WEEKLY

MARCH 17, 2025

ANALYSIS

JAPAN’S PPA CONTRACT VOLUME EXPANDED IN 2024 AMID PUSH FOR MORE VARIETY

- The Japanese market for Power Purchase Agreements (PPAs) expanded last year

- The following is a summary of the first part of a new report by Japan NRG covering the PPA sector

JAPAN TO INCREASE ITS LNG CARRIER FLEET: IS THE GLOBAL MARKET STRONG ENOUGH?

- Japan’s shipping companies seek to expand LNG fleets by 40% through FY2030, reinforcing their dominance in LNG transportation.

- Should LNG lose its luster over time, however, both Japan’s shipping industry and power industry could be left in the lurch.

ASIA PACIFIC REVIEW

This column provides a brief overview of the region’s main energy events from the past week

NEWS

- Japan to set up monitoring guidelines for offshore wind environmental impact

- Govt approves bill to amend the EIA process

- FEPC chairman urges govt to be more flexible on coal-power plants shutdown

- EEX record for daily, weekly power futures trading

- Kyushu Electric expands UK offshore transmission

- TEPCO’s financial struggles and reconstruction

- Govt announces tender to support nationwide hydrogen hubs

- U.S. hydrogen market slowdown poses challenges for Japan

- SoftBank invests $130 mln in AI-driven solar farm

- Hirosaki Univ develops lithium recovery method

WIND POWER AND OTHER RENEWABLES

- METI, MLIT: offshore wind projects from Round 1 can switch to FIP

- JERA and bp tap leadership for offshore wind JV

- FLOWRA inks MoU to explore floating wind tech

- U.S. tech giants bet on nuclear power to fuel AI

- ANRE determined to restart Kashiwazaki-Kariwa NPP this summer

- JERA urges Australia to boost LNG competitiveness amid U.S. expansion

- INPEX to expand oil & gas output over 10 years

- Trump’s ambassador pick vows to push Japan to buy more LNG and strengthen joint minerals ties

CARBON CAPTURE & SYNTHETIC FUELS

- Tokyo Govt starts registrations for its carbon credit trading system

- MOL joins global coalition to promote e-methane

- Chitose Bio Evolution raises ¥7.3 billion to expand algae biomass production

EVENTS

| Mar 31 | End of Japan’s fiscal year 2024 |

| May 3-6 | May Golden Week Holidays |

| June 4-5 | Kyushu Innovation Week / Kyushu GX Decarbonization Expo @ Marine Messe Fukuoka |

| June 4-6 | AXIA EXPO 2025 (Hydrogen and Ammonia Next-Generation Energy Exhibition) @ Aichi Sky Expo |

SUBSCRIPTIONS & ADVERTISING

Japan NRG offers individual, corporate and academic subscription plans. Basic details are our website or write to subscriptions@japan-nrg.com

For marketing, advertising, or collaboration opportunities, contact sales@japan-nrg.com For all other inquiries, write to info@japan-nrg.com

JAPAN NRG WEEKLY

PUBLISHER

K. K. Yuri Group

Editorial Team

Yuriy Humber (Editor-in-Chief)

John Varoli (Senior Editor, Americas)

Kyoko Fukuda (Japan)

Magdalena Osumi (Japan)

Filippo Pedretti (Japan)

Tim Young (Japan)

Tetsuji Tomita (Japan)

Regular Contributors

Chisaki Watanabe (Japan)

Takehiro Masutomo (Japan)

OFTEN-USED ACRONYMS

METI | The Ministry of Economy, Trade and Industry | mmbtu | Million British Thermal Units |

MoE | Ministry of Environment | mb/d | Million barrels per day |

ANRE | Agency for Natural Resources and Energy | mtoe | Million Tons of Oil Equivalent |

NEDO | New Energy and Industrial Technology Development Organization | kWh | Kilowatt hours (electricity generation volume) |

TEPCO | Tokyo Electric Power Company | FIT | Feed-in Tariff |

|

KEPCO |

Kansai Electric Power Company |

FIP |

Feed-in Premium |

|

EPCO |

Electric Power Company |

SAF |

Sustainable Aviation Fuel |

|

JCC |

Japan Crude Cocktail |

NPP |

Nuclear power plant |

|

JKM |

Japan Korea Market, the Platt’s LNG benchmark |

JOGMEC |

Japan Organization for Metals and Energy Security |

|

CCUS |

Carbon Capture, Utilization and Storage | ||

|

OCCTO |

Organization for Cross-regional Coordination of Transmission Operators | ||

|

NRA |

Nuclear Regulation Authority | ||

|

GX |

Green Transformation |

NEWS: GENERAL POLICY AND TRENDS

Japan to establish monitoring guidelines for offshore wind environmental impact

(Government statement, March 14)

- Japan’s govt launched a study group to develop monitoring guidelines for offshore wind projects, enhancing environmental impact assessments.

- The goal is to gather scientific data during construction and operation to optimize environmental protection measures and reduce the sector’s overall impact.

- The study group, composed of experts in environmental assessments, will review global trends and scientific findings, define the roles of the government and businesses, and draft guidelines.

- CONTEXT: The decision comes amid growing concerns in the industry over profitability of projects under the existing subsidy and bidding schemes, which caused the Mitsubishi Corp-led consortium awarded in Round 1 to reassess its ability to continue developing its three large-scale projects.

TAKEAWAY: Environmental impact assessments take up about half the time of the entire offshore wind project, according to research conducted in a special report by Japan NRG late last year. The time and resources involved make the assessments a major cost item for the developers. What’s more, the environmental impact data developers currently receive from the government is insufficient, often necessitating additional work. Therefore, this latest effort by the govt to review the current setup and improve it should be seen as a positive step. It may come too late to help developers resolve issues with ongoing projects, but it should help to influence the direction of future offshore wind developments.

Govt approves bill to amend the EIA process

(Government statement, March 11)

- The govt approved a bill to amend the Environmental Impact Assessment Act that will streamline procedures for redevelopment projects. The Act also calls for the MoE to ensure continuous access to EIA public documents.

- The amendment exempts certain surveys for redevelopment projects where existing facilities are replaced with similar ones in the same or nearby location. Instead, it will require businesses to disclose environmental considerations for the new structures based on the impact of the existing project.

- This change is expected to apply to wind farms undergoing renewal after reaching their lifespan.

- Additionally, the bill allows EIA documents, such as scoping and assessment reports, to remain accessible online even after the public viewing period.

- CONTEXT: More than 25 years since its enactment, many infrastructure projects subject to EIA procedures now face redevelopment, but the law lacks provisions for projects where location and scale remain largely unchanged, treating them the same as entirely new projects.

FEPC chairman urges govt to be flexible on coal-power plants shutdown

(Nikkei, March 14)

- Hayashi Shingo, chairman of the Federation of Electric Power Companies (FEPC) said he supports the govt’s policy to shut down inefficient coal-fired power plants by 2030. Still, he opposes a uniform reduction with a fixed deadline.

- He urges a flexible approach that considers the intentions of power companies and the need for a stable power supply.

- He also called for caution when decommissioning high-efficiency power plants. He requested the govt to consider compensation for lost profits.

TAKEAWAY: The shutdown of coal power plants in Japan has faced ongoing utility and industry pushback ever since the first version of a government strategy to do so appeared in the summer of 2020. At the time, METI was gearing up to phase out over 100 ‘inefficient’ coal-fired units. The ministry categorized 110 out of the 140 units in the country as ‘inefficient’ based on their energy efficiency. No sooner were those plans floated than debates broke out over what should be deemed ‘inefficient.’ The plans soon became bogged down and remain uncertain to this day.

Toshiba ESS, Chubu Electric ink deal on large-scale rock thermal energy system

(Company statement, March 12)

- Toshiba ESS, Chubu Electric, and Okazaki City, Aichi Pref, agreed to introduce the largest plant in Japan using rock thermal storage and energy management technology.

- By late FY2026, they’ll conduct a feasibility study (FS) of equipment, including the optimal thermal capacity and installation site, based on actual data of electricity and heat demand in Okazaki City.

- Toshiba will be responsible for overall coordination, general equipment specifications, and operational simulations. Chubu Electric will provide power system data. Okazaki City will verify and provide actual energy data.

- Based on the FS results, Toshiba and Chubu Electric plan to begin manufacturing the units in FY2027; thermal capacity is expected to be in the tens of MWh.

- Okazaki City plans to deploy a rock thermal energy storage system by FY2029 to supply heat and electricity to residences, public facilities, and businesses in the city.

- CONTEXT: In FY2022, Toshiba ESS and Chubu Electric developed a rock thermal energy storage test facility of about 500 kWh. In FY2026, they plan to conduct a test of about 10 MWh in cooperation with Shin-Tokai Paper and Shimada City, Shizuoka.

TAKEAWAY: Long Duration Energy Storage (LDES) is attracting attention as a means of eliminating renewable energy supply instability and responding flexibly to changes in power demand. Energy storage today is dominated by batteries and mechanical pumped storage, but thermal storage could also become an important tech, and its deployment is progressing.

Cabinet approves bill to clamp down on copper cable theft

(NHK, other reports, March 11)

- The Cabinet approved a bill to curb the sale of stolen copper cables and valuable metals, particularly from solar farms. Copper theft has been driven by high metals prices.

- The bill compels scrap metal dealers to verify sellers’ identities, workplace, and addresses, and requires businesses buying copper scrap to register with the state. Violators will face up to six months in prison, or ¥1 million in fines, or both.

- The bill now heads to the Diet and is expected to take effect within a year.

- CONTEXT: According to the National Police Agency, metal theft incidents have risen from 5,478 in 2020 to 20,701 in 2024. Solar farms have been prime targets. In 2024 alone, 7,054 cases of cable theft from such facilities were reported.

NEWS: ELECTRICITY MARKETS

TOCOM’s electricity futures trading surged in Feb, posted record in March

(Exchange statement, March 13)

- The Tokyo Commodity Exchange (TOCOM) said that on March 13 it set a record-high daily trading volume of 711 GWh, surpassing the previous record set on Nov 7, 2024 (153 GWh).

- This came on the back of a strong February performance. Driven by larger trades in both day and night sessions, TOCOM’s power futures trading volume rose to 3,085 contracts in February, more than doubling from 1,303 contracts in January.

- Demand for FY2025 annual contracts (April 2025 – March 2026) and winter contracts (Dec 2025 – Feb 2026) increased, with some market participants citing a lack of alternative futures products for winter hedging.

- Weekly contracts saw growth, especially in Western Japan, where volatility was higher due to fluctuating solar power generation and temperature-sensitive price movements in JEPX’s spot market.

- Large trades exceeded 100 contracts in multiple sessions, including a 500-contract deal for February 2026 at ¥16/ kWh and a total of 700 contracts for the same month traded between ¥15.90 – 16.10/ kWh.

- CONTEXT: West Japan is the main driver of power trading volumes this year. Volumes on the TOCOM rose 60.3% in January to 90.7 GWh. West Japan baseload contracts grew 66.2%, surpassing East Japan baseload for a second consecutive month. On Jan 20, a major deal was struck in response to a sharp decline in spot market prices, contributing to 60% of the month’s West Japan baseload volume.

TAKEAWAY: Power trading in Japan is not only winning volumes but also interest from traditional utilities. About 70% of trades occurring on the TOCOM are now directly posted on the exchange, rather than off-market deals. And while it’s true that the majority of the volumes are concentrated in about 15-20 players, interest outside of Japan is growing. Perhaps one of the biggest bottlenecks to market growth today may not even be on the financial or technical side – it’s the shortage of traders to execute.

- SIDE DEVELOPMENT:

TOCOM to launch annual electricity futures contracts in May

(Denki Shimbun, March 10)- TOCOM will introduce annual electricity futures contracts on May 26, allowing market participants to fix prices for one year. The new contracts cover four categories: baseload and daytime load in both the eastern and western Japan markets.

- A “cascading” mechanism will be introduced, automatically converting unsettled annual contracts into monthly contracts by the fiscal year-end, reducing margin requirements and increasing liquidity in monthly contracts.

- Annual contracts will be tradable up to two years in advance, addressing strong market demand for long-term price hedging, especially from renewable energy producers and retailers.

- CONTEXT: A full-scale adoption of the contracts is expected in autumn 2025.

EEX sets record for daily and weekly power futures trading

(Company statement, March 10)

- EEX, the power trading marketplace, set a record for daily volume, with 2.8 TWh of contracts processed in one day.

- It also set a record for volume traded in one week – 6.1 TWh of electricity derivatives in the first week of March. EEX expects growth to continue thanks to new monthly options contracts and an upcoming orderbook trading facility feature.

- CONTEXT: EEX has succeeded in capturing over 95% of all electricity derivatives trading in Japan since entering the market five years ago. Other exchanges that offer Japanese power futures include TOCOM and ICE.

- SIDE DEVELOPMENT:

- Intraday electricity market sees slight increase, peak price hitting ¥60

(Denki Shimbun, March 11)- The JEPX intraday market saw a 0.6% increase MoM in average daily trading volume to 16.6 GWh, marking the second consecutive monthly rise. Trading surged in early January due to severe cold, with daily volumes exceeding 30 GWh on two days.

- Total monthly trading volume reached 514 GWh, up 0.6% from December, while the number of trades fell 6.7% to 218,083. The market accounted for 0.6% of Japan’s total electricity demand.

- The highest price was ¥60/ kWh on Jan 30, exceeding surrounding periods by nearly ¥50. The lowest price of ¥0.01/ kWh was recorded in 91 settlement periods.

OCCTO awards 93 MW in solar power auction with average bid at ¥5

(Government statement, March 7)

- Japan awarded 93 MW of solar power capacity to five successful bidders in its 23rd auction. This was the 4th round for FY2024, which ends this month.

- The highest capacity, 29.91 MW, was awarded to hep SPV 16 Japan (a unit of hep solar, a developer operating in Germany and Japan), for a price set at ¥5. It secured the same capacity at the same price in March 2024. It was followed by Manago Taiyoko, which secured 29.9 MW at ¥4.47.

- The weighted average bid price was ¥5.06/ kWh, with individual bids ranging from ¥4.47/ kWh to ¥6.98/ kWh, under a cap of ¥8.98/ kWh.

- The total number of business plans submitted for bid qualification screening was 50. The total number of bids submitted was 43. Winners are:

Company name | Price (¥/ kWh) | Capacity (MW) |

Manago Taiyoko* | 4.47 | 29.9 |

Nemuro Nishihama Taiyoko* | 4.47 | 16 |

hep SPV 16 Japan | 5 | 29.91 |

ENEOS Renewable Energy | 6.5 | 9.5 |

Shizen Energy | 6.98 | 7.96 |

- * The first two projects were awarded to the same bidder.

Kyushu Electric Group expands offshore transmission in UK

(Company statement, March 10)

- Kyushu Electric International and Kyushu Electric Power T&D signed an asset transfer and financing agreement for subsea transmission of the Seagreen Phase 1 Offshore Wind Farm. Power will be sent to mainland UK.

- The project, 27 km off the east coast of Scotland, with a transmission capacity of 1.08 GW, is managed through an SPC established with UK infrastructure fund Equitix.

- CONTEXT: The firms are part of Kyushu Electric Group. The project is financed through a £568 million syndicated loan, arranged by the Japan Bank for International Cooperation (JBIC), Mizuho Bank, Sumitomo Mitsui Trust Bank, and Aviva Life & Pensions UK.

TEPCO’s financial struggles and new reconstruction plan

(Nikkei, March 13)

- TEPCO is preparing a new reconstruction plan to improve its financial balance by ¥100 billion through asset sales and investment reductions. This move comes as delays in restarting the Kashiwazaki-Kariwa NPP raise concerns.

- The utility could have a potential cash shortage within the next 1-2 years. TEPCO is seeking support from the state and banks to maintain financial stability, negotiating for loan repayment extensions and new credit lines.

- TEPCO faces ¥2.6 trillion in short-term debt maturing by the end 2024. If no nuclear reactors restart by FY2025, cash reserves could fall below the ¥300 billion level needed for stable operations.

- TEPCO postponed the release of its new plan to summer 2025 due to uncertainties around nuclear restarts.

- CONTEXT: The company’s cash flow has been negative for six consecutive fiscal years, despite ¥1.6 trillion in cumulative net profit over the past decade.

TAKEAWAY: While financial institutions question TEPCO’s ability to execute reforms, the company is in no shape to operate as a ‘normal’ business. It remains state-controlled in terms of equity and strategy, but the government cannot help TEPCO resolve one of its biggest issues – restarting its remaining operable NPP. There is no financial institution that sees lending to TEPCO as a business proposition. A ¥400 billion emergency loan in 2023 remains unpaid. Which means, TEPCO remains in limbo, a ‘zombie’ company despite its numerous viable businesses. The group needs a real restructuring. Should private banks balk at further loans, as expected, METI will need to embark on a restructuring process within FY2025.

Osaka Gas, CleanMax to help Indian clients with energy transition

(Company statement, March 10)

- Osaka Gas formed a JV with India-based Clean Max Enviro Energy Solutions, a leading Asian renewables provider.

- The JV will be called Clean Max Osaka Gas Renewable Energy (CORE), and it will acquire a portion of CleanMax’s renewables assets and develop new ones. By 2028, CORE is expected to own a total of 400 MW of renewables assets.

- CONTEXT: With this partnership, Osaka Gas is entering the clean energy market in India. The JV was formed by the gas company’s subsidiary, Osaka Gas Singapore, and the Japan Bank for International Cooperation (JBIC).

- CONTEXT: The govt of India, anticipating a substantial long-term increase in electricity demand due to economic growth, set a goal to introduce 500 GW of renewables by 2030.

NEWS: HYDROGEN

Govt announces tender to support nationwide hydrogen hubs

(Government statement, March 5)

- METI announced a tender to build infrastructure at sites around Japan that would like to become hydrogen hubs. Facilities must serve multiple end users of hydrogen or related fuels, such as ammonia. Applications close June 30, 2025.

- CONTEXT: This is part of the govt’s program to establish three hubs near major cities, and five regional sites that would have the infrastructure to import and distribute hydrogen and related fuels in Japan. The availability of such infrastructure is vital to building business demand for the clean-burning fuels.

- CONTEXT: JOGMEC is now reviewing various hub proposals from around the country. More than eight groups/ consortia are interested in creating such hubs in Japan, but METI is keen to initially limit the support to eight sites.

- In the first, FY2025 round, only support for FEED (Front End Engineering Design) will be distributed with a focus on low carbon fuel transportation or storage facilities. The projects that win must complete the FEED by March 2026.

TAKEAWAY: Infrastructure development is one of the biggest challenges to creating a hydrogen society. So, it’s surprising this support scheme was rolled out without announcing a total budget, as was the case in the ongoing Contract for Difference (CfD) scheme to support hydrogen end-users. Further details are expected later. There was speculation last year that METI’s infrastructure support would be about ¥1 trillion.

Tokyo Govt selects three projects for new energy tech support program

(Government statement, March 10)

- Tokyo Govt and Tokyo Environmental Public Service Corp decided on three projects for the FY2024 “New Energy Promotion Technology Development Program”.

- 1) “Demo project for new high-pressure hydrogen gas distribution methods and expanded use for hydrogen energy conversion” by Suntory Holdings, in collaboration with Tomoe Shokai, Samtech, and Nippon Trex.

- 2) “Demo project for exchangeable battery EV” by Mitsubishi Fuso Truck and Bus, in collaboration with Mitsubishi Motors, Aqua, Ample, etc.

- 3) “Development of new biofuel (HVO) blended fuel and supply chain construction, and social implementation” by Euglena, in collaboration with Tokyu Bus, Shimizu, Takenaka, Asahi Kosan, Isuzu Motors, Kamei, etc.

- The support is mainly for large companies with headquarters or branches in Tokyo, and the period is up to three years, with a maximum of ¥3 billion per group; the subsidy is up to two-thirds of eligible expenses.

- CONTEXT: Tokyo Govt is working toward the realization of “Zero Emission Tokyo,” with the goal of halving carbon emissions by 2030.

U.S. hydrogen market slowdown poses challenges for Japan

(Nikkei, March 14)

- Enthusiasm for hydrogen energy in the U.S. is cooling, with Japanese and American companies delaying or withdrawing from hydrogen projects due to policy shifts under the Trump administration and rising costs caused by inflation.

- INPEX postponed a Houston-based ammonia project by at least a year, citing uncertainty about U.S. decarbonization policies and a preference for natural gas.

- Major industrial gas company Air Products will withdraw from three hydrogen projects in New York State, reflecting a decline in investment confidence.

- CONTEXT: The U.S. shift in energy policy threatens Japan’s hydrogen strategy since the country’s utilities have banked on ammonia imports as a pathway to reduce CO2 emissions at coal-fired power plants.

TAKEAWAY: With U.S. hydrogen and ammonia projects facing setbacks – and most importantly uncertainty about their cost structures due to the freezing of IRA and other subsidies – Japanese companies may turn to alternative suppliers, such as in the Middle East and Australia.

MHIET achieves rated output with 500 kW-class hydrogen engine

(Company statement, March 12)

- Mitsubishi Heavy Industries Engine & Turbocharger (MHIET) achieved a rated output with a six-cylinder 500 kW-class hydrogen engine power generation system.

- The system was verified, including newly made hydrogen-only reciprocating engines, generators and auxiliary equipment with additional safety features.

- By establishing an integrated development cycle for hydrogen-only engines within its own factory, MHIET says it can commercialize the product in FY2026.

- CONTEXT: MHI Group is working on the development and practical application of hydrogen engines based on conventional diesel and gas engines. Projects include:

- In August 2021, in cooperation with Toho Gas, testing of a gas engine (450 kW) with a hydrogen co-firing rate of 35%.

- In November 2023, a single-cylinder gas engine (5.75 MW) to generate power and stable combustion with a hydrogen co-firing of up to 50%.

Mitsubishi and partners develop ammonia-fueled large carrier

(Company statement, March 14)

- Mitsubishi Shipbuilding, MOL, and Namura Shipbuilding developed a large ammonia carrier, receiving Approval in Principle (AiP) from Nippon Kaiji Kyokai.

- The newly designed ship uses ammonia as its primary fuel and is larger than conventional VLGCs and VLACs, improving transport efficiency while remaining compatible with existing ammonia terminals.

Companies invest $17 mln in Supercritical Solutions

(Company statement, March 11)

- Toyota Ventures and Shell Ventures led a $17.4 million investment in Supercritical Solutions, a UK startup developing green hydrogen technology.

- Supercritical Solutions has developed an electrolysis system that operates at over 200 bar pressure with 99% purity, eliminating the need for additional hydrogen compression. With a world-class energy efficiency of 42 kWh/ kgH₂.

Nikko develops world’s first hydrogen burner-compatible asphalt plant

(Company statement, March 11)

- Nikko Corp developed a groundbreaking hydrogen burner-compatible asphalt plant that converts ammonia into hydrogen for combustion.

- A full-scale demo will be held in March 2025, with plans to commercialize and implement the technology in asphalt plants by 2027.

NEWS: SOLAR AND BATTERIES

SoftBank invests $130 mln in AI-driven solar farm automation

(Financial Times, March 13)

- SoftBank Group’s Vision Fund 2 led a $130 million round for California-based Terabase Energy, which uses AI and robotics to automate solar farm construction.

- This assembly line was piloted at three U.S. solar farms (40 MW in total capacity), with two more projects underway and plans to scale to hundreds of MWs by 2026.

- The 50-meter-long mobile factory can install 2,000 solar panels in eight hours, and claims to reduce costs, boost efficiency, and address labour shortages.

- CONTEXT: Bill Gates’s Breakthrough Energy was an early backer of the startup that has raised $200 million from investors including Fifth Wall and EDP Ventures.

Hirosaki Uni develops lithium recovery method; seeks practical use with Toyota, etc

(Nikkei, March 11)

- Hirosaki University developed technology to efficiently recover lithium from used batteries and is testing the method with companies like Toyota Motor.

- This could reduce recovery costs to about one-tenth of those when extracting lithium from ore. The goal is to achieve practical application in the next few years.

- The process involves heating and crushing the batteries, dissolving the material in sulfuric acid, and applying voltage to facilitate the migration of lithium ions through the membrane. This method allows for the extraction of lithium hydroxide or lithium carbonate with nearly 100% purity.

- The operational cost to recover 1 kg of lithium carbonate using this method is estimated at around ¥130, compared to ¥1,500/ kg when refining from ore.

- Collaborative research is underway with Toyota Motor, nonferrous metals manufacturer DOWA, and Chubu Electric.

- Plans include a pilot plant capable of recovering several kilograms of lithium per month between 2025 and 2026.

- CONTEXT: Japan plans to amend laws to mandate the recovery of rare metals from battery waste. Li-ion batteries are widely used in EVs and for storing electricity generated from renewable energy sources. An EV typically contains about 5 to 10 kg of lithium. However, due to the high cost and technical challenges associated with lithium recovery, such as reactivity with impurities, the recovery rate remains low, at 5–10%. While recycling technologies for metals like cobalt and nickel have advanced, lithium recycling has lagged behind.

- SIDE DEVELOPMENT:

- TOYO to build electrolyte production site for Li-ion batteries

- (Company statement, March 11)

- Toyo Engineering inked a contract with Nippon Shokubai – a manufacturer of basic and fine chemicals, synthetic resins, and catalysts – to build a new electrolyte manufacturing plant for Li-ion batteries in Fukuoka Pref.

- The electrolytes will enhance Li-ion batteries used in EVs, contributing to shorter charging times, extended battery life, and improved output in low-temperatures.

- CONTEXT: TOYO has collaborated with Nippon Shokubai on various projects since 2003, such as construction of a superabsorbent polymer (SAP) production plant in China. The partnership also includes SAP plant expansion in Indonesia.

JERA unit partners with PowerX, West HD on battery storage and solar PPA business

(Company statement, March 12)

- JERA Cross inked a deal with PowerX to develop battery storage projects, securing grid-scale battery capacity for JERA Cross’s ‘24/7 carbon-free’ electricity initiative.

- CONTEXT: This is Japan’s first joint battery operation between power sector players.

- Separately, JERA Cross extended its partnership with renewables developer West Holdings, allowing it to directly procure excess rooftop solar power from West HD.

- Also, JERA Cross will provide solar PPA services for West HD’s solar farms and to work jointly on battery storage projects.

Shin Idemitsu to build grid-scale BESS in Kumamoto

(Company statement, March 11)

- Japan’s major petroleum distributor, Fukuoka-based Shin-Idemitsu (IDEX), said it will build a grid-scale battery storage system in Nagasu Town, Kumamoto Pref. IDEX is also involved in the installation of solar energy systems.

- The Nagasu Storage Plant will have an installed capacity of 1.99 MW and a storage capacity of 8 MWh. The facility’s investment of around ¥1.2 billion will be partially covered by a state subsidy ( ¥320 million).

- The facility is set to begin operations in November 2026. Operation will be entrusted to J-Power, which will sell electricity through three markets: wholesale, balancing, and capacity.

- SIDE DEVELOPMENT:

- Power X partners with Hexa Energy Services to develop grid-scale BESS

- (Company statement, March 11)

- PowerX will partner with Hexa Energy Services, owned by I Squared Capital, to develop grid-scale battery storage projects across Japan.

- They’ll launch over 10 high-voltage battery storage sites over the next 12 months.

- PowerX will supply its containerized stationary battery system, “Mega Power,” and will also handle site selection and overall project development.

- Hexa Energy Service will own the battery storage sites and manage their market operations post-launch.

Noval Solar deploys grid-scale battery storage in Ibaraki

(Company statement, March 12)

- Noval Solar (Tsukuba, Ibaraki Pref) completed a grid-scale battery storage facility in Joso City, Ibaraki, set to begin commercial operations this month.

- The project features a 1.92 MW installed capacity and 4.88 MWh storage capacity using CATL’s lithium iron phosphate (LFP) batteries.

- The project has subsidies of ¥260 million from the Tokyo Metropolitan Govt.

- SIDE DEVELOPMENT:

- Q.ENEST to build grid-scale battery storage facility in Tochigi

- (Company statement, March 13)

- Q.ENEST Holdings, a green tech firm, will build a high-voltage storage plant in Sano City, Tochigi Pref, with a capacity of 1.99 MW and 8.22 MWh storage.

- The facility, scheduled to begin operations in July 2025, has secured around ¥110 million in subsidies from METI.

NEWS: WIND POWER AND OTHER RENEWABLES

METI and MLIT: offshore wind projects from Round 1 can switch to FIP

(Government statement, March 10)

- A meeting of a METI and MLIT-affiliated offshore wind promotion council clarified that projects awarded through the Round 1 tender will be allowed to transition from the Feed-in Tariff (FIT) to the Feed-in Premium (FIP).

- Since the FIP launched in FY2022 before the Round 1 tender, this will be classified as a “clarification of operations” rather than a “change.”

- The council pointed out that other power sources were allowed to switch to the FIP, and there is no reason for offshore wind to be an exception.

- Mitsubishi Corp, which won the Round 1 bids for three sea areas — offshore Noshiro City and Yurihonjo City in Akita Pref, and offshore Choshi City in Chiba Pref – is reassessing the projects’ economic viability and scheduling.

- With this decision, projects awarded in Round 1 can improve profitability through FIP conversion, signing corporate PPAs, and utilizing battery storage for time-shifting power supply, all while benefiting from FIP’ premium revenue.

- There were also calls to clarify conditions to extend occupancy permits, particularly from the perspective of reducing power generation costs through long-term operation.

TAKEAWAY: The council’s decision signals a shift amid international scrutiny; this decision will shape future offshore wind tenders and influence both domestic and foreign bidders. While Mitsubishi Corp is reassessing its three projects, the focus is now on the govt’s next moves, with expectations for more adjustments to enhance the attractiveness of Japan’s offshore wind sector. Industry members argue that bidding process changes for Round 4 and beyond are insufficient to attract global players, who see better terms in other Asian markets. Japan must provide clearer frameworks, especially for floating wind, and set up well-defined expectations for regulatory improvements.

Japan approves offshore wind development for Akita’s Hachinohe-Noshiro area

(Government statement, March 14)

- METI and MLIT approved the public occupancy plan for an offshore wind project in Hachinohe-Noshiro, Akita Pref, submitted by Happo Noshiro Offshore Wind.

- The 375 MW project was awarded to a consortium comprising ENEOS Renewable Energy, Iberdrola Renewables Japan, and Tohoku Electric. It will have 25 Vestas V236 turbines, each 15 MW capacity.

- This decision follows a 2023 public bidding process for four designated offshore wind zones. Approvals for three other areas (Oga-Katagami-Akita, Murakami-Tainai, and Saikai Eshima) were granted in December 2024.

- The latest approval ensures the official designation of the exclusive usage area and duration for wind power development in the Hachinohe-Noshiro zone.

- CONTEXT: The announcement comes amid news concerning technical issues detected in turbines manufactured by GE Vernova, which are being considered for other projects awarded through public bidding. The rumored defects have not yet impacted development projects in Japan.

JERA and bp tap leadership for offshore wind JV

(Company statement, March 7)

- JERA and bp announced the leadership for their 50-50 offshore wind JV, JERA Nex bp, with Nathalie Oosterlinck as CEO.

- The team includes executives from both companies, having expertise in finance, development, investment, operations, and engineering.

- CONTEXT: The JV aims to accelerate offshore wind development, with a 13 GW pipeline across Europe, Asia-Pacific, and the U.S.

Ibokin and Achiha recycle permanent magnets from direct-drive wind turbines

(Company statement, March 6)

- Recycling firm Ibokin and wind power generation firm Achiha achieved 100% domestic resource recycling by extracting permanent magnets from a direct-drive wind turbine generator dismantled in Hyogo Pref in 2024.

- The process was carried out both on-site and at Ibokin’s Tatsuno plant, after which the recycled materials were sold to domestic users.

- Direct-drive wind turbines commonly use rare-earth permanent magnets in their generators, such as neodymium, dysprosium, and terbium, for which Japan has minimal domestic supply.

- As wind turbines increase in size, the use of permanent magnet direct-drive systems is expected to grow, leading to a higher demand for rare-earth magnets.

FLOWRA inks MoU with ORE to explore floating offshore wind tech

(Organization statement, March 11)

- The Floating Offshore Wind Technology Research Association (FLOWRA) inked an MoU with the UK’s Offshore Renewable Energy Catapult (ORE Catapult) to explore tech development in the floating offshore wind sector.

- The goal is to reduce costs and risks in floating wind through collaboration between British and Japanese industrial, academic, and state bodies.

- CONTEXT: Established in 2013, ORE Catapult is a UK research organization dedicated to advancing offshore wind, wave, and tidal energy tech. Floating offshore wind, in particular, holds much potential due to Japan’s vast territorial waters and exclusive economic zone (EEZ), ranking sixth globally in size. On March 7, the govt approved a bill to expand offshore wind to the EEZ, planning to hold an offshore wind public tender in about two years. But the tech is still in an early phase.

Shikoku Electric to participate in two renewables projects in Uzbekistan

(Company statement, March 12)

- Shikoku Electric will take a 14.4% stake in a renewables power generation project in Uzbekistan that’s led by Saudi firm ACWA Power and Sumitomo.

- CONTEXT: This marks Shikoku Electric’s first power generation venture in Central Asia, a region with growing electricity demand.

- The company will help build a solar farm in Samarkand and a wind farm in Kungrad. Both will include energy storage facilities. Construction begins in the first half of FY2025, with full operation expected by 2027 for the solar farm, and by 2028 for the wind farm.

- The solar farm will have a max capacity of 1 GW; and the wind farm will have around 200 turbines with a max output of 1.5 GW.

- The total construction cost will be about ¥600 billion.

- CONTEXT: Uzbekistan aims to have 18 GW of solar and wind power by 2030.

Hokkaido Electric and Mitsubishi launch renewables aggregation business

(Company statement, March 12)

- Hokkaido Electric and Mitsubishi Corp set up Hokkaido Renewable Energy Aggregation.

- Both have a 50% stake in the new firm that will balance renewables-derived electricity from various locations in Hokkaido, smoothing fluctuating generation volumes to deliver stable energy supplies.

NEWS: NUCLEAR

U.S. tech giants are betting on nuclear power to fuel AI data centers

(Reuters, March 13)

- During CERAWeek in Houston, major companies like Amazon and Google signed a pledge to support tripling global nuclear power capacity by 2050. Other signatories include Occidental and Japan’s engineering major IHI Corp.

- The World Nuclear Association is leading the initiative, hoping for support from industries such as maritime, aviation, and oil & gas. Currently, nuclear power accounts for 9% of global electricity, with 439 reactors. Yet, only about 411 reactors are operational, with a 371 GW total capacity.

- CONTEXT: A medium sized data center needs power consumption of around 50 MW, while larger ones need double or triple that figure. Estimates show that current power usage by data centers worldwide requires around 55 GW, but many foresee a fourfold growth by 2030.

TAKEAWAY: SMRs seem to be at the center of the tech giants’ talks. While Microsoft aims to restart the Three Mile Island NPP, both Amazon and Google are betting on SMRs. One of the issues with SMRs is whether their manufacturing costs can be reduced to make them a more cost-efficient alternative to GW-scale reactors. Google said it hopes that costs can be brought down with innovation.

ANRE determined to restart Kashiwazaki-Kariwa NPP this summer

(Nikkei, March 14)

- Discussions began in the Niigata Prefectural Assembly on the restart of TEPCO’s Kashiwazaki-Kariwa NPP. The govt aims to resume operations by this summer and emphasized the restart’s importance.

- Still, some Assembly members are concerned about evacuation procedures. Public understanding, a key prerequisite for the restart, remains insufficient.

- ANRE’s Director-General attended and said, “Restarting Kashiwazaki-Kariwa is crucial to addressing the vulnerability of the power supply structure in East Japan.” This was the first time a govt official explained the restart’s importance to the Niigata Assembly since equipment preparation work for Unit 7 in June 2024.

- Governor Hanazumi Hideyo, however, remains cautious about making a decision.

- CONTEXT: Public opposition to the restart remains. In the 2024 House of Representatives election, the LDP suffered heavy losses in Niigata’s constituencies, which can be interpreted as local resistance. Even among pro-nuclear LDP members, there is skepticism that the governor will move forward with a decision anytime soon.

TAKEAWAY: The urgency behind the govt and TEPCO’s push for a summer restart stems from the fact that Unit 7 cannot operate beyond mid-Oct. TEPCO recently said anti-terrorism equipment completion for Unit 7 won’t happen in time for the regulatory deadline. The govt seeks to restart Unit 7 before this.

- SIDE DEVELOPMENT:

TEPCO to begin construction of Kashiwazaki HQ - (Denki Shimbun, March 10)

- TEPCO will begin full-scale construction of its new Kashiwazaki headquarters, to support operations related to Kashiwazaki-Kariwa NPP. By the end of FY2026, about 200 employees will move to the new HQ.

- Kashiwazaki mayor said this will improve local safety and economic development.

Takahama NPP: Court rules against residents on extended operation

(Nikkei, March 14)

- The Nagoya District Court dismissed a lawsuit by Aichi and Fukui Pref residents against the federal govt. Residents sought to revoke the operational extension granted to Takahama NPP Units 1&2 operated by KEPCO.

- This lawsuit is the first court decision on extension of operational permits for NPPs.

- The court case focused on the adequacy of the NRA on reactor degradation and risks such as earthquakes.

- CONTEXT: Both reactors have been operational for over 40 years. The NRA has approved operation extension for up to 20 years.

Hokkaido Electric amends reactor permit application for Tomari NPP

(Company statement, March 14)

- Hokkaido Electric said it submitted a revised application to the Nuclear Regulation Authority (NRA) to restart reactor No. 3 at the Tomari NPP. The revisions incorporate all feedback from previous safety reviews.

- Once the NRA approves the revisions, it will prepare a draft safety assessment, which effectively serves as preliminary approval. After public consultations, the plant could receive formal clearance.

- CONTEXT: Since submitting the original application on July 8, 2013, the utility submitted amendments on Sept 29, 2021 and Dec 22, 2023.

TAKEAWAY: Now, Hokkaido Electric is aiming to get approval this fiscal year and resume operations by 2027. There are further regulatory reviews ahead, about construction design and operation safety. Still, this is a step forward in the restart process for Tomari NPP.

Itochu invests in Uzbek uranium mine

(Nikkei Asia, March 13)

- Itochu will invest in a uranium mine in Uzbekistan; it anticipates rising global demand for nuclear fuel.

- Itochu will take a minority stake in Nurlikum Mining, a JV between France’s Orano (51%) and Uzbek state miner Navoiyuran (49%).

- The project aims to produce up to 700 tons of uranium a year for at least 10 years.

- Itochu is a major player in uranium trading, handling around 5,000 tons a year.

NEWS: TRADITIONAL FUELS

JERA urges Australia to boost LNG competitiveness amid U.S. expansion

(Company statement, March 11)

- JERA’s senior VP, Hitoshi Nishizawa, warned that Australian LNG will face more competition, such as from expected increases in U.S. supply by the mid-2030s.

- Many existing Japanese contracts with Australian LNG suppliers will expire around that time, increasing uncertainty for future procurement, Nishizawa said.

- CONTEXT: Australia is Japan’s top LNG supplier, providing close to 40% of all imports last year. The second-largest seller, Malaysia, holds a 16% market share.

- Nishizawa called for more investment incentives in Australian LNG, and state support for carbon capture and storage to maintain competitiveness.

TAKEAWAY: JERA, like Japan as a whole, would like to ensure that procurement remains diversified to hedge risks associated with politics, logistics, etc. As the U.S. seeks to become a more prominent LNG seller, there are opportunities for JERA to sign new contracts with U.S. projects. But switching to U.S. supply to a large degree would limit the hedging strategy. Thus, it makes sense for JERA to encourage one of the world’s top LNG exporters (Australia) to ensure that its fuels sector can thrive even though some in that country want an end to the local oil and gas industry. That said, a recent report by Rystad Energy calls into question Australia’s ability to remain an LNG exporter. With eastern Australia (which had previously stopped exports for a time) facing energy shortfalls due to aging gas fields, and limited pipeline capacity, “LNG imports to Australia are looking like an inevitability,” said Rystad.

INPEX plans to expand oil & gas production over next 10 years

(Nikkei, March 7)

- INPEX plans to boost oil and gas production by 30% over the next decade, reaching over 800,000 barrels per day (oil equivalent) by 2035. This decision is due to rising electricity demand amid AI adoption and population growth.

- INPEX will invest ¥1.8 trillion until 2027, with 90% allocated to oil and gas projects.

- INPEX holds a 65% stake in the Abadi LNG project in partnership with Indonesia’s national oil company Pertamina. The $20 billion project aims to produce 9.5 Mt of LNG a year. It could generate ¥500 billion in revenue.

- INPEX also plans to increase LNG production at Australia’s Ichthys LNG where a third LNG facility could launch in the early 2030s, boosting production 1.5 fold.

- CONTEXT: The IEA forecasts a 6% rise in global natural gas demand by 2035. This has led to a 4% upward revision in gas demand forecasts from a year ago.

Trump’s ambassador pick vows to push Japan to buy more LNG

(Nikkei Asia, March 14)

- George Glass, tapped by President Donald Trump to be U.S. ambassador to Japan, told Senate lawmakers at his confirmation hearing that he’ll press Tokyo to increase imports of natural gas from the U.S. while lessening dependence on Russian supplies.

- He said he’ll hold Japan to the promise of buying more American energy and strengthen joint efforts to secure the critical minerals supply chain.

- CONTEXT: Glass is a real estate developer and a fundraiser for Trump. He said his eldest son and wife lived in Japan for 13 years and his granddaughter was sworn in as a U.S. citizen by the ambassador to Japan at the time, Bill Hagerty.

LNG stocks down from previous week, up YoY

(Government data, March 12)

- As of March 9, the LNG stocks of 10 power utilities were 1.79 Mt, down 9.6% from the previous week (1.98 Mt), up 21% from end March 2024 (1.48 Mt), and down 11.8% from the 5-year average of 2.03 Mt.

NEWS: CARBON CAPTURE & SYNTHETIC FUELS

Tokyo Govt starts registrations for its carbon credit trading system

(Government statement, March 11)

- Tokyo Govt opened registrations for its carbon credit trading system that seeks to facilitate trading carbon credits by small and medium-sized firms in Japan and abroad.

- Registration is free, and J-Credits and voluntary overseas credits can be purchased on the website.

- SIDE DEVELOPMENT:

- Tokyo Govt signs with Gold Standard on carbon credit trading

- (Government statement, March 11)

- Tokyo Govt signed an MoU with the Gold Standard Foundation for cooperation and collaboration in revitalizing carbon credit trading.

- The MoU seeks to promote understanding of carbon credits among companies in Tokyo, and to promote mutual cooperation between the Tokyo trading system and the Gold Standard Foundation’s credit information site.

- CONTEXT: The Gold Standard Foundation is a non-profit organization based in Geneva, Switzerland, that promotes activities by private companies and other organizations to address climate change.

Daiwa House, Osaka Univ reach methane-to-methanol breakthrough conversion rate

(Organization statement, March 11)

- Daiwa House Industry, Japan’s largest homebuilder, and Osaka University, have developed a new synthesis method that converts 89% of methane into methanol.

- The process can utilize non-fossil-derived biogas from sources such as food waste and livestock manure, without relying on natural gas.

- The tech allows to downsize production equipment, even to 1/6 of original scale. Daiwa House aims to first implement the tech in-house by around 2030.

- CONTEXT: In 2017, a team led by Prof Okubo Takashi at Osaka Univ was the first to produce methanol under ambient temperature and pressure conditions. But the conversion efficiency was only 14% and a large amount of raw material was needed. A conversion rate of 10–20% is considered the commercially viable threshold.

- The Daiwa-led research team achieved a breakthrough in conversion efficiency by using perfluoroalkyl ether as the reaction solvent.

- CONTEXT: Methanol is a critical chemical with a global market of 99 Mt as of 2024, projected to reach 120 Mt by 2029. It is used as a fuel, among other purposes. Japan relies almost entirely on imports for methanol.

MOL joins e-NG Coalition to promote e-methane

(Company statement, March 3)

- Mitsui O.S.K. Lines (MOL) joined the e-NG Coalition, an international alliance promoting adoption of e-methane. The coalition now includes 20 companies.

- CONTEXT: The e-NG Coalition, established in October 2024 in Brussels, aims to expand e-methane adoption globally through policy advocacy, industry collaboration, etc. Current members include Mitsubishi, Osaka Gas, Toho Gas, Tokyo Gas, IHI, etc.

- SIDE DEVELOPMENT:

MOL to acquire Dutch chemical tank facility operator

(Nikkei Asia, March 11)- Mitsui O.S.K. Lines (MOL) will acquire LBC Tank Terminals, a Dutch chemical tank facility operator, for $1.72 billion — its largest acquisition to date.

- LBC operates storage tanks for chemicals, crude oil, and petrochemicals in Europe and the U.S. It also offers loading and unloading services.

- CONTEXT: MOL operates 113 chemical tankers.

Chitose Bio Evolution raises ¥7.3 billion to expand algae biomass production

(Nikkei, March 10)

- Singapore-based biotech startup Chitose Bio Evolution raised ¥7.3 billion through a third-party allotment from Sumitomo Mitsui Banking Corp, Mizuho Bank, etc.

- The firm specializes in algae-based biomass products and sustainable agriculture. The funds will be used to expand production.

- Chitose Bio Evolution has a 50,000-m3 algae biomass production facility in Malaysia, and is building a 1-million m3 facility to meet growing demand for aviation fuel, etc.

BY KYOKO FUKUDA AND YURIY HUMBER

Japan’s PPA Contract Volume and Size Expanded in

2024 Amid Push for More Variety

WHAT IS A PPA?

Corporate PPAs are generally 10- to 20-year power supply contracts between consumers (buyers) and suppliers. The PPAs can be both physical and virtual. The former works as a regular supply contract, with the buyer directly securing the volumes for which they signed up. This can be either via the usual power line transmission (offsite PPAs), or by adding generation equipment on the end-user’s property (e.g., solar panels on a factory roof). The latter is called an Onsite PPA.

Virtual corporate PPAs, on the other hand, are derivatives. In this arrangement, the power firm sells its electricity volume into the wholesale market, while the corporate consumer gets power from a traditional retailer. The Virtual PPA acts as a contract for the difference.

The extra benefit of the Virtual PPA is that the buyer can claim the environmental value of the contracted electricity, regardless of how the power they actually receive was produced. Put simply, the buyer can say they buy 100% green electricity, because that’s what they paid for, while the actual electrons they receive may come from thermal generation.

Physical PPA is a category under the Offsite PPA, when buyers purchase electricity with environmental attributes such as renewable energy certificates from sellers.

The Japanese market for Power Purchase Agreements (PPAs) expanded last year while also adding more variety in power sources and concluding deals that offered more electricity capacity.

The number of publicly disclosed PPA deals tracked by Japan NRG in 2024 rose 18% to 226, compared to a year earlier. This brought the total capacity covered by deals over the past two years to around 1.68 GW, our data show. We forecast that the rest of the decade is likely to see further but uneven growth due to bottlenecks in supply and grid constraints.

We began tracking publicly announced PPA deals from calendar year 2023. Our database collects information on details divulged by the counterparties or the government, and contains parameters such as electricity volumes, forecasted CO2 savings, type of contract, and the sector background of buyers and sellers. It does not include contract prices as these are not shared by the parties publicly. However, based on conversations with market players and references to additional sources, we have included a section below that gives an outline of the price ranges and numbers based on anecdotal / market average evidence.

Since the earliest known PPA deals in Japan appeared around 2020, the number of total contracts is now estimated to be close to 500, covering over 2 GW in capacity. Market players suggest that at least the same amount of capacity tied to PPA deals has not been disclosed in the Japanese market, covering mainly in-house or onsite arrangements.

The following is a summary of the first part of a new special report by Japan NRG covering the PPA sector, focusing on providing a practical snapshot of market trends and a basic analysis of buyers/sellers, deal types, and environmental impact.

Dataset overview

Japan’s market for PPAs saw strong growth again in 2024. The number of projects increased from 192 in 2023 to 226, up 18%, according to Japan NRG data tracking. The average capacity of projects also increased. In 2023, nearly 60% of the PPA deals were for less than 1 MW of capacity. But in 2024, the share of sub-1 MW deals dropped to less than half, while almost 40% were between 1 MW and 5 MW.

The total capacity tied to PPA deals (based on disclosed numbers) was about 691 MW (based on 184 out of 226 projects stating their capacity). This compares with 992 MW in 2023 (based on 178 out of 192 projects revealing their capacity).

Over the past two years, the total PPA capacity disclosed surpassed 1.68 GW. Considering the number of deals that are undisclosed and the PPAs signed from 2020 to 2022, we estimate that the total capacity in such agreements to date is over 2 GW and likely closer to 2.5 GW.

The vast majority of that capacity (and deal numbers) remains linked to solar farms. However, last year saw the emergence of onshore wind, hydro and mixed-source agreements. There are also PPAs linked to offshore wind projects that are in a preliminary stage and are therefore not covered in this report. We expect PPAs for offshore wind farms to be finalized closer to the start of operations, in the latter part of this decade.

Recent growth in the PPA market is based on several factors:

· Continued policy support for renewables to play a bigger role in the energy mix;

· Corporate sustainability commitments for both domestic and overseas firms operating in Japan, which seek secure green power volumes;

· Desire to lock in prices in an electricity market that is expected to see more price volatility as it embraces more intermittent power sources (without adequate energy storage capabilities currently in place);

· Grid constraints, which limit new power source connections and delay the rollout of more supply side, thus raising the value of green volumes already on the market.

One more important factor driving the uptick in energy demand is the construction of new semiconductor production facilities in Kyushu and other regions, and the proliferation of new data centers nationwide. Last year, Japan’s weather-adjusted electricity demand rose 0.9% YoY, according to Yes Energy data. That compares with a 1.9% weather-corrected YoY drop in the 2023 calendar year.

Weather Adjusted Power Demand (MWh)

2023 | 2024 | YoY Growth | |

Jan | 109,613 | 108,189 | -1.3% |

Feb | 108,942 | 107,898 | -1.0% |

March | 94,159 | 95,870 | 1.8% |

April | 83,900 | 83,829 | -0.1% |

May | 80,603 | 80,732 | 0.2% |

June | 88,846 | 87,704 | -1.3% |

July | 100,344 | 101,269 | 0.9% |

Aug | 101,923 | 101,487 | -0.4% |

Sept | 92,633 | 92,026 | -0.7% |

Oct | 83,434 | 83,887 | 0.5% |

Nov | 90,050 | 88,868 | -1.3% |

Dec | 102,789 | 102,654 | -0.1% |

Total | 1,137,236 | 1,134,413 | -0.2% |

Source: Yes Energy

Notably, physical and virtual PPAs remain the main tool for emission reduction for corporations in Japan. The purchase of carbon credits as an offset mechanism is another option since trading was launched on a trial basis on the Tokyo Stock Exchange in October 2023. The volumes – while showing YoY growth – represent a fraction of the nation’s billion-ton CO2 footprint. So far, only credits representing about 675,000 tons of CO2-equivalent have changed hands.

Summary of Traded Volume of Carbon Credits in Japan

Energy Saving | Renewable (Electricity) | Renewable (Heat) | Forestry | Woody Biomass | |

2023 | 37,944 | 54,565 | 121 | 64 | 0 |

2024 | 173,454 | 390,298 | 12,031 | 2,954 | 3,648 |

Total | 211,398 | 444,863 | 12,152 | 3,018 | 3,648 |

Cost of PPA

The costs of onsite PPA vary by the power generation capacity, contract period (number of years), and area (of installation). Since PPA contract prices are not made public, pricing information is usually only available on an anecdotal basis, either through insiders familiar with certain deals, aggregator sites, or solar sector specialists, such as Tokyo-based RTS Corporation. In addition, the Renewable Energy Institute (REI) publishes an annual report that includes pricing information that references RTS numbers.

Most sources concur that during the early years of PPA contracts in Japan, during the 2021 to 2022 period, the PPA contract price averaged around ¥11/ kWh (tax included). That compared with an average 24h spot system price on the JEPX of ¥14.15/ kWh in 2021 and ¥22.30 in 2022.

Spot prices then fell to ¥11.93 on average for 2023 and ¥11.67 in 2024. However, PPA contract prices rose due to rising costs for PV panels and electric equipment in the post-pandemic period. Furthermore, a boom in onsite PPAs in Japan stoked demand, with average PPA contract prices said to be at around ¥12 or higher in the past two years. For smaller scale facilities, however, the PPA contract price can reach ¥20 or more.

For offsite physical PPAs tied to solar, the 2024 price range cited by REI based on RST numbers was ¥13-16/ kWh (generation cost only, not including tax). Which brought the total cost for consumers (including wheeling fees, retailer margins, renewable energy surcharges, and tax) to about ¥25-28/ kWh for high voltage and ¥21-24 / kWh for special high voltage. This was still lower than regular tariff in some cases, but no longer an obvious money saver. It’s also worth mentioning that prices are subject to change based on various conditions.

The basic numbers for offshore wind projects from the early auction rounds, which would be structured mostly as virtual PPAs, are understood by Japan NRG to be around the ¥23-26 level on average. That’s considerably higher than solar PPAs and still more than for onshore wind projects, which tend to start in the mid ¥10s range.

A final point to note on pricing is that with the carbon credit trading system fully launching in FY2026 and a fossil fuel levy introduced in 2028 the cost of CO2-emitting thermal power in Japan will increase. The scale of the increase is difficult to predict due to fossil fuel price volatility. The more predictable nature of a PPA could then become even more attractive.

The above text is based on the opening part of a special report on the PPA deals by Japan NRG, which was published last week. The report goes on to cover:

- The reference for power prices based on high-voltage and extra-high-voltage electricity

- A breakdown of the PPA deals database collated by Japan NRG based on

- Contract types (onsite vs offsite, etc)

- Generation capacity of contracts

- Buyers and their business categories (which sectors are the most active? Standout projects, etc)

- Power sources that feed into the PPA (it’s not all solar anymore…)

- Which sellers are the most active

- CO2 reduction impact of the PPAs

- Outlook on future trends

Japan NRG premium subscribers are able to purchase the report for a one-off fee of ¥20,000 (excluding tax).

Get in touch for further details or to purchase the report: info@yuri-group.co.jp

BY FILIPPO PEDRETTI

Japan to Increase Its LNG Carrier Fleet: Is the Global Market Strong Enough?

While the first international LNG shipment took place in 1959, only in the past decade or so has the super-chilled fuel blossomed into a prospering global market. Today, Japan is at the center of it, both as a major consumer, and due to its leading role in the LNG shipping industry.

Currently, Japan is the world’s second largest LNG consumer, but it also transports over 30% of global LNG supplies. Not planning to rest on its laurels, Japan’s major shipping companies seek to expand their LNG fleets by 40% through FY2030, reinforcing their dominance in LNG transportation.

This status is in large part due to Japan’s geography – with no possibilities of importing LNG via pipelines (as in Europe or U.S.), Japan has had to focus on maritime supply routes.

Yet, the fleet expansion strategy hinges on the belief that LNG will maintain its status as a vital energy source in the coming decades. While climate activists want to shut down all fossil fuel usage, LNG is seen by the U.S. and many in Asia as an inexpensive lower-carbon fuel, compared to coal.

If that holds, Japan’s maritime bet on the fuel’s future role will look as a strategically smart play. Should LNG lose its luster over time, both Japan’s shipping industry and power industry could be left in the lurch. As it is, the LNG market is a highly volatile one, particularly sensitive to geopolitical vicissitudes. Japan NRG takes a look at the lay-of-the-land in the country’s LNG transportation industry.

Leaders: MOL, NYK and K-Line

The global LNG carrier fleet has grown 90% since 2014, currently reaching 751 vessels. Ten years ago, the number stood at around 400. While Japan is the top nation in carrier operations, nearly 70% of all LNG transport ships are built in South Korea.

Mitsui O.S.K. Lines (MOL), the world’s top LNG transport owner, plans to increase its LNG carrier fleet from the current 97 vessels to 140 by FY2029, and then up to 150 by FY2030. This aggressive growth plan calls for investment of up to ¥600 billion.

In January, MOL signed its eighth long-term charter contract for a new LNG carrier. South Korea’s Samsung Heavy Industries will build the vessel – 290 meters long and with a 174,000 m³ membrane tank. When launched in 2026, MOL will manage the ship’s operations for JERA, Japan’s largest power utility.

Also in January, the company launched a new LNG vessel, called MOL Azure, ordered by MOL LNG Ship Management. It sails for a unit of TotalEnergies under a time charter contract. The first loading was at a port in the U.S.

The LNG carrier MOL Azure

Besides MOL, the other two Japanese shipping giants, Nippon Yusen Kaisha (NYK) and Kawasaki Kisen Kaisha (K-Line), also plan to expand their LNG carrier fleets. NYK targets a 30% increase to reach 120 vessels by FY2028, supported by ¥250–¥300 billion in investments. K-Line plans the largest proportional increase, growing its fleet 60%, from the current 47, to 75 by FY2030, with a similar investment range of ¥250–¥300 billion.

The three companies are expecting major profits in the late 2020s betting on rising LNG demand. One factor that will determine the returns is ship ownership structure. Hitherto, it was common for an LNG carrier to be shared among four or five parties, to divide the burden of the costs. However, there’s a new trend where one ship is owned by only two or maybe three parties; hence, less stakeholders with whom to divide the profits.

All three major shipping companies intend to share vessel construction costs with overseas partners. The price tag for one LNG carrier is about ¥30–40 billion, though cost overruns are common. To help offset these costs, shipping companies are also eyeing opportunities for long-term transport contracts.

A fluctuating market and rising LNG demand

Profits from shipping LNG are far from certain due to the challenges and volatility in the market.

An excess of LNG carriers, and delays in new LNG terminals, has recently led to record-low shipping rates. In December 2024, shipping rates for LNG carriers hit their lowest levels since records began in 2018.

The primary reason was an abundance of vessels that had followed a surge in new ship orders in 2022. Despite an expected rise in LNG production, delays in projects such as the Golden Pass LNG terminal in Texas left many carriers idle. Estimates say the slump could continue until 2027, when production and transport capacity reach a balance.

A key factor in the current global market turbulence has been U.S. energy policy. In early 2024, President Biden imposed a halt on approvals for new LNG export projects, leading to a reduction in expected LNG shipments, thus weakening charter rates. But, with Trump’s election, these restrictions have been rescinded.

The change in energy direction under the Trump White House has been welcomed by many governments in Asia, since the alternative LNG supply routes – from the Middle East and Russia – have been disrupted by geopolitical tensions. For example, MOL was impacted by military conflict in the Suez Canal area, and the company also had to alter the purpose of three LNG carriers originally meant to serve Russia’s Arctic LNG 2 project after the U.S. announced additional sanctions last year. For Europe, disruption of pipeline-supplied gas from Russia has been a boost for LNG imports, requiring more carriers.

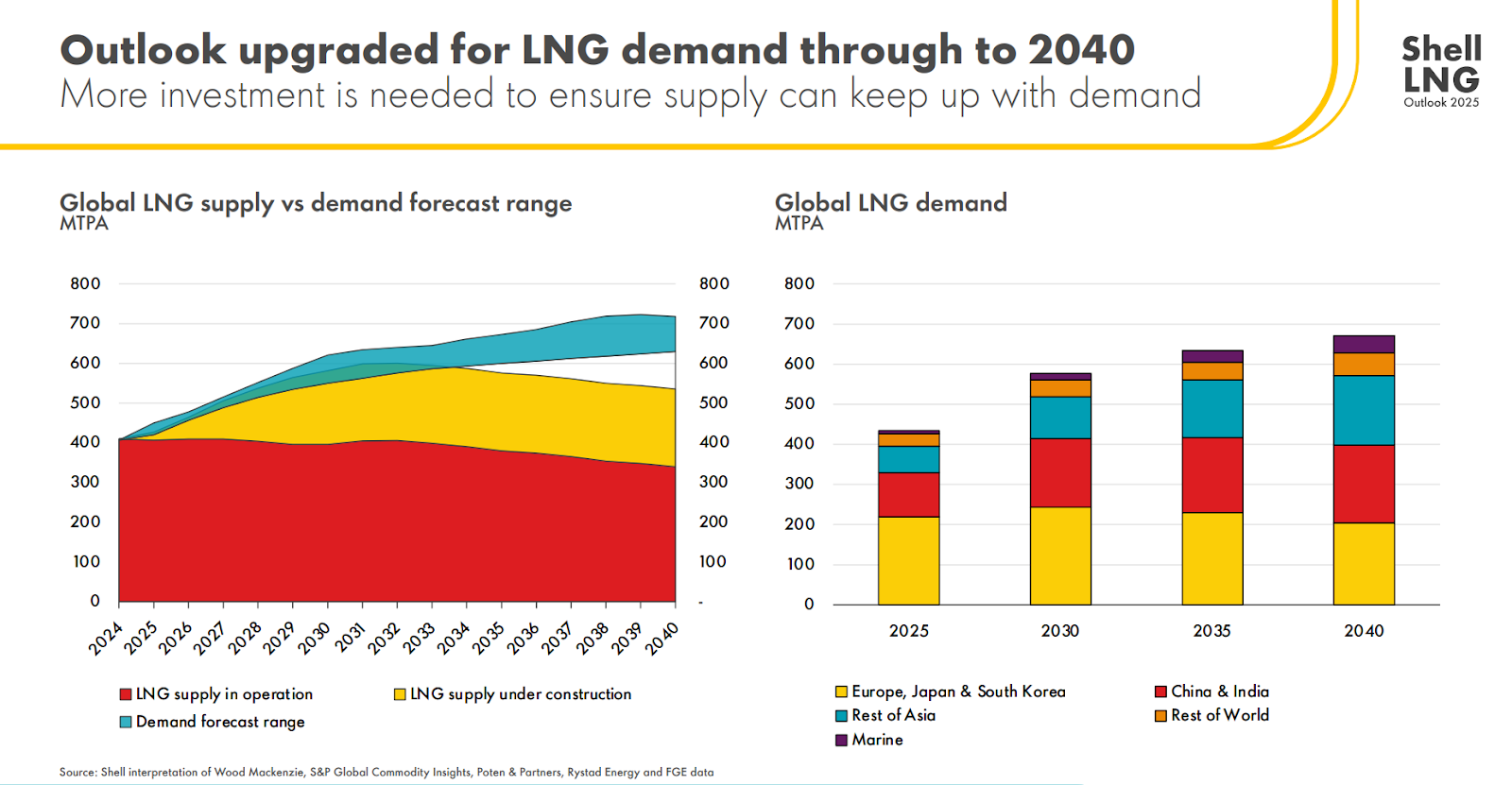

LNG demand looks set to continue on an upward trajectory. Shell forecasts a 60% rise in LNG demand to 2040, driven by increasing energy needs in Asia. Further growth potential is in new markets such as South America.

Gas industry critic, the IEEFA, however, warns that structural LNG demand growth in Asia could be constrained by diverse factors. Inherent volatility of LNG prices, coupled with long development timelines for projects and large costs, may hinder a rapid expansion.

Gas industry critic, the IEEFA, however, warns that structural LNG demand growth in Asia could be constrained by diverse factors. Inherent volatility of LNG prices, coupled with long development timelines for projects and large costs, may hinder a rapid expansion.

If the bullish forecasts are right, then broadly speaking, investing now will have the advantage of low shipbuilding costs and charter rates ahead of future demand. With U.S. exports expected to rise in the next few years, demand for ships to carry the fuel should follow.

Global LNG trade volume now stands at around 400 million tons per year, but sector analysts see it soaring to 700 million tons. MOL, for example, is undertaking its fleet expansion based on forecasts for demand to reach 624 million tons a year by 2035.

Conclusion

Many countries have incorporated LNG into their decarbonization and energy diversification strategies, but the question remains: is a higher LNG utilization rate compatible with energy transition goals and will it be seen as such by future governments?

There’s also the issue of energy security: will the LNG trade fall prey to geopolitics? China’s pause on all future LNG contracts with the U.S. amid tariffs, counter-tariffs and other trade tensions shows that at least one major buyer believes so.

Japan’s overall domestic LNG demand, which until very recently had been forecast by METI to wane due to nuclear reactor restarts, a shift to green energy and depopulation, means that the country’s shipping industry is making a high-stakes bet on the fuel’s appeal across Asia.

Expanding the LNG fleet makes sense should Japanese firms be successful in selling the fuel to developing countries such as Vietnam, Indonesia, Bangladesh and the Philippines. Beyond the CO2 footprint, this strategy also hinges on delivering the LNG at lower prices than what consumers in Japan can accept – and beating international players such as the traders and oil majors to the deals.

While the debates continue, Japan’s shippers are moving full-steam ahead.

ASIA ENERGY REVIEW

BY JOHN VAROLI

A brief overview of the region’s main energy events from the past week

Australia / BESS

Quinbrook Infrastructure Partners will build a long-duration battery energy storage system (BESS) in collaboration with CATL. Quinbrook said this will be the “world’s first genuine 8-hour battery at more than double the current maximum 4-hour duration BESS.”

Australia / Power bills

Power prices are set to rise again, as the Australian Energy Regulator lifts the caps on how much retailers can charge. The default market offer will rise by up to 8.9% in some areas, as the cost of power generation and the maintenance of the poles and wires network keeps climbing.

China / Oil refining

Shandong Yulong Petrochemical is expected to soon start operating its second crude oil processing unit. The start of full operations at the $20 billion complex would help lift China’s crude imports and its output of refined products in 2025.

China / Renewables

CLP China commissioned two renewable energy projects, doubling its renewable energy portfolio in the Mainland. One is the 150 MW Bobai Wind Farm. The other project is the 90-MW Yixing Phase I Solar Power Station in Jiangsu.

India / Renewables

Tata Power Renewable Energy will develop 7 GW of clean energy projects in Andhra Pradesh. This will include solar, wind, and hybrid projects with or without storage solutions.

India / Coal imports

India’s coal imports from April to December 2024 reached 183.42 MT, falling 8.4% from the same period last year.

Indonesia / Natural gas

Sembcorp terminated a gas deal with West Natuna Exploration, Empyrean Energy, and Coro Energy Duyung. “As regulatory approval in Indonesia has not been obtained, the GSA will accordingly be terminated,” Sembcorp said.

Malaysia / Power turbines

Worldwide Holding Berhad’s 1.2 GW Pulau Indah combined cycle gas turbine (CCGT) power plant in Malaysia has started operation.

Offshore wind

Uncertainty in the U.S. offshore wind market following the reelection of Trump presents an opportunity for APAC and Europe. “Trump’s election has undoubtedly reduced the confidence in parts of the offshore wind industry for some time, but we need to recognise how shifting momentum can help us turn adversity into opportunity,” said Tim Fischer, director for Ramboll’s Global Wind Division.

Singapore / Offshore wind

A joint report on Offshore Wind Power Trade Cooperation between Vietnam and Singapore was endorsed on March 12. The report facilitates regulatory approvals and licences from both countries for renewable energy development and cross-border electricity trading.

South Korea / Offshore wind

Deep Wind Offshore Korea, the subsidiary of Norwegian developer Deep Wind Offshore (DWO), secured a Public Waters Occupancy and Use Permit (PWOP) for its 1.5 GW Abalone offshore wind farm off southwestern South Korea. The Abalone project is part of a partnership between DWO and BP to develop four offshore wind projects with a potential capacity of 6 GW across the Korean peninsula.

Disclaimer

This communication has been prepared for information purposes only, is confidential and may be legally privileged. This is a subscription-only service and is directed at those who have expressly asked K.K. Yuri Group or one of its representatives to be added to the mailing list. This document may not be onwardly circulated or reproduced without prior written consent from Yuri Group, which retains all copyright to the content of this report.

Yuri Group is not registered as an investment advisor in any jurisdiction. Our research and all the content express our opinions, which are generally based on available public information, field studies and own analysis. Content is limited to general comment upon general political, economic and market issues, asset classes and types of investments. The report and all of its content does not constitute a recommendation or solicitation to buy, sell, subscribe for or underwrite any product or physical commodity, or a financial instrument.

The information contained in this report is obtained from sources believed to be reliable and in good faith. No representation or warranty is made that it is accurate or complete. Opinions and views expressed are subject to change without notice, as are prices and availability, which are indicative only. There is no obligation to notify recipients of any changes to this data or to do so in the future. No responsibility is accepted for the use of or reliance on the information provided. In no circumstances will Yuri Group be liable for any indirect or direct loss, or consequential loss or damages arising from the use of, any inability to use, or any inaccuracy in the information.

K.K. Yuri Group: Hulic Ochanomizu Bldg. 3F, 2-3-11, Surugadai, Kanda, Chiyoda-ku, Tokyo, Japan, 101-0062.