JAPAN NRG WEEKLY

JUNE 21, 2021

ONE-YEAR ANNIVERSARY EDITION

JAPAN NRG WEEKLY

June 21, 2021

NEWS

TOP

- Govt. lists measures to avoid extreme power price spikes: more demand forecasts, closer monitoring of market players, defined price caps and stress on risk-hedging among top actions outlined

- Firm that vowed to build Japan’s first hydrogen-fired power plant now seeks to convert nation’s coal power stations to burn biomass

- Japan group wins rights to develop Nagasaki offshore wind area

ENERGY TRANSITION & POLICY

- Japan to stop financing overseas coal plants that have no offsets

- Environment Minister slams potential delays to Basic Energy Plan

- Japan needs to bolster use of joint crediting mechanism: MoE

- Local govt. hopeful on promises of grants for renewable projects

- ENEOS, Chiyoda join forces to develop cheaper green hydrogen

- Hino to start EV bus sales in 2022; Honda quits fuel cell model

- Toho Gas joins Japan group in Australia carbon capture project

- JERA wins funds to test CO2 capture and methanation in U.S.

- Toppan, ENEO to commercialize paper-to-bioethanol process

- Shipping firms make major commitments on new fuels … [MORE]

ELECTRICITY MARKETS

- METI asks TEPCO to delay maintenance of thermal plants to meet winter peak requirements

- Shikoku Electric plans to restart Ikata nuclear reactor this October; Chugoku Electric’s Shimane NPP gets closer to regulator approval

- Govt panel proposes price caps for non-fossil fuel certificates

- Osaka offers discounts to buyers of solar panels with batteries

- Mitsubishi to develop giant wind farm in Laos for Vietnam supply

- Toho Gas gets into solar power installation and maintenance

- Tokyo Gas, Octopus Energy JV to start operation in fall … [MORE]

OIL, GAS & MINING

- Japan’s May LNG imports jump 8.2% YoY, coal imports rise

- Platts launches carbon neutral LNG price market for Japan / Asia

- Industry sees raw materials supply risks in decarbonization

ANALYSIS

LNG MAKES NEW FRIENDS IN JAPAN’S SHIPPING TO COMPENSATE FOR DECLINE IN SALES TO POWER

As Japan’s imports of LNG for power plants continues to slide, in part due to the decarbonization trend, a new domestic buyer is emerging. The country’s shippers are betting that super-chilled LNG will provide a near-term option to make a significant dent in their emissions. There are just three LNG-fueled ships operating in Japan at present, with most of the rest running on oil-based bunker fuel.

The LNG-fueled ship number is due to jump by a factor of 40 or more within this decade as part of the second of a three-stage transition by Japanese shipping towards net-zero emissions by mid-century.

MISSING LINKS IN THE CARBON-NEUTRALITY PLANS OF JAPAN’S STEEL INDUSTRY

Japan’s top steel maker, and one of its biggest CO2 emitters, has offered not one decarbonization plan but three. Nippon Steel has vowed to replace coal with hydrogen in its steel production; to switch the type of furnaces it operates to a low-carbon option; and to employ carbon capture, among other measures.

The problem for the company, which is single-handedly responsible for almost 8% of Japan’s CO2, is that all of these actions are based on currently unavailable technology or materials. Its roadmap to a cleaner future for steel has several core missing links. This brings about another major mid-term risk.

GLOBAL VIEW

Parts of the U.S. experience highest temperature in over 100 years. Scientists say global warming may be irreversible. EU prepares world’s first GHG tax. China says nuclear fuel issue not a safety concern. Chile starts world’s first molten salt thermo-solar plant. Details on these and more in Global View.

EVENT CALENDAR / DATA SECTION

JAPAN NRG WEEKLY

PUBLISHER

K. K. Yuri Group

Editorial Team

Yuriy Humber (Editor-in-Chief)

Tom O’Sullivan (Japan, Middle East, Africa)

John Varoli (Americas)

Regular Contributors

Mayumi Watanabe (Japan)

Daniel Shulman (Japan)

Takehiro Masutomo (Japan)

Art & Design

22 Graphics Inc.

Sponsored

SUBSCRIPTIONS & ADVERTISING

Japan NRG offers individual, corporate and academic subscription plans. Basic details are our website or write to subscriptions@japan-nrg.com

For marketing, advertising, or collaboration opportunities, contact sales@japan-nrg.com

For all other inquiries, write to info@japan-nrg.com

OFTEN USED ACRONYMS

METI The Ministry of Energy, Trade and Industry

ANRE Agency for Natural Resources and Energy

NEDO New Energy and Industrial Technology Development Organization

TEPCO Tokyo Electric Power Company

KEPCO Kansai Electric Power Company

EPCO Electric Power Company

JCC Japan Crude Cocktail

JKM Japan Korea Market, the Platt’s LNG benchmark

CCUS Carbon Capture, Utilization and Storage

mmbtu Million British Thermal Units

mb/d Million barrels per day

mtoe Million Tons of Oil Equivalent

kWh Kilowatt hours (electricity generation volume)

NEWS: ENERGY TRANSITION & POLICY

METI energy panel lists govt. measures in response to power price spike last winter

(Japan NRG, June 15)

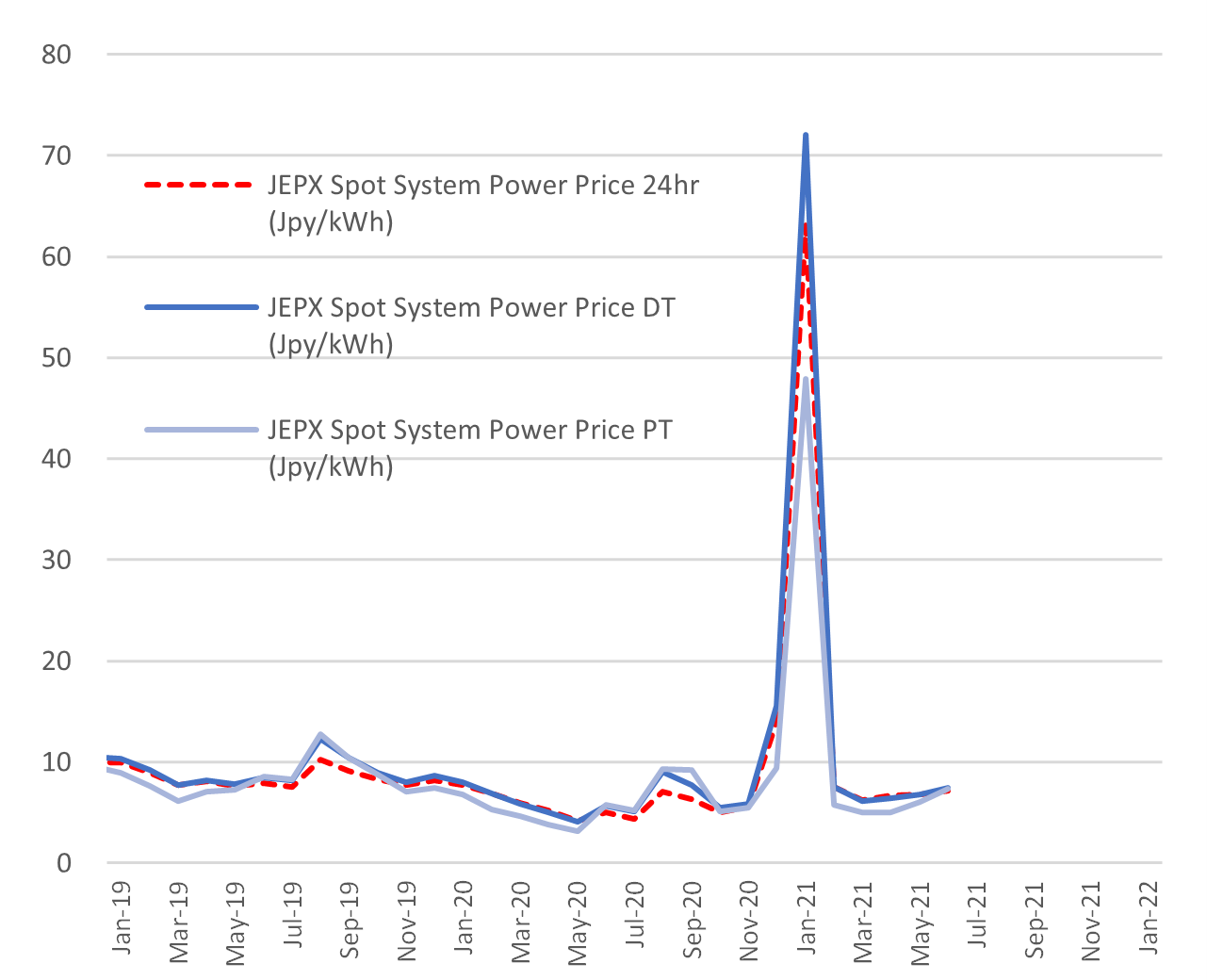

- The Energy Research Council, which reports to METI, published an interim report on last winter’s situation that led to power shortages and a price spike. It listed several proposed government measures to avoid a similar situation this winter and beyond.

- First, the govt. will expand its power supply and demand forecasting, both in terms of scope and frequency. The analysis will center on a kw and kWh basis, and there’ll be periodical reviews in addition to the main study two months before peak season.

- The govt. plans new guidelines on fuel procurement during power shortages.

- New standards are planned in the wholesale power market to reduce the impact of large players on trading. To increase the liquidity of the wholesale market, the govt. will also raise the frequency of baseload auctions.

- Also, operators will be encouraged to utilize various futures hedging mechanisms.

- Click on the headline for access to the original report.

- SIDE DEVELOPMENT:

METI sets price caps on power imbalancing rates for normal and extreme conditions

(Japan NRG, June 16)- METI revised relevant ordinances to set a price cap of ¥80/ kWh and ¥200/ kWh on imbalancing rates in the wholesale electricity market.

- The lower cap will apply in normal market conditions and the higher one will kick in during an acute power shortage. The latter will be determined as such when the 10 major regional utilities say they have less than 3% spare capacity to meet demand.

- CONTEXT: METI used such caps on imbalancing rates to put a ceiling on electricity prices during the massive spike in January.

TAKEAWAY: The spike in power prices that occurred in January was closely scrutinized by the government. Measures to counter some of what was identified as the causes of the spike are now being rolled out.

Biomass operator plans to buy Japan coal plants and convert them to clean fuels

(Nikkei, June 18)

- eRex, an operator of biomass power plants in Japan, plans to buy coal-fired generation facilities and convert them to a cleaner fuel.

- The Japanese company is in talked with owners of coal power plants in Japan’s Kanto, Hokuriku and Shikoku regions. At first, eRex may buy about four plants with a 150 MW to 500 MW capacity each.

- eRex then plans to install equipment such as biomass storage, crushers and more to convert the plants to burn biomass.

- Initially, coal would be mixed in with biomass, which would account for 30% of the total fuel mix. It is hoped that by 2025 the plants could switch entirely to biomass.

- The cost of 1 kWh at a purchased coal-fired facility that’s burning 30% biomass is estimated to be less than ¥10, which is cheaper than burning coal only.

- eRex uses sorghum-based biofuel and grows the grain in Vietnam and the Philippines.

- CONTEXT: Sorghum is a cereal grain in the grass family that can be harvested several times a year.

TAKEAWAY: eRex is also the company that in April said it would seek to build Japan’s first hydrogen-fired power plant, which is slated to come online in March 2022. This and the coal plant conversions could make the hitherto little-known company a major player in Japan’s power industry in the coming years.

Environment Minister slams METI for allegedly delaying Basic Energy Plan

(TBS News, June 15)

- In a warning to the Ministry of Economy, Trade and Industry, Environment Minister Koizumi sharply criticized reports that proposed amendments to Japan’s basic energy plan could be postponed until after the election because they are unpalatable to voters.

- Koizumi said he was sure METI would not dream of “sabotaging” the amendments as some reports allege.

- Koizumi said the amendments should be finalized by the COP26 UN climate change conference in November.

TAKEAWAY: In last week’s edition we detailed the multiple political factors that now seem certain to delay the presentation of Japan’s latest Basic Energy Plan, a roadmap for how the government wants the energy and electricity industries to look by 2030 and beyond. The Ministry of Environment is clearly upset by the delays since they cause complications with Japan’s COP26 message and also potentially weaken its influence on the final report. On the back of PM Suga’s ambitious declaration of a 46% cut to national emissions by FY2030, the Ministry of Environment has managed to lobby for a higher share of renewables in Japan’s future power mix. However, that position does not look solid. Lots of other energy sources would like to make their case. Minister Koizumi’s comments suggest that a growing role for renewables is not a widely held opinion in government, bureaucracy and business circles, and should COP26 pass other political forces may have the upper hand.

Environment Ministry announces overseas decarbonization goal via carbon credits

(Kankyo Business, June 16)

- The Ministry of the Environment announced a private/public sector initiative to leverage the “joint crediting mechanism” and overseas projects to slash greenhouse gas emissions by 100 million metric tons by 2030.

- Environment Minister Koizumi announced the new target in the context of decarbonization initiatives in the Indo-Pacific aimed at supporting the transition to a more sustainable society.

- He added that the new target can’t be achieved only by continuing existing programs, and that the ¥1 trillion investment will spur growth in the global decarbonization market, as well as Japan’s decarbonization technology.

Local governments hopeful after MoE offer of grants for renewable energy development

(Mega Solar Business News, June 14)

- At a June 9 meeting hosted at the Prime Minister’s residence, the government unveiled its regional decarbonization roadmap

- The roadmap stipulates that at least 100 regions should achieve net zero CO2 emissions by 2030 and initiatives to promote renewable energy have significant potential to revitalize Japan’s regions.

- Environment Minister Koizumi said he’s thinking about grants scheme for regions that invest in renewable energy.

- One day earlier, Shinjiro said while local bodies receive grants for hosting nuclear power plants, the same is not true of renewable plants.

- Previously, Hagiwara Seiji, the mayor of Mimasaka (Okayama), which has more large-scale solar farms than anywhere in Japan, had unsuccessfully called for grants to nuclear power plants to also be extended to solar farms.

- While the minister has yet to provide details, it’s likely that a portion of profits from solar farms will be reinvested in communities hosting them.

TAKEAWAY: Ever since a wind power developer in northern Japan suggested paying local fishermen 1% of the revenue from the offshore project to compensate for lost fishing grounds the idea became almost common practice. Solar needs to offer a similar compensation to the local communities that to date have seen little practical reason to support the green power push. As one government advisor said at a policy meeting last year: localities need to have something at stake and it can’t be the chance to help save the planet.

Japan vows to stop financing overseas coal power plants without offsets

(Nikkei, June 15)

- PM Suga said during the G7 Summit in the U.K. that Japan will withdraw from financing overseas coal-fired power plant projects led by domestic companies if they do not have offsets.

- The exit could take place as soon as this year and will bring Japan in line with the rest of the G7.

- The move puts more pressure on China to follow.

- A METI official suggested Japan will continue to support ongoing projects that are already under contract.

- The G7 communique makes exceptions for coal-fired power plants that deploy carbon capture technology to reduce emissions.

ENEOS ties up with Chiyoda Corp to develop cheaper green hydrogen technology

(Nikkei, June 20)

- The two companies will work on R&D to create a cheaper electrolysis process that can reduce the hydrogen price to ¥330 per kg, which is one third of the current price at which the gas is distributed in Japan.

- This price level is also the goal the government has set for the country by 2030.

- ENEOS, a major oil refiner, and Chiyoda, an engineering firm, plan to build a plant possibly in Australia by 2030 due to the country’s cheaper land and renewable energy costs.

- The Japanese company’s approach focuses on electrolyzing water and toluene at the same time to directly produce a liquid compound called methylcyclohexane (MCH). The latter can be easily transported and converted to hydrogen. This would be a simplification of the current production process, cutting capital investments by half.

- By 2025, ENEOS wants to be able to produce MCH on 5 MW electrolyzers and then set up a facility with 1,000 units to establish mass scale.

Hino to start sales of small EV bus from spring 2022

(New Energy Business News, June 17)

- Hino Motors will release the small electric bus, “Hino Poncho Z EV”, in the spring of 2022. It accommodates 30 passengers and is equipped with a 105kWh lithium-ion battery that is compatible with standard quick chargers.

- The vehicle will be handled by a JV between Hino Motors and Kansai Electric.

- “Hino Poncho” was released in 2002 and is a diesel bus widely adopted nationwide to service small communities.

- SIDE DEVELOPMENT:

Honda to discontinue fuel cell car Clarity due to weak demand

(Nikkei, June 16)- A high price tag and a lack of fueling stations undercut demand for a vehicle Honda earlier saw as a key pillar of its decarbonization strategy.

- Honda only sold about 1,900 units worldwide.

TAKEAWAY: Honda is not ending its forays into fuel cell vehicles, and Hino’s EV bus is only used for shorter, community routes. Still, there are more positive news of late for EVs than their fuel cell cousins. Toyota remains Japan’s biggest driving force for a fuel cell transport future. Should it waver, the entire FCV rollout may need to be re-considered.

Renewable energy task force outlines guiding principles

(Mega Solar Business News, June 16)

- On June 3, the 10th session of the Cabinet Office task force for the review of regulations governing renewable energy was convened.

- The task force stipulated the prioritization of renewable energy, flexibility, and the establishment of an environment for fair competition.

- The task force called for more state resources in the renewable energy sector, and the reform of renewables-friendly energy systems and markets.

- The group highlighted deficiencies in Japan’s power grid, which it said are an unfair obstacle to operators that did not exist in regions like Europe. The group hopes to abolish the requirement for on-site power storage in Hokkaido, opening up local groups to more generators. It also wants to review grid connections from operators currently on a non-firm connection based on economic merit rather than a first-come first-served basis.

Toho Gas joins Japan group in Australian carbon capture and storage project

(Denki Shimbun, June 16)

- Toho Gas will participate in Australia’s offshore CO2 capture and storage hub project “Deep C Store”. A joint study contract was signed with the developer, Transborders Energy.

- Deep C Store collects, liquefies, and transports CO2 generated from various industrial facilities in the Asia-Pacific region, including Australia, and injects the gas into an underground reservoir from an offshore injection hub facility for long-term storage.

- Transborders Energy already signed an MoU last December with Kyushu Electric, Tokyo Gas, Osaka Gas and others to explore the potential development. Now, Toho Gas and JX Nippon Oil & Gas have joined.

JERA wins NEDO funds to study CO2 capture and methanation in the U.S.

(Company statement, June 16)

- JERA won a grant to do a feasibility study on CO2 capture and methanation in the U.S. from state-backed New Energy and Industrial Technology Development Organization (NEDO). The study period is June 2021 to February 2022.

- JERA aims to produce CO2-free methane gas on a commercial basis and will use the tests in the U.S. to investigate the business potential of this process.

- The utility plans to generate hydrogen needed for the methanation reaction using locally sourced low-cost renewable energy and will employ CO2 captured from U.S. thermal power plants and refineries.

- JERA said it believes methanation can utilize existing LNG-related infrastructure to cut the cost of decarbonization in Japan and elsewhere.

- CONTEXT: JERA has U.S. investments across multiple fields, including renewables, hydrogen, gas-fired power generation and LNG production.

TAKEAWAY: Please see the June 7 edition of Japan NRG Weekly for a deep dive on what is happening with the development of methanation in Japan and why it’s vital for the country. In short, it is seen as a main way to decarbonize the nation’s gas industry.

Toppan and ENEOS aim to commercialize paper-to-bioethanol process

(Kankyo Business, June 16)

- Toppan and ENEOS agreed to establish a new process for manufacturing bioethanol from paper and cardboard waste.

- The two companies want a commercially viable process by 2027.

- Even forms of paper currently deemed unsuitable for recycling, such as waterproof paper and carbon paper, will be converted to ethanol.

- The process will enable the continuous addition of raw materials.

- By utilizing paper waste, rather than potential food sources like sugarcane, the new process aims to avoid competition with food sources.

Nippon Yusen (NYK) to order 12 LNG-fueled vehicle transporter ships to cut emissions

(Nikkei Asia, June 14)

- Shipper Nippon Yusen will invest over ¥100 billion ($912 million) in 12 new vehicle transporters ships fueled by LNG as clients, such as auto manufacturers, seek to reduce CO2 emission in their supply chains.

TAKEAWAY: Please see the Analysis section of this week’s report for a deep dive on how Japan’s shipping industry plans to decarbonize.

Government offers subsidy for off-site power management

(Kankyo Business, June 14)

- The Ministry of the Environment welcomes applications from generators and renewable electricity users that want to participate in off-site power management.

- The ministry will subsidize half of the cost of remotely controllable battery systems, heat pumps, electric vehicle batteries, and other such infrastructure.

- To be eligible for the subsidy, operators need to demonstrate energy management arrangements that reduce their CO2 emissions.

Itochu syndicate promotes ammonia as fuel for ships

(Kankyo Business, June 15)

- A group of companies led by Itochu Corporation set up a council to promote ammonia as a zero emissions fuel for shipping.

- Members include Ube Industries, Kawasaki Kisen, JERA, Anglo American, MAN Energy Solutions, and Vopak Terminal Singapore.

- The Council will assess the safety of ammonia fuels and of ammonia fueling arrangements, determine specifications for maritime ammonia, and quantify the net CO2 emissions generated by ammonia manufacture.

AIST develops humidity-based energy harvesting system

(New Energy Business News, June 14)

- The National Institute of Advanced Industrial Science and Technology has developed a system that generates electricity from differences in atmospheric humidity.

- The system combines hygroscopic media with salinity gradient-based energy harvesting to generate a current of a few milliamps, enough to power smart devices.

- Ambient humidity is high during the day and low at night, and it’s theoretically possible to leverage this to generate electricity indefinitely.

Mitsubishi technology used in ground-breaking CO2 recovery project

(Kankyo Business, June 11)

- Mitsubishi Heavy Industries Engineering said its proprietary CO2 recovery technology is being used in a project led by UK utility Drax to recover CO2 emitted by a biomass-fired power station.

- By combining carbon-neutral, plant-based fuel sources with CO2 recovery, the project aims to create the world’s first commercial scale “negative emission” plant.

- Drax aims to have a negative carbon emissions profile by 2030.

- Mitsubishi says Drax was impressed by the performance of the Kansai Mitsubishi Carbon Dioxide Recovery process, codeveloped by Mitsubishi and KEPCO, in CO2 recovery projects in the U.S., and this led Drax to implement the solution at its plant.

Yokohama trials on-road vehicle charging

(Kankyo Business, June 11)

- Yokohama City and Tokyo-based e-Mobility Power began trialing electric vehicle charging stations erected on public roads.

- The trial will examine the effectiveness of road-mounted charging stations and consider road management issues presented by the technology.

- The relative visibility of road-mounted charging stations to drivers helps reassure prospective electric car users about the availability of charging infrastructure. Yokohama and e-Mobility Power believe installing such stations could potentially help accelerate the transition to EVs.

JAXA and Honda announce plans for lunar energy system

(Kankyo Business, June 15)

- The Japan Aerospace Exploration Agency and Honda are working on a system to provide energy for long-term lunar activity and human colonization of the moon.

- The system leverages fuel cell technologies and high-pressure hydrogen electrolysis technologies to provide oxygen, water and electric power.

Mitsubishi supplies sustainable biofuel for scheduled flights

(PR Times, June 18)

- In a world first, Mitsubishi Power supplied wood-sourced aviation fuel for a regularly scheduled commercial flight under a contract from government-backed New Energy and Industrial Technology Development Organization.

- The fuel was synthesized from gasified cellulose using the Fischer-Tropsch process.

- The technology was developed at a pilot plant situated on the grounds of JERA’s Shin-Nagoya thermal power station, which has been trialing the conversion of wood chips to sustainable aviation fuel. Gasification was performed using Mitsubishi Power’s entrained flow process, and Toyo Engineering was responsible for synthesizing and distilling the gas before blending it with conventional jet fuel.

NEWS: POWER MARKETS

| No. of operable nuclear reactors | 33 | |

| of which | applied for restart | 25 |

| approved by regulator | 16 | |

| restarted | 9 | |

| in operation today | 7 | |

| able to use MOX fuel | 4 | |

| No. of nuclear reactors under construction | 3 | |

| No. of reactors slated for decommissioning | 27 | |

| of which | completed work | 1 |

| started process | 4 | |

| yet to start / not known | 22 | |

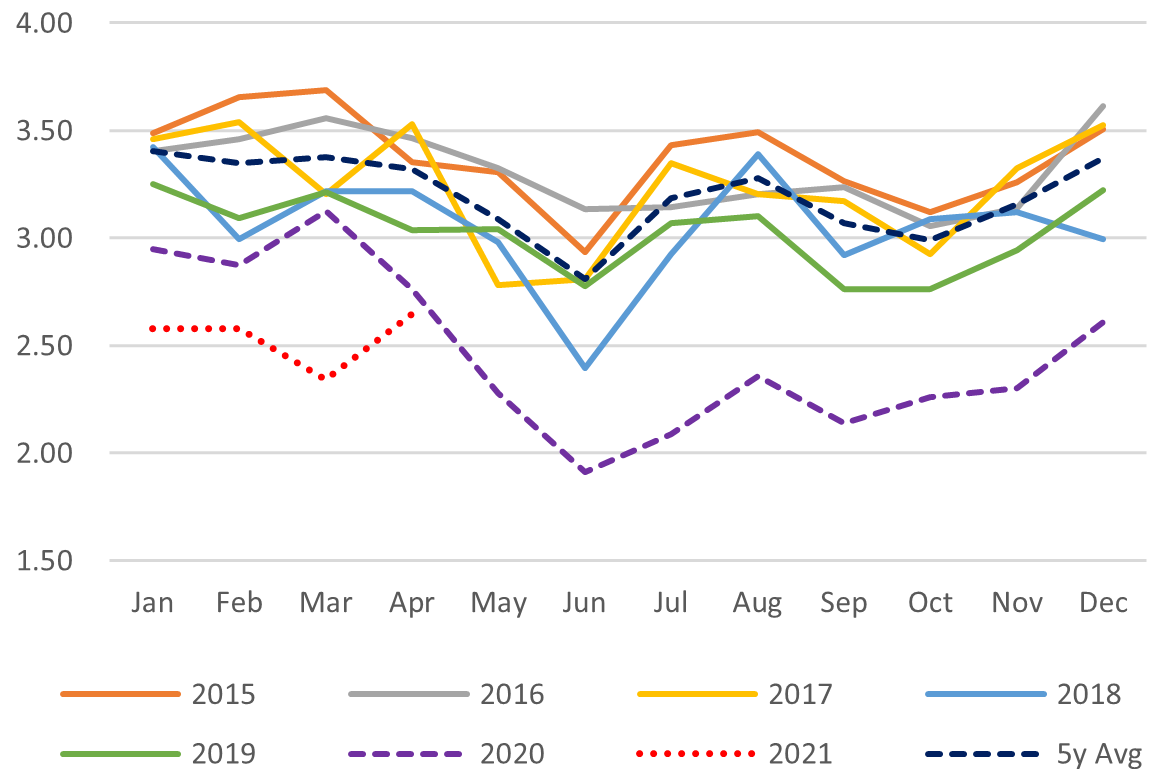

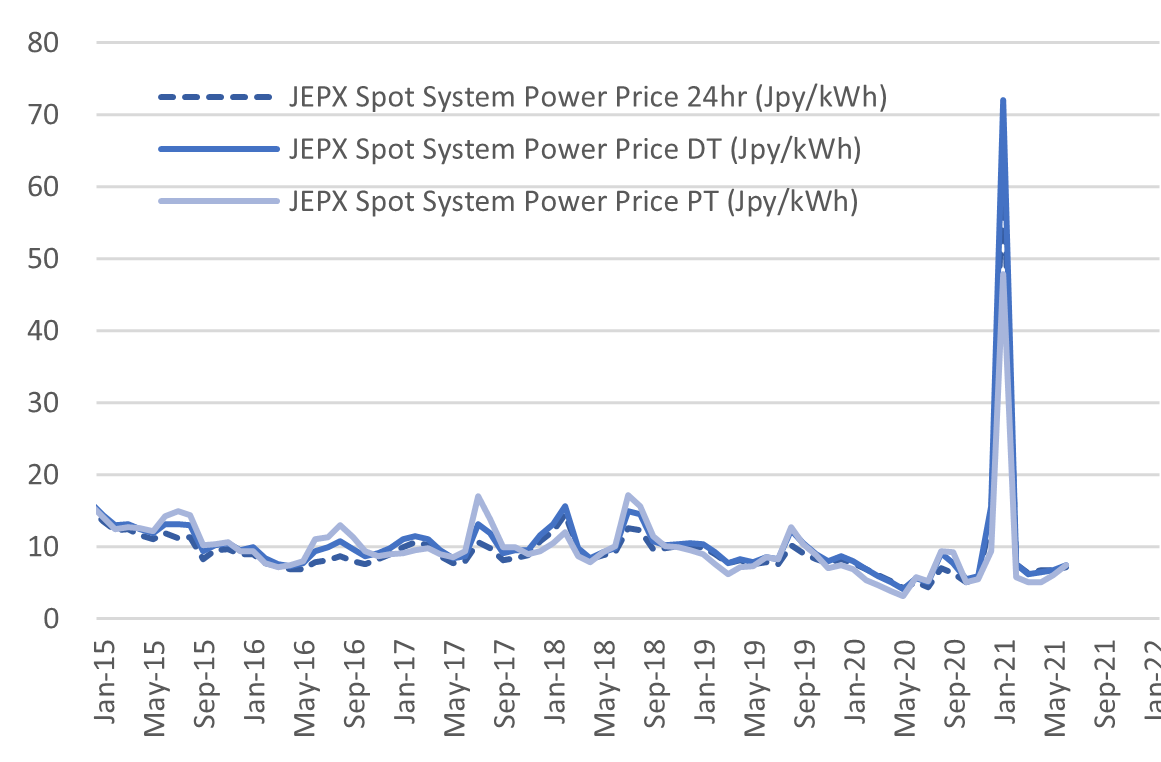

Spot Electricity Prices, Monthly Avg.

Source: Company websites, JANSI and JAIF, as of June. 15, 2021

Toda consortium selected to build Japan’s first commercial-scale floating offshore wind farm

(Kankyo Business, June 14)

- METI selected a consortium led by Toda Corporation to construct a 2,700-ha wind farm off the coast of Nagasaki.

- The 16 MW project will comprise of eight turbines.

- The other companies in the consortium are ENEOS, Osaka Gas, KEPCO, INPEX, and Chubu Electric.

TAKEAWAY: This result is the first from the four major sea area tenders for offshore wind development. The bidding period closed at the end of May and results from the other areas in northern Japan and off the coast of Chiba are expected to take some time. Those three are for fixed bottom offshore wind projects. The Nagasaki tender is the only one for floating wind technology, which is expected to play the dominant role in Japan in the future but which at this stage is still being tested and refined. As such, it is not surprising that only one bidder materialized and that it was in fact a very wide consortium of companies that would not naturally work all together. The Nagasaki project is best seen as an advanced R&D project and not a fully commercial development. However, it does give a sense of which players in Japan are interested in working with floating projects in the future.

We plan to publish a more in-depth take on the offshore wind tenders in an upcoming issue of the Weekly.

- SIDE DEVELOPMENT:

- Hitachi ABB Power Grid starts providing transformer products for floating offshore wind

(Morning Star; June 7, 2021)- Hitachi ABB Power Grid will start offering transformer products for floating offshore wind turbines.

- The product line is designed to withstand the harsh environment of floating offshore wind turbines.

- Hitachi ABB Power Grid will support the spread of floating offshore wind power plants and the efficient use of wind-powered energy through these products.

METI asks TEPCO to delay maintenance of thermal plants to meet winter peaks

(Asahi Shimbun, June 16)

- METI published measures to help avoid power shortages this winter, especially within the zone dominated by Tokyo Electric Power Company (TEPCO). The ministry asked the utility to delay some maintenance works of thermal power plants in order to have enough capacity online during peak periods.

- TEPCO reported earlier this year that its reserve capacity margin is expected to reach minus 0.2% in January next year and minus 0.3% in February.

- Japan’s power regulations call for a minimum of 3% reserve capacity, which in TEPCO’s case would be about 1.5 GW, equivalent to 1.5 nuclear reactors.

- METI’s suggestions will free up an additional 1 GW or capacity for the first two months of next calendar year. A further 500 MW is expected to be secured by restarting suspended thermal power facilities.

- A final decision on which power stations will be utilized will be made by TEPCO Power Grid, which handles local power transmission and distribution.

- METI expects that JERA’s Anegasaki Thermal Power Station in Chiba would be part of the restarted capacity. It was idled in April this year.

- The cost of restarting capacity will be added to the transmission line usage fee (the consignment fee) in the TEPCO jurisdiction and will be collected from power retailers. In essence, it will be borne by the consumer.

- Power shortages may occur elsewhere in Japan. Six of the major regional utilities, including Chubu, Kansai, and Kyushu EPCos, are expected to have a reserve margin of only 3% in February next year.

TAKEAWAY: A recent report by the systems operator OCCTO suggests the above measures and a few restarts of nuclear reactors are starting to ease government and industry concerns about possible shortages this summer.

Shikoku Electric plans to restart Ikata No. 3 nuclear reactor in October

(NHK, June 16)

- Shikoku Electric plans to restart its Ikata NPP’s Unit 3 on Oct. 12, with commercial operations due to begin by Nov. 12.

- The facility aims to complete upgrades to its anti-terrorism safety measures by Oct. 5, which would be the last barrier to its restart.

- The reactor has been idled since December 2019 after a Hiroshima city court ruling that prohibited operations and sided with an anti-nuclear citizens group. A high court in the same city reversed the earlier decision in March 2021.

- According to the utility, the reactor would be hooked up to the grid on Oct. 17.

- SIDE DEVELOPMENT:

Chugoku Electric’s Shimane NPP No. 2 reactor edges close to restart

(Sanin Chuo Shinpo, June 17)- Comments by the Nuclear Regulation Authority chair Fuketa, made a meeting on June 16, suggest that the watchdog is edging closer to authorizing the restart of Chugoku Electric’s Shimane NPP Unit 2.

- The facility is being examined as to whether it meets new regulatory standards and a decision could be made as soon as June 23, the chairman said.

TAKEAWAY: As Japan NRG has previously mentioned, the nuclear industry is benefitting from several factors in recent months and trying to build momentum for more of the existing reactors to restart. The 10-year Fukushima anniversary has passed; PM Suga has set very ambitious decarbonization targets for 2030 and 2050; and many industrial players are unhappy at rising electricity prices, which they often attribute to a rising percentage of renewable energy in the mix. Overall, the government’s position on nuclear is still very divided. Some key ministers are starkly against a return to pre-Fukushima reliance on nuclear power. However, for now at least, the pro-nuclear lobby has more momentum with ex-PM Abe and other top figures in the ruling party announcing their backing for nuclear power.

Power panel proposes floor and cap prices for non-fossil certificates

(Japan NRG, June 14)

- A sub-committee of Energy Research Council proposed a price floor of ¥0.6/ kWh and a cap of ¥1.3/ kWh for non-fossil-fuel certificates. The levels were decided based on past data and surveys.

- Power retailers who are mandated to offer green power to consumers traded the certificates in a range of ¥0.9 to ¥1.0.

- The sub-committee also proposed a 6% threshold on an operator’s share of externally sourced certificates. This 6% equates to 75.6 billion kWh.

- To enforce compliance in the certificate trading space, the panel suggested monitoring quarterly auctions and holding a separate annual review. It will discuss identifying dominant players to be subject to monitoring, which will be expanded in time.

Osaka offers discounts to buyers of solar panels discounts if they also procure batteries

(Kankyo Business, June 15)

- The Osaka prefectural government and Osaka City are offering operators of solar panels and storage batteries discounts of up to 30% by participating in the Osaka Smart Energy Center’s syndicated procurement plan.

- Those buying panels receive a discount of 30% off market prices, those buying batteries receive a discount of 22%, and purchasers of both panels and batteries receive a discount of 23%.

- The plan’s goal is to support every step of the installation process.

Mitsubishi Corp to co-develop giant onshore wind farm in Laos, export electricity to Vietnam

(Nikkei, Kankyo Business, June 17)

- Trading house Mitsubishi Corp. plans to co-develop a 600 MW onshore wind farm in Laos with the idea to then export the electricity to Vietnam. This will be one of the largest onshore wind farms in Southeast Asia.

- The investment in the Monsoon wind power project was not disclosed but is expected to be in the hundreds of millions of dollars.

- Mitsubishi’s Diamond Generating Asia subsidiary will make a joint investment in the project with two Thai firms. These are a unit of Impact Electron Siam and a unit of BCPG Public Company Ltd. Mitsubishi’s stake in the project will be around 20%.

- Construction of the Monsoon project is due to start in 2024. The electricity will be sold to Vietnam’s state-run power utility under a 25-year contract.

- Mitsubishi anticipates the market for cross-border power sales in Southeast Asia will develop further.

Toho Gas starts to offer solar power facilities on-site maintenance services

(Nikkan Kogyo Shimbun, June 16)

- Toho Gas has started a third-party servicing business based on solar power generation. The gas utility based in Nagoya will install and maintain the solar equipment on the customer’s premises.

- Corporate clients will be able to have solar panels installed on-site at no initial cost, and then consume the electricity generated. Toho Gas would receive a service maintenance fee.

- The gas company already found its first customer for the service, adding 13 KW of solar on-site power at a Meiko Construction office in Nagoya.

TAKEAWAY: It’s interesting to see major power and gas companies in Japan start to offer third-party services for renewables. While they have so far shied away from installing significant solar capacity themselves, the fact that they are involved and earning money solar operates is a boon for the renewables industry. The EPCOs and gas companies now have a tangible reason to help renewables players seek better terms and business expansion.

JV between Tokyo Gas and Octopus Energy to starts operating this fall

(Denki Shimbun, June 14)

- The JV called TG Octopus Energy opened its Tokyo office on June 7. About 20 staff are at the office, with some expected to join from the U.K.

- The two partners aim to develop a variety of electricity price plans using Octopus’ IT platform, with customer-facing service due as early as October.

- The policy is to launch one simple price menu and gradually expand with a focus on retailing electricity from renewable sources.

- Tokyo Gas hopes to bring to Japan several products and approaches that Octopus successfully applied in the UK and other European countries.

- This is the UK firm’s first entrance into the Asia market.

- CONTEXT: Since market liberalization in 2016, Tokyo Gas has grown to be the largest retailer of electricity in Japan after the incumbent power utilities (the EPCos). The gas firm aims to have 3.8 million power customers by FY2022. It currently has about 2.7 million signed contracts.

Parliament enacts law limiting foreign ownership of land near nuclear power plants

(Parliamentary notice, June 17)

- Japan’s upper house, the House of Councilors, enacted on June 16 a new law limiting foreign ownership of property close to sensitive facilities, including nuclear power plants, defense facilities and remote islands. The prime minister will have direct oversight on the law.

- Areas one kilometers away from such facilities will be defined as sensitive zones, and there’ll be a second category of sensitive zones.

- The PM will also set up a new advisory council to review enforcement of the law, which will come into force three months after its official proclamation.

J-Power’s exits one coal plant project but remains bullish on existing thermal plants

(Sentaku, June edition)

- J-Power announced on April 16 that it will give up on construction of a coal-fired power plant in Ube City, but a person affiliated with major power companies in Japan said that this was more of a token gesture to show that J-Power is doing its part for decarbonization. In reality, the company is committed to continuing operations of coal-fired facilities, according to this industry source.

- J-Power gave up on the 600 MW thermal plant in Ube after losing support from potential co-investor Osaka Gas, among others. However, on the same day, J-Power said it would refurbish its Matsushima thermal station in Nagasaki prefecture. After transforming the facility to IGCC from 2024, capacity should increase and operations will restart in 2026.

- Major power utilities cheered the Matsushima development as they’d like the thermal power business to continue.

- J -Power has seven coal stations with 14 power units. Over 80% of its power sales are generated at thermal power plants. What’s more, J-Power owns stakes in several Australian coal mines: 22.2% of Clermont, 7.5% of Narrabri and 10% of Maules Creek. Based on its equity, J-Power’s attributable annual coal production is around 3.9 million tons of coal.

- J-Power is able to earn ¥38 billion annually from coal sales alone and prices are almost double from last year’s low of $50 a ton.

- J-Power will likely escape criticism for continuing to rely on coal.

- The company’s emissions were at about 44 million tons of CO2 in FY2019, and this number will not be able to drop by more than 40% in total.

- The company has no problem securing funds from top banks in Japan.

- One negative for the company is its declining share price, down 20%, YoY.

Sojitz and ENEOS team up on Australian solar farm project

(New Energy Business News, June 14)

- Sojitz and ENEOS began building a 240 MW solar farm in Queensland, Australia, in conjunction with Spanish construction company Grupo Gransolar.

- The project represents the largest ever attempted by a Japanese company in Australia, and is Sojitz’s and ENEOS’ first foray into the Australian market.

- The 430-ha farm is scheduled to begin feeding the grid in late 2022.

Sanki opens battery testing center in Kanagawa

(New Energy Business News, June 14)

- Sanki Engineering opened a new battery testing center in its Kanagawa research and development center that is able to subject batteries to temperatures between negative 42 and 100°C.

- The facility is 40% more energy-efficient than traditional technologies.

- Sanki will use the facility to test new technologies aimed at boosting battery performance (safety, energy density, etc.).

Japan’s power industry to test digital currency transactions

(Denki Shimbun, June 16)

- The electricity industry will start PoC (proof of concept) testing for next-generation payments, Japan’s Digital Currency Forum announced.

- Kansai Electric is one of the companies involved in the Forum’s Electricity Trading Subcommittee. The latter is examining the potential to use digital currencies in commercial and trading transactions, as well as the potential for green financing based on the environmental impact of electricity.

Fukushima Dai-Ichi: Regulator deems radiation measurements unnecessary

(Tokushima Shimbun, June 18)

- Nuclear Regulation Authority chair Sarata said there’s no legal requirement to measure radioactivity levels of tritiated water discharged into the ocean from the Fukushima Daiichi site.

- TEPCO will estimate radioactivity levels in discharged water based on the radioactivity of the water in the tank and the water volume used to dilute it.

NEWS: OIL, GAS & MINING

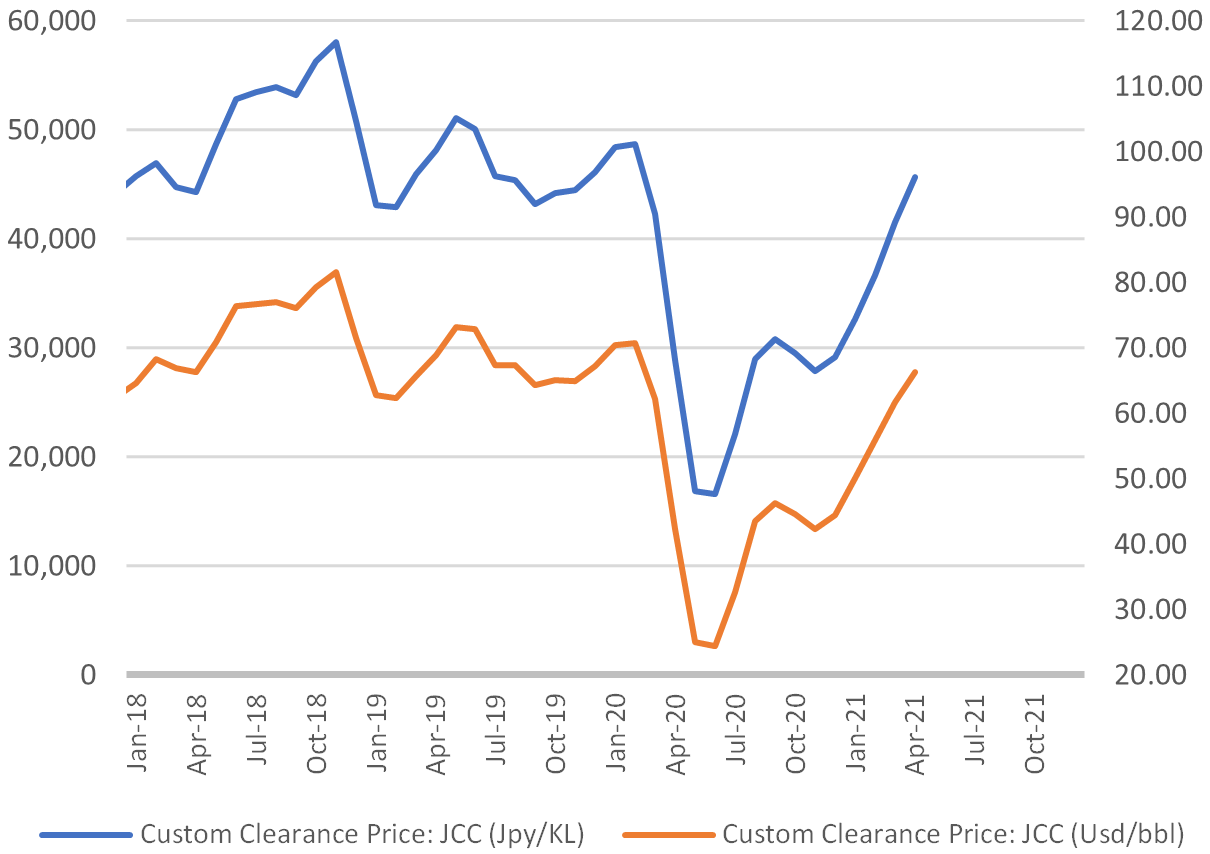

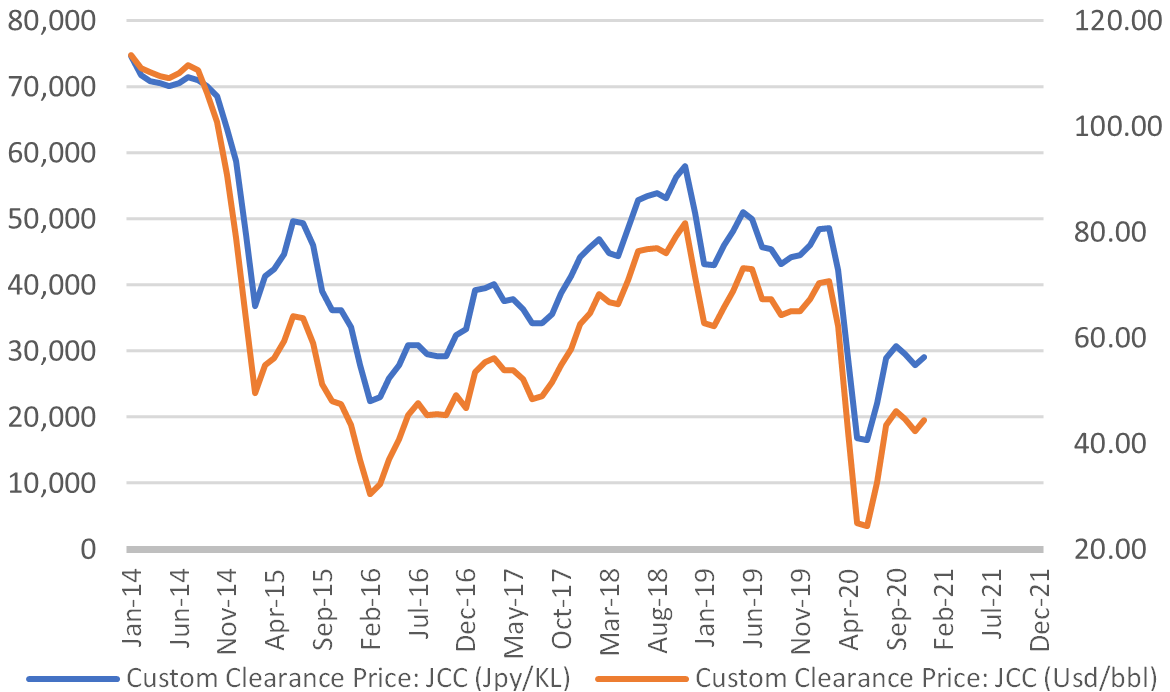

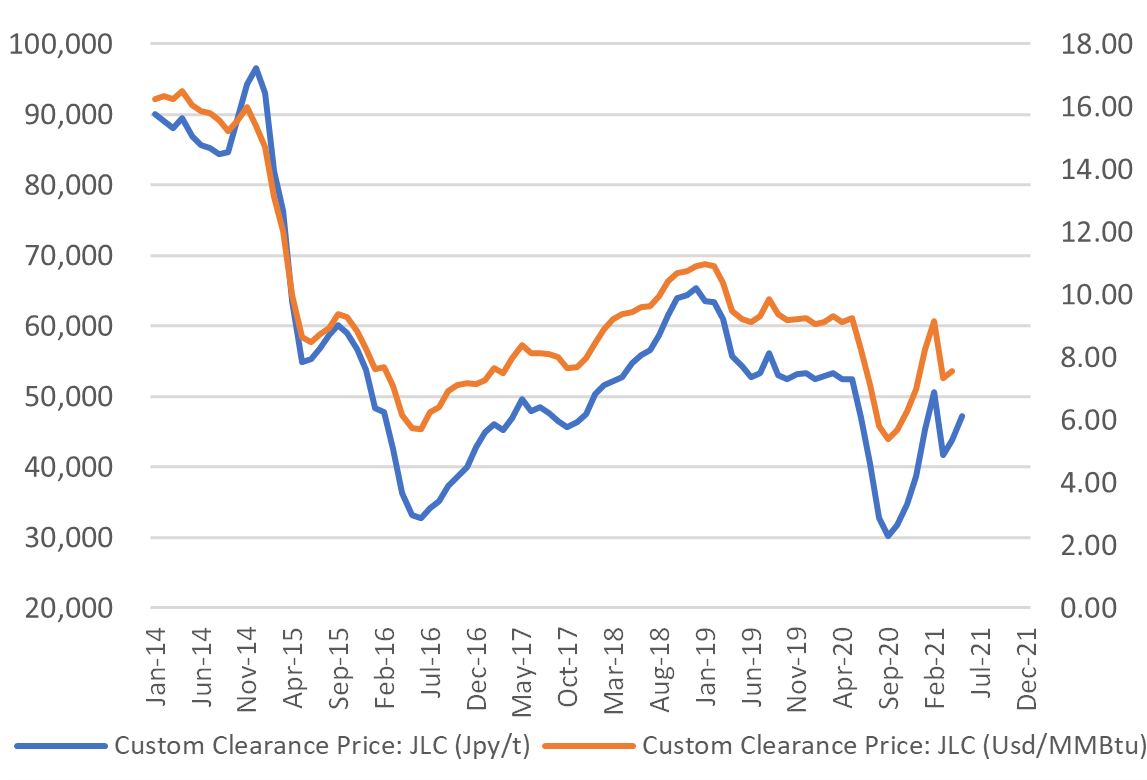

Japan Oil Price: $66.26/ barrel

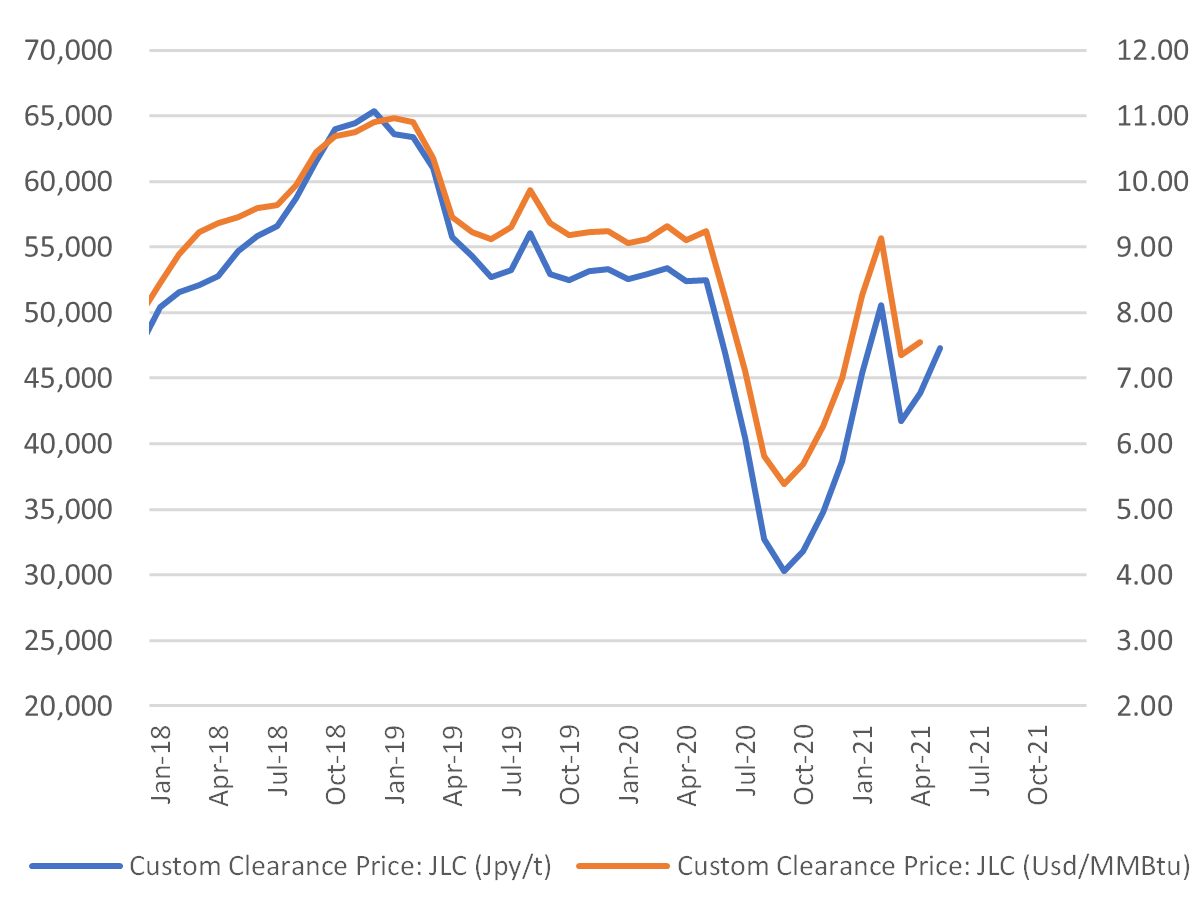

Japan (JLC) LNG Price: ¥47,276/ mmbtu

Japan’s May LNG imports rise 8.2%, thermal coal up 12.1% y-on-y

(Japan NRG, June 16)

- Japan’s May LNG imports rose 8.2%, year-on-year, to 4,953,000 tons, while thermal coal imports were up 12.1% to 8,051,000 tons, according to preliminary customs data.

- The May figures for LNG were down from 4,975,000 tons a month ago.

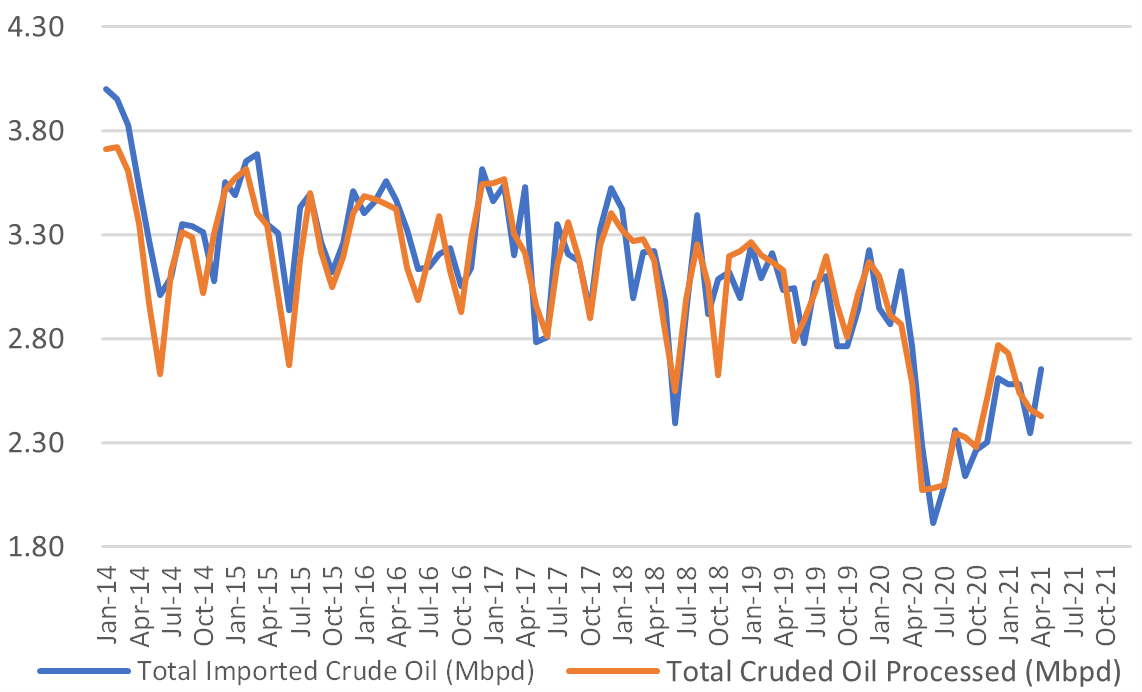

- Crude oil imports were also marginally up, year-on-year, by 1.5% to 9,614,000 kiloliters.

Platts launched a carbon-neutral LNG price assessment for Japan and the Asia region

(Company statement, June 16)

- S&P Global Platts launched a daily spot differential assessment reflecting carbon neutral LNG deals in the Japan/Korea/Taiwan/China (JKTC) region from Australia.

- The assessment reflects CO2 emissions offset on a well-to-tank basis, and takes into consideration production emissions, including an estimate for fugitive emissions, liquefaction, freight (including ballast leg) and regasification.

- The pricing service said the new assessment owes to growth in the trade of carbon neutral LNG cargoes in 2021, most notably those delivered to JKTC from Australia.

Decarbonization boom poses threat of green bottleneck

(Nikkei, June 15)

- As the global economy recovers, a commodities shortage is causing prices to skyrocket.

- Particularly affected are rare earths. Combined with land shortages and other supply issues, shortages of these commodities could put a spanner in the works of the green energy boom.

- A tenfold increase in electric vehicle manufacture by 2030 will necessitate a six-fold increase in rare earth production and investment of around $35 trillion, which equates to around one-third of the total operating capital deployed around the world.

- Unfortunately, investment tends to be concentrated in wealthy economies and delays in approval for green projects mean the actual investments are far lower than hoped.

- SIDE DEVELOPMENT

Growing scarcity of critical raw materials means Covid not only concern for Japan auto makers

(Nippon Hoso News Online, June 14/15)- Japan’s big car companies released financial results last month. While the Covid-19 pandemic forced many factories to close last year, operations at most have recovered. Both Toyota and Honda report increased profits.

- The picture is less rosy for Nissan, which is predicting zero profits in 2021/22, and Mitsubishi, which is trying to reverse recent losses.

- Serious shortages of semiconductors are also a major concern for Japan’s automobile manufacturers. Shortages forced Honda and Mitsubishi to slash production. Partly to blame are Covid-related factory closures combined with increased demand for video games and computers as more people work from home.

- Growing global demand for semiconductors could mean that the current shortages are not an isolated incident.

- The increasing scarcity of rare metals is also a subject of concern for carmakers as drivers transition to electric and fuel-cell vehicles.

- In terms of battery capacity, Toyota is projected to manufacture 30 times more hybrid vehicles over the next 10 years alone than it has in the 24 years since the Prius was released.

ANALYSIS

BY SAKI ISETANI

At risk in power generation, LNG makes new friends in Japan’s shipping lanes

As Japan’s imports of LNG for power plants continues to slide, in part due to decarbonization, a new domestic buyer is emerging. The country’s shippers are betting that super-chilled LNG will provide a near-term option to make a significant dent in their emissions.

There are just three LNG-fueled ships operating in Japan at present, with most of the rest running on oil-based bunker fuel. That number is due to jump by a factor of 40 or more within this decade as part of the second of a three-stage transition by Japanese shipping towards net-zero emissions by mid-century.

According to the World Bank, however, that’s a mistake. The bank recently called on the shipping industry in Japan and elsewhere to skip LNG’s “transitional” stage and make a direct leap into zero-emissions vessels.

While Japan is also developing ships that will run on electricity, hydrogen, or other CO2-free sources, the country sees those technologies as commercially viable only closer to 2030. In the meantime, key clients such as automakers are demanding cuts in emissions now. The need to act quickly is part of what has accelerated a recent multi-billion-dollar investment drive into LNG, a move that could lock Japan’s shipping into using the fuel for at least two decades.

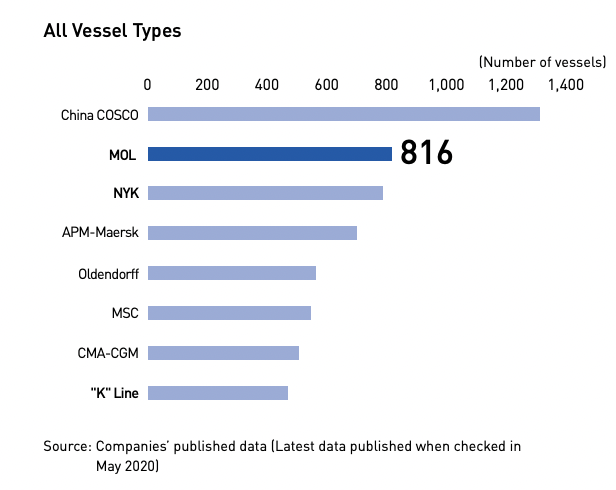

Japan shipping: an overview

- Japan has a 10% share of the global merchant fleet, or transports over 1 billion tons of cargo annually, on over 2,500 merchant vessels. Japan also has a current market share of over 20% in new global shipbuilding.

- Japan’s top shipping companies are Mitsui OSK (MOL), Nippon Yuen Kabushiki (NYK Line or NYK), and Kawasaki Kisen (K Line). They are among the world’s 10 largest merchant fleet operators.

- Number of Japanese seagoing vessels of 1,000 gross tons and above: 3,910 (2020); of those around 3,001 are under foreign flag; 909 under the Japanese flag (data from UNCTAD’s Review of Maritime Transport and the Japanese Shipowners Association).

- Number of LNG-fueled ships in the world: In 2010, there were just 18 LNG-fueled ships in the world. By 2019, this grew to 276, of which 162 were in operation and the rest were LNG-ready, according to MLIT (Ministry of Land, Infrastructure, Transport, and Tourism)

- First LNG-fueled ship in Japan: the Sakigake, a tugboat, started operation in Aug. 2015. It is owned by Nippon Yuen Kabushiki (NYK Line). According to MLIT, two other LNG-fueled ships have since entered service in Japan and seven more are in production.

- NYK, which also owns one LNG-fueled vehicle carrier, this month announced plans to build another 12 LNG-fueled vehicle carriers. Altogether, NYK expects to have 20 LNG-fueled vehicle carriers by 2028 and as much as double that in terms of total LNG-fueled ships a few years after.

- By 2030, MOL could have 90 LNG-fueled ships, the firm said last week.

- In total, by the end of the decade, Japan may count 120 or more LNG-fueled ships.

- How much LNG does one ship use: In November 2020, the world’s largest LNG-bunkering vessel, “Gas Agility” carried out LNG bunkering to the world’s largest LNG-fueled container vessel “CMA CGM Jacques Saade”, supplying a total of 17,300 m3 of LNG. This is enough fuel for a round trip voyage between Rotterdam and Asia, according to MOL.

- Ports: several of Japan’s major ports from April wavered entry fees for ships fueled by LNG and hydrogen.

One step at a time

Japan’s shipping industry plans to decarbonize in three stages, according to a roadmap adopted in April 2018 by MLIT. The plan’s first stage calls for short-term measures that can easily reduce emissions without wholesale changes and improve energy efficiency.

As an example, MOL announced an Air Lubrication System, also known as MALS, which improves the energy efficiency of ships by creating a flowing layer of air bubbles between the hull and seawater. This helps to reduce the resistance as the ship moves through the water, which can cut CO2 emissions by up to 10-15%.

Part two of the plan sees Japan’s shipping start its switch to low-carbon fuels and further improving energy efficiency. LNG is identified as the main fuel for this stage of the process since it’s expected to reduce ships’ carbon release by between 25% and 30% compared to oil-based fuels. Aside from carbon, Japanese officials say LNG would eliminate or significantly reduce other atmospheric pollutants such as sulfur oxides (SOx) and nitrogen oxides (NOx) and particulate matter (PM).

Switching to LNG is not limited to building new ships. Some vessels can be retrofitted to use LNG and are known as LNG-Ready Ships. That means changing the propulsion system, while also adapting to LNG bunkering and security other LNG-fuel related infrastructure in place.

So far, Japan’s shipping industry has wavered on a transition to LNG mainly out of cost considerations. Ships fueled by gas tend to be about 20% more expensive than their petrol version. Until Japan’s recent net-zero 2050 commitments, these expenses were seen more as a luxury than a necessity.

However, Japanese companies, such as Toyota Motor Corporation, are now more demanding that supply chains lower emissions, which follows similar moves by overseas rivals. At the same time, private initiatives are pouring money into the transition. A new ¥600 billion fund by Tokyo-based Anchor Ship Partners started this year to offer lease financing for fuel-efficient new LNG carriers.

Not all are convinced that the lurch to LNG is indeed a good thing for the environment. In a recent report called The Role of LNG in the Transition Toward Low- and Zero-Carbon Shipping, the World Bank noted that methane, the largest component of LNG, is roughly 86 times more potent over a 20-year time scale, and this is a concern because the use of LNG can allow for a small percentage of methane to slip into the atmosphere.

Final stage of shipping’s transition

The final phase of Japan’s shipping industry roadmap, from 2030-2050, sees the commercial rollout of ships that operate on zero-carbon fuels.

There are several possibilities being explored. The first is a second transition from LNG to carbon-recycled methane. (See the June 1 edition of Japan NRG Weekly for details of Japan’s methanation strategy). Another is to move to either hydrogen or ammonia fuels, or both, because they do not release CO2 when burnt. In both cases, the fuels would need to emit almost zero GHG emission in the production, distribution, and usage to qualify.

Importantly, the roadmap notes that these zero-emission ships would operate in addition to LNG-fueled vessels. That’s because a ship, once launched, tends to stay in service for about 20 years. The investment required to re-mold Japan’s shipping fleet to LNG, including all the adjacent infrastructure in ports and at sea, also dictates that the country is unlikely to abandon the fuel after this decade.

As with LNG, there are also drawbacks when employing “future” fuels for ships. Besides the fact that hydrogen and ammonia are much more expensive compared to conventional fuels, ammonia is also toxic and when emitted would release nitrogen oxides. Liquified ammonia also requires a tank four times larger than for a ship running on bunker fuel, making it difficult to commercialize.

In the case of hydrogen, a whole new infrastructure system that can cope with the gas’ volumetric energy density and transportation must still be built.

Given the technical and cost challenges, it’s unclear if Japan’s shipping will be able to undergo two (or more) significant fuel transitions in the next two decades. That could mean that LNG’s position in shipping could be secure for well into the future.

Japan’s shipping beyond LNG:

- MOL is constructing two of the world’s first zero-emissions electric tankers or ‘e5’ tankers.

- MOL is also working on ammonia-fueled ships and expects to have 110 “next-generation fuel” vessels by 2035. That would cut its CO2 release by 45% compared with FY2019 numbers, according to MOL.

Source: Mitsui OSK (MOL)

- ITOCHU is leading a group of German and Japanese firms to develop an ammonia-fueled ship by 2024

- A group consisting of NYK, Toshiba, Kawasaki Heavy, Nippon Kaiji Kyokai , ENEOS, and NEDO started testing a high-power fuel cell vessel in Sept 2020 and plan to begin pilot operations off the coast of Yokohama in 2024

- Yanmar plans to release a fuel-cell powered boat by 2025

- Japan’s Tsuneishi Facilities and Craft built the world’s first commercial hydrogen-powered vessel, the HydroBingo. The dual fuel ferry also has a diesel internal combustion engine and started sea trials this year

ANALYSIS

BY MAYUMI WATANABE

The Missing Links in Japan’s Carbon-Neutrality Plans

For the Steel Industry

Pressured to follow Japan’s net-zero commitments, the country’s top steel maker, and one of its biggest CO2 emitters, offered not one decarbonization plan but three.

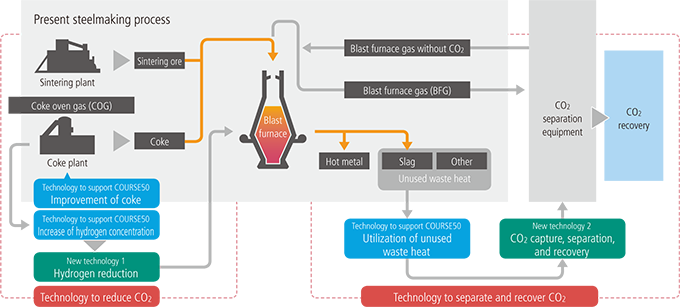

In a recent announcement Nippon Steel vowed to replace coal with hydrogen in its steel production; to switch the type of furnaces it operates to a low-carbon option; and to employ carbon capture, among other measures.

The problem for the company, which is single-handedly responsible for almost 8% of Japan’s CO2, is that all of these actions are based on currently unavailable technology or materials. The roadmap to a cleaner future for steel has several core missing links.

Unless Nippon Steel and its peers find near-term solutions, they could face a curtailment of production volumes within a decade.

The three plans of Nippon Steel

Nippon Steel likes to stress just how energy-intensive the industry was. Indeed, steelmaking accounts for 10% of Japan’s energy input.

Despite generating 89% of its own electricity, Nippon Steel has to buy another 3.8-terawatt hours from outside suppliers. The company’s total power demand is equivalent to half that of Singapore.

As a result, Nippon Steel released 94 million tons of carbon in 2019. Of that, 84 million tons of CO2 were directly from steelmaking.

The company has identified three action plans to reduce these numbers to 70 million tons of CO2 in FY2030 and net-zero by 2050.

- Gradually replace coking coal, a reduction agent that reacts with iron ore to make pig iron, with hydrogen;

- Build large electric arc-furnaces (EAF) to replace some pig iron production at blast furnaces;

- Advance the use of carbon recycling, carbon capture and storage (CCS) and similar technologies.

The first plan is considered the ultimate goal, the golden standard for the industry’s future. It proposes a wholly new steelmaking concept to replace coking coal, the most polluting element, with CO2-free hydrogen. The exact technology is being developed by the country’s top steelmakers, which also include JFE Steel and Kobe Steel, as well as the state-backed research entity NEDO. The joint project is dubbed Course50.

This new hydrogen-driven furnace will allow for a 30% reduction in the release of harmful gases, according to the Japan Iron and Steel Federation (JISF).

Steelmakers warn that a switch to hydrogen will be done in phases and Nippon Steel’s 25-30 million tons/ year of coking coal consumption will not be replaced by hydrogen overnight – even after the first Course50 furnace is completed.

Source: Nippon Steel

The development and introduction of the new technology could take well over a decade. So, in the meantime, Nippon Steel expects to pursue the second plan: build large EAFs to replace some pig iron production that currently takes place in a blast furnace. The EAF’s carbon release is one quarter of that from the blast furnace. It also utilizes steel scrap from dismantled buildings and scrapped cars as feedstock, which promotes more recycling.

Nippon Steel said it will build the world’s largest EAF with a 4 million tons/ year capacity in Setouchi, Japan, ready by 2022. It will install another giant EAF at the Calvert plant in the U.S. by 2023. The Calvert plant is a 50-50 joint venture with ArcelorMittal.

While EAF has less impact on the environment, it accounts for only a quarter of Japan’s crude steel output. That’s because there is a trade-off involved. Due to the impurities contained in scrap feedstock, EAF production is limited to ordinary-grade steel, also called “carbon steel”. This metal degrades when exposed to intensive moisture and ultraviolet lights.

Nippon Steel will need to refine its impurity control techniques to produce high-end products such as electro-galvanized sheets (used in cars, energy infrastructure, and domestic appliances) and high-tensile steel (used for engine parts, trucks, bridges, and other high-stress environments).

The elephant in the steelmaking room

There is something that neither of the first two plans by Nippon Steel addresses.

Steelmaking is a two-part process. The first involves making pig iron. The second is making that into a steel product.

In Part I, iron ore or steel scrap is added to coal and treated in a blast furnace, which uses steam from coal as an energy source. EAF, as the name suggest, do not need coal for the process but require large volumes of electricity, which in many countries including Japan comes from coal-fired plants.

In Part II, pig iron is deoxidized before it is cast, rolled, cut and shaped into 30 or so different forms like sheets, plates and tubes.

Part I accounts for roughly 60% of the total carbon emissions from steelmaking, according to research by The Institute of Applied Energy Studies. The rest comes from Part II and therein lies the problem.

First missing link: green electricity

Nippon Steel admits that the company’s current decarbonization plans will only reduce emissions from the first half of the process. What happens in Part II depends entirely on the availability of carbon-free electricity, a company official said.

As mentioned earlier, Nippon Steel generates 89% of its electricity in-house, and of that four-fifth comes from gas cogeneration. In other words, from gas that’s released inside a blast furnace during the iron ore-coal reaction. Cogeneration is more energy efficient and less polluting than procuring electricity from a thermal power plant, but it is not CO2-free.

However, even that efficiency and emissions saving mechanism is reduced if the steel is no longer made in blast furnaces. Currently, Nippon Steel relies on the power from cogeneration to run most of its Part II processes (the cast house, the rolling mills and other finishing facilities).

Switching to an EAF or the new Course50 hydrogen-iron reduction technology will cut carbon emissions in Part I, but also leave Part II without power.

Like most steelmakers, Nippon Steel also operates several coal-fired power plants to secure a stable and cheap source of electricity for its factories. Retaining them will require carbon capture or similar technology to reduce emissions. Closing them will mean having to buy even more external electricity from providers, and Japan has among the highest electricity prices in the world.

What’s more, given the need for uninterrupted, high-density power supply, the steel industry has so far been wary of considering variable renewable energy sources.

Second missing link: hydrogen

Once Course50 furnaces are installed, Nippon Steel faces another issue: securing an adequate supply of hydrogen and the cost associated with it.

Blast furnaces already generate hydrogen as part of the coal and iron ore reaction. However, in that state hydrogen is mixed with other gases and cannot be easily separated and then re-purposed for treating iron ore.

Creating new technology capable of separating the hydrogen in a cost-efficient manner is considered decades away. In the meantime, steelmakers need to look elsewhere for hydrogen.

Japan’s steelmakers will need 7 million tons of hydrogen to produce 75 million tons of carbon-neutral pig iron in 2050, Nippon Steel informed the government earlier this year.

Based on current estimates, the power sector would require another 5-10 million tons of hydrogen, while the transport sector will need 6 million tons, according to Central Research Institute of Electric Power Industry.

Today, Japan’s hydrogen capacity stands at about 2 million tons a year, according to NEDO.

The “easiest” solution: shrink production

Given the vast energy problems and hydrogen shortages, some experts wonder if it’s worth retaining the country’s steel sector at its current scale.

Last fiscal year, Japan produced 82.8 million tons of crude steel, a 52-year low. Output dropped 16% due to the impact of the pandemic and slower economic activity. And yet, Japan still exported 32.1 million tons of iron and steel products, according to JISF.

As developing economies ramp up their own steelmaking capacities, demand for Japanese steel will likely decrease and be limited to high-end products. Japan’s shrinking and aging population is already hurting demand from key domestic buyers of the metal – the housing and auto industries.

Aware that they could be a target for a government looking for ways to quickly reach emissions goals, the steel industry has enlisted veteran lobbying support. This month, several conservative lawmakers led by Hosoda Hiroyuki, the former deputy secretary general of the ruling LDP party and Harada Yoshiaki, the former Minister of Environment, formed a special task force to support the decarbonization of steel and heavy industry.

The struggle promises to be intense. Steelmakers have among the strongest voices in corporate Japan and are top employers. The industry will also claim that it could be integral to the creation of an offshore wind supply chain in Japan.

How much of Japan’s steel capacity will stay in place by FY2030, of course, remains to be seen. But one thing is certain – the country’s steel production is going to head downward, and the age of high-polluting heavy industries is coming to an end.

GLOBAL VIEW

BY TOM O’SULLIVAN

Below are some of last week’s most important international energy developments monitored by the Japan NRG team because of their potential to impact energy supply and demand, as well as prices. We see the following as relevant to Japanese and international energy investors.

Climate Change:

1). Severe heat waves in the Western and Southern U.S. – especially in Texas, Utah and California – are threatening power outages as temperatures have reached their highest levels in over 100 years. Grid operators in Texas and California are urging conservation to avoid blackouts. Meanwhile, in some regions of China, electricity is being rationed as power demand increased 15% YoY, and in Europe more coal is being burned to meet power demand due to rising temperatures.

2). A team of 300 scientists who returned from an expedition to the North Pole in Q4 last year are warning of irreversible global warming based on 150 terabytes of data accumulated over one year. The disappearance of summer ice in the Arctic is the most obvious manifestation of global warming.

3). The UK Climate Change Committee warned last week that the UK is not adapting fast enough to the impacts of climate change with episodes of extreme heat becoming more frequent.

4). Concerns are growing over climate finance in the run-up to COP26 in the UK in November. The global energy transition is estimated to cost $140 trillion by 2050 and the rich countries’ target of providing $100 billion per annum is not being met.

Carbon Taxes:

The 27-member EU block is planning to introduce legislation in July that would tax imports based on GHG emissions, making it the first global limit on carbon in international trade.

Carbon Offsets:

Tree-tracking technology platforms used to substantiate carbon offset programs have raised $44 million in financing, YTD. Barclays estimates that “investment in nature” programs could generate $3.6 trillion of investments. Forestry and land use is the second most popular offset program after renewable energy.

G7: Elimination of Unabated Coal:

The final G7 communique reinforced the policy that global investment in unabated coal that fails to use carbon filtering is inconsistent with the Paris Agreement. The G7 countries also committed to halve GHGs by 2030 vs. 2010 and to mobilize $100 billion by 2025 to combat climate change.

EVs:

1). The Chief Executive and CFO of Lordstown Motors both quit following revelations of amendments to annual reports filed with the SEC.

2). GM will invest $35 billion in EVs and autonomous vehicles by 2035, an increase of 30%, including the construction of two battery plants.

Aviation:

GE and Safron, the two largest makes of jet engines, will extend collaboration by a decade to 2050 to produce jet engines that consume 20% less fuel by 2035.

Nuclear Power:

1). An increase in the concentration of gases at the Taishan 1 EPR in Guangdong Province is related to damaged fuel rods according to China’s National Nuclear Safety Administration (NSSA). The NSSA said the increase is a regular phenomenon and is still in accordance with the requirements of the plant’s technical specifications. France’s EDF/Framatome, which designed the EPR and owns 30% of the Taishan NPP, said the unit was experiencing a performance issue early last week. Taishan is 140 km from Hong Kong.

2). One of Europe’s largest battery energy storage systems is to be built at the Olkiluoto nuclear power plant in Finland under a contract signed by Teollisuuden Voima Oyj, the operator, and Hitachi ABB Power Grids. The 90 MW system will act as a fast-start backup power source to ensure the stability of Finland’s energy network in the event of an unplanned shutdown of the Olkiluoto 3 EPR unit, currently being commissioned at the site.

3). Bill Gates’ nuclear power company, TerraPower, plans to apply for a construction permit in 2023 and an operating license in 2026 for its Natrium fast reactor, according to a plan sent to the U.S. Nuclear Regulatory Commission. TerraPower and GE-Hitachi Nuclear Energy Americas formed a JV in 2019 to develop the Natrium technology and are backed by Bechtel, Energy Northwest, Duke Energy, and PacifiCorp.

4). NRC in the U.S. has approved for the first time the use of higher enriched uranium in conventional nuclear plants. The new fuel is referred to as HALEU and is enriched 5% to 20% compared with uranium in conventional nuclear plants that is only enriched 3% to 5%. This should improve reactor energy performance.

Biomass:

Following complaints from environmental groups and scientists, the EU will reconsider whether use of wood pellets or organic waste counts towards renewable green energy targets.

Fossil Fuels:

1). The share of fossil fuels in the global energy mix has not decreased over the last decade according to REN21, the green energy policy network. Fossil fuels still account for 80% of the global energy mix.

2). Climate campaigners are taking Norway to the European Court of Human Rights over oil drilling in the Barents Sea inside the Arctic Circle, claiming that it breaches their right to life. Norway is Western Europe’s largest oil and gas producer.

ESG:

1). In the U.S. the newly-appointed chairman of the SEC, Gary Gensler, has completed solicitation of public comments on proposed changes in ESG reporting rules that aim to bring consistency and comparability to climate risk reporting for U.S. listed companies.

2). PwC, the global consultancy, will increase headcount by 100,000 and invest $12 billion in an ESG advisory expansion before 2025.

3). Legal & General, the UK’s largest investor, has blacklisted AIG over insufficient policies on climate change risks including its exposures to the coal industry.

NATO: Carbon Neutrality:

The NATO military alliance has committed to carbon neutrality by 2050. Annual EU military expenditure generates as much CO2 as 14 million cars and eight of the 10 NATO host countries are highly exposed to climate change according to SIPRI. A switch from fossil fuels to synthetic fuels is thought to be the most feasible option for the military alliance to reduce its carbon footprint.

Cryptocurrencies:

Tesla will reinstate Bitcoin for its automobile purchases once it establishes that 50% of the consumed mining energy is clean.

China:

1). Several trillion dollars of trade in the Yangtze River estuary and Hangzhou Bay regions are at risk of devastating impact of rising water levels due to climate change. Shanghai, Suzhou, and Jiaxing are the most exposed Chinese cities in the region according to the FT, with $1.5 trillion of annual GDP at risk.

2). Twelve people were killed in a gas explosion in Shiyan City in Hubei Province on Sunday.

3). China will host an UN-sponsored biodiversity summit on Oct 11th to draft a new global treaty on protection of ecosystems including forests and oceans.

4). The International Institute of Green Finance is reporting that 50% of Chinese-backed overseas coal fired projects have been cancelled or shelved over the past six years.

5). China is clamping down on Bitcoin mining in Sichuan Province due to excessive electricity usage.

South Korea:

1). Three South Korean shipbuilders, Hyundai Heavy Industries, H-Line Shipping, and SM Line are planning H2 2021 IPOs that could raise $3.3 billion as global shipping volumes soar.

2). SK Group is being accused of greenwashing after finalizing a new $1.4 billion LNG investment in the offshore Barossa-Caldita gas field in Australia after committing to end all overseas oil and gas investments.

Cambodia:

The U.S. is ending a $100 million Cambodian aid program at a Wildlife sanctuary due to worsening deforestation, illegal logging, and human rights abuses.

Belarus:

On Monday the EU may formally approve sanctions, including oil sanctions, against Belarussian state companies. The sanctions against the state oil company, Belneftekhim, could impact around $4.2 billion of Belarusian oil export revenues.

Ukraine:

Naftogaz Ukraine will take legal action against Russia’s gas monopoly, Gazprom unless it unlocks gas supplies from Central Asia and releases them through Gazprom’s pipelines in Ukraine. The gas flows have been blocked for 15 years.

Egypt:

The French government committed to provide over $2 billion of financing to Egypt including for various power generation projects. The U.S. is also committing to assist Egypt with its energy transition.

Norway:

Aker Carbon Capture, which specializes in capturing CO2, moved to the main section of the Oslo Stock Exchange on Friday and now commands a market capitalization of around $1 billion.

Denmark:

Alstom, the French railway group, won a $2.4 billion contract with Danish State Railways to provide 100 Corodia Stream regional trains. This is the largest train tender in Danish history. Rail is expected to be a major beneficiary of the green revolution.

Switzerland:

A referendum to curb CO2 emissions through the introduction of taxes on fossil fuels was defeated in a referendum last Sunday.

Spain:

EQT, the Swedish private equity group, will buy Spanish solar operator, Solarpack, for $1.3 billion or $600,000/MW of capacity.

France:

Brittany Ferries signed a letter of intent with Regent of Boston, a U.S. technology start-up, for the delivery of two electric ‘seaglider” flying ferries that will operate between France and the UK.

U.S.:

1). Average vehicle age in the U.S. rose to 12 years in 2020 for the first time ever as quality improved with 280 million vehicles now on U.S. roads.

2). BlackRock raised $1.7 billion for a new fund, the Global Infrastructure Debt Fund, that will invest in wind energy among other things

Chile:

Chile inaugurated South America’s first ever thermo-solar energy plant, the 210 MW Cerro Dominador in the Atacama Desert, that uses molten salt to generate electricity. It will save 600,000 tons of CO2 and has 18 hours of energy storage.

EVENTS CALENDAR

A selection of domestic and international events we believe will have an impact on Japanese energy.

| February | Approval of Fiscal 2021 Budget by Japanese parliament including energy funding projects;

CMC LNG Conference |

| March | 10th Anniversary of Fukushima Nuclear Accident;

Smart Energy Week – Tokyo; Quarterly OPEC Meeting; Japan LPG Annual Conference; Full completion of all aspects of the multi-year deregulation of Japan’s electricity market; End of 2020/21 Fiscal Year in Japan; |

| April | Japan Atomic Industrial Forum – Annual Nuclear Power Conference;

38th ASEAN Annual Conference-Brunei; Japan LNG & Gas Virtual Summit (DMG)-Tokyo Three crucial by-elections in Hokkaido, Nagano & Hiroshima – April 25th |

| May | Bids close in first tender for commercial offshore wind projects in Japan;

Prime Minister Suga to visit the U.S. |

| June | Release of New Japan National Basic Energy Plan-2021;

G7 Meeting – U.K. Presidents Biden and Putin are due to meet at a summit in Geneva Forum for China-Africa Cooperation Summit (Senegal) |

| July | Tokyo Metropolitan Govt. Assembly Elections;

Commencement of 2020 Tokyo Olympics |

| August | Hydrogen Ministerial Conference in conjunction with IEA |

| September | Ruling LDP Presidential Election; Possible dissolution of the lower house of parliament

UN General Assembly Annual Meeting that is expected to address energy/climate challenges; IMF/World Bank Annual Meetings (multilateral and central banks expected to take further action on emissions disclosures and lending to fossil fuel projects); End of H1 FY2021 Fiscal Year in Japan; Japan-Russia: Eastern Economic Forum (Vladivostok)-tentative |

| October | Possible holding of Japan’s 2021 General Election (Oct. 10 or 17);

METI Sponsored LNG Producer/Consumer Conference; Innovation for Cool Earth Forum – Tokyo Conference; Task Force on Climate-Related Financial Disclosure (TCFD) – Tokyo Conference; G20 Meeting-Italy |

| November | COP26 (Glasgow);

Asian Development Bank (‘ADB’) Annual Conference; Japan-Canada Energy Forum; East Asia Summit (EAS) – Brunei |

| December | Asia Pacific Economic Cooperation (APEC) Forum – New Zealand;

Final details expected from METI on proposed unbundling of natural gas pipeline network scheduled for 2022. |

DATA

Japan Oil Price

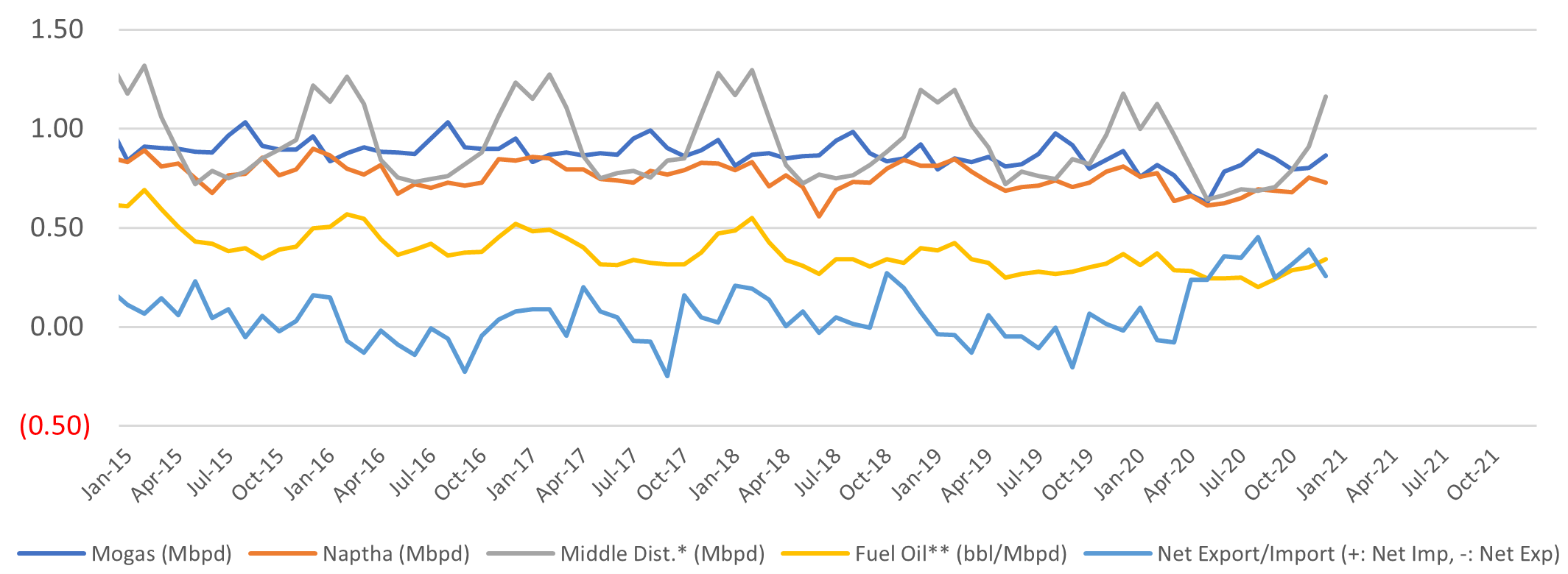

Crude Imports Vs Processed Crude

Monthly Oil Import Volume (Mbpd)

Monthly Crude Processed (Mbpd)

Domestic Fuel Sales

SOURCES: Ministry of Economy, Trade, and Industry (METI), Ministry of Finance, and the Petroleum Association of Japan

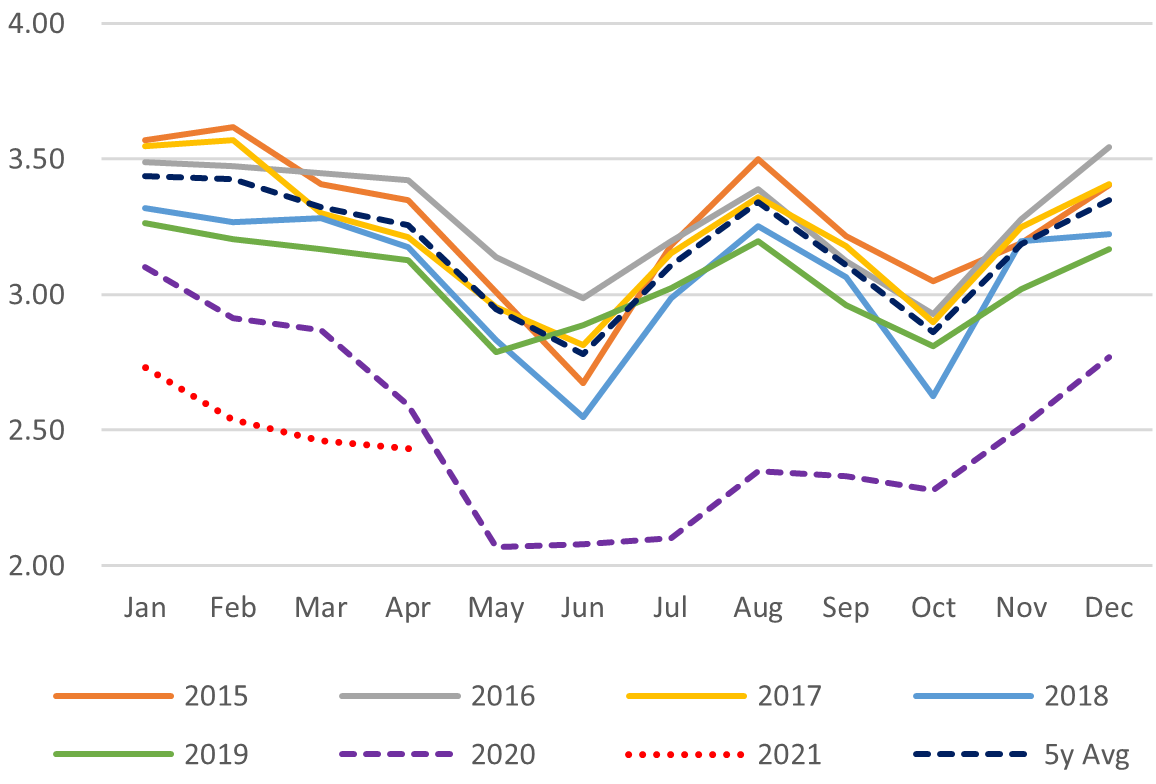

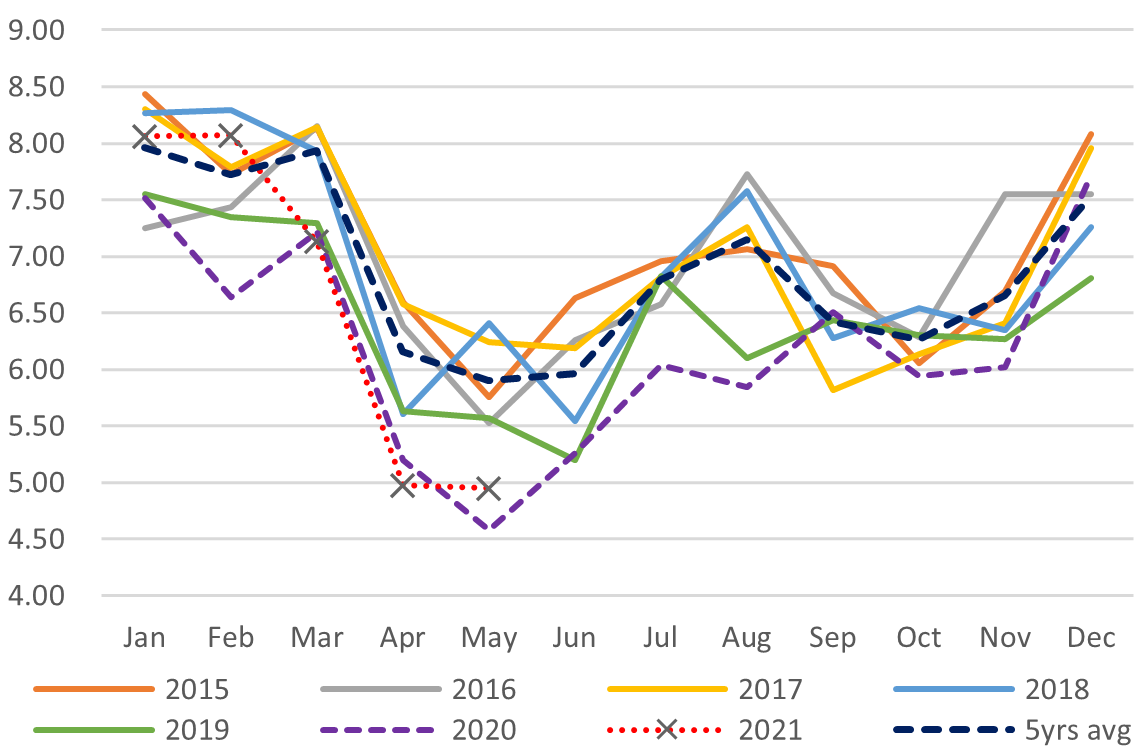

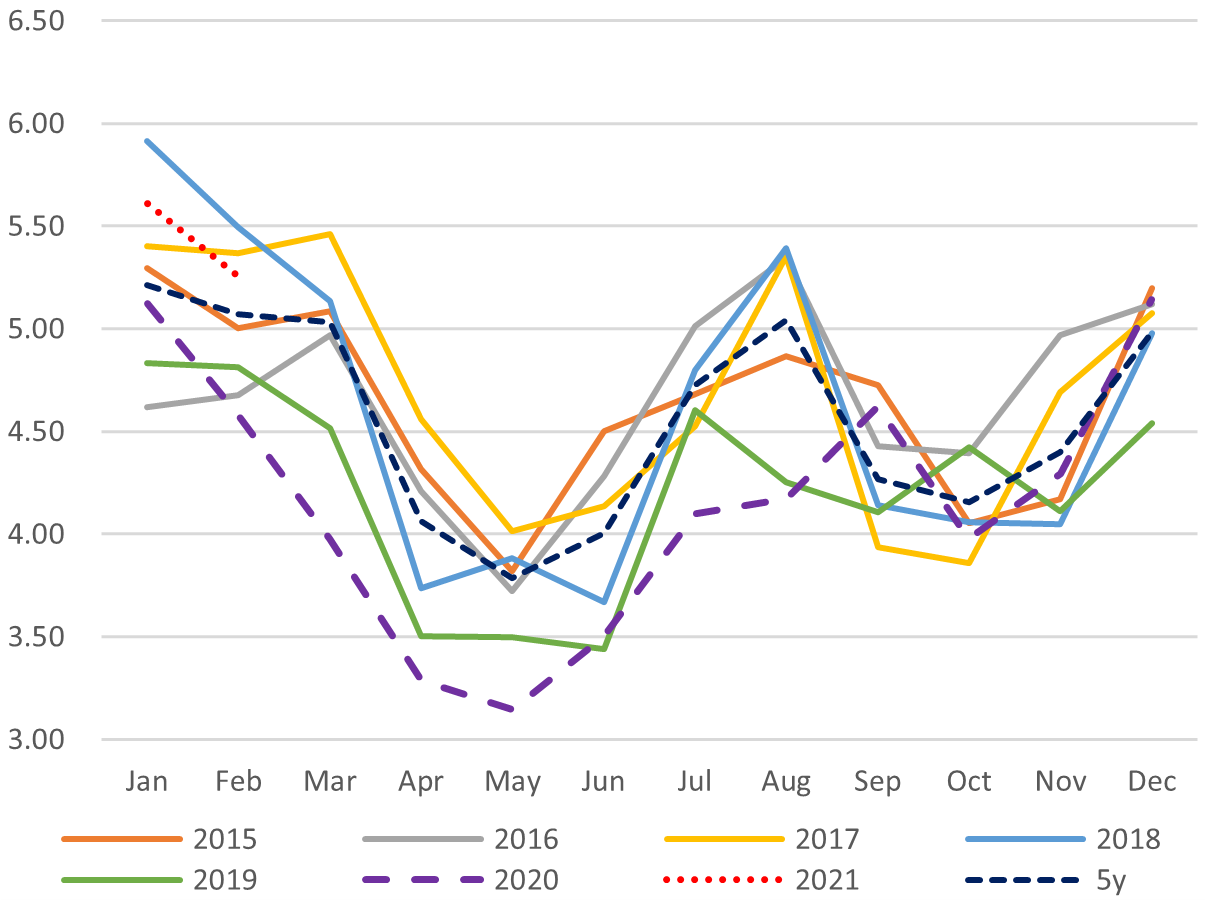

Japan LNG Price

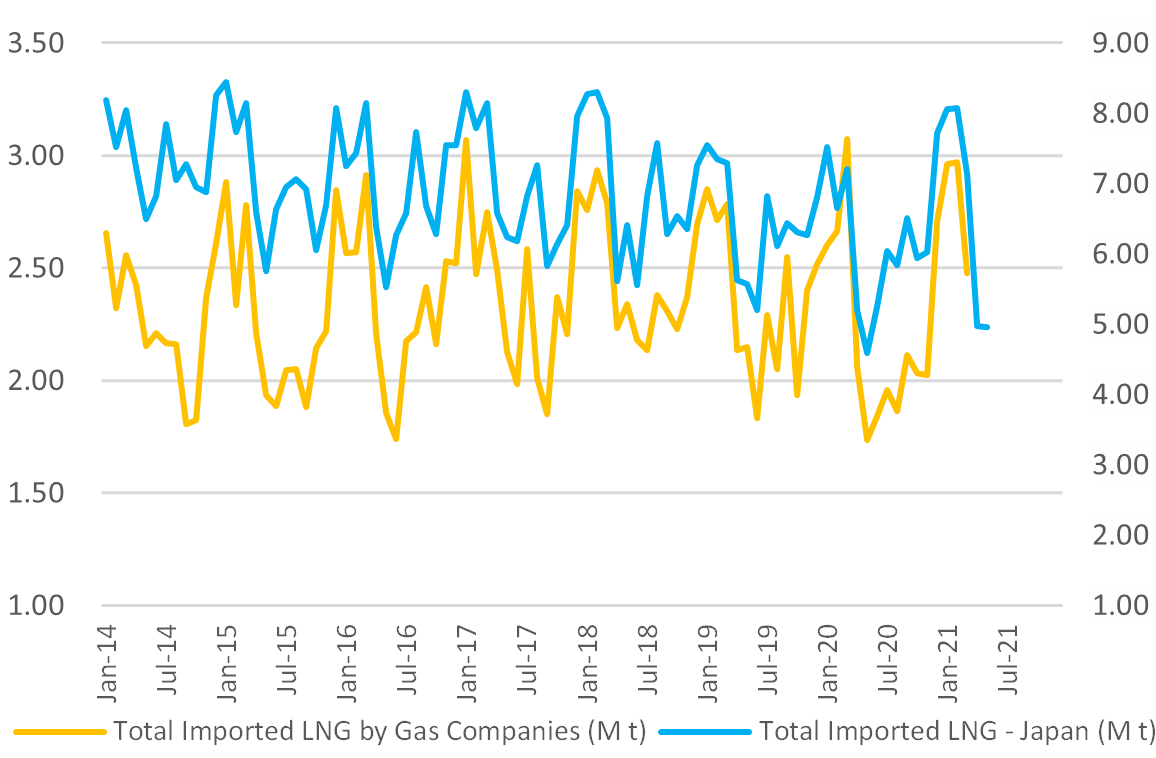

LNG Imports: Japan Total vs Gas Utilities Only

Total LNG Imports (M t)

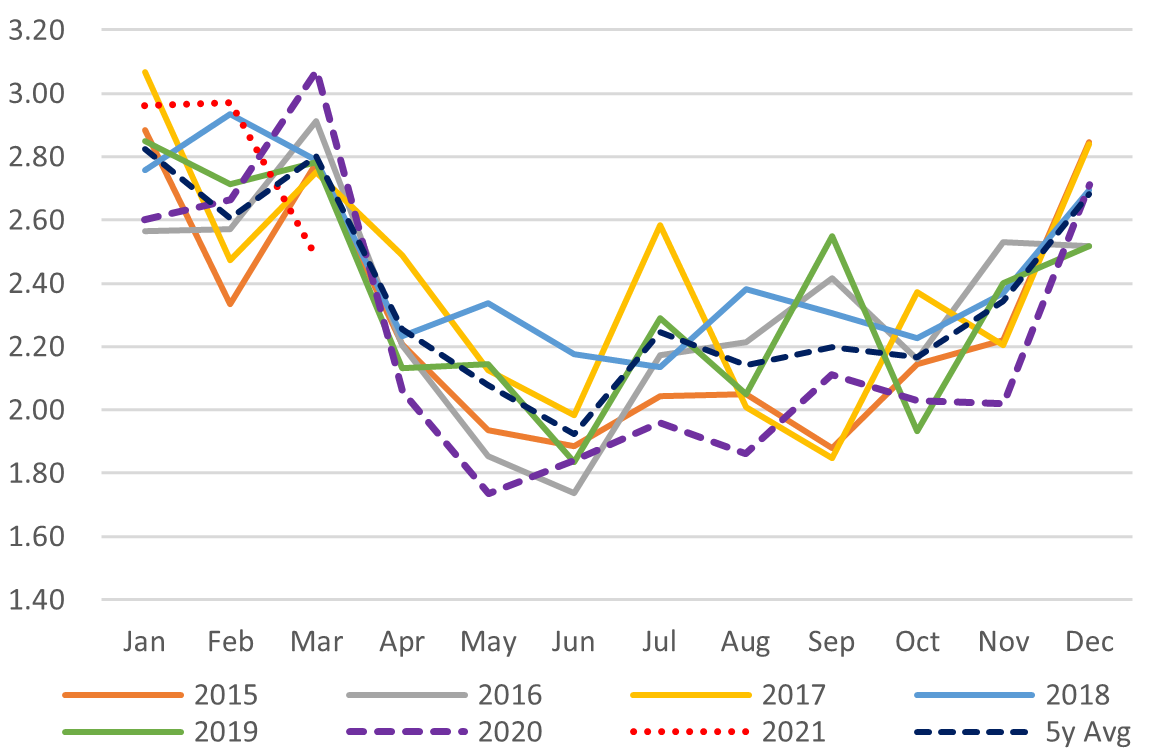

LNG Imports by Gas Firms Only (M t)

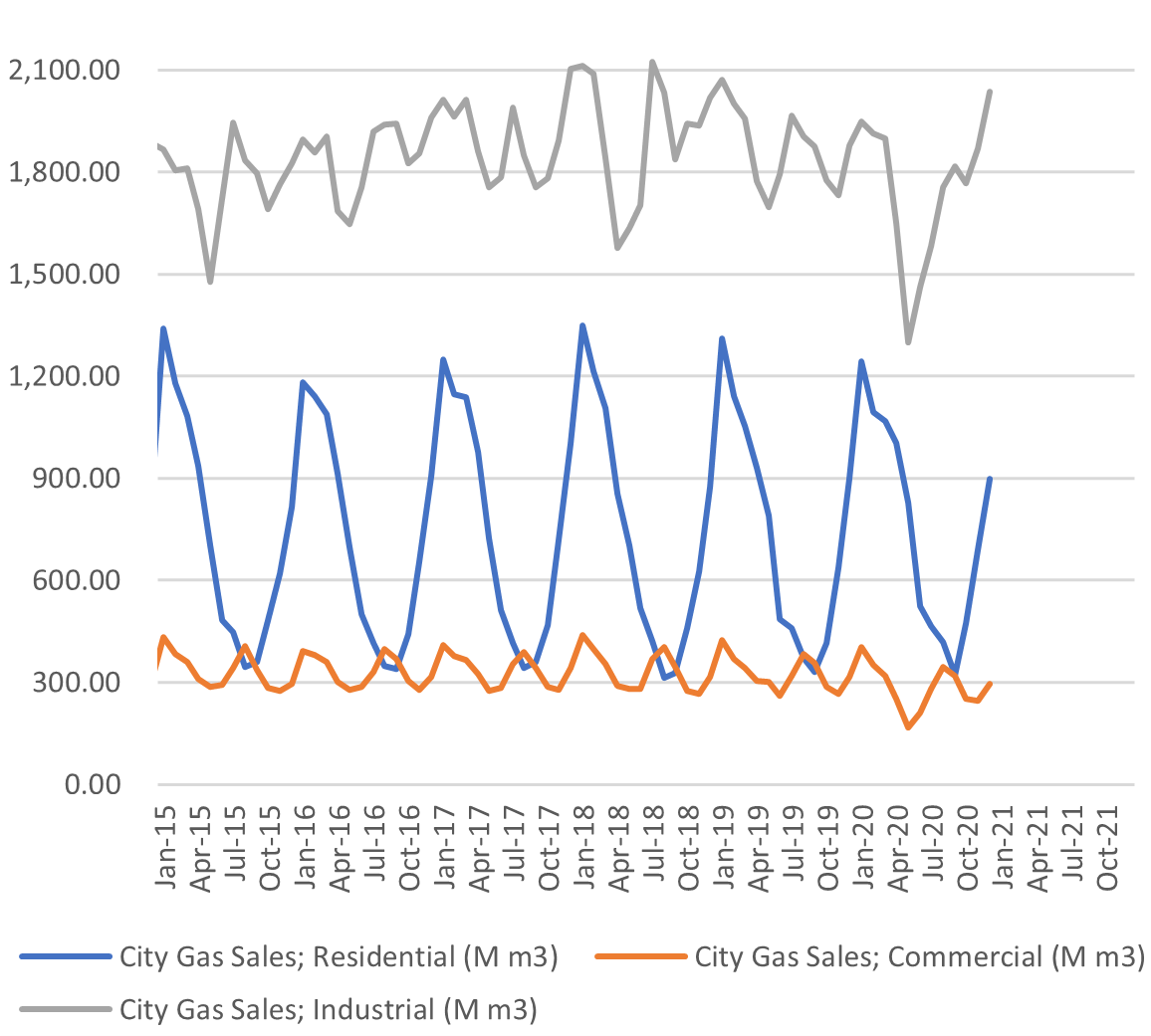

City Gas Sales – Total (M m3)

City Gas Sales by Sector (M m3)

SOURCES: Ministry of Economy, Trade, and Industry (METI),

Ministry of Finance

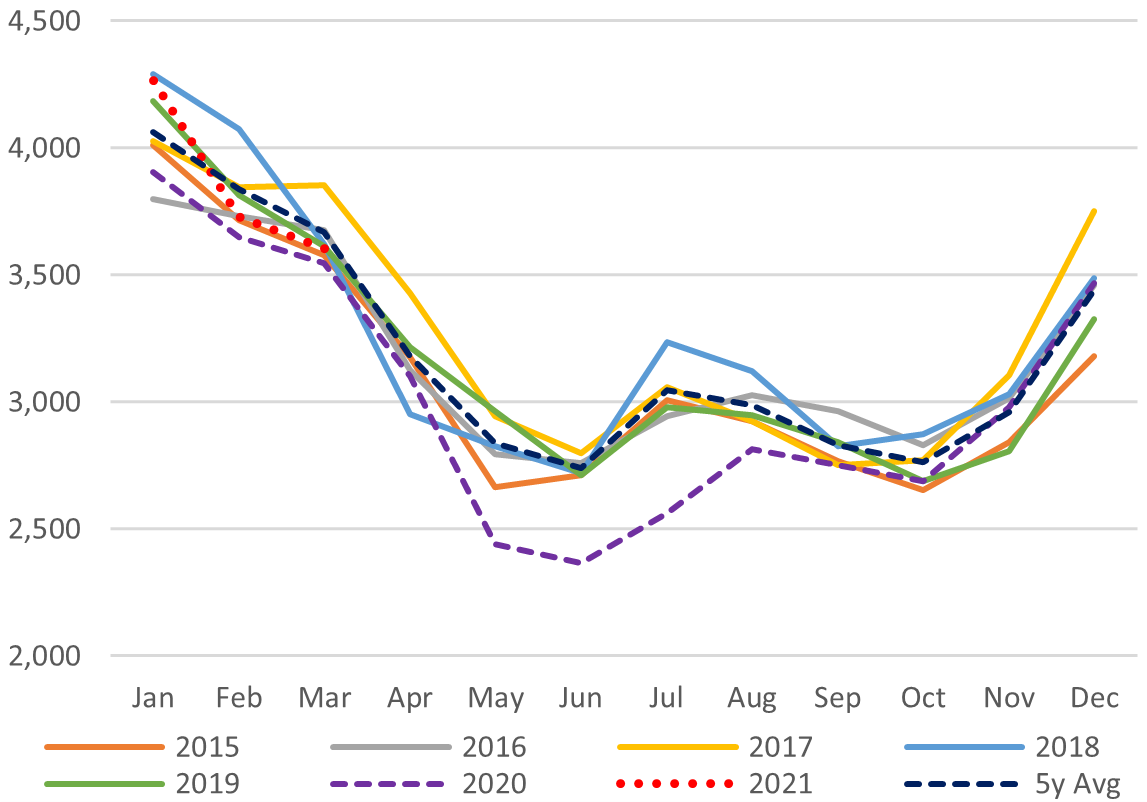

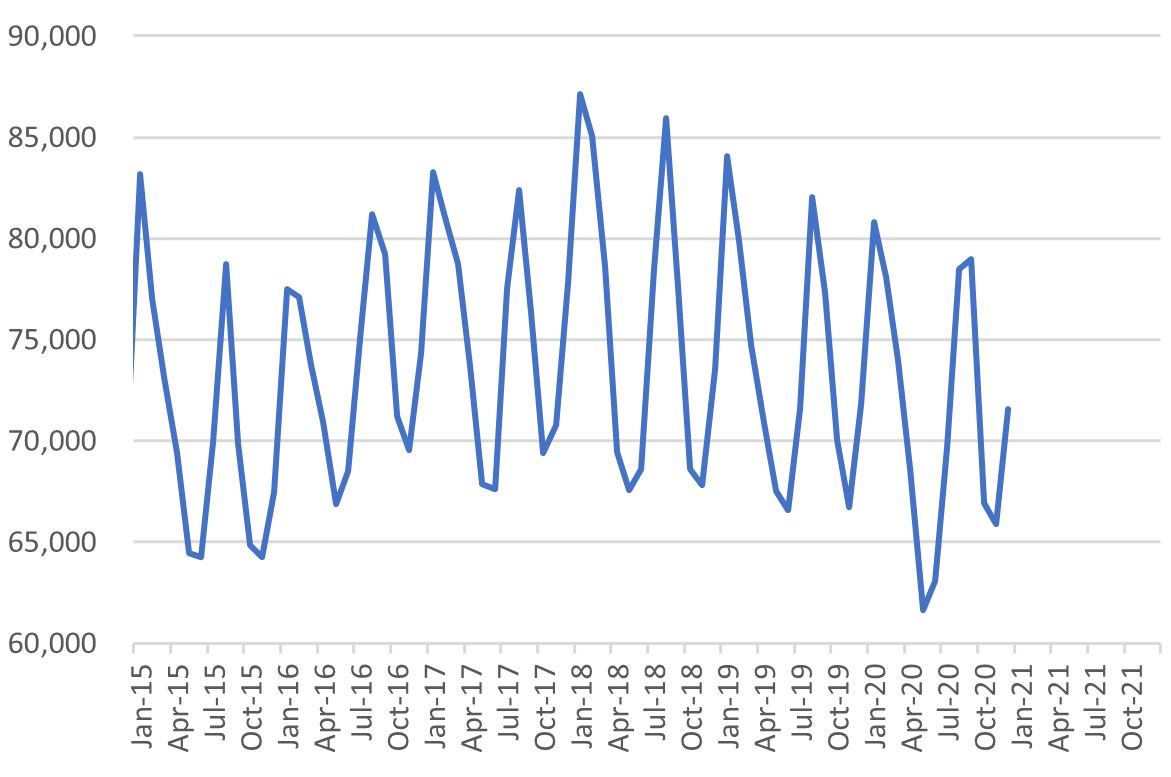

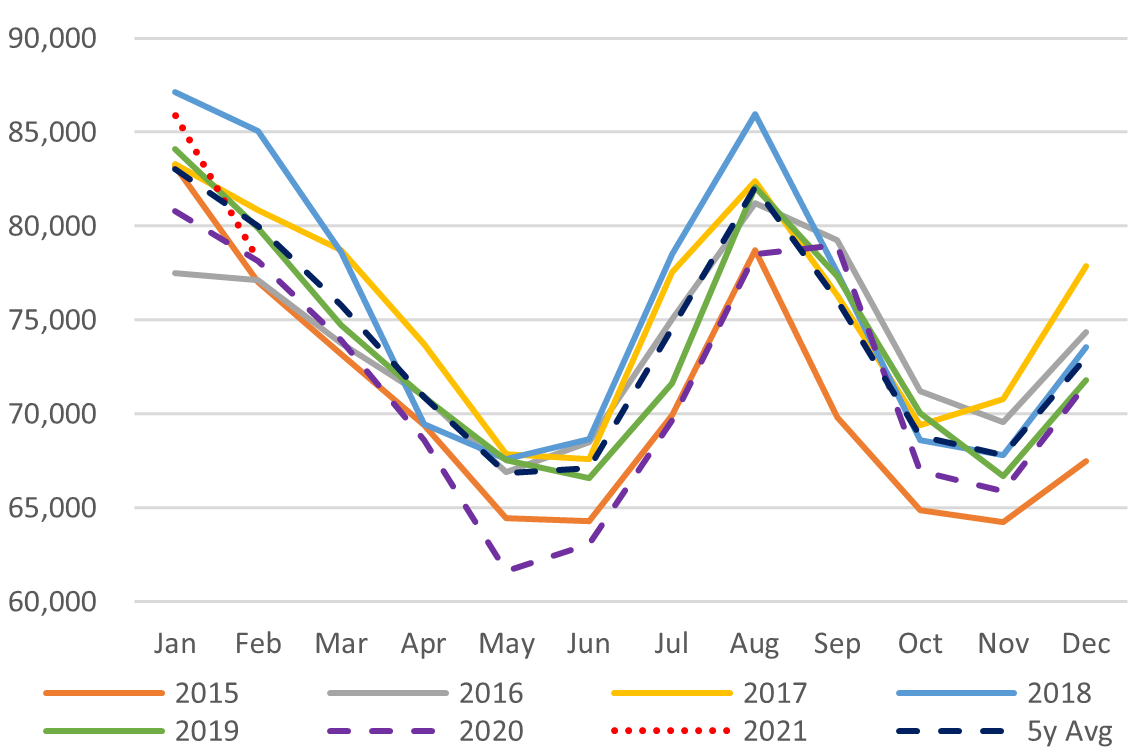

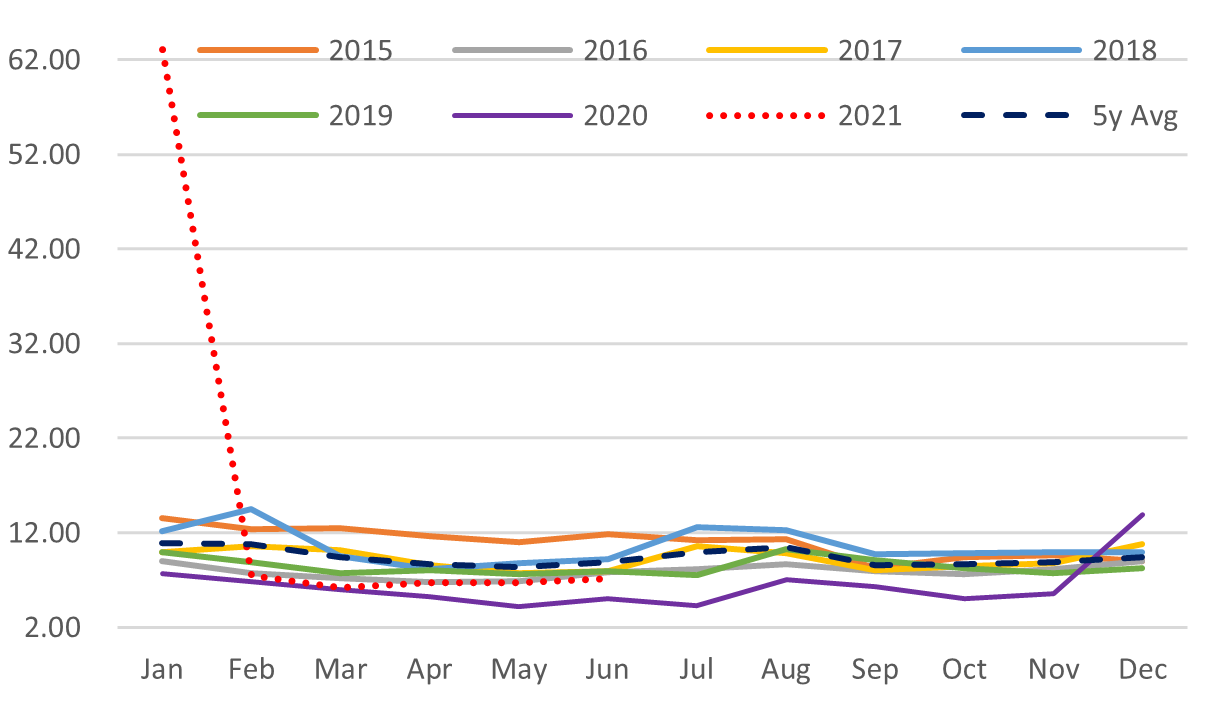

Japan Total Power Demand (GWh)

Current Vs Historical Demand (GWh)

Day-Ahead Spot Electricity Prices

Day-Ahead Vs Day Time Vs Peak Time

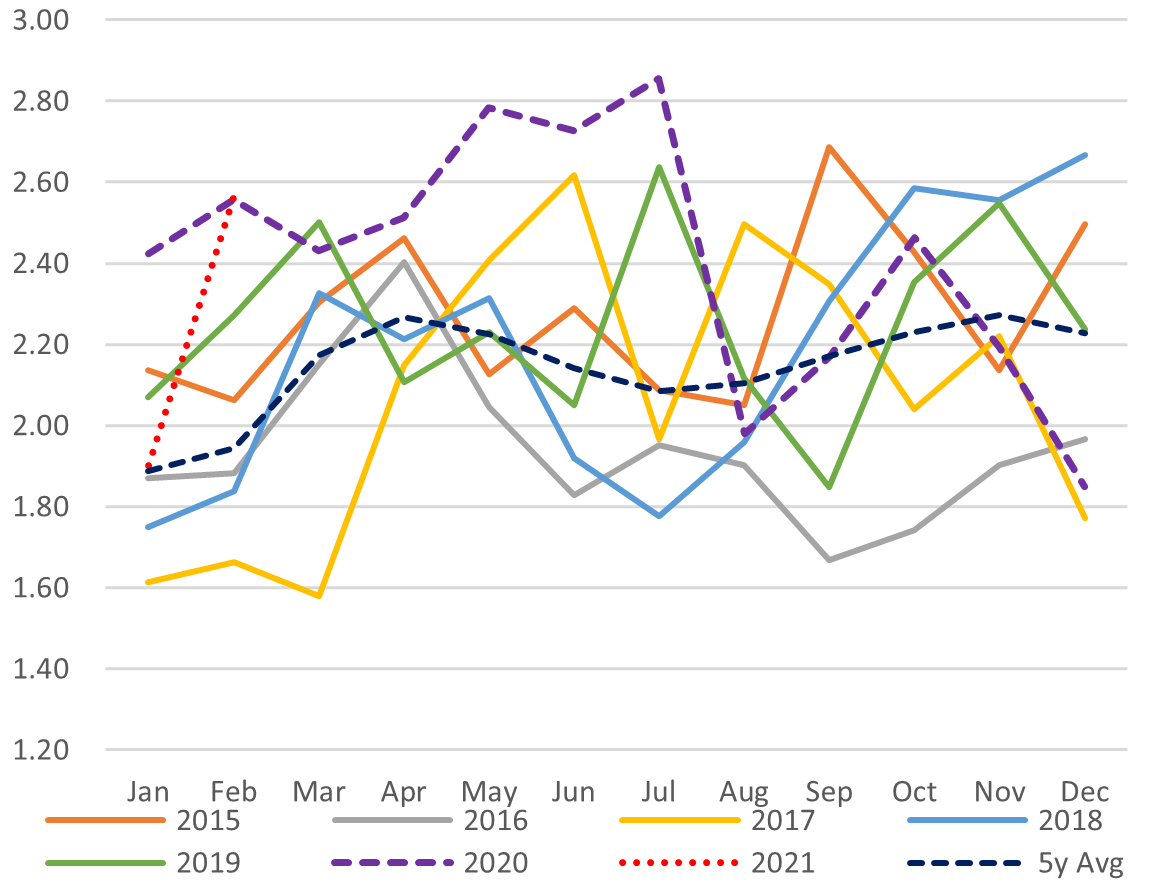

LNG Imports by Electricity Utilities

LNG Stockpiles of Electricity Utilities

SOURCES: Ministry of Economy, Trade, and Industry (METI), and the Japan Electric Power Exchange

Disclaimer

This communication has been prepared for information purposes only, is confidential and may be legally privileged. This is a subscription-only service and is directed at those who have expressly asked K.K. Yuri Group or one of its representatives to be added to the mailing list. This document may not be onwardly circulated or reproduced without prior written consent from Yuri Group, which retains all copyright to the content of this report.

Yuri Group is not registered as an investment advisor in any jurisdiction. Our research and all the content express our opinions, which are generally based on available public information, field studies and own analysis. Content is limited to general comment upon general political, economic and market issues, asset classes and types of investments. The report and all of its content does not constitute a recommendation or solicitation to buy, sell, subscribe for or underwrite any product or physical commodity, or a financial instrument.

The information contained in this report is obtained from sources believed to be reliable and in good faith. No representation or warranty is made that it is accurate or complete. Opinions and views expressed are subject to change without notice, as are prices and availability, which are indicative only. There is no obligation to notify recipients of any changes to this data or to do so in the future. No responsibility is accepted for the use of or reliance on the information provided. In no circumstances will Yuri Group be liable for any indirect or direct loss, or consequential loss or damages arising from the use of, any inability to use, or any inaccuracy in the information.

K.K. Yuri Group: Oonoya Building 8F, Yotsuya 1-18, Shinjuku-ku, Tokyo, Japan, 160-0004.