JAPAN NRG WEEKLY

DEC 18, 2023

JAPAN NRG WEEKLY

DEC 18, 2023

NEWS

TOP

- Round 2 offshore wind auction results announced for three sites: groups led by Mitsui, Itochu and Sumitomo emerge as winners

- Energy Agency details the timeline for developing advanced nuclear reactors and outlines key challenges

- Rising materials costs and compensation push Fukushima NPP accident cleanup bill to ¥23.4 trillion

- EGC reviews grids investment as revenue cap system kicks off

- Corporate tax reduction to boost production in strategic fields

- Itochu invests in Australian distributed power and battery firm

- Sumitomo Chemical begins demo methanol production from CO2

- Mitsubishi and Maersk to build base for green methanol fuel

- Itochu, Hive Hydrogen cooperate on green ammonia production

- KHI to commercialize DAC by 2025; sets output target for 2030

- ENEOS installs Swiss-made DAC to produce synthetic fuel

- Marubeni begins imports of perovskite to meet growing demand

- Construction major to buy embattled Japan wind developer

- Singapore firm to build Japan’s biggest battery storage system

- Japan-Denmark venture outlines plans for 1.5 GW wind farm

- Kawasaki City to mandate solar power from FY2025

- Sumitomo, etc to develop 1.5 GW hydro project in Mozambique

- Shizen Connect to draft plans for solar microgrid in Nagano Pref

- Sojitz, Kansai Electric, JR West sign potentially biggest PPA deal

- Tokyo Gas unit to buy U.S. natural gas producer for $2.7 billion

- Kansai Electric to partner with Hartree Partners on LNG

- LNG stockpiles see double-digit increase from last week

ANALYSIS

METI WELCOMES NEW MINISTER

AMID CABINET PURGE

On Dec 14, Saito Ken was named the new METI minister following his predecessor’s resignation over a financial scandal in the Cabinet. He replaces Nishimura Yasutoshi, who alongside other members of the ruling LDP stands accused of underreporting the party’s income. Japan NRG takes a brief look at Saito, his background in energy, and the challenges he will face.

ENERGY JOBS IN JAPAN:

THE MERITS OF A GENERALIST APPROACH

To generalize or to specialize? In Japan, the generalist approach is often favored, and there is an expression ‘Jinji Ido’ (personnel reshuffling) that’s common practice. The logic is rooted in Japan’s corporate culture. By exposing employees to different functions and sections in a company, they better understand each moving piece. For prospective employers looking to hire Japanese talent, this system presents both advantages and disadvantages.

GLOBAL VIEW

A wrap of top energy news from around the world.

EVENTS SCHEDULE

A selection of events to keep an eye on in 2023.

JAPAN NRG WEEKLY

PUBLISHER

K. K. Yuri Group

Events

Editorial Team

Yuriy Humber (Editor-in-Chief)

John Varoli (Senior Editor, Americas)

Mayumi Watanabe (Japan)

Wilfried Goossens (Events, global)

Kyoko Fukuda (Japan)

Magdalena Osumi (Japan)

Filippo Pedretti (Japan)

Tim Young (Japan)

Regular Contributors

Chisaki Watanabe (Japan)

Takehiro Masutomo (Japan)

SUBSCRIPTIONS & ADVERTISING

Japan NRG offers individual, corporate and academic subscription plans. Basic details are our website or write to subscriptions@japan-nrg.com

For marketing, advertising, or collaboration opportunities, contact sales@japan-nrg.com For all other inquiries, write to info@japan-nrg.com

OFTEN-USED ACRONYMS

| METI | The Ministry of Economy, Trade and Industry | mmbtu | Million British Thermal Units | |

| MoE | Ministry of Environment | mb/d | Million barrels per day | |

| ANRE | Agency for Natural Resources and Energy | mtoe | Million Tons of Oil Equivalent | |

| NEDO | New Energy and Industrial Technology Development Organization | kWh | Kilowatt hours (electricity generation volume) | |

| TEPCO | Tokyo Electric Power Company | FIT | Feed-in Tariff | |

| KEPCO | Kansai Electric Power Company | FIP | Feed-in Premium | |

| EPCO | Electric Power Company | SAF | Sustainable Aviation Fuel | |

| JCC | Japan Crude Cocktail | NPP | Nuclear power plant | |

| JKM | Japan Korea Market, the Platt’s LNG benchmark | JOGMEC | Japan Organization for Metals and Energy Security | |

| CCUS | Carbon Capture, Utilization and Storage | |||

| OCCTO | Organization for Cross-regional Coordination of Transmission Operators | |||

| NRA | Nuclear Regulation Authority | |||

| GX | Green Transformation |

NEWS: ENERGY TRANSITION & POLICY

Round 2 offshore wind auctions: winners of 1.4 GW of capacity announced

(Government statement, Dec 13)

- METI announced the results for three of the four Round 2 offshore wind auctions. The highly-anticipated auction saw three projects with a total of 1.4 GW in capacity all go to consortiums led by Japanese trading houses (Itochu, Mitsui and Sumitomo).

- For the first time in these auctions, an overseas company was among the parties in a winning consortium.

- Itochu’s project in Akita Pref includes JERA as a partner and covers 5,315-hectares off the coast of Oga, Katagami and Akita cities. The 315 MW wind farm offered a zero-premium price of ¥3/ kWh; it’s slated to begin operation in June 2028. The project will have 21 Vestas wind turbines (each 15 MW).

- The second successful bid went to a consortium of Mitsui, RWE and Osaka Gas. It won the 684 MW wind farm auction off the coast of Murakami-Tainai in Niigata Pref (9,200 hectares). It plans to begin operation in June 2029. It will use 38 GE turbines (each 18 MW). The price at a zero premium is designated at ¥3/ kWh. Capacity was decisive in the winning bid, as rivals had all proposed to use 15 MW Vestas turbines.

- The third auction win went to Sumitomo and TEPCO’s renewable power unit for a 420 MW wind farm off the coast of Eno Island in Saikai City, Nagasaki Pref. It will cover 3,984 hectares, with 28 Vestas turbines (15 MW each), and will launch in August 2029. Its rate is ¥22.18/ kWh.

- While the govt didn’t disclose the costs of the projects, the total across four sites is estimated at ¥1 trillion. The results for the fourth site — off Happo and Noshiro towns in Akita Pref — will be disclosed in March 2024.

- CONTEXT: Round 1 auctions were held under the Feed-in Tariff (FIT) system, but Round 2 was moved to the Feed-in Premium (FIP), which introduces more of a market price element. The zero-premium level in Round 2 puts the onus on operators to find their clients directly or via the market, rather than rely on a fixed rate from the government for the duration of their contract.

- Next up is Round 3 that will likely cover two project areas: Sea of Japan (South), Aomori Pref (600 MW); and Yuza, Yamagata Pref (450 MW). Round 3 bids are expected to face a deadline of late June 2024.

TAKEAWAY: So far, the results look to be free of scandal and have largely been met positively by those in the industry. That’s already a big step and reflects the much broader range of winners. Round 1, the results of which were announced at the end of 2021, led to intense scrutiny of the auction rules and process after all three winning bids went to groups led by trading house Mitsubishi. The outcry that followed delayed further auction rounds by at least a year as various industry players demanded a revision of the tender system, which has been tweaked to prevent one company from dominating.

There are several interesting results to examine in Round 2. For one, it’s uncanny that all of the auctions so far have been won by a group led by a trading house. However, these companies do possess unique qualities that give them certain advantages at this stage of market development. They are known as good project managers; retain large staff in Japan and around the world; invest in overseas specialist companies to acquire industry know-how; and can take on the challenge of building a new supply chain in Japan almost from scratch thanks to their broad connections. Trading houses also enjoy good credit scores and can attract low-cost financing, while attracting key suppliers with large contracts.

Among other issues of note is the huge gap between the winning Round 2 bids for the Akita and Niigata projects, and the Nagasaki projects. One important reason is the type of foundation. Most of the wind farms in shallow water are monopile constructions, but the Nagasaki offshore site was deemed unsuitable for such structures as they require heavy duty equipment for installation. Hence, the Nagasaki project had a rate cap set at ¥29/kWh. And yet, Sumitomo and TEPCO beat rivals thanks to a lower price predicated on a monopile-type substructure. The cost of jacket-type foundations is 1.9 times higher than for monopile structures.

The appearance of a non-Japanese winner, RWE, as part of the Mitsui-led consortium should give encouragement to other overseas companies seeking a piece of this market. No doubt, the number of international firms involved in Japan’s offshore wind sector will only grow over the years, though initial entry will be tough. As several parties interested in Round 2 discovered, the economics of current projects are still somewhat uncertain and returns may be below the levels sought by international investors. In part, that’s why some of the companies that carried out environmental assessments for Round 2 site did not follow through with a bid. However, as Round 1-2 projects start to get developed, the maturing of the domestic supply chain and of the logistics infrastructure should give clearer visibility for future developments.

| Project Name | Project Capacity and Bid (¥ / kWh) | Operation Starts | Project Members | Wind Turbine Manufacturer |

| Akita Oga-Katagami-Akita Offshore Wind | 315 MW

(¥3) | June 2028 | JERA, Itochu, J-Power, Tohoku Electric | Vestas (15 MW x 21 units) |

| Niigata

Murakami-Tainai Offshore Wind | 684 MW

(¥3) | June 2029 | Mitsui, RWE, Osaka Gas | GE (18 kW x 38 units) |

| Nagasaki Saikai-Enoshima Offshore Wind | 420 MW

(¥22.18) | Aug 2029 | Sumitomo, TEPCO Renewable Power | Vestas (15 MW x 28 units) |

| Akita

Happo-Noshiro Offshore Wind | To be disclosed in March 2024 |

Losing bidders in Round 2:

| Project Name | Vendors | Bid: Units | Commissioning | Capacity |

| Akita Oga-Katagami-Akita Offshore Wind |

| (15 MW x 22)

(17 MW x 20) | Dec 2030

June 2030 | 330 MW

340 MW |

| Niigata

Murakami-Tainai Offshore Wind |

| (15 MW x 38)

(15 MW x 31) (15 MW x 44) | June 2030

June 2029 March 2031 | 570 MW

465 MW 660 MW |

| Nagasaki Saikai-Enoshima Offshore Wind |

| (15 MW x 24) | Aug 2030 | 360 MW |

ANRE cites key research challenges to develop advanced nuclear reactors

(Government statement, Dec 11)

- ANRE has detailed the timeline for developing advanced nuclear reactors and identified 11 key research challenges. This relates to developing both high-temperature, gas-cooled nuclear reactors and fast reactors. An 11-member working group, headed by Prof Kurosaki Ken of Kyoto University, will now propose solutions.

- The group will review the R&D advances, seek input from power utilities and others, and will write development scenarios for each of the key challenges.

- ANRE eyes 2030 as a target timeline to construct a demo high-temperature reactor, and 2040 for a demo fast reactor.

- CONTEXT: In June, MHI was chosen by ANRE to lead a project to develop a fast reactor and a high-temperature gas-cooled reactor. The project is expected to draw ¥1 trillion in public and private investments.

Advanced reactor R&D issues

| High-temperature gas cooled reactors | Fast reactors |

| Setting specs of demo reactors (output and reactor design); identifying criteria such as earthquake resilience, fuel quality | Setting specs of demo reactors (output and reactor design); identifying criteria such as earthquake resilience, fuel quality |

| Identifying the fuel property (coated fuel particles, graphite etc) for high-temperature treatment in reactors in advanced stages | Testing connectivity and interface solutions of large demo plants (identifying equipment and evaluation methods) |

| Reuse of heat (hydrogen production, etc.) and setting technical and regulatory frameworks for system safety; to develop hydrogen production technology | Obtaining radiation data of fuel and other materials including minor actinide (MA)-containing mixed oxide fuels (MOX), eyeing regulatory control |

| Testing connectivity and interfaces solutions of large demo plants (identifying equipment and evaluation methods) | Setting regulatory standards, identifying different requirements compared to light water reactors |

| Setting regulatory standards, identifying different requirements compared to light water reactors | Fuel production, including production of MOX |

| HALEU (High-Assay Low-Enriched Uranium) processing technologies | — |

EGC reviews grids investment as revenue cap system kicks off

(EGC statement, Dec 11)

- The Electricity and Gas Market Surveillance Commission (EGC) released its grid investment plan for FY2023-2027. The data will be used to set power transmission cost targets and the maximum amount operators will be able to earn. The system started this year.

- Japan’s 10 grids will invest a total of ¥6.7 trillion, of which ¥2 trillion are for transmission networks. Of that figure, ¥1.26 trillion will go to local transmission lines, and ¥750 billion for the interconnecting lines.

- TEPCO Power Grid ranked the top in both total and network investment.

Grids facility investments breakdown (¥ billion)

| Grid | Total investment | Total network investment | Interconnecting lines | Local lines |

| Hokkaido NW | 324.7 | 76 | 20.9 | 55 |

| Tohoku NW | 870 | 303.3 | 157.8 | 145.5 |

| TEPCO PG | 2,062.2 | 725.8 | 269.8 | 455.9 |

| Chubu PG | 854.3 | 168.7 | 50.2 | 118.5 |

| Hokuriku T & D | 191.4 | 52.9 | 9.3 | 43.6 |

| Kansai T & D | 899 | 270.4 | 92.6 | 177.8 |

| Chugoku NW | 484.9 | 116.7 | 19.7 | 97 |

| Shikoku T & D | 214.8 | 40.1 | 10.4 | 29.7 |

| Kyushu T & D | 715.1 | 227.5 | 117.8 | 109.7 |

| Okinawa Electric | 95.3 | 26 | 3.7 | 22.3 |

| Total | 6,711.6 | 2,007.5 | 752.3 | 1,255.2 |

- SIDE DEVELOPMENT:

Corporate tax reduction proposed to boost production in five strategic fields

(Mainichi, Dec 12)- The govt and ruling party have compiled a new corporate tax reduction system proposal to promote domestic production in five strategic fields: chips; EVs and FCVs; sustainable aviation fuel (SAF); green steel; and green chemicals

- The idea is to reduce corporate taxes for 10 years based on production/ sales volume of applicable goods. This would strengthen economic security by supporting the production of strategic materials essential for decarbonization and cutting-edge tech.

Itochu invests in Australian distributed power source and storage battery company

(Company statement, Dec 12)

- Itochu will invest in UON, a major distributed power company in Australia. It will acquire a 20% stake through a third-party allotment to increase capital.

- Itochu plans to provide its expertise in batteries to UON for R&D, and to expand its business scope in Asia and the U.S.

- UON, which is partly owned by Macquarie Group, will use the investment to expand its battery storage business and for R&D, and proposes combining battery storage with renewable energy sources like solar power for mines and other facilities.

- CONTEXT: UON specializes in supplying and maintaining “off-grid” power sources for areas with limited power supply infrastructure, such as mines.

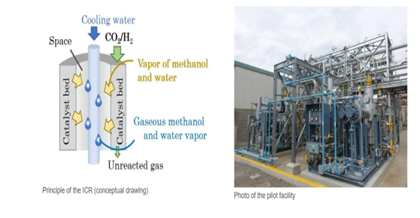

Sumitomo Chemical begins demo production of methanol from CO2

(Company statement, Dec 12)

- Sumitomo Chemical launched production of methanol from CO2 at a demo plant in Ehime Pref that will run until 2028.

- The company and Prof Omata Koji of Shimane University improved the efficiency of converting CO2 to methanol by utilizing the internal condensation reactor (ICR). It condenses and separates methanol and water, which was not possible before.

- Thanks to ICR, yield and energy efficiency improved, and the equipment was downsized. Catalyst degradation, which happens when a catalyst comes in contact with water, will likely be limited.

- Sumitomo Chemical plans to commercialize the ICR process and license the technology to third parties in the 2030s.

- CONTEXT: Sumitomo Chemical is developing a suite of amine-based carbon capture equipment for customers ranging from small offices to big industries. With its carbon-to-methanol conversion processes, the company may be able to offer a turn-key “carbon capture to utilization” solution for chemical plants.

TAKEAWAY: Researchers are exploring new methanol production processes since “green” methanol could have higher market value than green hydrogen or ammonia. Osaka University is developing a methanol production process using carbon collected from cow manure-derived biogas; Ibaraki University uses carbon captured from air, to name a few. The key challenges to this technology are the endurance of the methanol conversion equipment; the ability to make the product at a low cost: and creating an efficient process from carbon capture to utilization.

Mitsubishi Gas Chemical and Maersk to build base for green methanol fuel in Japan

(Nikkei, Dec 15)

- Danish group A.P. Moller-Maersk has chosen Yokohama as the site of its first supply base for green methanol to fuel ships.

- By the years’ end, the firm plans to sign an MoU with Mitsubishi Gas Chemical and the city of Yokohama to start supplying methanol.

- The fuel will be procured by the Danish group from overseas and by MGC from its plant in Niigata Pref. It will be sold to Maersk and other shipping companies.

- CONTEXT: Earlier this year, the International Maritime Organization joined global decarbonization efforts and set a target to make emissions from oceangoing vessels net zero by around 2050. Maersk began sailing its first ship powered with green methanol in October and plans to launch such vessels in Asia.

Itochu to cooperate with Hive Hydrogen South Africa for green ammonia production

(Company statement, Dec 11)

- Itochu signed a MoC with Hive Hydrogen South Africa on the development of a green ammonia production project. The project aims to produce and market green ammonia using wind and solar power.

- CONTEXT: In September, the two countries signed an MoC for collaboration in the fields of hydrogen and ammonia.

- CONTEXT: Itochu is also working on projects to manufacture and sell low-carbon ammonia in Canada, develop ammonia-fueled ships, and use low-carbon ammonia for fertilizer-related applications.

TAKEAWAY: This project could supply over 900,000 tons of ammonia to Japan, Korea and Europe each year. In Sept 2022, Itochu announced a collaboration on ammonia with Sasol, also from South Africa. If these collaborations develop, South Africa could become a significant source of ammonia for Japan.

- SIDE DEVELOPMENT:

Marubeni joins green ammonia project in Oman

(Company statement, Dec 13)- A consortium of Marubeni, South Korean Samsung C&T, the UAE’s Dutco Overseas and Oman’s OQ Alternative Energy inked an agreement with Hydrogen Oman (Hydrom) to produce green ammonia.

- Hydrom is a state-owned company with a mission to annually produce 1 million tons of green hydrogen from solar and wind power by 2030. The consortium will use green hydrogen supplies from Hydrom to produce the green ammonia.

- The consortium has also acquired the right of usufruct and development rights of a green ammonia supply chain for a period of 47 years. The ammonia will be supplied to local and international markets.

- SIDE DEVELOPMENT:

Itochu and Osaka Gas buy stake in Danish green hydrogen company

(Company statement, Dec 13)- Itochu and Osaka Gas inked a deal to take a stake in Everfuel, a Danish green hydrogen company. A special purpose company (SPC) will be created to buy 13.56% of the shares from Nel ASA, a current shareholder.

- Everfuel is involved in the design, engineering, procurement, construction (EPC), and operations of green hydrogen production facilities. It also distributes and sells hydrogen in the mobility and industrial sectors.

KHI to commercialize DAC by 2025, aims for 1 mln tons of annual recovery by 2030

(Denki Shimbun, Dec 13)

- Kawasaki Heavy Industries plans to develop and commercialize Direct Air Capture (DAC) technology to achieve about ¥50 billion in sales by 2030.

- In 2025, the company will launch a DAC recovery plant with an annual capacity of 20,000 tons of CO2. The goal is to build large facilities capable of recovering 500,000 to 1,000,000 tons annually by 2030.

- The strategy calls for promoting the business in regions with suitable locations for DAC storage and abundant renewable energy in order to power those facilities.

- CONTEXT: KHI President Hashimoto said DAC is an area where the company can use its strengths and create a big business.

- SIDE DEVELOPMENT:

ENEOS installs Swiss-made DAC to produce synthetic fuel

(Company statement, Dec 11)- ENEOS began a demo of DAC (Direct Air Capture) at the Central Research Institute of Technology (Yokohama City). The unit was made by Swiss startup Climeworks.

- This was the first time in the Asia-Pacific region that the Swiss company’s CO2-capturing equipment was installed.

- ENEOS seeks to verify whether the recovered CO2 can be used as raw material for synthetic fuel.

- CONTEXT: The demo is expected to last more than a year. A DAC unit collects CO2 from the atmosphere using a filter, heating it up to extract the CO2. The amount of CO2 recovered is about 75 kg per day, and the installation area is 7 meters x 7 meters.

KHI clarifies boil-off rates of liquefied hydrogen

(Company statement, Dec 11)

- The boil-off rate of liquefied hydrogen, or the rate of its evaporation, has been reduced to LNG levels thanks to new tank technologies, Kawasaki Heavy Industries said, announcing the results of its research.

- The first journey of a ship carrying liquified hydrogen was made in 2021; several journeys have been made since. The boil-off rate was 0.3% per day when the hydrogen was transported from Australia to Japan on Suiso Frontier, a ship developed by KHI. The rate was 0.06% per day when it was stored in Kobe in onshore storage tanks, also developed by KHI.

- CONTEXT: KHI has developed two-tier stainless steel tanks to transport and store liquefied hydrogen. The Suiso Frontier has a capacity to load 75 tons of liquefied hydrogen, but it was not clear how many tons were actually delivered to Japan.

TAKEAWAY: Based on KHI figures, 75 tons of liquefied hydrogen would reduce to 49 tons after a two-week sail, and would halve after 25 days. Some experts believed liquefied hydrogen transport, in general, was unrealistic due to the high boil-off rate. KHI’s clarification will improve the visibility of building international hydrogen supply chains using liquefaction technologies. See: “How are Less-loved Hydrogen Carriers Developing?” in the Dec 11 issue of Japan NRG.

Miyazaki Pref ports chosen for trial assessment of decarbonization efforts

(Kankyo Business, Dec 7)

- Three ports on Japan’s Kyushu island – Hososhima, Miyazaki and Yabutsu (Miyazaki Pref), were chosen for a trial assessment ahead of the launch of a full-scale certification scheme for evaluating decarbonization progress at port terminals.

- The move is part of the govt’s plan for decarbonization of ports nationwide.

- Full-scale operation is scheduled to begin by late 2024.

- CONTEXT: The proposed CNP certification system is aimed at evaluating decarbonization efforts within terminals, boundary areas, such as berthing vessels, and trucks, which account for over 90% of the total emissions from port terminals.

- SIDE DEVELOPMENT:

JERA, NYK Lines and Resonac to study world’s first supply of fuel ammonia to ships

(Company statement, Dec 13)- JERA, NYK Line and Resonac seek to achieve the world’s first supply of fuel ammonia to ships. Their study involves the supply of fuel ammonia to a tugboat powered by an ammonia-fueled engine developed by NYK Line.

- It also includes studying operational methods for supplying fuel ammonia, and aims to develop systems for its transport and reception at ports.

ENEOS, Tokyo Univ, govt laboratories launch blue carbon studies

(Company statement, Dec 12)

- ENEOS, Tokyo University, and three govt research institutes (Port and Airport Research Institute, Japan Agency for Marine Earth Science and Technology, and the National Institute of Advanced Industrial Science and Technology) launched studies on the underwater ecosystem known as blue carbon.

- Blue carbon is a process of sea vegetation absorbing carbon in air through photosynthesis, and storing it. The parties aim to develop the blue carbon ecosystem to a scale enabling the capture of over 1 million tons of CO2.

Opinion: Japan’s energy strategy in SE Asia driven by financial interests, not climate

(Dec 12, Nikkei)

- CONTEXT: This is an opinion piece by Raoul Manuel, a member of the Philippine House of Representatives and representing the Kabataan Party.

- Japan’s climate aid to ASEAN is more focused on financial interests rather than genuine climate action. Support for fossil fuel-based technologies like gas expansion, CCUS, and ammonia co-firing at power plants will not help achieve the global 1.5 C target and it could hinder the shift to renewable energy in Southeast Asia.

- ASEAN countries need to transition from fossil fuels to renewables, such as solar and wind. Japan’s strategy emphasizes loans for technologies related to fossil fuel, rather than grants for renewables.

TAKEAWAY: Japan’s support for certain technologies isn’t solely based on its manufacturers seeking to export their equipment. Many countries in Southeast Asia place high importance on oil and gas production, such as Indonesia and Malaysia. Their emphasis on CCS is a way to protect such industries and their relatively young fossil fuel fired power plants. However, popular opinion in Southeast Asian countries may shift in time. What’s more, oil and gas production in the Philippines is relatively minor and has decreased in recent years, which may change local attitudes to fossil fuels.

NEWS: ELECTRICITY MARKETS

Costs for handling Fukushima NPP accident cleanup increased to ¥23.4 trillion

(Nikkei, Dec 15)

- METI plans to increase the state bonds sale plans by ¥1.9 trillion to cover the increased costs related to the Fukushima Daiichi NPP accident. This raises the current bill for the cleanup to ¥23.4 trillion.

- The govt has been issuing bonds, capped at ¥13.5 trillion, to lend funds to TEPCO for compensation and decommissioning work. Due to rising costs, including those for the release of treated water, the bond limit will be increased to ¥15.4 trillion.

- This change is partly due to extra compensation for evacuees and fisheries affected by the nuclear accident, as well as expenses related to interim nuclear waste storage.

- CONTEXT: After the 9.0 earthquake in 2011 and ensuing tsunami, the wrecked facility has had to deal with a number of serious issues. One of the most contentious, at least from the public standpoint, has been the release of water initially used to cool the reactors and then treated to eliminate most of its radiation. At present radiation levels, the water is safe to be released into the ocean, according to the IAEA and other scientific bodies. But this has not stopped criticism both at home and abroad. China’s reaction in particular has caused economic damage to the local fisheries industry since the neighboring country banned most Japanese seafood imports. In response, Japan’s government has promised to compensate domestic fishermen and other affected parties for lost earnings.

- SIDE DEVELOPMENT:

IAEA and MoE release Fukushima bay area report, confirm monitoring accuracy

(Government statement, Dec 12)- The MoE and IAEA issued a report based on sampling in the Fukushima bay area during November 2022 as part of an ongoing Sea Area Monitoring Plan to evaluate the level of radionuclides in the vicinity of Fukushima Daiichi NPP.

- The samples were collected in an area close to the NPP and several species of fish were sampled from a market in Fukushima Pref.

- The IAEA concluded that Japan’s sample collection procedures adhere to its standards, and statistical tests passed with nearly 100% confidence.

- CONTEXT: The study is part of an ongoing campaign to assist Japan with monitoring the sea and reporting updates on conditions.

Marubeni imports perovskites amid growing demand for demos

(Japan NRG, Dec 15)

- A unit of trading house Marubeni began importing glass-mounted perovskite solar cells (PSC) to meet growing domestic demand for demos of the next-generation solar technology. Marubeni Eneble, encouraged by METI’s subsidies, is possibly the first Japanese importer of finished PSC products on a commercial scale.

- The company offers PSCs sized 0.72 square meters, either with a power efficiency of 18.06% or 15.28%. One unit costs ¥50,000; orders are for a minimum of 50 units.

- CONTEXT: The Marubeni offering is very attractive as one-square-meter local AGC-brand glass-mounted silicon solar modules cost ¥200,000.

TAKEAWAY: Many businesses are developing interest in PSCs but local manufacturers have not yet started mass production. Panasonic markets an inkjet printer for PSC production but one machine costs several tens of millions of yen. The Marubeni solution will possibly expand the scope of PSC product development beyond the companies in national projects as more businesses will be able to enter this sector.

Construction firm Infroneer to purchase JWD for ¥200 billion

(Company Statement, Dec 12)

- Infroneer, an infrastructure services company, is set to acquire Japan Wind Development from Bain Capital for about ¥203 billion.

- The deal will conclude in late January.

- CONTEXT: JWD currently operates 293 turbines, total capacity of 570 MW.

TAKEAWAY: Rumors about the buyout emerged earlier this month amid a bribery scandal involving JWD’s former management. The firm’s founder and former chief, Tsukawaki Masayuki, was indicted on bribing lower house lawmaker and ruling LDP member Akimoto Masatoshi. Tsukawaki admitted to the charges. The company was told by Japanese regulators to perform a legal compliance review, and the deal may help the company restore public trust. Bain acquired JWD and took it private in 2015. Infroneer was set up in 2021 as a holding company for construction firm Maeda and subsidiaries.

- SIDE DEVELOPMENT:

Toyo Construction to build self-propelled cable-laying vessel for offshore wind

(Company statement, Dec 8)- Toyo Construction plans to build a self-propelled cable laying vessel for use in construction of offshore wind farm facilities.

- The ship will be designed to operate in varied conditions, from shallow to deep waters.

- CONTEXT: The announcement comes as the firm plans to establish the Offshore Wind Power Business Division in April 2024. The vessel will be used in a variety of fields, such as foundation and floating offshore wind power mooring construction.

Singapore’s Gurin Energy to build 500 MW battery storage system in Japan

(Company statement, Dec 15)

- Singapore’s Gurin Energy plans to develop, build and operate Japan’s largest battery energy storage system (BESS). The 500 MW system will use 4-hour BESS capable of storing up to 2 GWh of electricity.

- The project, which is the company’s first in Japan, is estimated to cost ¥91 billion. Local partners include Nippon Koei Energy Solutions and TMEIC.

- Construction of the BESS is expected to begin in 2026 and take as long as 6 years. As the site has not yet been determined, Gurin is set to conduct an assessment for BESS development in either Fukushima or Tochigi Pref.

- CONTEXT: Thanks to increases in state subsidies in 2023, more foreign and domestic companies are now investing in the battery storage industry.

TAKEAWAY: Gurin’s entry into the Japanese market has come about quite quickly, showing there is strong interest overseas in the local battery sector. That’s partly due to the high (and growing) level of curtailment experienced by solar and wind operators nationwide. Investment in new grid infrastructure has lagged that of renewables capacity. The entry of BESS systems into the market, however, is at an early stage. This means, battery operators are having to navigate as yet unclear regulatory environments and technical uncertainties. In Gurin’s case, the company said it plans to set up an office in Tokyo and also launch a training program for technical and non-technical professionals from local communities.

Hokkaido Offshore Wind seeks to build 1.5 GW wind farm near Hiyama Coast

(Company statement, Dec 8)

- Hokkaido Offshore Wind Development, a JV between MHI and renewables investment firm Copenhagen Infrastructure Partners (CIP), plans to develop an offshore wind farm near Hiyama, Hokkaido.

- The wind farm will have a maximum capacity of 1.5 GW. The site will be about 34,614 hectares. The operator plans to install up to 135 turbines, each with a capacity ranging between 10 MW and 24 MW.

- CONTEXT: In May, the govt chose five sites off the coast of Hokkaido as “promising zones” for developing offshore wind farms, marking the second stage in a three-part selection process. The five sites were chosen after a government study confirmed they would have grid connection capability. Hokkaido is expected to accommodate up to 14.6 GW of wind power, about one-third of Japan’s approximate 45 GW target by 2040.

Marubeni enters PPA with Saudi firm in solar project via Dutch subsidiary

(New Energy Business News, Dec 15)

- Trading house Marubeni inked a long-term PPA deal with Saudi Arabia’s FAS Energy, a subsidiary of Fawaz Alhokair Group.

- Marubeni is acting via its fully owned Dutch subsidiary Axia Power, and will install solar modules on top of Cenomi Center shopping malls and parking lots.

- CONTEXT: Saudi Arabia aims to speed up its transition to renewable power and reach nearly 60 GW of capacity by 2030. Marubeni is also involved in Saudi Arabia’s Rabigh solar farm, capacity 300 MW.

Kawasaki City to mandate solar power from FY2025

(Government statement, Dec 8)

- Starting 2025, the city of Kawasaki seeks to mandate the usage of solar PVs on buildings that do not require land development.

- The decision is in line with its ordinance on promotion of measures to address the global climate crisis, which was revised in March.

- The installation of solar power equipment is expected to provide an economic benefit of more than ¥1 million over 30 years, according to the city’s estimates.

- CONTEXT: The city is currently promoting initiatives aimed at halving GHG emissions by FY2030 over FY2013 levels.

Sumitomo, EDF, TotalEnergies to develop 1.5 GW hydro project in Mozambique

(Company statement, Dec 14)

- EDF, TotalEnergies, and Sumitomo were chosen by Mozambique for the Mphanda Nkuwa hydropower project (MNK), which is a 1.5 GW project on the Zambezi River that would boost the country’s electricity production by over 50%.

- EDF leads the consortium, offering hydropower expertise. TotalEnergies brings experience in large energy projects in Africa.

- The consortium will have a 70% stake, while Mozambican entities will own the rest.

Shizen Connect to draft plans for solar microgrid in Nagano Pref

(Government statement, Dec 8)

- Shizen Connect, a subsidiary of Shizen Energy, inked a deal with the town of Obuse, Nagano Pref, on a design for a microgrid.

- The firm will study the optimal business and structural model for a solar power microgrid that would serve major public facilities.

- CONTEXT: The project aims to strengthen disaster resilience. During emergencies, the microgrid will supply power to the town hall and major public facilities, including the town library and elementary school.

Kansai Electric signs potentially biggest PPA to date with Sojitz, JR West

(Company statement, media reports, Dec. 14)

- KEPCO, in cooperation with Sojitz and JR West, will launch potentially Japan’s biggest corporate PPA project, with 18 MW of capacity involved.

- Sojitz will generate electricity from solar panels; and, KEPCO will supply power as a retailer to JR West for its trains running between Kyoto and Kobe. Power supply will be provided in combination with environmental values such as non-fossil certificates.

- The parties involved claim this will be the first corporate PPA in Japan that separates power generation and retail sales.

- CONTEXT: KEPCO’S largest corporate PPA at present is with a subsidiary of Panasonic Holdings. It relates to approximately 18 MW of capacity.

- SIDE DEVELOPMENT:

JR West to introduce renewable energy-sourced power in Kinki area

(Mynavi News, Dec 14)- JR West will introduce solar-generated electricity for train operations on lines in the Kinki area.

- The initiative starts in FY2026-2027. It would replace over 10% of JR West’s conventional line electricity with renewable energy.

KEPCO seeks wholesale electricity sales partners for FY2024

(Denki Shimbun, Dec 11)

- KEPCO began accepting bids for wholesale power sales partners for FY2024. Supply will be limited to the Kansai area.

- KEPCO will accept bids from retail electric power companies, including its retail division, until Dec 18. Bidding is scheduled on Dec 19 and results will be announced on Dec 28. The contract is scheduled to be signed in late January.

- The offer combines “all-day power supply” and “weekday power supply,” excluding weekends and holidays.

- The minimum bidding unit is 0.4 MW with two options: “limited volume” (5.6 GW) and “unlimited volume” (2.8 GW).

- SIDE DEVELOPMENT:

Kyushu Electric sets tailored plans for electricity suppliers for FY2024

(Denki Shimbun, Dec 11)- Kyushu Electric also announced a call for wholesale electricity suppliers for FY2024. It is accepting applications until Dec 27.

- The firm will offer two patterns of electricity supply: basic (all-day) and tailored to meet the buyers’ needs. The transaction will be conducted directly between Kyushu Electric and the retailer, without brokers.

- The volume available for sale has not been disclosed.

75 MW Tokushima Tsuda biomass plant starts commercial run

(Company statement, Dec 11)

- The 75 MW Tokushima Tsuda biomass power station in Tokushima Pref began commercial operation. Wood pellets and palm kernel shells are the main feedstocks.

- The power station is owned 60.8% by Renova, 33.5% by Osaka Gas and the rest by three minority stakeholders.

- CONTEXT: The plant was initially to be operational in February 2023 but was postponed due to technical issues over its boiler turbine.

TAKEAWAY: Wood pellet and palm kernel shell prices have skyrocketed since 2019 when construction began, possibly forcing the plant owners to change cost models. Some believe operational efficiency is their biggest challenge as the high fuel costs may result in low plant run rates.

KEPCO’s Takahama Unit 4 faces regular inspection until April 2024

(Company statement, Dec 14)

- KEPCO began the 25th regular inspection of Unit 4 at the Takahama NPP, beginning on Dec 16. This pressurized water reactor will be inspected for five months.

- Additionally, 69 of the total 157 fuel assemblies will be replaced. The NPP should resume full-scale operation by late April 2024.

- SIDE DEVELOPMENT:

Tohoku Electric submits plan for Onagawa NPP Unit 2 anti-terrorism facility

(Nikkei, Dec 14)- Tohoku Electric submitted a construction plan application to the NRA, for an anti-terrorism facility at the Onagawa NPP Unit 2 (Miyagi Pref).

- Onagawa Unit 2 should resume operation in May 2024, but the anti-terrorism facility must be installed by Dec 22, 2026.

NEWS: OIL, GAS & MINING

Tokyo Gas unit agreed to buy U.S. natural gas producer for $2.7 billion

(Company statement, Dec 16)

- A unit of Tokyo Gas has agreed to buy all shares of Texas-based natural gas producer Rockcliff Energy for about $2.7 billion, taking over the asset from private equity firm Quantum Energy Partners.

- TG Natural Resources, in which Tokyo Gas owns 79%, will complete the deal by Dec. 29, according to the Japanese company. It will help quadruple the gas production of TG Natural Resources to 1.3 billion cubic feet (37 million cubic meters) per day.

- Castleton Commodities International owns the other 21% of TG Natural Resources.

- Rockcliff Energy develops upstream assets in Texas and Louisiana. For Tokyo Gas, the acquisition is part of its strategy to triple profits outside of Japan.

TAKEAWAY: For all the concerns about the future outlook for fossil fuels, Japanese companies are comfortable investing in natural gas and related assets, seeing them not only as a source of resources for their domestic market, but also as a viable business in other countries. The geopolitical realignments in recent years also make investments in allied countries a kind of hedging mechanism on a corporate and national level.

Kansai Electric will partner with Hartree Partners on LNG and carbon investments

(Company statement, Dec 14)

- Kansai Electric Power Group inked a deal with UK-based Hartree Partners for LNG supply and an investment in a nature-based carbon project in Australia.

- The agreement enables KE Fuel Trading Singapore (KEFTS), part of Kansai Group, to expand its LNG portfolio. Hartree will assist Kansai Electric in acquiring high-integrity carbon credits.

- CONTEXT: Hartree Partners invests in global energy infrastructure. It owns and operates six natural gas storage facilities located in the U.S. Gulf Coast, with a combined working gas capacity of about 120 billion cubic feet.

LNG stocks increased to 2.54 million tons, up 16%

(Government data, Dec 13)

- LNG stocks of 10 power utilities increased to 2.54 million tons as of Dec 10, up 16% from 2.19 million tons a week earlier.

- This is 0.4% down from late November 2022, and 19.8% higher than the past 5-year average of 2.12 million tons.

ANALYSIS

BY MAGDALENA OSUMI

METI Welcomes New Minister Amid Cabinet Purge

On Dec 14, Saito Ken was named the new METI minister following his predecessor’s resignation over a financial scandal in the Cabinet. He replaced Nishimura Yasutoshi, who, alongside other members of the ruling LDP, is accused of underreporting the party’s income.

Prime Minister Kishida also ousted the economy minister, internal affairs minister, agriculture minister, as well as Chief Cabinet Secretary Matsuno. All are members of the LDP’s largest faction led by the late PM Abe. They allegedly received kickbacks worth ¥500 million through excess sales of tickets to fundraising events.

The scandal has plunged already limp ratings for PM Kishida’s government to worrying levels. His personal support rate dropped to 17% in a Jiji poll as similar allegations were made around other LDP factions. Kishida has already purged more than a dozen Abe faction members from top posts within the government and party.

Despite the political maelstrom, incoming METI minister Saito is expected to be a steady hand on the tiller. While this is his first ministerial position at METI, the ministry is actually where Saito began to build his government service career in the early 1980s.

He’s already hit the ground running, attending the key ASEAN-Japan Economic Co-Creation Forum on Saturday, Dec. 16, on top of the Japan-Thai Investment Forum the previous day. In meetings with the leaders of Vietnam, Thailand and Brunei, Saito has echoed the current government’s focus on an energy transition that aligns with regional interests.

New minister’s ‘To Do’ list

One of the first challenges that Saito will face is to promote understanding among neighbors that are skeptical of Japan’s decision to discharge treated water from TEPCO’s beleaguered Fukushima Daiichi nuclear plant. During a news conference following his appointment, Saito vowed to “support the people of Fukushima”.

“I feel a great sense of responsibility,” he said. “There is no problem with the safety of the treated water, but from the standpoint of security, it cannot be said that there are no problems, including China’s stance. We will make every effort to explain the situation and gain their understanding.”

Saito will also have to grapple with Japan’s effort to meet ambitious goals to decrease fossil fuels use and reduce GHG emissions by 46% in FY2030 over FY2013 levels. As part of those efforts, next summer he’ll oversee amendments to the Basic Energy Plan, which is revised every 3 years.

Earlier this year, the government issued its so-called “Green Transformation (GX) Basic Policy,” which is a roadmap for Japan’s decarbonization. Next year, the focus will be on GX fundraising as the government starts marketing the so-called GX Economic Transition Bonds, the first part of a ¥20-trillion, 10-year bond issuance program to raise capital for net-zero. The rest of the ¥150-trillion GX investment program is expected to come mostly from private capital.

The current Basic Energy Plan sets the 2030 goal of generating 36-38% of Japan’s electricity from renewable sources, which would be a jump from the 21.7% that the sector registered in FY2022. The push to renewables calls for halving power generation from fossil fuels; while nuclear energy is expected to make up 20-22% of the mix in 2030, with hydrogen comprising the remaining 1%.

Saito’s background

The 64-year-old Tokyo native who studied at Harvard University has significant experience in the energy sector. In 1983, he joined the then Ministry of International Trade and Industry (METI’s predecessor) and was involved in energy policy until March 2006, covering both the gas and electric utilities sector.

He also can tap into expertise gained during his tenure as agriculture minister from August 2017 until October 2018. Biofuels is one area where energy and agriculture policies overlap. Saito’s most recent government post was as Minister of Justice (Nov 2022 to Sept 2023).

Saito’s tenure as head of METI starts just as Japan is seeing a historic move towards scaling up renewables. On the day of his appointment, in a highly anticipated decision, METI and MLIT chose three consortiums to develop three separate large-scale offshore wind farms.

His role, however, will also include taking charge of policies related to the use of other energy sources such as nuclear and hydrogen. Nishimura’s predecessor, Hagiuda, openly spoke about how “indispensable” nuclear power is for decarbonization. Under Kishida, he pushed for restarting nuclear reactors.

Hagiuda also pledged “swift measures” to address shortcomings in existing power grids to speed up the introduction of renewables. Nishimura, meanwhile, gave a greater accent to the introduction of startups to Japan’s energy sector and supported a wider adoption of EVs.

Significantly, Saito was a member of the LDP’s Ishiba faction, which was formed by Ishiba Shigeru – a key rival to Abe and a vocal critic of his administration. After Ishiba’s failure to secure party leadership, his faction was reorganized into a looser grouping. Still, Ishiba remains a popular lawmaker and one of the few willing to openly challenge the LDP leaders. He’s recently called on PM Kishida to step down due to the funding scandal.

For all the changes in government and political uncertainties, the policy course at METI is unlikely to see any major changes. One ministry official, speaking after the appointment, said they expected little change in energy policy with Saito’s arrival. Instead, Saito’s international negotiation experience and awareness of issues in the energy sector should ensure a smooth transition, they said.

COLUMN: ENERGY JOBS IN JAPAN

BY ANDREW STATTER

Jinji Ido, the Generalist Approach

To generalize or to specialize? This is one of the age old questions of career planning and personnel development, with strong advocates on both sides. Where does Japan tend to lean? Here, the generalist approach is typically favored, and there is a Japanese expression ‘Jinji Ido’ (personnel reshuffling) that’s common practice, especially in larger firms.

Jinji Ido is the practice of rotating positions, usually from as short as two, to as long as five years. These can be quite drastic, for example shifting from frontline sales into human resource management, then into product management and so on. They can also include sudden moves to different cities, countries or rotations into subsidiary or joint-venture companies. Often, the employee has little say in the direction of their next rotation, and is not aware of what the upcoming move will be until a couple of months or even weeks before their new assignment. On top of this, the rotation schedule follows the HR department workflow rather than project schedules, hence rotations happen en masse at one time in the year, which leads to personnel changes across key positions in projects.

The logic behind this practice is deeply rooted in Japanese corporate and employment culture and linked to the practice of lifetime employment. By having employees become exposed to different functions and sections within the company, they can better understand each moving piece, communicate cross-functionally. And when moved up into leadership roles, have a more rounded view of the business and respect for differences.

For prospective employers looking to hire Japanese talent, this system naturally presents both advantages and disadvantages. Below, I’ll share a few of both, as well as some tips on what to look for when hiring a generalized Japanese professional.

Advantages:

Broad skill sets: This system tends to create well-rounded professionals who can understand and cover multiple key areas of business, and also communicate more effectively with members of other departments.

Proven adaptability: Due to the sudden and often unpredictable nature of these rotations, as well as the expectation to slot into a position that was just occupied by someone who knew what they were doing, Japanese professionals tend to learn and adapt quickly to new situations.

Project management and flexible leadership: As opposed to specialists who have worked their way up the corporate ladder, the well rotated Japanese leader will find themselves in a position where they can manage a department or organization that consists of diverse functions, personalities and needs. This has advantages both in project management and leading complex organizations.

Disadvantages:

Lack of real expertise: If mastery takes 10,000 hours, then this system certainly stops mastery in its tracks! For roles requiring a high level of expertise, often in the engineering area for example, this generalization is a clear detriment to finding the levels found in other markets.

Lower value roles: Some positions, such as those connected to corporate strategy, business planning etc, are ideal for those who will remain in the company forever since they are exposed to the inner workings of the organization, and develop important political connections. On the flipside, these roles take people away from the frontline of the business, therefore time in such roles is of little value outside of that particular organization. On top of this, Japanese companies fire low performers much less than Western firms. Rather, they tend to shuffle people into sideline positions where they have a nice title, are kept busy but don’t lead anything of real consequence.

Lack of ownership over one’s career: A generalization to be sure, however someone who accepts every rotation without taking control of their own career direction, without pushing for a role they want internally, or putting themselves on the market, will likely lack the direction, ownership and ambition that many prospective employers are looking for.

Well rounded stud or glorified paper pusher?

At its best, Jinji Ido will provide you with a fast-tracked, well-rounded, adaptable superstar. At its worst, the result will be years of various busy work without any real depth of expertise or track record of complete projects. How do you separate the wheat from the chaff?

Look for upward progression: Though this is more difficult than if the professional in question had stayed in a single function, career progression is detectable. Look for overseas transfers, roles in charge of key projects, exposure to team leadership early in the career, or a shift to corporate strategy / President’s office around mid 30s. These are all signs that the firm sees potential in the employee and are continuing to invest.

Core career theme or all over the place: A future business leader may have a core theme of commercial management with rotations into business development, financing, project management but coming back into larger, more complex commercial roles. This pattern of building complementary skill sets and increasing project complexity and size shows a winner on the way up. On the other hand, as Japanese companies find it hard to fire people, they will shuffle low performers around low impact, often highly unrelated positions. These positions will not allow for skill stacking or scaling up into bigger projects.

Return to the mothership or one way ticket to the outer territories: Rotations to subsidiary or joint-venture companies are not uncommon. When the move is into a position of authority, and that person is rotated back into the parent company in a few years, you know there is potential. A sideways move into a subsidiary on the other hand is in reality a move down. Likewise, not rotating back into the parent company, or gaining fast promotion in the subsidiary can be a red flag.

Case study #1 – The turn-around leader

A couple of years ago, we were retained by a global OEM in the renewable energy space to replace their General Manager. The previous two GMs had come from a pure sales background, very numbers driven, clear, ambitious and did well on the sales side. This firm, however, was only about 25% sales professionals, the other 75% consisting of service, logistics, engineering and others. These functions were chronically underperforming, had high staff turnover and low morale, leading to poor project implementation and client dissatisfaction, which hurt the bottom line.

APAC leadership recognised this and tasked us with finding a well-balanced leader who could bring the company together as a team. The gentleman who we identified and secured had worked with two large Japanese firms, had a core background in sales and new business development. However, he had a stint in production, as well as service and order fulfillment. He had also been expatriated overseas for a few years, allowing him to communicate with clarity and authority back to regional and HQ stakeholders.

In his first year in office, topline grew for the first time in years, employee turnover slowed 80%, and employee satisfaction surveys increased dramatically.

Case study #2 – Offshore wind engineers

Round 2 offshore wind results have just dropped. As expected, after the revision of the rules, there are a number of winners. That means multiple companies will need people to execute on these projects. We often field requests for fully bilingual structural engineers with 10+ years of experience in the offshore wind industry, or project controllers with 10+ years of experience in cost and schedule management for increasingly complex offshore projects. Unfortunately, these rare beasts do not yet exist in the nascent Japanese market.

The question then is, do you expatriate or hire global talent who can move into the role quickly, or hire the young, high-potential Japanese generalist and invest in their development? That is a topic for another article. However, considering that just about every developer, OEM and EPC in the market are stretched already, I feel you may guess which way I lean on this topic 😉

ASIA ENERGY REVIEW

BY JOHN VAROLI

This new weekly column will replace Global View and will focus on energy events in Asia and those that directly impact markets in the region.

Australia / Solar power

EDF Australia will invest €10 million in Vast Renewables, a developer of concentrated solar power (CSP) systems. This includes the Vast Solar 1 project in South Australia that will comprise 30 MW of CSP with 288 MWh of thermal storage. The project will be co-located with the planned Solar Methanol 1, the world’s first green methanol demo plant.

China / Power system

China is changing its power system to reduce payments to solar providers while making energy storage more profitable. At least 20 of China’s 35 provinces and regions have adopted electricity rate plans that reduce prices in the middle of the day and raise them in peak morning and evening hours.

China / Solar power

The cost of producing solar modules in China has dropped by 42% in the last 12 months to $0.15/ watt. This gives Chinese manufacturers an enormous cost advantage over international rivals, according to Wood Mackenzie.

India / Coal

Strong demand for coal is driving up the shares of mining companies. Coal India is up 55%, and power generator NTPC, which produces mostly coal-fired power, has surged 78%.

India / Oil

The average price of Russian oil sold to India in October rose to $84.20 per barrel, far above the $60 price cap set by the G7 in December 2022, according to Indian government data.

Kazakhstan / Wind power

TotalEnergies agreed with Kazakhstan to invest about $1.4 billion for onshore wind projects. TotalEnergies said its Mirny project will be composed of 160 turbines along with a 600 MWh of battery energy storage.

Panama Canal / Energy transit

A severe drought will impact trade flows and push up freight costs. U.S. diesel is increasingly heading to Europe as South America buys less due to Panama Canal logjams. Chile, for example, will instead likely pull gasoline from Asia.

Singapore / Energy transition

Tuas Power, the country’s leading power and utility firm and sole operator of a coal/biomass cogeneration plant, will rely on the use of more biomass and renewable energy imports for decarbonisation. Tuas accounts for over 20% of Singapore’s energy supply.

Singapore / Solar power

JTC awarded Sembcorp Solar Singapore the tender for a solar farm that will cover 60 hectares. It will have a capacity of 117 MW, increasing the total solar generation capacity of Jurong Island from 25 MW to 142 MW.

Vietnam / CRMs

China and Vietnam agreed to boost cooperation on security matters as President Xi visited the country. He also urged broader cooperation on critical rare minerals. Vietnam has the world’s second largest deposits of rare earths after China, which dominates the supply of CRMs.

2023 EVENTS CALENDAR

A selection of domestic and international events we believe will have an impact on Japanese energy

Disclaimer

This communication has been prepared for information purposes only, is confidential and may be legally privileged. This is a subscription-only service and is directed at those who have expressly asked K.K. Yuri Group or one of its representatives to be added to the mailing list. This document may not be onwardly circulated or reproduced without prior written consent from Yuri Group, which retains all copyright to the content of this report.

Yuri Group is not registered as an investment advisor in any jurisdiction. Our research and all the content express our opinions, which are generally based on available public information, field studies and own analysis. Content is limited to general comment upon general political, economic and market issues, asset classes and types of investments. The report and all of its content does not constitute a recommendation or solicitation to buy, sell, subscribe for or underwrite any product or physical commodity, or a financial instrument.

The information contained in this report is obtained from sources believed to be reliable and in good faith. No representation or warranty is made that it is accurate or complete. Opinions and views expressed are subject to change without notice, as are prices and availability, which are indicative only. There is no obligation to notify recipients of any changes to this data or to do so in the future. No responsibility is accepted for the use of or reliance on the information provided. In no circumstances will Yuri Group be liable for any indirect or direct loss, or consequential loss or damages arising from the use of, any inability to use, or any inaccuracy in the information.

K.K. Yuri Group: Hulic Ochanomizu Bldg. 3F, 2-3-11, Surugadai, Kanda, Chiyoda-ku, Tokyo, Japan, 101-0062.