, Japan hopes to offset its own CO2 emission by assisting with the construction of local CO2 storage. Potential sites for storage will be reviewed this year.

The recent East Asian Summit Energy Ministers Meeting welcomed Japan’s idea to establish an “Asia CCUS Network”, which is expected to become a platform to share knowledge and experience, as well as research on CCS activities in the region.

Still, Japan’s export potential for Asia will depend on the uptake of CCS domestically. So far, without carbon pricing, utilities have been reluctant to invest in high-cost CCS systems for coal and gas-fired generation facilities. A detailed government plan for carbon prices and tax is due to be published later this year.

ANALYSIS

BY MAYUMI WATANABE

Japan to Push Hydro, Geothermal and Biomass to New Pricing Scheme

Hydro, geothermal and biomass power sources are now more price competitive and able to move to the new Feed-in-Premium (FIP) pricing scheme for electricity that Japan will launch in April 2022. This was the recent conclusion of an expert panel advising the Ministry of Economy, Trade and Industry (METI).

The shift to FIP from the current Feed-in-Tariff (FIT) system indicates that the levelized cost of production from those renewables sources is starting to drop in Japan and, in some cases, approach spot market prices. It will also prove to be a divisive moment in renewables, according to industry players, because it makes it harder for small operators to survive. Meanwhile, bigger firms will likely exploit FIP to develop more mature sales and trading strategies and invest in storage.

The recommendations to MET came from the influential Tariff Calculation Committee (TCC), which on Jan. 27 released a roadmap of the transition to FIP.

Under the FIT system, Japan has stimulated a massive wave of investment in renewables, with solar capacity alone more than tripling since 2012. Currently, FIT applies to 93.47 GW of power projects nationwide, of which 58.24 GW has already been brought into operation. Most contracts fix the electricity sales price for a 20-year period.

In the eight years since its launch, the FIT has been applied to over 700,000 power generating units in Japan, which are run by about 600 different entities. FIT also covers residential solar installations, which number around 2.5 million units. To compare, Japan had just 9.16 GW of renewable capacity online before FIT was introduced, according to official data.

The FIT levels are updated every year for each renewable energy source. The new tariff rates take into account the latest information on each generation type’s capital costs, running costs, run rates and other parameters. TCC offers METI guidance on both the tariff levels and the process via which renewables projects can secure the FIT certificate (i.e., via a direct application, capacity auction, or other).

FIP changes

Under the new FIP system, operators will send their electricity output to the Japan Electricity Power Exchange (JEPX) and receive a premium on top of the market’s spot price. The idea is to incentivize operators to offer excess power, retained in storage batteries, during times of strong power demand. The current FIT system, which is isolated from market mechanisms, does not have the same incentives built-in.

The government’s ultimate goal is the termination of both the FIP and FIT so that renewable energy competes against thermal power on an equal footing.

Which renewable energy sources the FIP would apply to has been under deliberation for some time.

According to the TCC, small and middle-sized hydro power, geothermal and biomass plants are a good match for FIP because of their output stability and flexibility. The committee said that each of these energy sources is approaching market competitiveness, and after further cost reductions should suit the FIP system.

As of June 2020, the number of FIT-approved hydro power plants stood at 728. for hydro, 87 in geothermal, and 701 for biomass power plants. After reducing costs further, and when METI defines targets, they should be a much better fit for FIP.

Hydro

As of June 2020, the number of FIT-approved hydro power plants stood at 728. From fiscal year (FY) 2022, the TCC recommends that new hydro plants with capacity of over 1 MW should join the FIP scheme.

At the moment, hydro plants are paid a FIT rate of ¥29/kWh (as per FY2020 numbers), which is twice as high as the price in Germany. However, the medium size and bigger plants still have room to cut costs, the TCC said. Ten plants with capacity of 5 MW or higher are even efficient enough to operate at a cost that’s less than ¥10/kWh, which should allow them to sell their power on the JPEX at a profit. The market’s average spot price in December was ¥13.93/ kWh.

Geothermal

There are 87 geothermal power plants with a FIT certificate in Japan, as of June 2020. Those with a capacity of 1MW or over should be transferred to FIP from FIT from FY2022, according to TCC.

The industry has seen a clear drop facility running costs even though this year (FY2021) costs are expected to be above the FIT rate of ¥40/ kWh, according to the TCC. Despite the overshoot, the committee said it will not loosen the tariffs to reflect higher costs so as not to send a wrong message to the market.

Overall, electricity tariffs should trend down, according to the TCC.

Biomass

Japan had 701 biomass power units registered under the FIT scheme as of June 2020. From FY2022, the bigger plants, as in those with a capacity of 10 MW or higher, should be registered under FIP. The year after, the threshold should be lowered to 1 MW of capacity or higher, according to TCC recommendations.

Biomass power plants under the 10 MW capacity level enjoyed a FIT rate of ¥24/ kWh for FY2020. Larger facilities, at 10 MW or higher capacity, had to put in bids for electricity prices via an auction. The auction-set price was ¥19.6/ kWh.

Onshore Wind

Operators of land-based wind power plants enjoyed a FY2020 FIT rate of ¥18/ kWh, but such prices will be a thing of the past if the segment moves to FIP. The TCC said it sees “potential” for onshore wind to be added to the new pricing scheme and would look for a price point of ¥8-¥9/ kWh.

There are 7,908 wind power facilities that quality for FIT in Japan. Those that are price-competitive will be able to choose to shift to FIP, but this will rule them out from the auction system.

Solar

The majority of FIT-approved renewable energy plants in Japan are in solar. In the new TCC recommendations, those solar projects with a capacity of 1 MW or higher will fall under the FIP system starting in April 2022.

The current FIT rate for solar is determined by auction, which has resulted in a price range of ¥11.5-¥21/ kWh during FY2020. The committee sees this trend as naturally pushing the segment toward FIP.

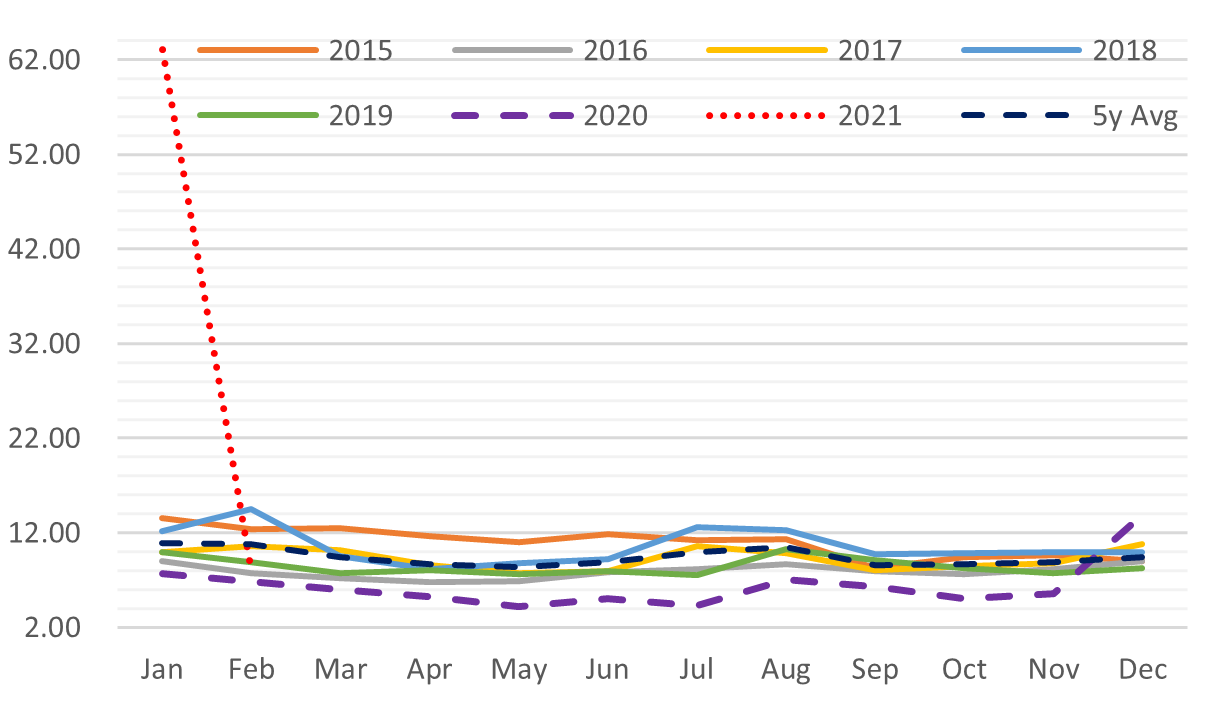

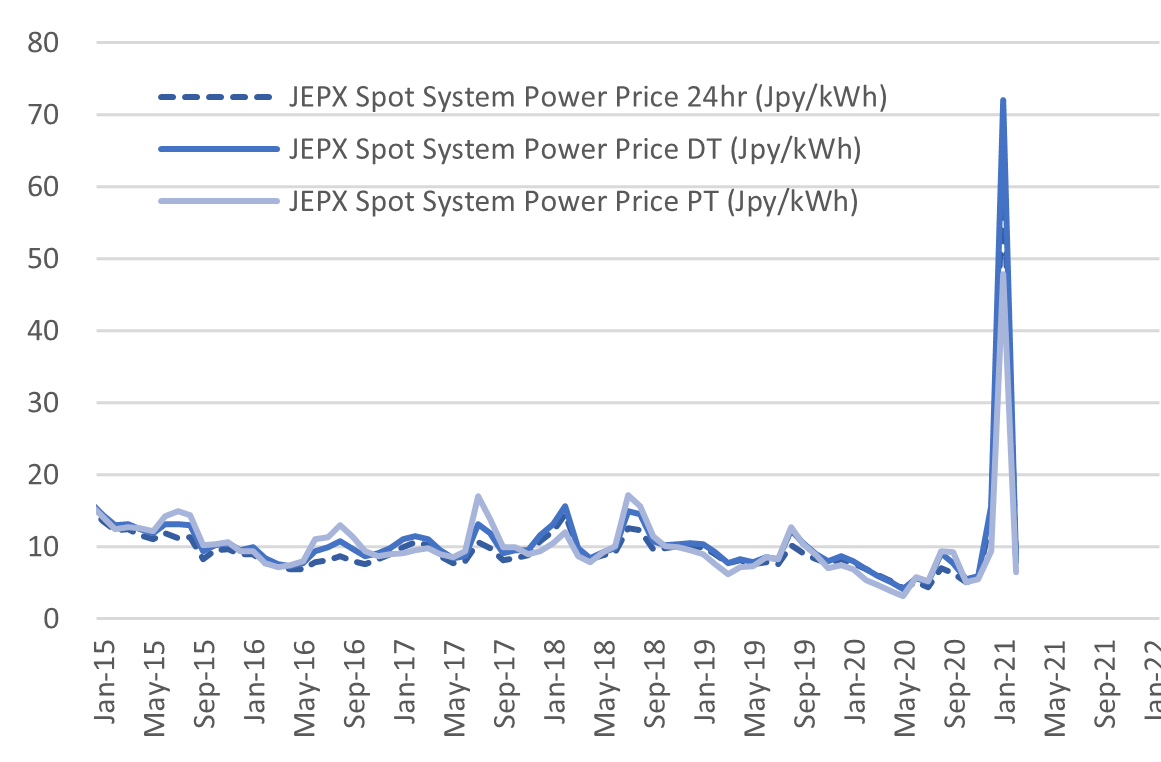

January price spike affecting shift to FIP

Following the strong price volatility on JPEX during January, which saw prices jump into triple figures for the first time ever from single-digits for most of the last five years, many companies are wary of moving away from state-regulated tariffs and embracing market price exposure.

Several power retailers have already announced plans to close.

This will make METI’s work to move the renewable industry towards FIP terms, and later pure market-based pricing, that much harder. Many in the renewables industry say they believe power futures contracts on the Tokyo Commodity Exchange and the EEX are not yet robust or liquid enough to be effective hedging options.

The complicated layering and grading of the FIP system is another issue that will likely slow developments. With additional segregation of price points, the smaller operators argue that the extra administrative burden of price risk management will curtail the number of players in the industry to the bigger companies, which can afford dedicated risk-hedging manpower.

At least two solar players with a portfolio of less than 100 MW have announced or explored an exit from Japan assets in the last few months.

As Japanese officials tout the potential upside of FIP for hydro, geothermal and biomass, they’ll need to make sure operators in those segments do not choose to do the same and exit ahead of the rising cost pressures. While a few large players are starting to emerge in Japan’s solar and wind space, the same still cannot be said for hydro, geothermal or biomass.

GLOBAL VIEW

BY TOM O’SULLIVAN

Below are some of last week’s most important international energy developments monitored by the Japan NRG team because of their potential to impact energy supply and demand, as well as prices. We see the following as relevant to Japanese and international energy investors.

Wind Power:

Daily wind power generation in the U.S. hit a record 1.76m MWh on Dec. 23 accounting for around 17% of total national power generation compared to an annual level of 9%. The previous record of 1.42MWh was set in April 2019.

Almost 18 GW of new U.S. wind projects were installed in 2020, a record, surpassing the previous milestone of 13 GW in 2012. The 2020 additions were driven by developers scheduling completion to qualify for expiring production tax credits.

Oil:

Oil prices enjoyed their best week since October with WTI and Brent rising by $6 to $58 and $60, respectively. Goldman Sachs now predicts oil consumption could hit the pre-pandemic level of 100m barrels a day by August.

U.S. natural gas prices also rose to $2.85 mmbtu last week, 60% higher YoY, because of extreme cold weather in the American northeast.

Rystad Energy is also now projecting demand for oil products in the U.S. to grow by 1 million bpd in 2021 to 19 million bpd.

U.S. Energy Information Administration (EIA):

On Tuesday, the EIA issued its annual energy outlook for 2021, predicting that a return to 2019 levels of U.S. energy consumption will take “years”, with any growth expected to come mainly from electricity and industrial consumption of fuels. Renewables and natural gas are expected to drive increased electricity usage, not coal or nuclear. EIA forecasts that the U.S. will continue to be a “globally significant” producer of crude oil until 2050.

Pipelines:

A U.S. federal court has ruled against the Dakota Access Pipeline for failing to meet environmental approvals. The pipeline has been operating since 2017 and transits oil over a distance of 2,000 km from North Dakota to Illinois

Aviation:

The E.U is expected to issue new guidelines this month outlining a minimum requirement for use of green fuels in aircraft refuelings inside the bloc.

Carbon Prices:

Carbon prices in the E.U. crossed E38 for the first time ever last week as the bloc committed to further emissions cuts.

Rare-Earths:

U.S.-based USA Rare Earths, is considering a market listing that could value the company at over $1 billion. The company is planning to mine lithium in Texas.

China:

1). Open interest in renminbi-denominated oil futures on the Shanghai Energy Exchange increased fourfold YoY in 2020.

2). Chinese oil major CNOOC Ltd announced plans to raise the share of natural gas to half of its total output by 2035, switching from its current oil focus.

South Korea:

1). Kia Motors is exploring options to assemble Apple’s EV in the State of Georgia.

2). South Korea unveiled a $43.2 billion plan to build an 8.2 GW wind power plant by 2030. It would be the world’s largest.

Vietnam:

In a recently published blueprint issued after the just-concluded five-year congress, the ruling Communist Party increased its target national growth rate to the range of 6.5% to 7.0% for 2021-2025, up from the 6% pre-pandemic level.

Thailand:

Chevron continues arbitration negotiations with the Thai government over the Erawan natural gas field that supplies around one-third of Thailand’s gas. It’s due to transfer control to PTT in April 2022.

Myanmar:

The coup on Monday is likely to significantly complicate current and future energy investments, including construction of natural gas and LNG facilities. Japan has traditionally been one of the largest sovereign investors in the country.

India:

Last week, the IEA and India signed a Strategic Partnership Framework to strengthen collaboration in energy security and the clean energy transition. The Framework may lead to eventual IEA membership for India.

Saudi Arabia:

Riyadh is now thought to have attracted 24 multinationals, including Bechtel, to establish regional headquarters in the country.

Oman:

BP will sell a 20% stake in the Khazzan and Ghazeer natural gas blocks to Thailand’s PTT for $2.6 billion.

UAE:

President Biden refused to lift tariffs on aluminum exports from the UAE to the U.S. citing risks for domestic U.S. producers.

Iran:

In a significant escalation, and in contravention of the 2015 Nuclear Agreement, Iran is now thought to have augmented its uranium enrichment capabilities at Nananz, using unapproved centrifuges.

Russia:

The Anti-Corruption Foundation, a Moscow-based NPO with connections to Alexei Navalny, has issued a request to President Biden to further sanction 35 individuals including Rosneft’s Igor Sechin, Gazprom’s Alexei Miller, Oleg Deripaska, and Transneft’s Nikolai Tokarev.

Ethiopia:

The Sudanese government has warned Ethiopia that filling the Renaissance Dam hydropower project in July will directly threaten Sudan’s national security. Sudan believes electricity generation from Sudan’s Merowe Dam and Roseires Dam could negatively impacted the livelihoods of 20 million Sudanese living downstream. Egypt also views the dam as a major threat to its fresh water supplies.

Denmark:

Denmark will construct the world’s first wind energy hub on an artificial island in the North Sea. The 10 GW project will be the largest construction project in Danish history and is expected to be completed by 2033. The first phase of the project is expected to cost $34 billion.

France:

On Wednesday four environmental groups, including Oxfam, successfully sued the French government, which was found guilty by the Administrative Tribunal in Paris of failing to meet its Paris Agreement climate change goals. The tribunal ruled that France failed to reduce greenhouse gases under commitments made in 2015 and was responsible for ecological damage.

UK:

1). BP announced a loss of $5.6 billion for FY2020, its first since the Deepwater Horizon oil spill in the Gulf of Mexico in 2010. The company has net debt of $39 billion, with rating agency S&P saying it has insufficient cashflow to support this. BP also has a 20% stake in Rosneft, which is developing new Arctic projects that may require the construction of 6,500 oil wells and 5,400 km of pipeline.

2). Royal Dutch Shell is expected to announce an increased commitment to power trading when it launches a new business strategy next Thursday. It just announced a loss of $22 billion for FY2020, its first ever, and one of the largest in UK corporate history. It has net debt of $75 billion and wrote down assets by $21 billion in 2020.

Brazil:

Vale has agreed to a $7 billion settlement for the Minas Gerais mining disaster in 2019 that killed 270.

U.S.:

1). Chevron and Exxon are thought to have discussed a possible merger last year that would have a created a company with a $350 billion market capitalization and with oil production of 3.5 mbpd.

2). Exxon announced a loss of $20 billion for FY2020, the first in its history. It also announced the establishment of a ‘low carbon solutions’ division that will invest $3 billion through 2025.

3). Only one of President Biden’s energy and infrastructure cabinet appointments have been confirmed so far by the U.S. Senate – Secretary of Transportation Pete Buttigieg.

EVENT REPORT

Renewable Energy Institute (REI) RE-Users Summit 2021: Feb. 3

On Wednesday REI hosted over 1,000 Japanese corporations at its annual summit focusing on procurement of clean energy in Japan.

Speakers included Apple’s Global Head of Supplier Clean Energy Program, the president of Audi Japan, the head of Kirin’s Energy Procurement Strategy, a senior METI official from the Electricity Infrastructure Division, representatives from Sony and Aeon, and Minna Denryoku, an independent power retailer.

The agenda focused mainly on certifications for clean energy procurement and structural issues around corporate power purchase agreements in Japan.

While most parties agreed that there was still a shortage of renewable energy in Japan for corporates seeking to switch, a number of positive examples and developments were presented. For example, Kirin outlined firm plans to have 100% of its group electricity come from renewable sources by 2040 and to take ownership of Scope 3 emissions, with an eye of reducing them by 30% by 2030.

The number of RE100 companies in Japan grew to 46 at the end of last year.

The gap between demand from corporates and renewable energy supply will rise to 20 TWh by 2030, BNEF said at the event. Part of the issue is the cost of solar power in Japan, which at $124/ MWh was four times higher than in China, three times up on the U.S., Australia, and is more than double the UK and Germany figures.

EVENTS CALENDAR

Below is a selection of domestic and international events that we believe will have an impact on the Japanese energy and electricity industry.

|

February |

Approval of Fiscal 2021 Budget by Japanese parliament including energy funding projects; CMC LNG Conference |

|

March |

10th Anniversary of Fukushima Nuclear Accident; Smart Energy Week – Tokyo; Quarterly OPEC Meeting; Japan LPG Annual Conference; Full completion of all aspects of the multi-year deregulation of Japan’s electricity market; End of 2020/21 Fiscal Year in Japan; |

|

April |

Japan Atomic Industrial Forum – Annual Nuclear Power Conference; 38th ASEAN Annual Conference-Brunei; Japan LNG & Gas Virtual Summit (DMG)-Tokyo Three crucial by-elections in Hokkaido, Nagano & Hiroshima – April 25th |

|

May |

Bids close in first tender for commercial offshore wind projects in Japan; Prime Minister Suga to visit the U.S.-tentative |

|

June |

Release of New Japan National Basic Energy Plan-2021; G7 Meeting – U.K. Forum for China-Africa Cooperation Summit (Senegal) |

|

July |

Tokyo Metropolitan Govt. Assembly Elections; Commencement of 2020 Tokyo Olympics |

|

August |

Hydrogen Ministerial Conference in conjunction with IEA |

|

September |

Ruling LDP Presidential Election; UN General Assembly Annual Meeting that is expected to address energy/climate challenges; IMF/World Bank Annual Meetings (multilateral and central banks expected to take further action on emissions disclosures and lending to fossil fuel projects); End of H1 FY2021 Fiscal Year in Japan; Japan-Russia: Eastern Economic Forum (Vladivostok)-tentative |

|

October |

Last possible month for holding Japan’s 2021 General Election; METI Sponsored LNG Producer/Consumer Conference; Innovation for Cool Earth Forum – Tokyo Conference; Task Force on Climate-Related Financial Disclosure (TCFD) – Tokyo Conference; G20 Meeting-Italy |

|

November |

COP26 (Glasgow); Asian Development Bank (‘ADB’) Annual Conference; Japan-Canada Energy Forum; East Asia Summit (EAS) – Brunei |

|

December |

Asia Pacific Economic Cooperation (APEC) Forum – New Zealand; Final details expected from METI on proposed unbundling of natural gas pipeline network scheduled for 2022. |

DATA

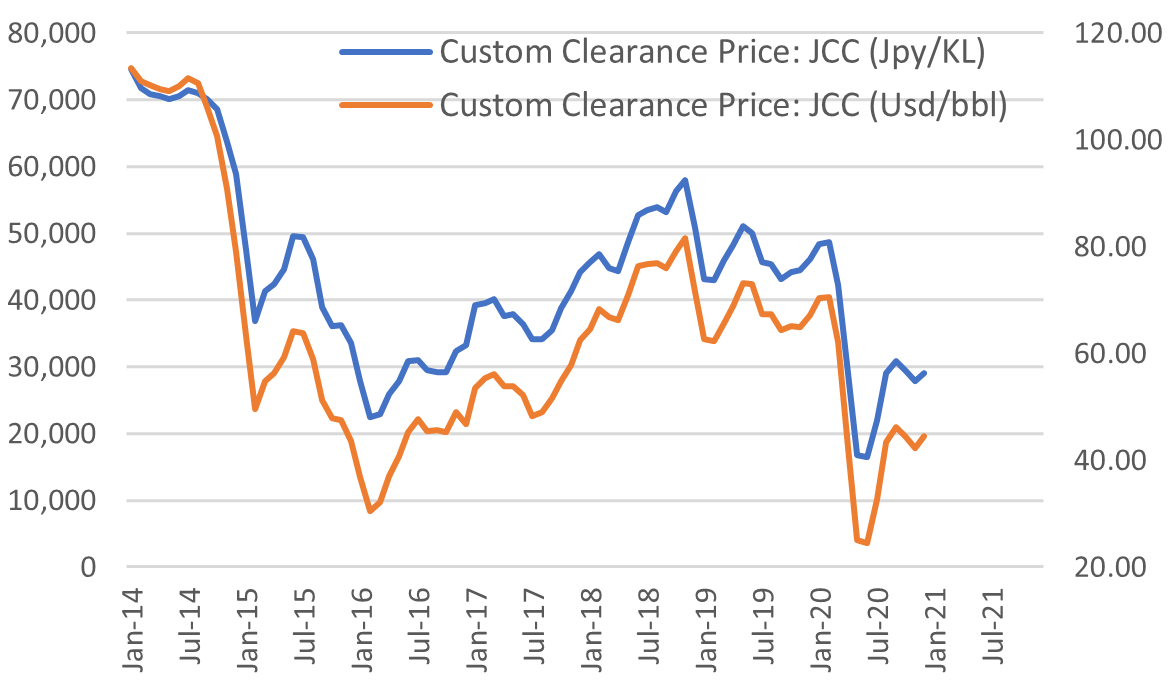

Japan Oil Price

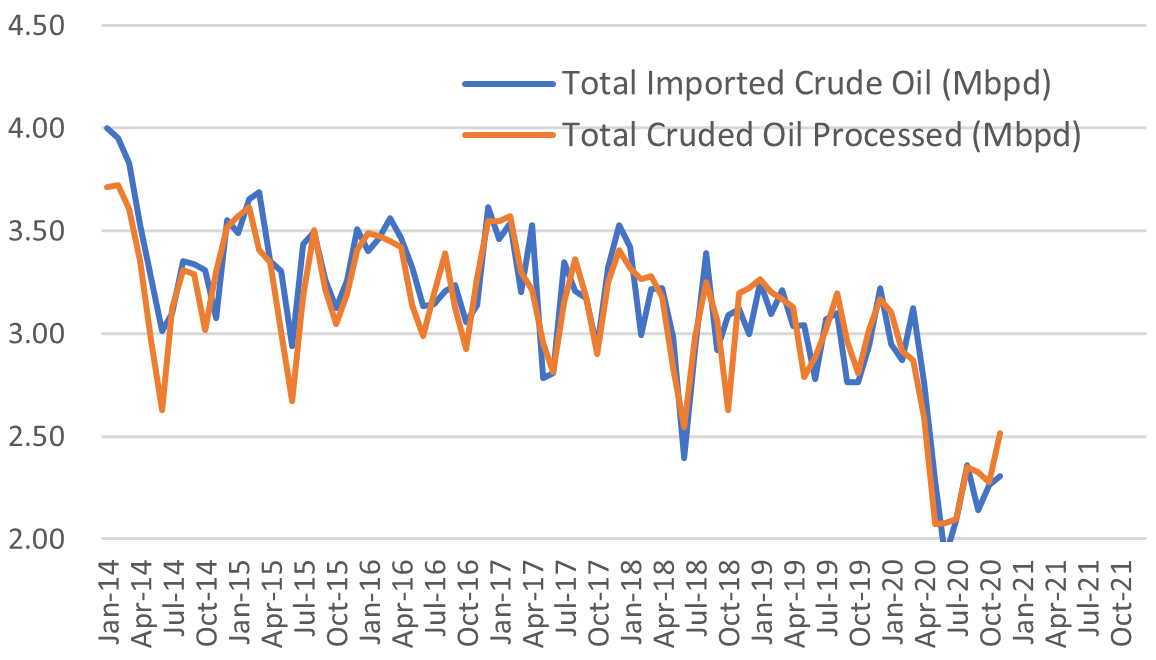

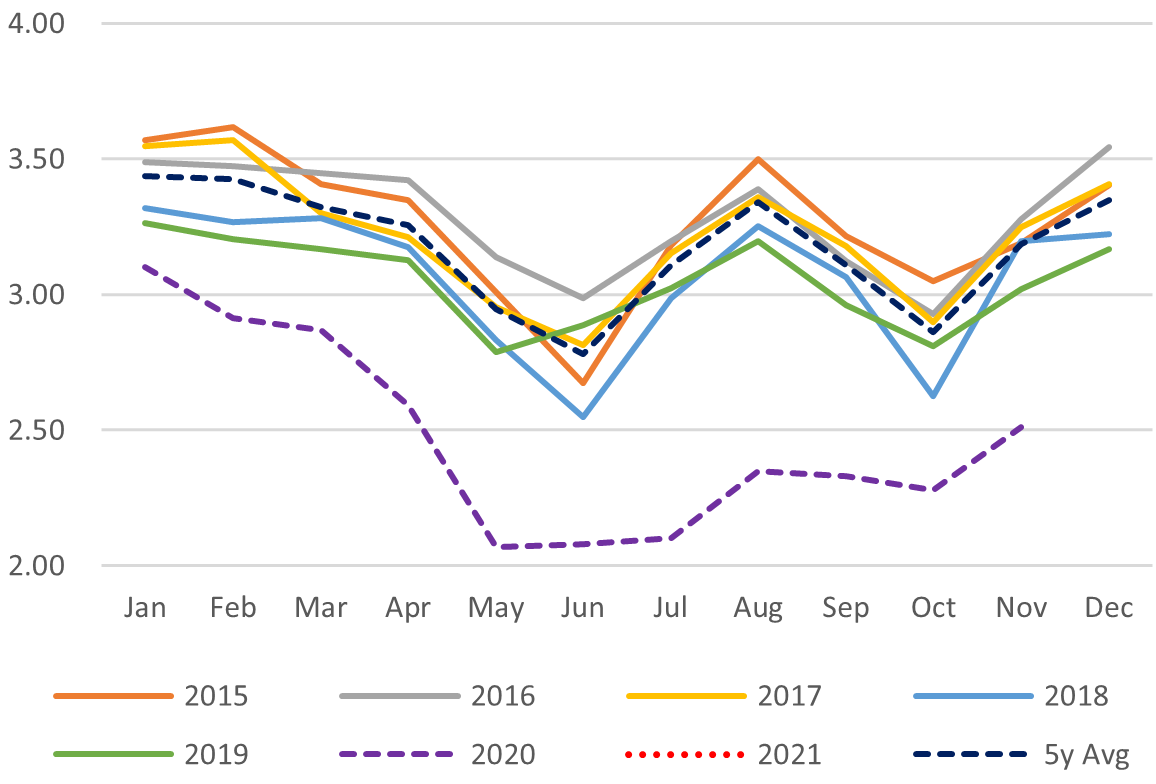

Crude Imports Vs Processed Crude

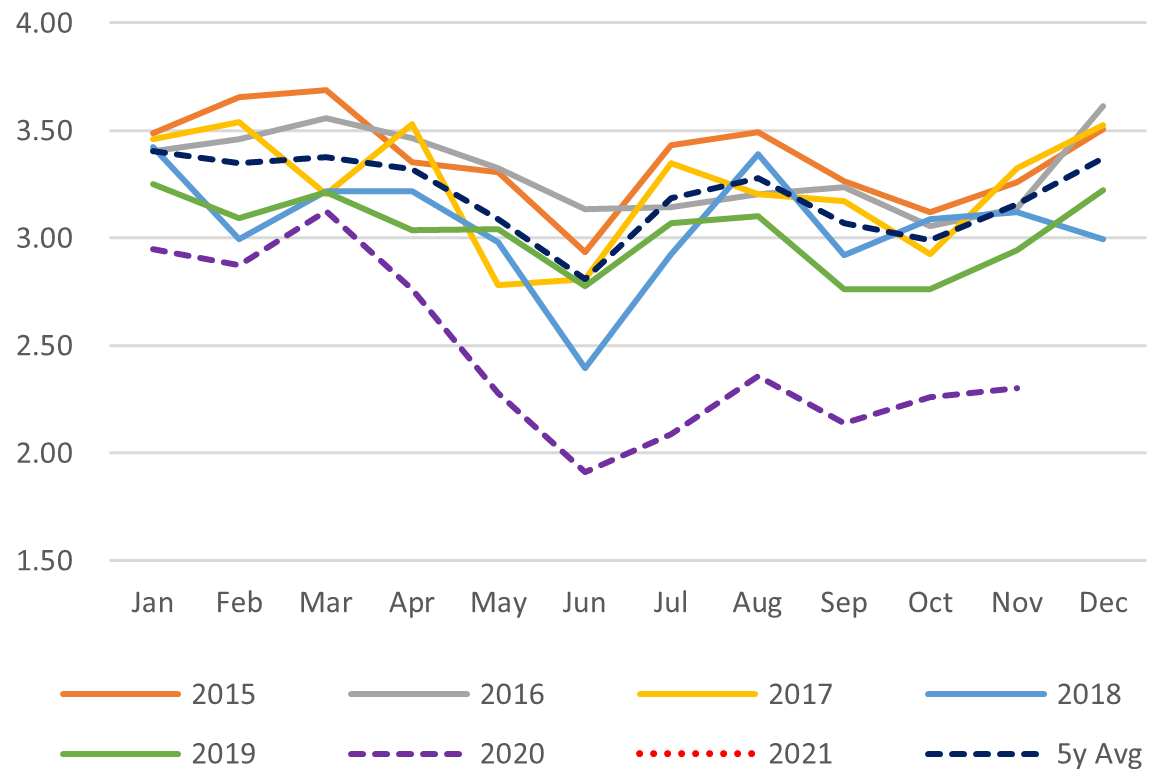

Monthly Oil Import Volume (Mbpd)

Monthly Crude Processed (Mbpd)

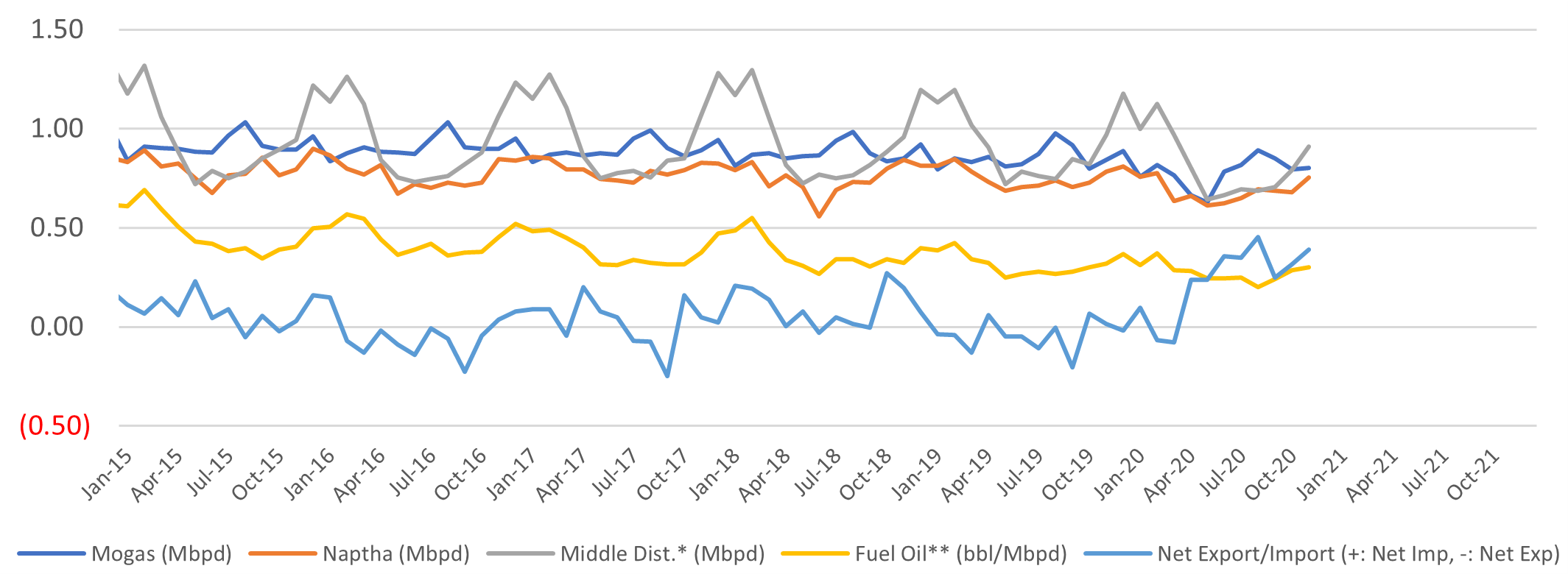

Domestic Fuel Sales

SOURCES: Ministry of Economy, Trade, and Industry (METI), Ministry of Finance, and the Petroleum Association of Japan

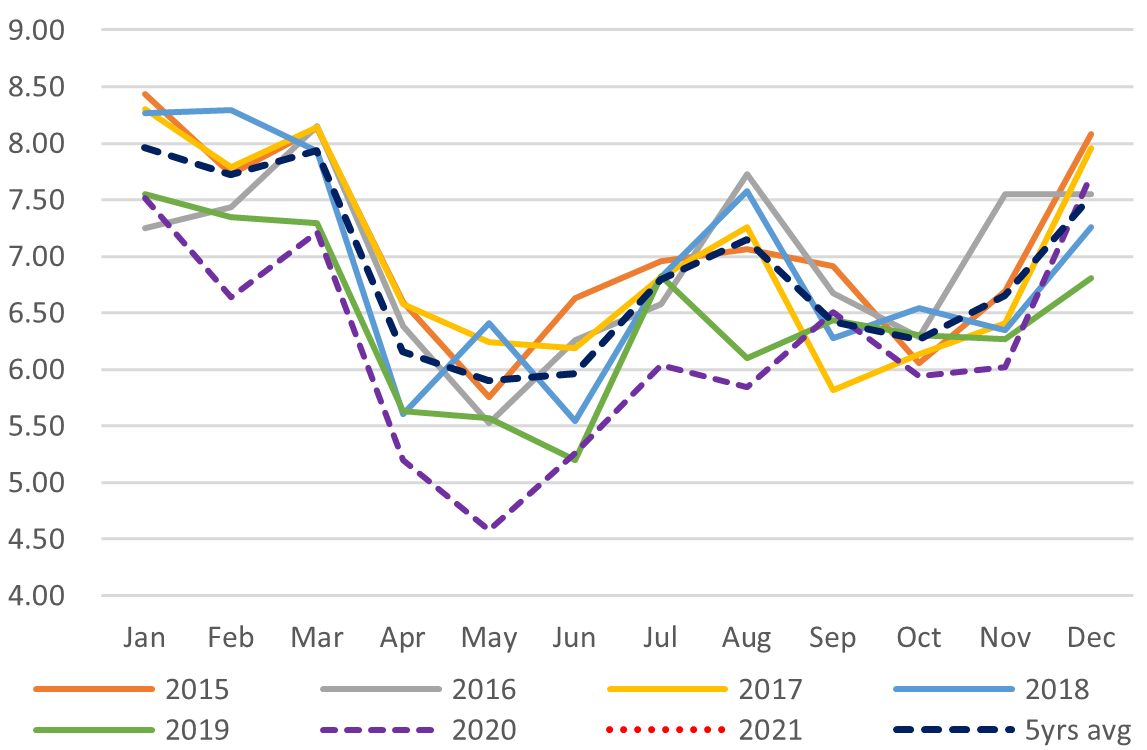

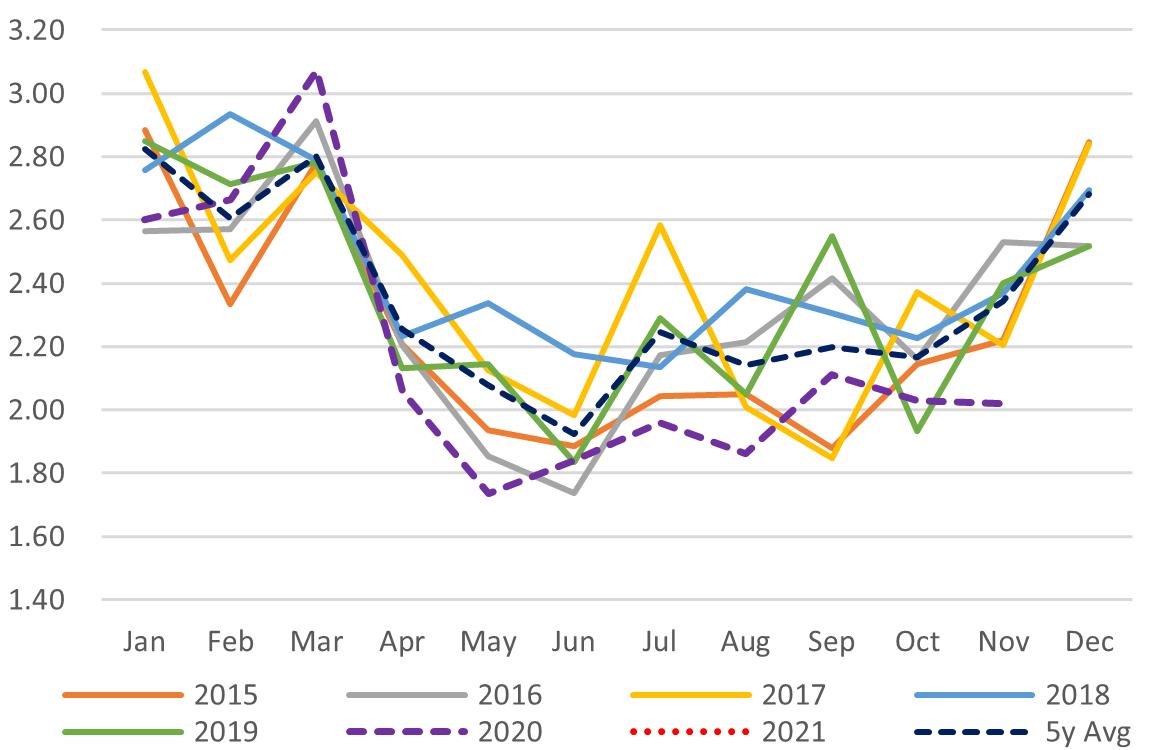

Japan LNG Price

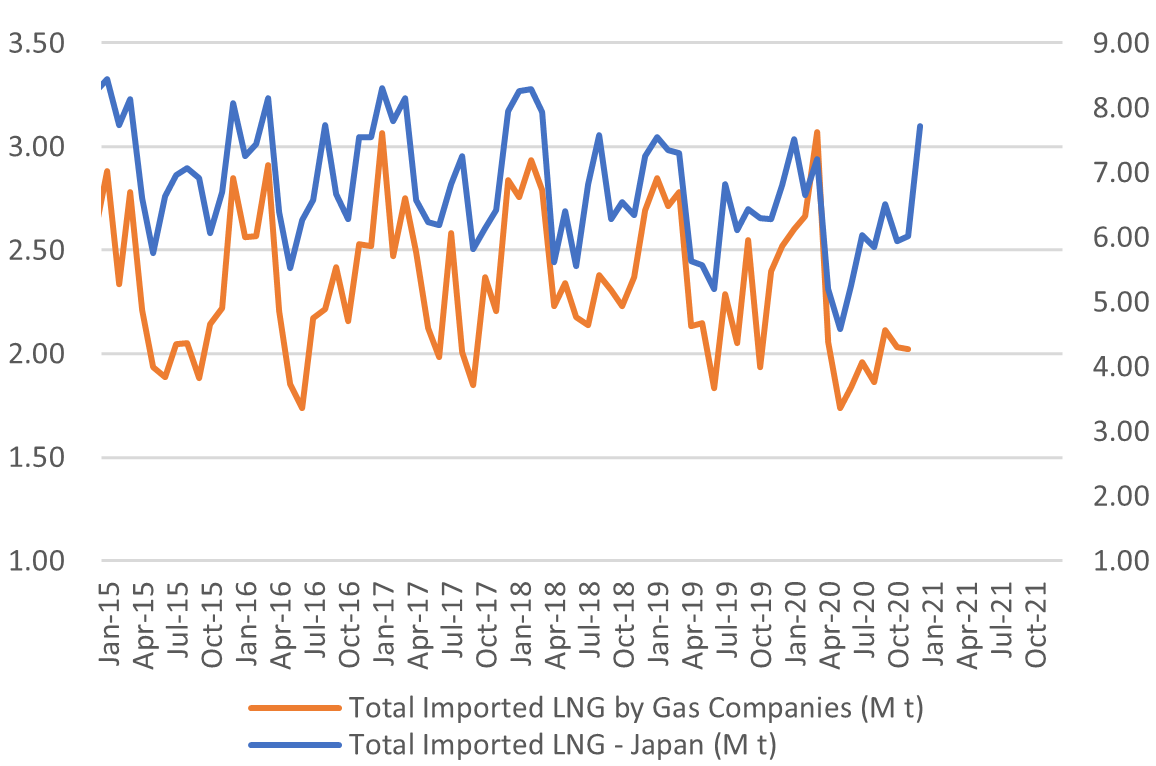

LNG Imports: Japan Total vs Gas Utilities Only

Total LNG Imports (M t)

LNG Imports by Gas Firms Only (M t)

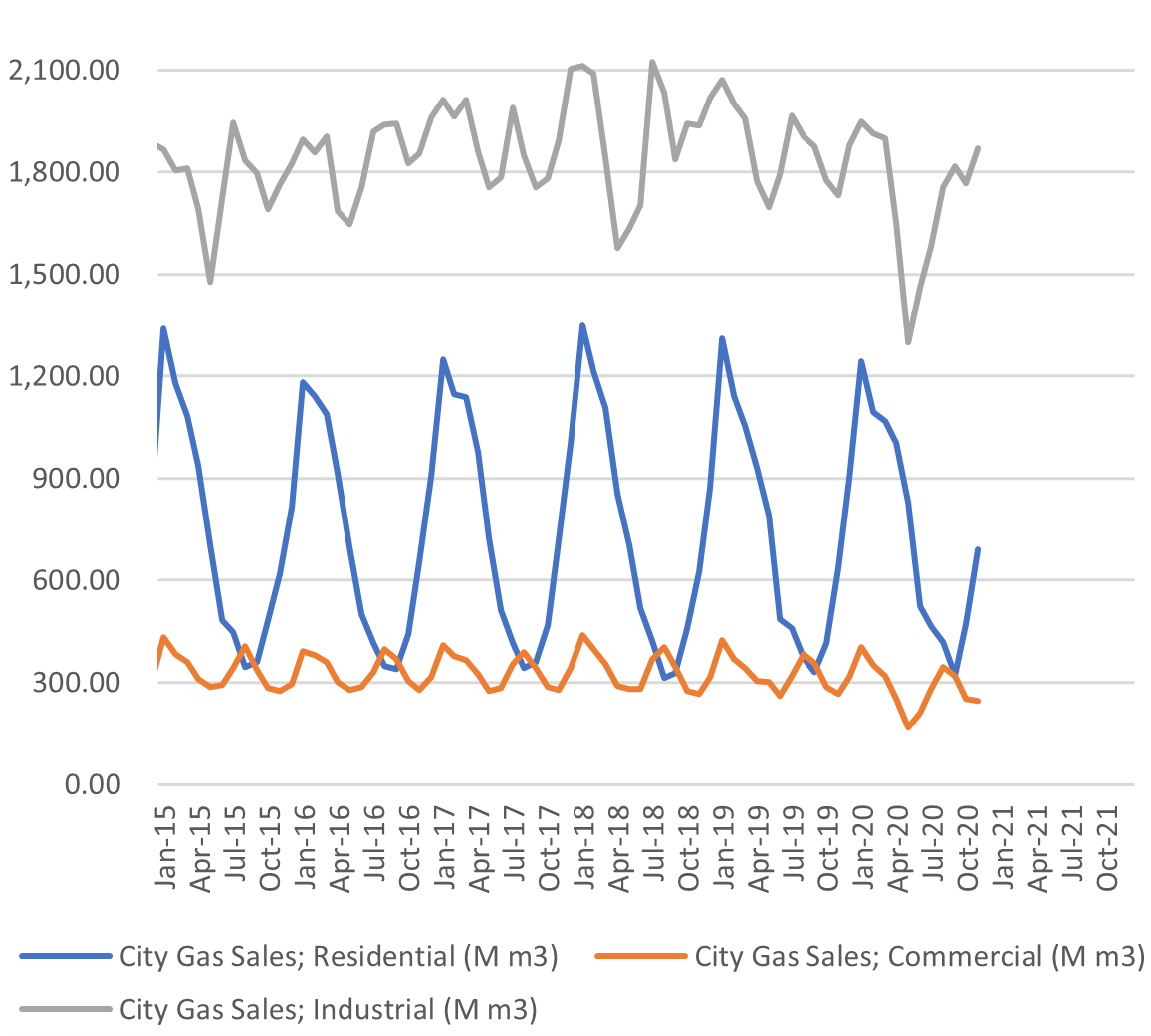

City Gas Sales – Total (M m3)

City Gas Sales by Sector (M m3)

SOURCES: Ministry of Economy, Trade, and Industry (METI),

Ministry of Finance

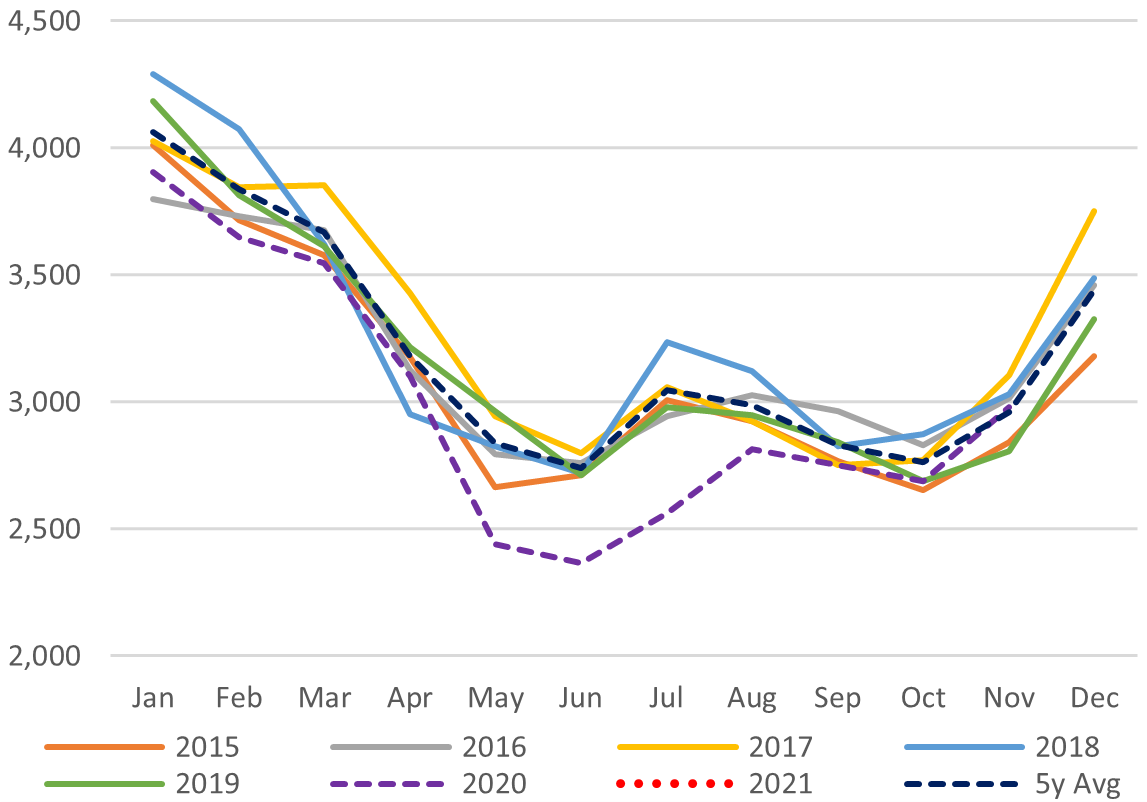

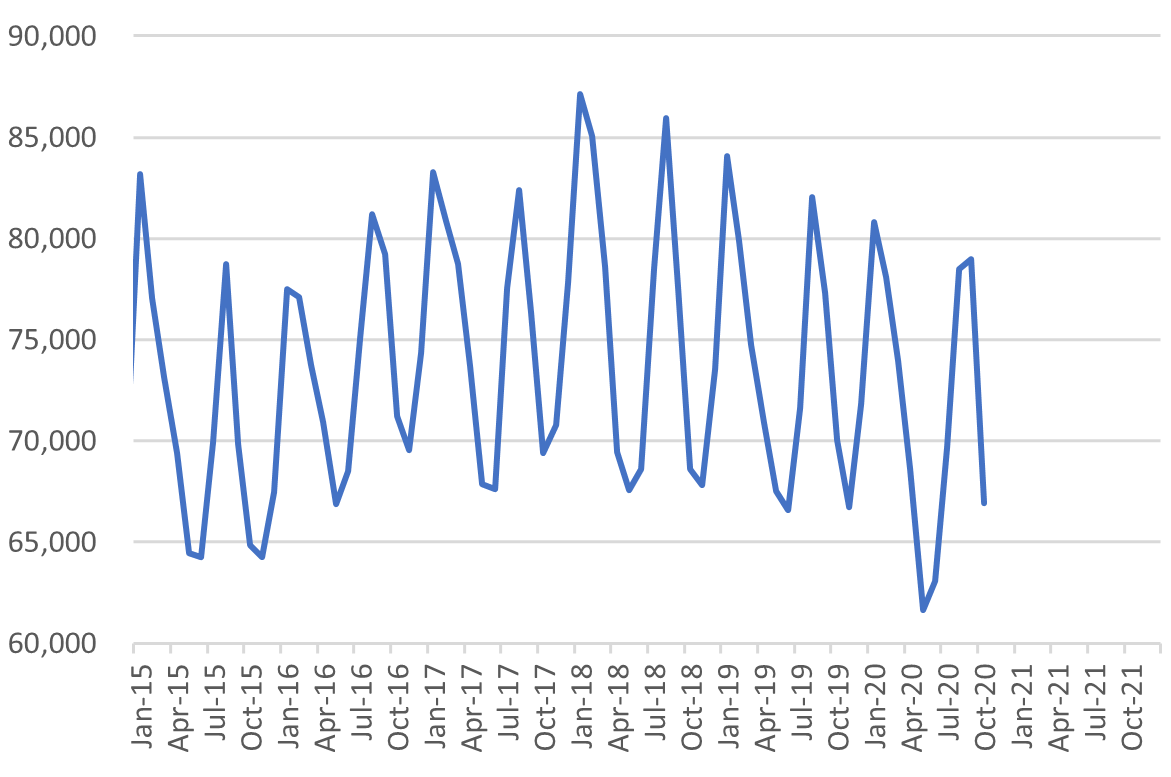

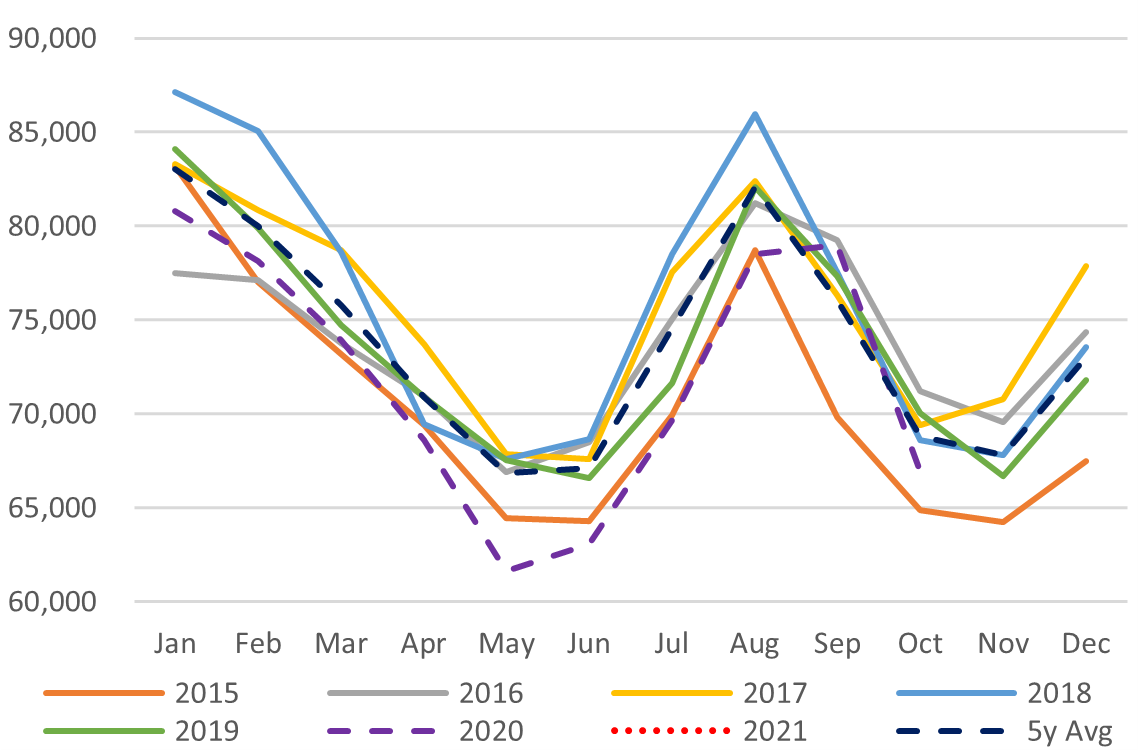

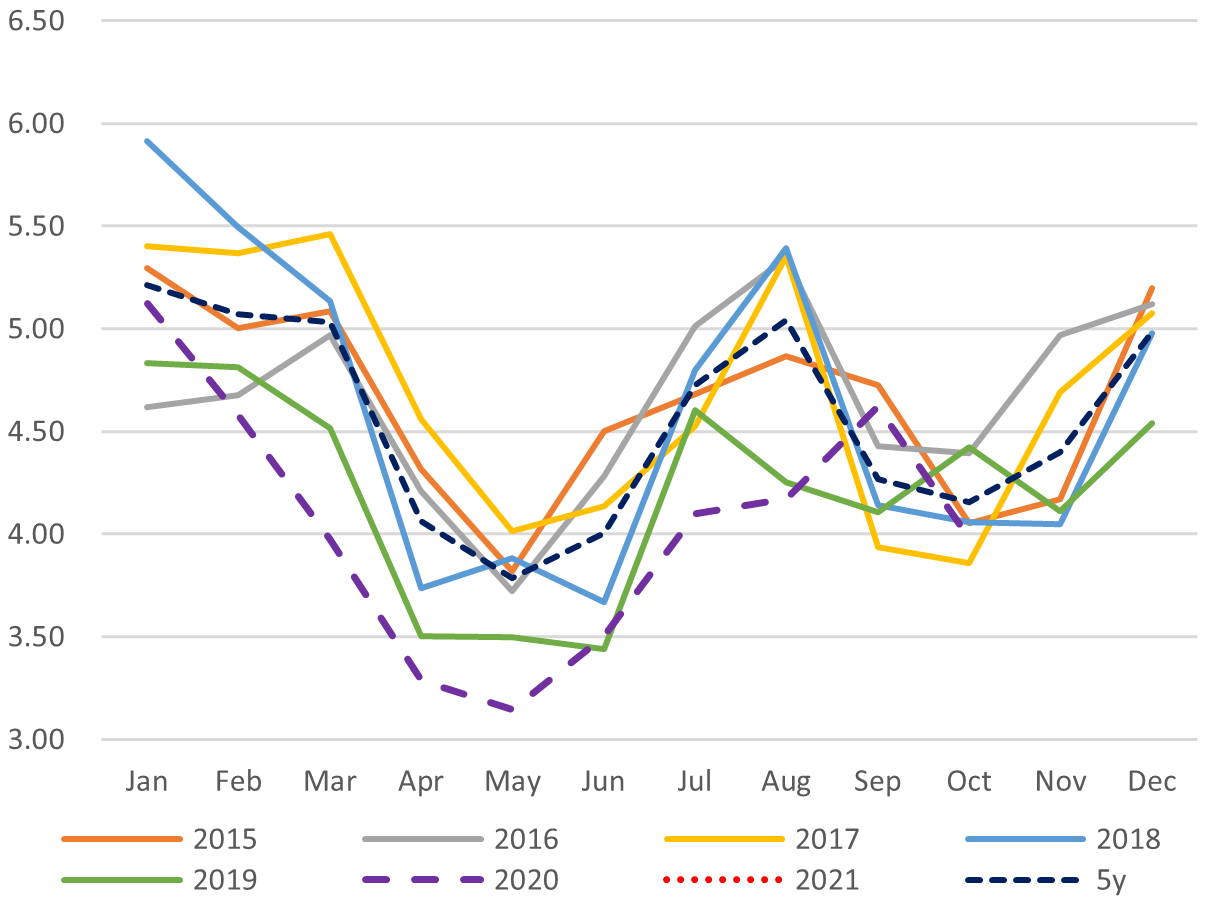

Japan Total Power Demand (GWh)

Current Vs Historical Demand (GWh)

Day-Ahead Spot Electricity Prices

Day-Ahead Vs Day Time Vs Peak Time

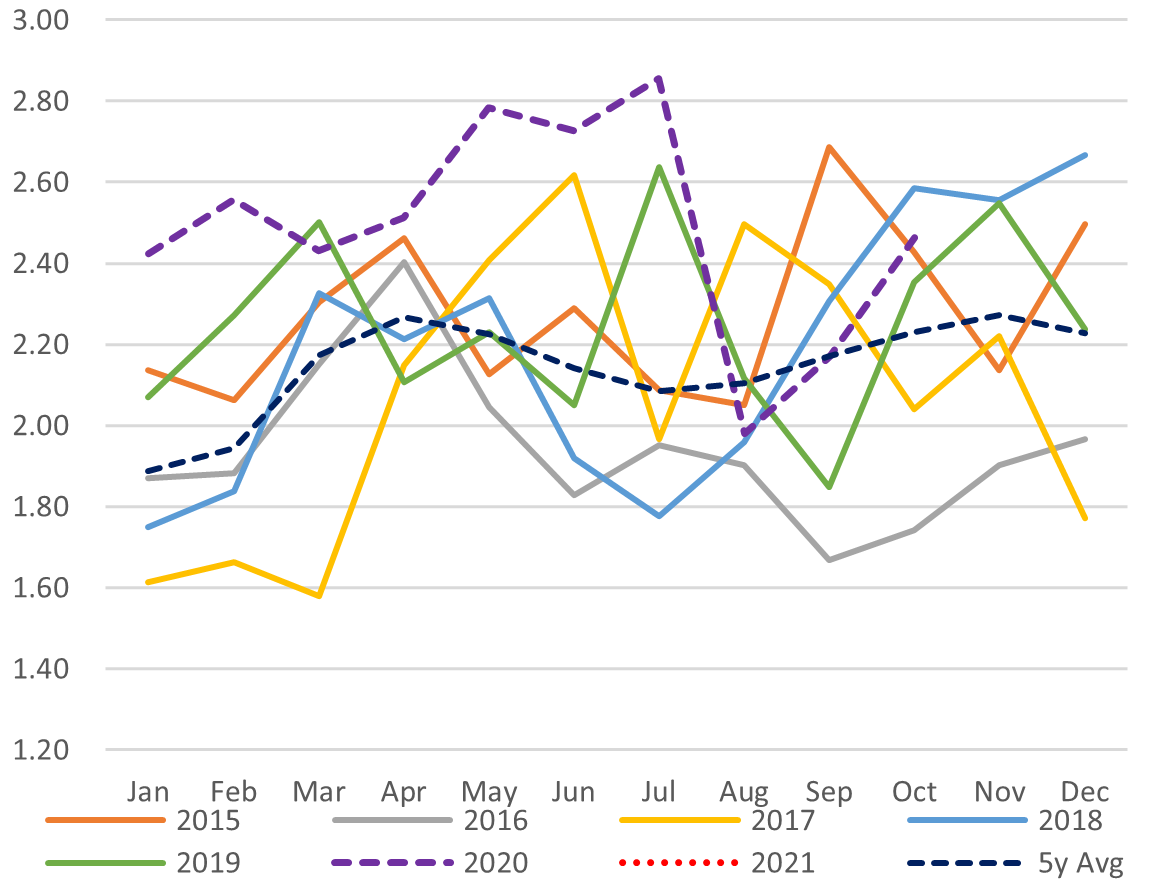

LNG Imports by Electricity Utilities

LNG Stockpiles of Electricity Utilities

SOURCES: Ministry of Economy, Trade, and Industry (METI), and the Japan Electric Power Exchange

ACRONYMS

|

METI |

The Ministry of Energy, Trade and Industry |

mmbtu |

Million British Thermal Units |

|

ANRE |

Agency for Natural Resources and Energy |

mb/d |

Million barrels per day |

|

TEPCO |

Tokyo Electric Power Company |

mtoe |

Million Tons of Oil Equivalent |

|

KEPCO |

Kansai Electric Power Company |

kWh |

Kilowatt hours (electricity generation volume) |

|

EPCO |

Electricity power company, refers to the 10 regional utilities that used to control all parts of the Japanese power industry | ||

|

NEDO |

New Energy and Industrial Technology Development Organization | ||

|

JCC |

Japan Crude Cocktail | ||

|

JKM |

Japan Korea Market, the Platt’s LNG benchmark | ||

|

CCUS |

Carbon Capture, Utilization and Storage | ||

|

CCUR |

Carbon Capture, Utilization and |