WEEKLY

MAY 26, 2025

ANALYSIS

THE ABUNDANT NATURAL WEALTH OF ‘RESOURCE-POOR’ JAPAN

- “Resource-poor” is often used to describe Japan. All other countries and regions along the Ring of Fire have extensive deposits of oil, gas and metals.

- Why does Japan stand out among its neighbors, and is it really “resource-poor”?

CAN JAPAN AVOID A MASSIVE BLACKOUT LIKE THE ONE IN EUROPE

- The recent blackout on the Iberian Peninsula ignited a debate on grid stability, prompting Japan to reconsider measures to prevent outages.

- This is an opportunity to revisit the complexities of Japan’s power grid, which relies on factors such as frequency control, inertia, interconnection capacity, and demand forecasting.

ASIA PACIFIC REVIEW

This column provides a brief overview of the region’s main energy events from the past week

NEWS

- OCCTO discusses long-term thermal power and supply-demand balance outlook

- 2024-25 electricity supply-demand report is published

- METI: No power-saving request for summer

- Japan braces for warmer, wetter summer: JMA

- Cross-border players account for majority of EEX trading

- TOCOM launching annual power futures contracts

- New power companies’ share to rise by FY2030

- Japan and the Netherlands expand hydrogen and ammonia partnership

- METI selects priority regions to promote FCVs

- Japan probes Chinese solar panels over hidden device fears

- ANRE suspends more FIT/ FIP grants for solar projects over violations

WIND POWER AND OTHER RENEWABLES

- Glocal’s floating offshore wind plans in Japan

- MoE urges J-Power to make geothermal project a model for sector

- MoE tells Cosmo to coordinate work on wind farm

- Japan eyes first field test for fusion in early 2030s

- KEPCO’s Mihama NPP Unit 3 restarts after checks

- Russia’s Arctic LNG 2 plant said to expand production despite sanctions

- METI wants evaluation of gas system reforms by March 2027

- JAPEX acquires 50% stake in Indonesia gas firm

CARBON CAPTURE & SYNTHETIC FUELS

- Kyushu Electric investment plan with ¥1.5 trillion for decarbonization

EVENTS

June 4-5 Kyushu Innovation Week / Kyushu GX Decarbonization Expo @ Marine Messe Fukuoka

June 4-6 AXIA EXPO 2025 (Hydrogen and Ammonia Next-Generation Energy Exhibition) @ Aichi Sky Expo

June 15-17 G7 Summit @ Kananaskis, Alberta, Canada

June 18-20 Japan Energy Summit & Exhibition ` Tokyo Big Sight

PUBLISHER

K. K. Yuri Group

Editorial Team

Yuriy Humber (Chief Editor)

John Varoli (Senior Editor, Americas)

Kyoko Fukuda (Data, Events)

Magdalena Osumi (Renewables & Storage)

Filippo Pedretti (Thermal, CCS, Nuclear)

Tetsuji Tomita (Power Market, Hydrogen)

George Hoffman (Sales, Business Development)

Tim Young (Design)

SUBSCRIPTIONS & ADVERTISING

Japan NRG offers individual, corporate and academic subscription plans. Basic details are our website or write to subscriptions@japan-nrg.com

For marketing, advertising, or collaboration opportunities, contact sales@japan-nrg.com For all other inquiries, write to info@japan-nrg.com

NEWS: GENERAL POLICY AND TRENDS

OCCTO discusses long-term thermal power and supply-demand outlook

(Agency statement, May 21)

- OCCTO discussed the electricity supply-demand outlook for 2040 and 2050, focusing on the role of thermal power generation and the balance in supply and demand.

- Two models were created to examine whether thermal plants nearing end-of-life will be replaced, in addition to factoring in newly announced construction and closures. This thermal replacement modeling was incorporated into a broader analysis of supply-demand scenarios.

- A total of 20 model cases were analyzed: four scenarios for 2040 combining OCCTO’s two demand assumptions with and without thermal replacement, and 16 scenarios for 2050 that varied demand levels and included options for nuclear and thermal replacement. Each scenario was further broken down into four time periods—summer day, summer night, winter day, and winter night.

- OCCTO ran simulations to assess whether the reserve margin in each case would meet reliability standards under a range of demand assumptions and uncertainties.

- CONTEXT: The long-term outlook includes nuclear, renewables, pumped hydro, and battery storage. Demand scenarios are based on studies by the Research Institute of Innovative Technology for the Earth (RITE) and Deloitte Tohmatsu Consulting. OCCTO’s models assume 2040 demand at either 900 or 1,100 TWh, and 2050 demand at 950, 1,050, 1,150, or 1,250 TWh.

OCCTO publishes 2024-25 electricity supply-demand report

(Agency statement, May 21)

- OCCTO has released its biannual report on electricity supply and demand, reviewing the FY2024 winter season and forecasting the FY2025 summer.

- During the FY2024 winter, peak demand reached 147.9 GW on January 10, with a reserve margin of 12.5%. Actual supply came in at 166.4 GW – below forecast – due to unexpected thermal plant outages and lower-than-expected hydro output. Solar power generation, however, exceeded projections.

- Looking ahead to FY2025 summer, OCCTO assumes conditions similar to the hottest year in the past decade. Under this scenario, maximum power demand (H1) is expected to remain unchanged. By factoring in emergency supply measures and inter-regional power sharing, all regions are projected to maintain the minimum 3% reserve margin required for reliability.

- CONTEXT: OCCTO publishes its Report on Verification of Electricity Supply and Demand twice a year, in May and October. The May edition reviews the previous winter and forecasts the upcoming summer; the October edition does the reverse.

- SIDE DEVELOPMENT:

- METI: No power-saving request for summer

- (Nikkei, May 23)

- METI Minister Muto said “no power-saving request will be issued this summer”, the second consecutive year without such a request.

- CONTEXT: The govt issues a request when the power system’s capacity reserve margin is forecast to shrink below the minimum 3% required for stable supply. Power-saving requests were issued nationwide in summer 2022 and in TEPCO’s area in summer of 2023.

- METI estimates the reserve margin for August at 7.6% for Hokkaido, Tohoku, Tokyo, and Chubu EPCO areas; and at 9% for Hokuriku, Kansai, Chugoku, and Kyushu areas. Shikoku is at 21.4% and Okinawa at 20.7%.

TAKEAWAY: This is potentially bad news for TEPCO and its plans to restart the Kashiwazaki-Kariwa NPP this summer. Ample reserves make it harder for the utility to argue that the facility is vital to meet summer peak loads.

Head of FEPC comments on LTDA and suggests improvements

(Denki Shimbun, May 19)

- Kingo Hayashi, Chairman of the Federation of Electric Power Companies of Japan (FEPC), commented on the results of the second long-term decarbonized power sources auction (LTDA). He praised successful bids by nuclear power plants.

- He said that investment predictability has improved. The current auction is based on a competition between various power sources using fixed costs. Kingo argued that this risks favoring specific types like batteries. He suggested setting procurement volumes by power source type.

- Hayashi also raised concerns about the inability to recover fixed costs due to post-bid cost increases. This may include rising material prices and extra safety investments for NPPs. For projects with long lead times, he proposed mechanisms such as upfront payments for capacity.

- Many bids reached the ¥100,000/ MW threshold. Hayashi called for upper price limits and payment levels that better reflect actual costs and technology-specific risks. This is especially pertinent for sources like hydrogen and ammonia.

- He also called for measures to maintain a stable level of thermal power.

TAKEAWAY: The LTDA mechanism has become something like a Swiss army knife, helping various sectors meet their immediate needs. The big utilities see it as a new source of funding for thermal power (LNG, nuclear and later co-firing) and seek to protect their interests against (mostly new) market entrants that are focused on BESS. Still, the govt has clearly encouraged the inflow of battery bids and will continue to support that sector. Tensions around price caps, however, are likely to increase given the complexity of comparing the cost structures of various power sources. This is why it’s possible that the LTDA will evolve into several, separate auctions in the future.

Govt continues to discuss details of simultaneous market

(Government statement, May 20)

- METI and OCCTO discussed market price calculations, the handling of distributed energy resources (DER), and the simultaneous market itself.

- On market prices: focus was on technical feasibility and discrepancies between prices calculated based on retail bidding and actual power supply conditions.

- DER was proposed to avoid congestion in local power grids. While the simultaneous market mainly handles high-voltage grids, local congestion can prevent DERs from operating as scheduled.

- Accurate demand forecasting and bidding by electricity retailers in the day-ahead market was identified as essential.

- CONTEXT: The study group is working on a system that simultaneously settles both supply (kWh) and balancing capacity (ΔkW). The simultaneous market will manage generation based on grid constraints and generator characteristics, mainly focusing on the two highest-voltage levels.

Govt discusses long-term strategies for Watt-Bit Coordination

(Government statement, May 19)

- The second meeting for Watt-Bit Coordination discussed short- and medium- and long-term policies for data center location and infrastructure.

- In terms of efficiency, data centers of a certain size should be concentrated in one location.

- Location will be selected based on the “Welcome Zone Map,” which lists the available capacity of each TSO.

- By installing storage batteries and cogeneration systems at each data center and shifting workloads, they make more effective use of existing power infrastructure.

Honda to cut EV-related investments

(Company statement, May 20)

- Honda is revising its electrification strategy due to slower EV market growth. It will cut planned EV-related investments by ¥3 trillion, for a new total of ¥7 trillion by FY2030, when EVs are now expected to account for under 30% of sales.

- Honda will now focus on hybrid vehicles, launching 13 models in 2027-2030.

NEWS: ELECTRICITY MARKETS

Japan Braces for Warmer, Wetter Summer: JMA’s June–August 2025 Outlook

(Agency statement, May 20)

- The Japan Meteorological Agency (JMA) forecasts above-normal temperatures across much of Japan from June through August 2025, with the strongest warming expected in mainland eastern and western regions, including Tokyo, Osaka, and Fukuoka.

- Precipitation is projected to be near or above normal nationwide, with the upcoming rainy season expected to bring intensified rainfall, particularly in southern and western Japan. The rainy season will peak in June to early July, bringing flood risk.

- The Asian summer monsoon is anticipated to be near normal in overall activity, but circulation anomalies suggest a stronger and more expansive North Pacific subtropical high, potentially leading to prolonged hot and humid conditions in central and eastern Japan.

- ENSO-neutral conditions are likely to persist through the summer, meaning there will be no significant El Niño or La Niña influence on Japan’s seasonal climate.

Cross-border market players account for majority of EEX trading

(Exchange comment, May 21)

- Market players formed through cross-boarder M&A account for 51% of top traders by volume on the EEX, said the exchange’s Japan CEO Bob Takai at a forum to mark the 5 years since launch in Japan. Such players include JERA (which recently absorbed EDF Trading in Tokyo) and hedge fund Citadel, which acquired Tokyo-based Energy Grid.

- International players led by RWE, Macquarie, BP, Engie, Engelhart and Mercuria make up another 32% of trading volume; Japanese firms form the remaining 16%.

- The number of market participants that trade more than 500 GWh per month has grown from just one in 2023 to eight last year, and 15 in Q1 2025.

- Takai lauded the balance between overseas “risk-takers” and domestic utilities, which seek to hedge their physical power volumes, as a reason for EEX’s fast growth in Japan. The exchange welcomed its 100th market participant recently and expects to add 10-20 new traders each year.

- EEX is considering adding daily futures products for the Kansai area, and adding the number of Japan areas to its derivatives lineup. It will also add Japanese fiscal year futures contracts – up to 6 years out – before the next hedging season in autumn.

- CONTEXT: In May 2020, EEX launched power futures clearing services in Japan. Japanese power futures are now the No. 8 global market for Germany-based EEX, with its home national market leading, followed by the U.S. business.

- SIDE DEVELOPMENT:

- ORIX preparing to begin electricity derivatives trading on the EEX

- (Japan NRG, May 21)

- Financial conglomerate ORIX will start trading on the EEX in coming months after securing registration.

- ORIX wants to use derivatives as a form of hedging to support its physical assets in the power sector.

- CONTEXT: ORIX was one of the early investors into renewable energy in Japan and started retailing 100% renewables plans in 2019. It built up one of the largest domestic portfolios in solar and wind, and entered battery storage in 2022.

TAKEAWAY: ORIX has an ambition to be active in the balancing and capacity markets as it scales the BESS division to complement its solar and wind facilities. The company is working on a 134 MW/ 548 MWh sized BESS in Shiga Pref and plans to bring it online in 2027. The EEX platform commands the vast majority of power derivatives liquidity in Japan, which is luring both domestic and international players.

TOCOM launching annual power futures contracts

(Exchange statement, May 19)

- Previously, hedging of electricity price required purchase of 12 monthly contracts, but starting May 26 TOCOM launches annual contracts for baseload and daily load.

- The baseload contracts will cover 24-hours, and each trading unit will represent 876 MWh of electricity. The daily load will cover the 8 a.m. to 8 p.m. period and represent 289 MWh. The basic price unit will be ¥0.01/ kWh.

- Both contracts will cover East and West Japan, on and off-exchange. The available trading period will be two years.

TAKEAWAY: The variety of electricity derivatives products linked to Japan power continues to proliferate, both from TOCOM and the EEX. Short-term trading in daily contracts now accounts for about a sixth of the total for EEX, the exchange revealed last week. Annual contracts are also gaining in interest across the two platforms as utilities look to lock in profits over a longer period. TOCOM sees the market moving to a model similar to Europe and the U.S., where hedging is accumulated for three to five years in advance.

- SIDE DEVELOPMENT:

- TOCOM to launch Chubu-area power futures

- (Denki Shimbun, May 19)

- Electricity futures for Chubu region will launch around spring 2026, addressing market demand for hedging regional price differences seen in spot trading.

- The new Chubu-area futures will include monthly and annual contracts, covering both baseload and daytime load.

- Additionally, TOCOM plans to shift evening session trading hours earlier to 4:30 p.m. to align better with active European energy market hours.

New power companies’ share to rise by FY2030

(Institute statement, Denki Shimbun, May 23)

- Yano Research Institute forecasts the electricity sales market share of new power companies (shin denryoku) to increase from about 20% in FY2024 to 23.5% by FY2030.

- CONTEXT: The economic recovery from COVID-19 and surge in fuel and electricity prices triggered by the Ukraine war dealt a blow to new power companies in 2022. But as prices stabilize, retail competition is revitalizing. Amid forecasts of growing electricity sales by FY2030, driven by new data centers and advancing electrification, new power companies are expected to intensify customer acquisition efforts.

- Yano predicts that total electricity sales in FY2024 will rise 2.4% YoY to 821.8 TWh, with the EPCOs holding an 80% share (657.8 TWh) and new power companies accounting for 20% (164 TWh).

- By FY2030, electricity sales are forecasted to grow 2.3% over FY2024 to 840.87 TWh. The EPCOs are expected to hold a 76.5% share (642.8 TWh), while new power companies are forecasted to capture a 23.5% share (198 TWh).

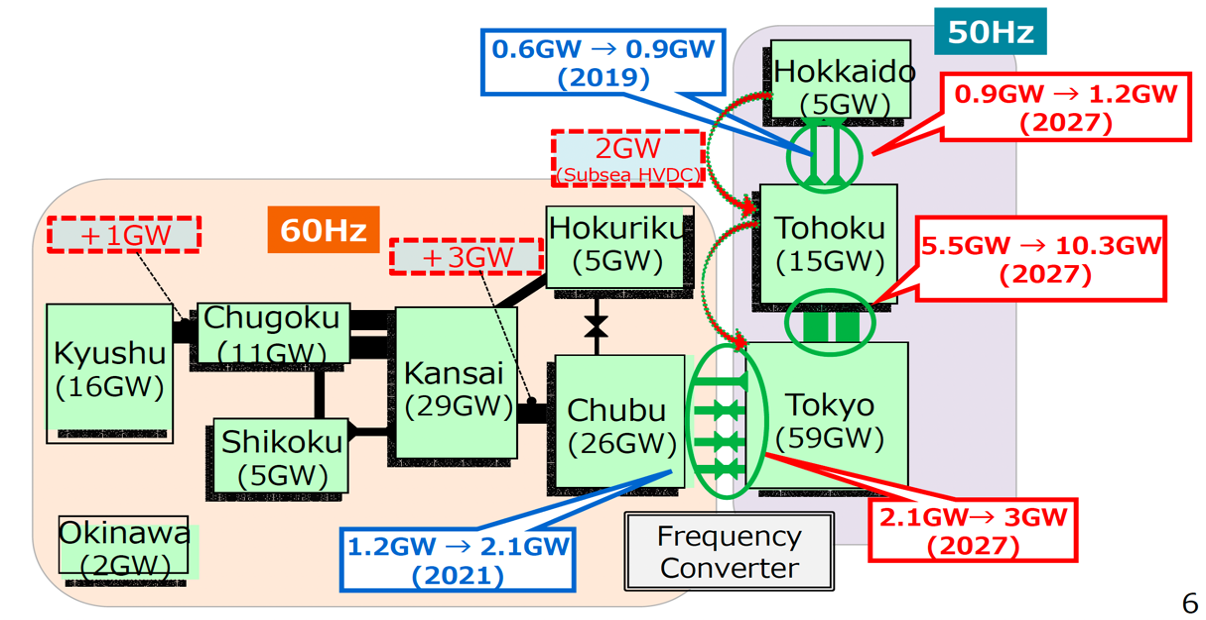

Tohoku’s renewable energy supply to Tokyo increases

(Nikkei, May 22)

- Tohoku Electric PN is expanding the Tohoku-Tokyo Interconnection Line, aiming to double the transmission lines connecting the areas.

- It involves building three transmission lines: Sendai City to Marumori (79 km), Marumori to Tamura City, Fukushima Pref (64 km), and Tamura City to Tomioka Town, Fukushima Pref (16 km). A new switching station to control electricity flow is also being built in Marumori.

- Total investment is ¥354 billion, completion set for November 2027, after which transmission capacity will rise 80%, from 5.73 GW to 10.28 GW.

- The Soma-Futaba Trunk Line, connecting Futaba and Minamisoma, will link directly to TEPCO’s grid, previously used by Fukushima Daiichi NPP, allowing large-scale transfer of surplus renewable energy to the Tokyo area.

- CONTEXT: Japan’s narrow landmass is divided among major utilities like Tokyo Electric, Tohoku Electric, and Kansai Electric, with differing frequencies (50 Hz in East Japan, 60 Hz in West Japan). Interconnections exist, but transfers are limited.

- SIDE DEVELOPMENT:

- Tohoku region sees frequent output curtailment due to surge

- (Nikkei, May 21)

- Tohoku Electric said that as of March, solar capacity in Tohoku and Niigata reached 9.33 GW, and wind capacity 2.25 GW, an increase over 2020 of 1.6 times and 1.4 times, respectively.

- As a result, curtailment is increasing. In FY2024, curtailment was three times a year, but in FY2025, it’s already been four times in just four months. Discarded electricity reached 276 GWh in FY2024, compared to 128.7 GWh over 14 days in FY2023.

NEWS: HYDROGEN

Japan and the Netherlands expand hydrogen and ammonia partnership

(Nikkei, May 20)

- Japan and the Netherlands inked an MoC on hydrogen collaboration, particularly co-firing and mono-firing technologies using hydrogen and ammonia; IHI, MHI, and KHI lead globally in these areas.

- European skepticism toward hydrogen co-firing, once viewed as a “lifeline” for fossil fuel infrastructure, has softened. Slow progress in green hydrogen has pushed the Netherlands to be more pragmatic, recognizing the transitional role of hydrogen derivatives like ammonia in reducing CO2 emissions from thermal power.

- The goal is to transform Rotterdam into a hydrogen import/ export hub. Given the complexity of transporting liquefied H2, emphasis will be on carrier technologies such as ammonia, synthetic methane, and liquid organic hydrogen carriers (LOHC).

- The MoC also addresses setting safety and efficiency standards for storage and transport, supporting mobility applications such as fuel cell vehicles (FCVs) and e-fuels, and enhancing supply chain resilience.

- The two govts will explore strategies to reduce reliance on Chinese-made electrolysis systems, which dominate 60% of the global market.

Japan to subsidize hydrogen fuel costs for trucks and buses via priority regions

(Government statement, Nikkei Asia, May 19)

- METI will subsidize hydrogen fuel by ¥700 ($4.80) per kilogram in selected prefectures to accelerate adoption of hydrogen-powered commercial vehicles. This subsidy covers about 75% of the cost gap between hydrogen and diesel, saving around ¥21,000 per refill for large fuel cell trucks.

- METI selected “priority regions” for promoting use of hydrogen in transportation:

- Tohoku Priority Region (Core: Fukushima Pref)

- Kanto Priority Region (Core: Tokyo Metropolis and Kanagawa Pref)

- Chubu Priority Region (Core: Aichi Pref)

- Kansai Priority Region (Core: Hyogo Pref)

- Kyushu Priority Region (Core: Fukuoka Pref)

- These “priority regions” are expected to have significant demand for fuel cell commercial vehicles and willingness of local govts to provide support measures.

- Around 90 hydrogen stations in these regions will receive funding from METI’s ¥46 billion budget for FY2024-25, reducing fuel costs for roughly 160 fuel cell trucks already in use, with a target of expanding to over 17,000 vehicles by 2030.

- SIDE DEVELOPMENT:

- Mitsubishi Fuso and Iwatani to develop liquid hydrogen refueling tech

- (Nikkei, May 21)

- Mitsubishi Fuso Truck and Bus Corp will cooperate with Iwatani Corp to develop a liquid hydrogen refueling tech, targeting use in hydrogen fuel cell (FC) trucks.

- The joint R&D will focus on a novel liquid hydrogen refueling method based on technology under development by Daimler Truck, Mitsubishi Fuso’s parent company.

- Compared to gaseous hydrogen, liquid hydrogen enables faster refueling and increased vehicle range.

- CONTEXT: FCVs generate electricity by combining hydrogen and oxygen in a chemical reaction. While EVs are common for shorter distances, FC trucks are preferred for heavy-duty, long-haul use.

Breakthrough in photocatalytic green ammonia synthesis

(Nikkei, May 22)

- University of Tokyo researchers successfully synthesized ammonia from nitrogen gas and water under ambient conditions, using visible light and two molecular catalysts: a molybdenum complex and an iridium complex.

- This is the world’s first use of visible light to drive ammonia synthesis from N₂ and H₂O, without requiring high temperatures or pressures.

- This is a key advance toward carbon-neutral fuel technologies.

NEWS: SOLAR AND BATTERIES

Japan probes Chinese solar panels over security fears

(Sankei Shimbun, other media reports, May 23)

- Japan is investigating Chinese-made solar panels after reports of hidden communication devices in similar products abroad.

- U.S. and Europe recently found suspicious, unlisted components in Chinese power inverters that connect solar panels to the grid and allow remote access.

- Experts say the hidden parts could bypass firewalls and allow outside remote control, risking blackouts or infrastructure damage.

- METI said it will inspect domestic solar systems if needed. Police will act on any illegal findings. Officials stress the issue is serious for national security.

- CONTEXT: Japan is heavily dependent on Chinese solar products. In 2024, nearly 95% of solar panels shipped in Japan were foreign-made. Over 80% were likely from China. This reliance grew as Chinese firms flooded the market with cheap, subsidized products. Most Japanese manufacturers have since left the industry.

TAKEAWAY: Though still underreported in Japan media, this investigation marks a turning point. Domestic experts see it as a wake-up call for Japan’s energy and trade policy. Waseda University’s Shigemura Toshimitsu, for example, has slammed what he calls a lack of clear national strategy on solar imports. If security concerns are confirmed, this will undermine Chinese panel market dominance. This may open the door to a revival in domestic panel manufacturing. It will also likely lead to higher panel procurement costs.

ANRE suspends FIT/ FIP grants for solar over violations, toll rises to 370

(Government statement, May 19)

- ANRE temporarily suspended FIT/ FIP subsidies for nine solar farms that violated forest development laws, such as lacking permits or breaching permit conditions.

- While four previous cases had issues resolved and subsidies reinstated, five remain under review. In total, 370 projects faced disciplinary actions in FY2024.

- CONTEXT: This move follows the April 2024 revision of the Renewable Energy Special Measures Act, which introduced stricter enforcement to ensure regulatory compliance and promote community-friendly solar development.

Zeon and Mitsubishi Electric invest in startup developing ‘self-healing’ solar cells

(Government statement, May 19)

- Zeon, Japan’s leading chemical firm, and Mitsubishi Electric invested in U.S.-based startup Solestial, which develops silicon-based solar cells for space applications. The investment was part of Solestial’s $17 million Series A funding round.

- Solestial’s solar cells are designed for low Earth orbit (LEO) satellites and feature self-repairing capabilities against radiation damage.

- The firm aims to produce ultra-thin, lightweight, flexible, and low-cost solar modules through automated manufacturing.

TAKEAWAY: Zeon and Mitsubishi Electric see this as a step toward expanding their presence in the growing space industry.

Young solar executive challenges Japan’s climate policy process

(The Japan Times, May 18)

- Ikeda Shota, 26-year old president of Hachidori Solar, publicly criticized Japan’s new 2035 emissions target of 60% as insufficient, calling for deeper cuts of at least 75%.

- Asked to attend a METI panel on climate action, he expressed frustration with the govt’s consultative process, which he felt discouraged real debate and overlooked younger voices.

- Despite limited influence during expert meetings, Ikeda urged continued public pressure on policymakers to drive climate ambition.

- CONTEXT: In its plan for 2040, the govt set the target at 73% but heavy industry has questioned the goal’s feasibility.

NTT Anode launches service with end-to-end support for grid-scale BESS

(Nikkei, Company statement, May 22)

- NTT Anode Energy will launch a new service in July that provides end-to-end support for grid-scale battery storage systems, from installation to operation.

- The service targets batteries connected to the grid for balancing electricity supply and demand through charging and discharging.

- The firm plans to leverage its nationwide maintenance network and 1,700 certified technicians. NTT will offer design, maintenance, monitoring, etc.

- By FY2027, it plans to install batteries at 23 locations across Japan (excluding Okinawa) and to generate ¥5 billion in annual revenue by FY2028.

TAKEAWAY: Full-cycle support before the start of battery operation is rare. But the service responds to growing demand; Japan’s grid battery capacity could reach 24 GWh by 2030, nearly five times current levels.

Energy Power secures ¥1.6 billion deal for grid-scale BESS

(Company statement, May 16)

- Osaka-based Energy Power secured a contract worth ¥1.7 billion for installation of grid-scale battery storage systems.

- This project’s revenue is expected to post between the fiscal periods ending August 2025 and August 2026.

Eku Energy to build a BESS at former coal-fired power station in UK

(Company statement, May 13)

- Eku Energy will build a 99 MW/ 198 MWh battery storage facility at the former coal-fired power station in Ocker Hill, UK, with operations set to begin by late 2026. Construction starts in June 2025.

- The project is financed by SMBC and NatWest, and will use 54 Tesla Megapacks. It’s Eku’s fourth UK battery project. SmartestEnergy, a wholly-owned subsidiary of Marubeni, will operate the facility under a 10-year deal.

PXP begins field trials of chalcopyrite solar panels on rooftop modules

(Company statements, May 19)

- PXP launched two demo projects using chalcopyrite thin-film solar cells.

- In Hakuba, Nagano, it is testing kilowatt-scale solar generation on a trailer house in snowy conditions, evaluating durability, snow impact, and safety.

- The power will help run a CO2-to-methane system inside the trailer.

- In a separate project with JGC in Yokohama, PXP is testing large-area film-type chalcopyrite modules installed using a lightweight, removable sheet method.

NEWS: WIND POWER AND OTHER RENEWABLES

Glocal’s floating offshore wind plans in Japan

(Nikkei, May 21)

- Glocal, a Hiroshima company specializing in floating offshore wind, plans to build a new wind power plant off Kitakyushu and start operations in FY2028.

- It aims to install three 10 MW floating turbines at the same site. The company is conducting environmental and geological surveys.

- The project is part of Japan’s push to scale up offshore wind as a key decarbonization strategy and was backed by a 2024 MoE subsidy.

- CONTEXT: Glocal originally was a maritime equipment maker that gained experience in floating offshore wind via a NEDO demo in 2014. In April 2024, it launched Japan’s second commercial floating turbine (3 MW) in Hibikinada.

- Glocal also targets the development of seven more 30 MW-class floating wind farms across three northern sea areas by 2030, with total investment up to ¥240 billion.

TAKEAWAY: While floating wind offers huge potential in Japan’s deep waters, there are lingering challenges like high construction costs, inflation pressures, and technical hurdles like transmission and stability in rough seas. While Japan lacks local manufacturers of wind turbines, it has strong capabilities in essential components like precision machinery, bearings, electrical systems, and offshore foundations. Japan can build a competitive local supply chain, reducing reliance on imports, enhancing energy security, and lowering costs.

- SIDE DEVELOPMENT:

- PowerX to supply BESS for offshore floating data center demo

- (Company statement, May 21)

- PowerX was selected to supply battery storage systems for a joint offshore floating data center field test starting in the fall.

- This is the first time PowerX’s battery system will be used in a data center, with the goal of being the world’s first offshore floating green data center.

- The project is led by five entities, including the Yokohama govt and Japanese corporations: NYK Line, NTT Facilities, Eurus Energy, and MUFG Bank.

- The goal is to operate the floating data center using 100% renewables in an off-grid environment. The facility will be installed on a mini-float platform at Yokohama’s Osanbashi Pier, using solar power and battery storage.

MoE urges J-Power to make geothermal project a model for sector

(Government statement, May 16)

- The MoE submitted an official opinion on J-Power’s proposed geothermal power project in Osaki City, Miyagi Pref. The plan calls for building a 15 MW geothermal power plant, with operations to begin in FY2032 or later.

- CONTEXT: J-Power made geothermal surveys such as surface studies, test drilling, and steam tests, which confirmed that the site has sufficient geothermal resources.

- Part of the project falls within the Kurikoma Quasi-National Park, with areas under environmental protection. MOE urges the project to serve as a model of responsible geothermal development in protected areas.

MoE tells Cosmo to coordinate work on planned wind farm

(Government statement, May 16)

- MoE submitted an opinion on the environmental assessment report for Cosmo Eco Power’s planned 56 MW wind power project in Yokohama Town, Aomori Pref.

- It will install 13 wind turbines (each 4.3 MW) across 570 hectares, with construction set to begin in Sept 2026 and operations to start by March 2030.

- MoE stressed the need for coordination with nearby wind projects to address potential cumulative environmental impacts.

- SIDE DEVELOPMENT:

- Vestas signs MoU with Cosmo Eco Power to collaborate on onshore wind

- (Company statements, May 16)

- Vestas inked an MoU with Cosmo Eco Power to collaborate on onshore wind projects in Japan, becoming the preferred turbine supplier for their planned 300 MW portfolio.

Chubu Electric and Mitsui Sumitomo cooperate on J Blue Credits

(Company statement, May 19)

- Chubu Electric Power Miraiz, Chubu Electric and Mitsui Sumitomo Insurance agreed to develop a service that creates and utilizes J Blue Credits.

- The three companies agreed on a reliable credit evaluation method, and to ensure accuracy of CO2 fixation estimates in seaweed beds and cultivation projects. The goal is to counteract underestimation of credits by the Japan Blue Economy Association.

- The firms will explore applications such as CO2-free energy plans based on these credits and financial services to support the scheme.

- CONTEXT: Blue CO2 refers to carbon captured by marine ecosystems through photosynthesis.

Mitsubishi UFJ to invest in Euglena’s biofuel project in Malaysia

(Company statement, May 12)

- Mitsubishi UFJ Trust Bank will invest up to $30 million in preferred shares of Euglena’s SPC, Euglena Sustainable Investment (ESIL).

- The funds will support a biofuel plant project in Malaysia, jointly developed by Euglena, Petronas, and Enilive.

- The plant aims to produce up to 12,500 barrels/ day of sustainable aviation and biodiesel fuels using various biomass.

- This enables Mitsubishi UFJ to participate through ESIL, while Euglena plans to increase its stake in the plant’s operating JV from 5% to up to 15%.

Biofuel-blended gasoline to be introduced in 2028

(Denki Shimbun, May 23)

- METI and ANRI plan to introduce gasoline blended with bioethanol as an automotive fuel starting in FY2028, with up to a 10% concentration.

- Following this initial phase, full-scale supply is targeted for FY2030, with plans to expand to 20% blends after FY2040 to increase the supply of low-carbon gasoline.

- CONTEXT: Bioethanol is derived from plant resources such as corn and sugarcane.

TES Engineering supplies renewable power to meat processing sector

(Company statement, May 14)

- TES Engineering, began supplying renewable electricity to Zenkai Meat in Kumamoto using a 457 kW rooftop solar system under an on-site PPA model.

- The system covers about 25% of the facility’s annual electricity needs.

TAKEAWAY: This project is notable for bringing renewables into the meat processing sector, an energy-intensive industry slow to decarbonize. The on-site PPA model avoids upfront investment and will enable 25% of electricity demand to be met with solar power.

NEWS: NUCLEAR

Japan eyes first field test for fusion in early 2030s

(Nikkei Asia, May 20)

- In early 2030s, Japan plans first field test of a nuclear fusion power plant. A revised Fusion Energy Innovation Strategy will include a pilot roadmap and timeline.

- Japan will set up a Cabinet-level task force to push legal and financial frameworks, and will also support workforce development, and public-private cooperation.

- The National Institute for Fusion Science, the National Institutes for Quantum Science and Technology, and the Institute of Laser Engineering, Osaka University received a total of ¥10 billion to develop test facilities.

- This is a move away from Japan’s earlier reliance on the delayed ITER project in France, whose operations are now set to begin in 2034.

- CONTEXT: Over 80 companies joined the Japan Fusion Energy Council. Kyoto Fusioneering also launched the FAST project in 2024, and is collaborating with universities and aims for fusion power by the mid-to-late 2030s.

KEPCO’s Mihama NPP Unit 3 restarts after inspection

(Company statement, May 20)

- Mihama NPP Unit 3 (PWR, 826 MW electric output) ended a periodic inspection that began on March 2. The reactor restarted on May 21. Full operation will resume on June 18 after comprehensive load performance testing.

- During inspection, KEPCO replaced part of the piping connected to the primary coolant system. It also conducted ultrasonic thickness inspections on 282 locations in the secondary system.

- Also, it replaced 57 of the 157 fuel assemblies, including 36 new ones.

Masuda City refuses literature survey for spent nuclear fuel site

(Nikkei, May 19)

- Owing to difficulties in gaining local consensus, part of the business community in Masuda City (Shimane Pref) withdrew a plan to accept a preliminary literature survey. This comes after the Shimane Gov expressed opposition.

- Local business reps were preparing to submit a petition to the city council. Yet, the leakage of the plan caused public uproar, making consensus impossible.

- CONTEXT: A ‘literature survey’ is the first step in selecting a final disposal site for high-level radioactive waste from NPPs.

TAKEAWAY: Despite coming with substantial govt subsidies (¥2 billion for the literature survey, ¥7 billion for the next phase), only three towns in Japan (Suttsu and Kamoenai in Hokkaido, Genkai in Saga) accepted the literature survey. This is due to widespread distrust among local communities toward hosting such a disposal site.

NEWS: TRADITIONAL FUELS

Russia’s Arctic LNG 2 plant said to expand production despite sanctions

(Bloomberg, May 20)

- Russia’s Arctic LNG 2 plant began using a second production line, defying Western sanctions. The first fuel at Train 2 was produced, overcoming a constraint on access to Western equipment and technical knowhow.

- CONTEXT: The project is Russia’s newest LNG plant and was originally invested in by JOGMEC and Mitsui, as well as other overseas investors. The plant had to largely stop production in October due to sanctions and winter ice built up.

- SIDE DEVELOPMENT:

- EU sanctions MOL’s cargoes from Russia’s Yamal

- (Bloomberg, May 21)

- The EU imposed sanctions on three LNG carriers – North Moon, North Ocean, and North Light – operated by Mitsui OSK Lines (MOL). These vessels transported cargoes from Russia’s Yamal LNG project.

- The move is part of the EU’s 17th sanctions package to put pressure on Russia’s energy revenues and defeat strategies to bypass restrictions.

- MOL pledged to follow both EU and Japanese regulations.

TAKEAWAY: Europe is expanding sanctions, now targeting ships from a reputable operator rather than ‘shadow fleets’ linked to Arctic LNG-2. The sanctioned ships have recently delivered LNG to China and Taiwan, not Europe.

METI wants evaluation of gas system reforms by March 2027

(Government statement, May 23)

- METI requires an evaluation of gas systems reforms by March 2027 – assessing effects of deregulation and effectiveness of market competition.

- To enforce fair practices, the govt introduced detailed behavioral regulations – restrictions on joint employment, outsourcing, advertising, and internal data sharing. The ultimate goal is a transparent, competitive, and secure energy market.

- CONTEXT: Only about 6% of Japan’s land is covered by gas pipeline access – in urban and industrial areas. 24% of retail gas is for households; 68% is for industrial and commercial purposes. The gas market, valued at about ¥3.9 trillion in 2024, serves around 28 million customers.

TAKEAWAY: The reform has had several legal and structural phases. In 2017, the gas market was liberalized, allowing consumers to choose suppliers; in 2022, legal separation of pipeline operations from gas production and retail. This pertained to the three largest gas companies (Tokyo, Osaka, and Toho). Smaller operators continue under accounting separation.

JAPEX acquires 50% stake in Indonesia natural gas firm

(Company statement, May 22)

- JAPEX will get a 50% stake in EMP Gebang, which holds a 100% stake in the Gebang Block in north Sumatra that has several undeveloped gas fields.

- JAPEX plans to lead development of the Secanggang Gas Field.

- JAPEX will transfer its shares (25%) in Energi Mega Pratama to EMP, which is involved in the Kangean Project in East Java. There, JAPEX has completed all exploration and development activities.

- CONTEXT: The project will focus on natural gas development, in partnership with Petronas and a subsidiary of South Korea’s SK Innovation.

MOL to halt new orders of LNG carriers from China due to U.S. port fees

(Nikkei, May 23)

- MOL will halt new orders for LNG carriers from Chinese shipbuilders and shift future orders to South Korean firms. This move follows the Trump admin’s port fees on ships built in China or registered under the Chinese flag that dock in the U.S.

- MOL is taking a wait-and-see approach with Chinese shipbuilders. MOL is the world’s largest LNG carrier operator with 107 vessels as of March. It aims to expand its fleet to 140 vessels by FY2028 to meet rising demand. Six ships were recently ordered from Chinese yards. MOL will not cancel existing contracts.

- South Korea remains the only viable alternative for high-tech LNG ship construction.

LNG stocks up from previous week, down YoY

(Government data, May 21)

- As of May 18, the LNG stocks of 10 power utilities were 1.98 Mt, down 2.1% from the previous week (1.94 Mt), up 4.4% from end May 2024 (2.07 Mt), and down 9.2% from the 5-year average of 2.18 Mt.

- CONTEXT: Nationwide temperatures are on the rise, reaching 29 °C during the day.

April Oil / Gas / Coal trade statistics

(Government data, May 21)

Imports | Volume | YoY | Value (Yen) | YoY |

Crude oil | 12.3 million kiloliters | 0.2% | 906.3 billion | -10.1% |

LNG | 5.4 million tons | 1.7% | 477.2 billion | 1.8% |

Thermal coal | 7.4 million tons | -2.7% | 134.4 billion | -29.1% |

NEWS: CARBON CAPTURE & SYNTHETIC FUELS

Kyushu Electric to invest ¥1.5 trillion in decarbonization

(Nikkei, May 19)

- By FY2036, Kyushu Electric will invest ¥1.5 trillion in decarbonization, expanding renewables, especially floating offshore wind, pumped hydro, and battery storage.

- The plan includes:

- Renewables capacity to more than double to 10 GW, aiming for a 37% increase in power sales (370 TWh by FY2036 over FY2024).

- A total ¥2.5 trillion investment fund including ¥1 trillion for M&A, urban development, and digital transformation.

- Overseas business expansion into power generation, grid services, and batteries, with 10% of 300+ urban projects abroad.

- Reducing GHG emissions 60% by FY2035 over FY2013.

- Strengthening efforts to decarbonize thermal power by introducing co-firing with 10% hydrogen and 20% ammonia.

- In nuclear power, the company will enhance efficiency in inspections and update steam turbines, targeting a 90% capacity utilization rate from FY2031 to FY2035. It’s also exploring next-gen reactors.

ANALYSIS

BY JOHN VAROLI

The Abundant Natural Wealth of ‘Resource-poor’ Japan

“Resource-poor Japan” – is a constant refrain to describe the country’s energy sector and industrial landscape. While for the most part true, such a moniker obscures a more nuanced reality.

With an area covering 380,000 square kilometers, a little bigger than Italy, Japan’s total size grows exponentially when the Exclusive Economic Zone is tallied. In that case, the country covers a massive 4.47 million square kilometres, about half the size of Brazil.

With such a vast area, statistically speaking, Japan should have significant deposits of natural resources, especially since it’s located in the earth’s most volcanic area, along the Ring of Fire. All other countries and regions along the Ring — Indonesia, Sakhalin, Alaska, California, Chile – have extensive deposits of oil, gas and metals precisely due to the intense geological activity.

Up until the mid 20th century, Japan had major onshore deposits of important metals such as copper, as well as an abundance of coal. But as those were depleted, the refrain became that the country has no raw minerals. So, why does Japan stand out today as the exception among its Pacific Rim neighbors, and is it really “resource-poor”?

Abundant resources in the past

Throughout history, Japan was a producer of important minerals such as coal, copper, and gold, but most known onshore deposits are depleted or are no longer viable due to high extraction costs. Mining for iron and copper ceased in the early 2000s, but small deposits of silver, lead, and zinc remain. Gold extraction continues on a very limited scale, mostly to train the country’s mining sector cadre.

From the late 19th century through 1970, Japan’s industrialization was propelled by coal mining, which peaked in the mid 1960s at 55 million tons annually, eventually dropping to 16 million tons by 1985 due to rising costs and competition from imported fuel. Today, coal reserves remain in Hokkaido and Kyushu, but with minimal extraction.

Japan’s last underground mine, near Kushiro City, Hokkaido, has seen production dwindle to just 0.3-0.5 million tons of coal per year. A handful of open-pit mines in Hokkaido produce fuel to power local coal-fired thermal stations, but altogether this output does not come near even 1% of the nation’s consumption.

The situation with oil and gas is similar. Today, Japan has a dismal ranking as the world’s 40th-largest producer of natural gas, accounting for just 0.03% of global production, which meets only 2–3% of Japan’s total needs. Crude oil production is just as meager, with Japan importing 97% of its oil needs.

Of the ten natural gas producing fields, one is located offshore. Onshore deposits are small and located in the Niigata, Akita, and Hokkaido prefectures. Niigata has the majority of gas fields, with six.

The size of these fields is too small to justify turning them into underground gas storage facilities, as has happened in other countries including in Europe.

In 2023, INPEX was the single largest natural gas producer, though output dropped 16% over 2022. JAPEX was the second-largest, with output down 6%, and Kanto Natural Gas Development was third with a decrease of 4%.

The country’s largest water-soluble natural gas deposit is the Minami Kanto Gas Field centered in Chiba Prefecture and which extends throughout the Kanto region into Ibaraki, Saitama and Kanagawa prefectures. It covers about 4,300 square kilometres and has total estimated reserves of around 736 billion cubic meters, with recoverable reserves of about 368.5 billion cubic meters.

For comparison, Russia, the world’s No. 2 gas producer, extracted about 700 billion cubic meters in 2023, white Iran, world’s No. 3, had production of about 238 billion cubic meters.

During World War II, the Minami Kanto field provided Japan with gasoline and aviation fuel that was extracted from the methane; even today this field accounts for 90% of Japan’s confirmed natural gas reserves, and it’s so vast that natural gas gushes out from the ground in certain areas and gas-related explosions are not uncommon.

And while today’s local production is small, the region’s water composition means that the natural gas is dissolved in underground brine – which contains high concentrations of iodine. This contributes to Japan’s position as the world’s No. 2 producer of iodine, which is the key element for perovskite solar cell manufacturing.

Offshore gas deposits

Japan’s offshore gas production is negligible. Furthermore, offshore production is costly and technically challenging due to Japan’s deepwaters and island geography.

Launched in 1990 and operated jointly by JAPEX and Mitsubishi Gas Chemical, the Iwafune-oki (Niigata Prefecture) is Japan’s only offshore oil and gas field.

Despite the high costs, new exploration goes forward. In 2022, exploration began on a field offshore in western Japan (Shimane and Yamaguchi Prefectures) that is said to hold 1.4 trillion cubic feet of recoverable natural gas reserves. Led by INPEX and JOGMEC, the project would be Japan’s first new offshore gas field in over 30 years and could yield 46 billion cubic feet per year.

Also, in 2019, JAPEX conducted exploratory drilling 50 km off the coast of Hidaka (Hokkaido), reaching 2,530 meters under the seabed. Significant natural gas reserves were confirmed, capable of stable production, but further research is needed to assess viability.

Most tantalizing is the Seventh Mining Zone, located on the Japan-South Korea Continental Shelf, which claims oil deposits five times larger than U.S. reserves and natural gas ten times Saudi Arabia’s. These rather extraordinary claims remain speculative and unverified. The area is managed by a joint Japan-South Korea agreement until 2028, after which Japan may gain exclusive rights.

Finally, methane hydrates are abundant in the Exclusive Economic Zone (EEZ). In 2013, JOGMEC made the world’s first extraction of methane hydrates from seabed deposits, and a second round of testing was done in 2017, but since then progress toward commercialization has been delayed several times.

Detected over 100 meters beneath the seabed, in crystalized form combined with water and methane, methane hydrates are referred to as “fiery ice” due to their shape. Some experts believe these reserves could meet Japan’s natural gas needs for decades, though, once again, economic viability remains a challenge due to technological costs and environmental hurdles.

In the near and intermediate future, natural gas imports remain Japan’s only viable solution due to much lower costs and reliability of supply chains. However, should any sudden and unexpected change occur in the global economy, Japan is not entirely without options.

Some domestic experts believe that at least the technical hurdles to seabed mining may be overcome within several years and point instead to politics and social / ESG pressures as the main brakes on the development.

More riches in the EEZ

The government’s 2023 ocean policy plan specifically emphasizes commercializing deep-sea resources to counter reliance on foreign rare-earths processing, particularly on China. The question is how to do it sustainably and in a way that does not draw international criticism.

The EEZ’s vast volume and deep waters – (Japan ranks first globally in ocean volume over 5,000 meters deep) – gives the region potential for significant resource development. However, disputes over EEZ boundaries and environmental concerns require sensitive diplomacy with neighbors and technological innovation. Deep-sea mining also poses environmental risks, and marine scientists have been clamoring for a moratorium.

Here’s a brief overview of more natural resources on Japan’s deep-ocean floor:

- Polymetallic nodules and Ferromanganese crusts: Found at depths over 1,000 meters, these deposits contain cobalt, nickel, copper, and rare-earths. A discovery in 2018 near Minamitorishima Island revealed about 16 million tons of rare-earth oxides, equivalent to 780 years of yttrium, 620 years of europium, 420 years of terbium, and 730 years of dysprosium at current global consumption rates.

- Cobalt-rich crusts: In 2020, JOGMEC made the world’s first successful excavation test of cobalt-rich crusts in the EEZ, highlighting the potential – 75 years of domestic cobalt consumption and 11 years for nickel.

- Polymetallic sulfides: Found at inactive hydrothermal vents, such as in the Okinawa Trough, these deposits contain zinc, lead, copper, gold, and silver. In 2017, tests by JOGMEC at 1,600 meters depth marked a global first.

- Rare-earths mud: Unlike nodules or crusts, rare-earths mud on the deep-sea floor is easier to extract and contains lower levels of toxic elements, reducing environmental impact. Japan is developing closed-chamber mining methods to minimize environmental disturbance.

Conclusion

Japan’s natural resource landscape reflects a significant disparity between limited onshore deposits and vast potential in the EEZ, which offers a new frontier for critical minerals and natural gas.

Advances in deep-sea exploration and sustainable mining technologies could eventually allow Japan to transform its domestic resource production profile by the late 2020s – if the political establishment wishes to embark on such a course.

Reducing import dependence and enhancing economic security is a national strategic goal. However, calls for responsible environmental stewardship carry much weight in Japan, not least because many of the consumer goods manufacturers are dependent on exports and fear consumer backlash.

If the right balance can be found between resource production and environmental care, then Japan could upgrade its status to a “resource-rich nation”, tapping into the abundant natural wealth of the Ring of Fire to meet domestic and global demand for critical raw materials.

ANALYSIS

BY MAGDALENA OSUMI

Can Japan Avoid a Massive Blackout Like the One in Europe?

The recent widespread blackout on the Iberian Peninsula has ignited a debate about power grid stability, prompting governments, utilities, and power suppliers in Japan to reconsider measures to prevent major local outages.

The April 28 outage plunged large parts of Spain, Portugal, and Southern France into darkness, sparking speculation about causes such as cyberattacks or geopolitical conflicts. While the event caused local panic, it also raised serious concerns in Japan about the possibility of a similar scenario. These concerns are not unfounded.

In the past decade, Japan’s vulnerability to natural disasters – including earthquakes, typhoons, and frequent torrential rains – has led to numerous power outages. While the earthquake of March 11, 2011 remains the most infamous date, many local outages receive less media attention despite serving as both symptoms and stress tests of energy security.

As the global community seeks to shift from fossil fuels to renewable energy, discussions on energy security are politicized, often overlooking grid stability. The Iberian blackout offers an opportunity to revisit the complexities of Japan’s power grid, which relies on frequency control, inertia, interconnection capacity, and demand forecasting.

Could Japan face a similar crisis?

The Iberian blackout began around 12:30 p.m. when three major generation units near Granada, Badajoz, and Seville tripped within seconds, causing a sudden loss of 2.2 GW of electricity. This led to a frequency drop below 48 Hz, the local threshold, triggering automatic load-shedding and disconnecting the grid from neighboring France. The entire Iberian system collapsed, although full restoration was completed by early April 29.

The incident is mostly attributed to low rotational inertia – only about 10 GW of power plants that utilize a turbine to generate electricity were available. Turbines provide rotational inertia by physically spinning at grid frequency, which keeps voltage and frequency within a narrow range despite sudden supply-demand imbalances.

Other causes included similar configuration of protection systems (which meant they all tripped at the same time), and limited capacity on the interconnection with France, which restricted how much electricity could be sold across the border at a time where there was too much volume for the Spanish users to absorb.

Japan has faced similar challenges. For example, the 2018 Hokkaido earthquake (magnitude 6.7) shut down the 1.65 GW Tomato-Atsuma coal power plant, the region’s main power source, causing a complete blackout that affected 2.95 million households. Power restoration in some areas took nearly two days, underscoring the vulnerability of isolated grids.

Unlike Europe’s relatively interconnected system, Japan’s power grid is fragmented and split between eastern (50 Hz) and western (60 Hz) systems, connected by only about 2.1 GW of transfer capacity. This limits power sharing across regions. After the 2011 Fukushima disaster, East Japan faced severe power shortages but couldn’t rely sufficiently on the West’s grid due to limited transfer capacity (which was even lower than today). This fragmentation complicates renewables integration and grid stability.

The Spanish blackout highlighted how a sudden disruption in a low-inertia grid can cascade into large-scale outages. Inertia is the natural resistance to sudden changes in electricity flow, acting as a shock absorber that slows frequency changes. Traditional power plants – coal, gas, nuclear, and hydro – use large rotating generators that provide this inertia naturally.

Renewable sources like solar and wind, however, use inverter-based technology and do not inherently provide inertia. This makes grids with high renewable penetration more vulnerable to frequency fluctuations.

Activists quickly blamed renewables for the Spanish incident, but this oversimplifies the issue. While renewables reduce physical inertia, such phenomena can also be addressed by technologies such as synthetic inertia, grid-forming inverters, and battery energy storage. In fact, since the incident, German TSOs have announced that starting in 2026 they will procure inertia capabilities from batteries and other sources.

Stable grid operation requires maintaining frequency tightly around either 50 Hz (eastern Japan, Europe) or 60 Hz (western Japan, U.S., South Korea). Japan’s inertia has declined notably since the 2011 nuclear shutdowns and continues to fall as renewables grow while grid updates lag behind.

Maintaining some nuclear power – around 20% of the energy mix – is part of Japan’s strategy to preserve inertia and stability. Countries that had reduced reliance on nuclear are now reconsidering their positions partly after grid issues like in Spain. For instance, Denmark recently announced a re-evaluation of its anti-nuclear stance.

Renewables and grid stability challenges

The Spanish blackout serves as a reminder that rapid increases in renewables require enhanced grid stability measures.

Japan has introduced synchronous condensers – special spinning machines that provide artificial inertia – and battery energy storage systems (BESS) capable of instant frequency response. Grid-forming inverters, which mimic traditional generators’ inertia-like behavior, are also being deployed. However, BESS has just launched in Japan, and grid modernization to enable fast Demand-Response and load shifting remains critical.

At the time of the Iberian blackout, 70% of Spain’s electricity came from solar and wind farms without grid-synchronous inertia. These used grid-following inverters programmed to disconnect if frequency dropped below 48 Hz – a threshold based on older grids designed for systems with rotating machines. Their simultaneous shutdown accelerated frequency collapse, triggering a cascading failure.

In Japan, 48 Hz is not the threshold for underfrequency protection, but it’s often used as a lower limit in protection settings, similar to Europe, especially for inverter-based systems.

Also, Japan’s current BESS capacity is as yet negligible. Spain’s grid-connected battery storage capacity on April 28 was equally minimal – only 0.035 MW – which was insufficient to provide meaningful fast frequency response or support during the sudden frequency drop.

Source: METI

Rising solar influence – grid modernization

The amount of rotational inertia required depends on grid size and frequency tolerance. Large systems like Japan’s and South Korea’s traditionally rely on synchronous generators to maintain stability.

Japan’s total generating capacity, for example, was 318.6 GW at the end of fiscal 2022. This consisted of 47.5% thermal power (15.9% coal, 24.8% LNG, and 6.8% oil), as well as 10.4% nuclear power and 15.4% hydro. All of these sources provide inertia as they rely on spinning turbines. The non-hydro renewables capacity, as of end FY2022, was 26%.

What makes the inertia issue more complicated, however, is the fractured nature of the grid in Japan, which splits the east and west regions into different frequencies with narrow gates to inter-connect them. As a result, the power mix within each area is more influential than the national picture, and the outcome is further exacerbated by weather and time conditions.

During the Golden Week holidays in April 2024, for example, solar and wind output was temporarily equivalent to almost 126% of local power demand in the Tokyo area and 124% in the Chugoku and Shikoku regions. In Kyushu, instances when solar volumes meet 70-80% of local power demand are more frequent.

As solar and wind power’s contribution to the total mix rises, synchronous generation – and thus physical inertia – drops, increasing vulnerability to frequency drops after large generation failures. To compensate, Japan’s strategy has been to test synchronous condensers, BESS, and grid-forming inverters, which emulate inertia and support frequency stability in renewables-heavy grids.

One example of a synthetic inertia trial was TEPCO Power Grid’s 2023 project on Haha-jima (part of Tokyo and the Ogasawara archipellago), jointly conducted with infrastructure major Meidensha. The partners tested VSG (Virtual Synchronous Generator) technology, which mimics synchronous machines, in a remote 100% renewable energy supply system.

Real-time simulations showed that without VSG control the frequency nadir of the system dropped outside of Japan’s accepted frequency variations, from 48.9 Hz to 47.4 Hz. With it, nadir matched the levels of a synchronous generator. Nadir refers to the lowest frequency to which the system drops after a disturbance such as a generator outage.

Practical application of VSG and other systems, however, is still in the testing phase and there have been few updates in this area recently.

Conclusion

Japan’s grid faces similar risks to the Iberian infrastructure since it has low penetration of BESS and no option to send surplus power overseas. The former at least will be addressed starting later this year as BESS projects that won LTDA capacity auction awards and other battery facilities come online.

Meanwhile, the more segregated nature of Japan’s power network, including the limited interconnection gates and the slower move to renewables compared with western Europe, may end up as an advantage in the sense of limiting the regional spread of blackouts and affording the country more time to invest in a modern, renewables-aligned power grid.

The exact causes of the Iberian blackout are still being digested and the conclusions that Japan draws will likely be debated for months and years to come. Still, one thing is for sure, turbine-based generation will now have another selling point in discussions with the government and big energy users. And Japan’s grid upgrades will surely become a more urgent topic on METI’s to-do list.

ASIA ENERGY REVIEW

BY JOHN VAROLI

A brief overview of the region’s main energy events from the past week

Asia / Petrochemicals

Several petrochemical producers will reconfigure their crackers to process more ethane to reduce costs and capitalize on rising U.S. supplies. These include South Korea’s largest cracker operator YNCC and SP Chemicals in China.

Australia / BESS and Solar

Blind Creek Solar Farm and Battery project received grid connection approval. Developed by Octopus Australia, it’s located 32 km from Canberra, with a 300 MW solar farm and 243 MW/ 486 MWh of co-located battery storage.

Australia / Coal

Newcastle coal export futures price has averaged just $99 per tonne so far in May 2025 down from $144 in the same month a year ago and $163 in May 2023. Rising domestic production in China and India impacted prices

Australia / Solar power

Engie has decided not to push through with its Yass Solar Farm in NSW after investigations and consideration of concerns raised by the community.

China / Solar power

China installed a record 60 GW of new solar PV capacity in Q1 2025, said Rystad Energy. Rooftop PV accounted for 60%, or 36 GW, of that total, marking the largest quarterly capacity addition for distributed PV in China’s history.

China / Power generation

Total power generation rose 0.9% in April to 711 TWh, a deceleration from the 1.8% growth rate in March, according to the National Bureau of Statistics.

India / Gas-fired capacity

India has phased out about 5 GW of gas-fired power capacity that became inoperable after being left idle for years. Some plants sold off machinery, while others had become so rusty they were no longer fit to use.

India / Renewable energy

India installed 4.5 GW of solar and wind capacity in March, according to JMK Research. Solar power accounted for 3.08 GW and wind for 1.45 GW.

Philippines / Renewable energy

First Gen Corp announced its acquisition of Pi Energy, from First Philippine Holdings Corp for $18.1 million.

Wind power

Wind turbine manufacturers installed 127 GW of new power capacity worldwide in 2024, according to the Global Wind Energy Council.

Disclaimer

This communication has been prepared for information purposes only, is confidential and may be legally privileged. This is a subscription-only service and is directed at those who have expressly asked K.K. Yuri Group or one of its representatives to be added to the mailing list. This document may not be onwardly circulated or reproduced without prior written consent from Yuri Group, which retains all copyright to the content of this report.

Yuri Group is not registered as an investment advisor in any jurisdiction. Our research and all the content express our opinions, which are generally based on available public information, field studies and own analysis. Content is limited to general comment upon general political, economic and market issues, asset classes and types of investments. The report and all of its content does not constitute a recommendation or solicitation to buy, sell, subscribe for or underwrite any product or physical commodity, or a financial instrument.

The information contained in this report is obtained from sources believed to be reliable and in good faith. No representation or warranty is made that it is accurate or complete. Opinions and views expressed are subject to change without notice, as are prices and availability, which are indicative only. There is no obligation to notify recipients of any changes to this data or to do so in the future. No responsibility is accepted for the use of or reliance on the information provided. In no circumstances will Yuri Group be liable for any indirect or direct loss, or consequential loss or damages arising from the use of, any inability to use, or any inaccuracy in the information.

K.K. Yuri Group: Hulic Ochanomizu Bldg. 3F, 2-3-11, Surugadai, Kanda, Chiyoda-ku, Tokyo, Japan, 101-0062.