JAPAN NRG WEEKLY

JUNE 20, 2022

JAPAN NRG WEEKLY

June 20, 2022

NEWS

TOP

- Japan’s May trade deficit second-largest ever due to crude price increases and weak yen, with import spending at all-time record

- Ministry names failing power retailers as 10% of sector “frozen”; firms no longer accepting new clients or are exiting the business

- Asian LNG prices jump 50% in a month as Russia supply to the European market falls, increasing global competition for cargoes

ENERGY TRANSITION & POLICY

- METI collects comments on Japan’s carbon pricing scheme; and seeks to boost reliance on Joint Credit Mechanism (JCM)

- Central govt. pushes back against proposed tax on solar panels

- PSK added to sustainable biomass fuel sources for Japan

- Tokyo City says work-from-home has helped reduce emissions

- U.S. govt. backs Mitsubishi Heavy hydrogen project in Utah

- Toyota, Toho, and Total partner on hydrogen infrastructure plan

- Asahi Kasei to make lithium-ion battery materials out of CO2

- Solar on public buildings could offer 6 GW of capacity: Ministry

- Mitsui OSK starts sea trials of bulk carrier powered by biofuel

ELECTRICITY MARKETS

- Utilities promote power saving to households with points scheme

- Kyushu Electric pulls out of LNG-fired power project on fuel fears

- Tokyo Gas retains rank as biggest power retailer outside EPCOs

- Mitsubishi consortium unveils plans for 910 MW project in Akita

- Green Power Invest to develop major offshore wind farm in Chiba

- Fukushima govt., TEPCO and Mitsui Oil keen on new geothermal

- Kansai Electric reveals more wind power projects for Hokkaido

- Itochu unit to test co-firing of woody biomass at coal power plant

OIL, GAS & MINING

- Idemitsu to slash oil refining capacity, eyeing electric car future

- Enechange invests in U.S. nickel-zinc battery developer

- Automakers seek to slash use of rare earths in EV motors

- May crude oil, LNG and coal imports up, lifting stockpiles

ANALYSIS

WARY OF RUSSIAN LNG SUPPLY RISKS,

JAPAN LOOKS AT OPTIONS ELSEWHERE

Within 10 years, all of Japan’s current contracts for LNG from Russia will expire. The longest of these, set for 24 years, will end during 2031, though volumes will start to drop five years prior to that, unless the supply deals are renewed. How Japan proceeds regarding continued ownership of its Russian LNG assets is a complex issue. There currently isn’t a solution, and bar any major agitations either from allies or the Kremlin, it’s not a situation that will find resolution any time soon. Japan needs a Plan B should Russian LNG supplies stop becoming an option either in the short or the longer term.

ETHANOL FROM PAPER:

A GAME CHANGER FOR BIOETHANOL IN JAPAN?

In recent years Japan has been tepid on bioethanol, with annual consumption of only about 800,000 kiloliters, most of it imported from Brazil. To put things into perspective, that’s just 20% of India’s total consumption. Even more indicative of the fuel’s lack of popularity, Japan’s local production is negligible. It’s so small that the government doesn’t even collect data on it. But recent developments indicate there’s reason to think that bioethanol has a future in Japan.

GLOBAL VIEW

Gazprom gas flows to Europe drop. UK investigates prices at the pump. U.S. struggles to convince local fuel producers to raise output. India gets a new investor in green energy. China increases Russian gas imports. BP quits Canadian oil sands but invests in green hydrogen in Australia. Details on these and more in our global wrap.

EVENTS SCHEDULE

JAPAN NRG WEEKLY

PUBLISHER

K. K. Yuri Group

Editorial Team

Yuriy Humber (Editor-in-Chief)

John Varoli (Senior Editor, Americas)

Mayumi Watanabe (Japan)

Wilfried Goossens (Japan, Events)

Regular Contributors

Chisaki Watanabe (Japan)

Takehiro Masutomo (Japan)

Daniel Shulman (Japan)

Art & Design

22 Graphics Inc.

Events

SUBSCRIPTIONS & ADVERTISING

Japan NRG offers individual, corporate and academic subscription plans. Basic details are our website or write to subscriptions@japan-nrg.com

For marketing, advertising, or collaboration opportunities, contact sales@japan-nrg.com For all other inquiries, write to info@japan-nrg.com

OFTEN USED ACRONYMS

METI The Ministry of Energy, Trade and Industry

MOE Ministry of Environment

ANRE Agency for Natural Resources and Energy

NEDO New Energy and Industrial Technology Development Organization

TEPCO Tokyo Electric Power Company

KEPCO Kansai Electric Power Company

EPCO Electric Power Company

JCC Japan Crude Cocktail

JKM Japan Korea Market, the Platt’s LNG benchmark

CCUS Carbon Capture, Utilization and Storage

mmbtu Million British Thermal Units

mb/d Million barrels per day

mtoe Million Tons of Oil Equivalent

kWh Kilowatt hours (electricity generation volume)

NEWS: ENERGY TRANSITION & POLICY

Japan’s May trade deficit was second-largest on record due to high crude prices, weak yen

(Customs Data, Reuters, June 16)

- Preliminary trade statistics from the Ministry of Finance show, Japan’s trade balance was at a deficit of ¥2.3847 trillion in May. This is the second-highest on record.

- CONTEXT: The highest was in January 2014, also due to record-high imports of crude oil and other resources and a weak yen.

- Japan’s spending on imports rose 48.9% YoY to ¥9.6367 trillion, the largest ever since records began in 1979. Yen-based spending on imports of crude oil from the United Arab Emirates (UAE), coal from Australia, and LNG increased for the 16th consecutive month.

- Exports were up 15.8% YoY to ¥7,252.1 billion, led by steel, fuels, semiconductors and other electronic equipment.

TAKEAWAY: Japan’s macro situation is stuck between a rock and a hard place. If the Bank of Japan were to target inflation (thus undoing a decade of efforts to push it to the target 2%) and help the yen strengthen, it would increase the debt repayment costs for the nation. Continuing the bank’s ultra-loose policy means a prolongation of record trade deficits. Historically, a weak yen would help boost Japanese exports. But with most of the Japanese manufacturing moved elsewhere, the weaker yen is more of a burden. Plus, most of Japan’s exports are finished or semi-finished products, all of which rely on the high and rising raw material prices.

24 entities in Japan, 3 overseas file comments on Japanese carbon pricing scheme

(Japan NRG, June 15)

- Comments were filed by 24 entities in Japan and 3 overseas organizations on Japan’s proposed carbon pricing scheme, which consists of voluntary caps on emissions and trading credits on the national carbon exchange. The comments were collected from April 13 to May 13, and will be factored into the METI carbon pricing report to be released later this month.

- From overseas, the Integrity Council for the Voluntary Carbon Market said clarifying which voluntary credits can be used in Japan’s framework is needed, and urges Tokyo to adapt its Core Carbon Principles.

- The International Emissions Trading Association said international credits without corresponding adjustment shouldn’t trade on the Japanese exchange. Singapore’s AirCarbon Exchange urged the launch of an exchange based on its platform.

- SIDE DEVELOPMENT:

Carbon pricing panel promotes ideas to boost credit economy

(Japan NRG, June 15)- METI’s panel on carbon pricing has pitched ideas to increase carbon credit supplies and set up secure credit trading mechanisms. METI plans to increase Joint Credit Mechanism (JCM) partners to 30 countries, up from 17, and expand the scheme to private sector projects starting this year on the back of growing interest among multinationals.

- Direct air capture and other carbon removal technologies could also be future credit sources. The national carbon exchange, to be launched next April, is likely to have a slow start and there was a suggestion to hold J-Credit sale auctions to cover a lack of price signals.

TAKEAWAY: The Japanese carbon pricing model allows businesses to set their own emission caps. The world is watching to see if such a system could work or the European Emission Trading Scheme where governments’ sectoral emission targets are more realistic.

Central government pushes back against solar tax

(Mainichi Shimbun, June 13

- The Ministry of Internal Affairs and Communications told the town of Misaka (Okayama Prefecture) to reconsider a plan to tax solar panels.

- Misaka needs Ministry approval for the tax bylaw to take effect.

- Misaka proposed the bylaw in response to concerns about increased erosion and flooding risks on solar farm sites.

- Okayama is home to Japan’s largest solar farm.

TAKEAWAY: Japan NRG has covered this issue closely. If successful, this tax could be extended to other parts of the country and other renewable energy sources. However, as expected, the national government is pushing back, although we expect the tussle to continue for some time yet.

PKS added to sustainable biomass fuel source from April 2024

(Japan NRG, June 16)

- Biomass power operators will be able to use palm kernel shell (PKS) imports from April 2024, provided they obtain third-party certifications. Presently, power supplies covered by the Feed-in-Tariff scheme cannot combust PKS.

- Suppliers’ compliance to human rights, legal and agricultural standards were held in question and power operators will be required to obtain third party certifications of PKS farms and oil extraction plants to qualify for FIT.

Nuclear Regulation Authority issues 13 backfit orders in ten years

(Japan NRG, June 15)

- The Nuclear Regulation Authority has issued 13 ‘backfit orders’ in the past 10 years. Nuclear Regulatory Commission chairman Fuketa said most cases resulted from the overhaul of nuclear safety regulations with the establishment of the NRA ten years ago.

- He added that backfit measures are likely to decrease in coming years unless there are major technology upgrades such as digitization.

- CONTEXT: Backfitting refers to modification of nuclear systems and facilities resulting from regulatory changes.

Tokyo City emissions down due to work-from-home

(Kankyo Business, June 14)

- The Metropolitan Government said that work-from-home has led to a drop in the city’s CO2 emissions, about 2,337 tons a day (9.7% reduction), as fewer cars commute.

- The city claims that further emission reductions are possible as more people embrace telework. Also, such a work-style can reduce energy consumption in offices.

U.S. government backs Mitsubishi hydrogen project

(Nikkei, June 14)

- Mitsubishi Heavy Industries (MHI) said the U.S. Department of Energy gave over $540 million in loan guarantees for a MHI-led energy project in Utah.

- The project will convert a coal-fired power plant to run on gas and build a hydrogen generation facility to enable natural gas/hydrogen co-firing.

- By 2025, the plant will run on a gas blend enriched with 30% hydrogen.

- While the DoE loan guarantees are part of infrastructure goals, it’s unusual for a project with a Japanese company to receive such state support.

Toyota, Toho, Total mull hydrogen venture

(Nikkei, June 13)

- Toyota Tsusho Corp and Toho Gas will partner with TotalEnergies to bring hydrogen to Japan to help clients reduce GHG emissions.

- The three will spend a year researching the viability of establishing hydrogen infrastructure in central Japan.

- The hydrogen would be shipped from overseas.

Asahi Kasei to make lithium-ion battery materials out of CO2

(Nikkei Asia, June 16)

- Chemicals maker Asahi Kasei has developed technology that can make lithium-ion battery materials from CO2. Licensing of the tech begins in fiscal 2023.

- A solvent is produced that can absorb CO2 that’s equivalent to half its weight, thus removing more carbon from the atmosphere than is generated during battery production.

- Manufacturing is simple and can cut costs of battery solvent production by 30%.

- By fiscal 2025, the company aims to switch to plant-derived organic compounds for its solvent raw materials combined with CO2, further lowering emissions.

Solar on public buildings could offer 6 GW of capacity

(Kankyo Business, June 10)

- MoE director Ogasawara believes solar is the most realistic option to roll out renewable capacity in Japan this decade, and the ministry will help it get online.

- The revised government action plan calls for the introduction of PV power generation in about 50% of government-owned buildings by 2030. Local governments will also install solar on 50% of their buildings by the same deadline, with the public sector as a whole expected to add 6 GW of PV capacity.

Mitsui OSK to start sea trials of panamax bulk carrier powered by biofuel from Chevron

(Company Statement, June 10)

- Mitsui O.S.K. Lines (MOL) will start sea trials of Panamax bulk carrier “C.S. OLIVE”, using biofuel.

- MOL inked a biofuel deal with Chevron Singapore; about 500 tons of International Sustainability & Carbon Certification (ISCC) biofuel will be bunkered in Singapore.

- Chevron’s biofuel is blended with Used Cooking Oil Methyl Ester as a 20% to 24% component in the VLSFO.

- SIDE DEVELOPMENT:

Mitsui OSK claims offsets make first “carbon neutral” sea voyage

(Company Statement, June 15)- One of MOL’s car carriers completed a “carbon-offset” voyage. The emissions from the transport of cars from Japan to Europe were offset with voluntary carbon credits.

- This initiative was conducted as a pilot case to study the specific use of carbon credits in ocean shipping to compensate for CO2 emissions.

- CONTEXT: The shipping firm says CO2 emissions during the voyage between Japan and Europe were about 4,000 tons, including from production through consumption of fuel oil. The calculation was verified by assessor Bureau Veritas.

- MOL used carbon credits generated from afforestation projects in Ghana and China.

Shipper NYK ties up with BHP to study ammonia-fueled vessels

(Company Statement, June 10)

- BHP and NYK will study next-gen, zero-GHG emission ships fuelled by green or blue ammonia.

- BHP and NYK will promote GHG emission reduction measures such as energy-saving innovations and technologies.

- The two signed an MoU to work on decarbonisation of ocean transport.

NTT Anode, Mitsuibishi seek to reduce solar curtailment with battery storage

(Company Statement, June 10)

- NTT Anode Energy, Kyushu Electric, and Mitsubishi Corp want to restrict solar power curtailment in Japan using grid-scale battery storage.

- CONTEXT: A large amount of solar power in Japan, especially in the sunny Kyushu area, is wasted as supply exceeds demand at certain times of the day. To balance the two, the grid operator asks solar operators to reduce or curtail output.

- To tackle the issue, the three companies will jointly establish a business model that utilizes grid-scale battery storage, trading the electricity in various markets.

- As a first step, NTT will install a 4.2 MWh li-ion battery in Fukuoka by February 2023.

JERA and Idemitsu may establish hydrogen network in Ise

(Denki Shimbun, June 17)

- JERA and Idemitsu are discussing a proposal to establish a hydrogen supply chain in the Ise Bay area.

- The two parties will examine the logistics and infrastructure challenges involved in increasing hydrogen use in the area, which is home to JERA’s Kawagoe LNG-fired power station and Idemitsu’s Aichi oil refinery.

Cosmo Oil makes first purchase of blue ammonia from ADNOC

(Denki Shimbun, June 16)

- Cosmo Oil, a subsidiary of Cosmo Energy, will purchase “blue ammonia” from Abu Dhabi National Oil Company (ADNOC) of the United Arab Emirates (UAE). Cosmo will use the product at its domestic sites and gain knowledge for building a supply chain. The company will first purchase about 13 tons.

NEWS: POWER MARKETS

Ministry names power retailers that failed to make payments

(Kankyo Business, June 15)

- METI named five retailers that did not make the appropriate payments of levies due on May 31, or comply with additional instructions on the matter. These are:

- Hope Energy (Fukuoka City, Fukuoka Prefecture)

- Mino Shimin Energy (Mino City, Gifu Prefecture)

- IS Energy (Osaka City, Osaka Prefecture)

- New Power Frontier (Osaka City, Osaka Prefecture)

- Kumamoto Electric Power (Kumamoto City, Kumamoto Prefecture)

- IS Energy and Hope Energy have filed for bankruptcy protection. Mino Shimin Energy and Kumamoto Electric announced the suspension of their retail electricity business.

- According to Teikoku Databank, about 10% of “new electric power companies”, which refers to retailers who entered the sector since the 2016 market liberalization, have suspended or withdrawn from contracts as of June 8 due to turmoil in the electricity market caused by soaring fuel prices.

TAKEAWAY: Soaring wholesale electricity prices have put pressure on retail firms that did not have the risk management or hedging tools to handle market price volatility.

According to Teikoku Databank, citing METI, there are now 13,045 “electric power refugees,” clients who are supplied by major power utilities because they are unable to continue their contracts due to the bankruptcy or withdrawal of electric retailers. The data company reported that some 104 power retailers, or 15% of total, have quit the market, gone bankrupt, or stopped offering new contracts in the last year. METI has called the actions of many retailers irresponsible, and is now sure to greatly tighten its oversight of the market.

Utilities promote power saving with points scheme

(Yomiuri Shimbun, June 11)

- Electricity companies are promoting initiatives to encourage power conservation. The goal is to avoid large-scale power outages this summer due to the threat of shortages caused by the shutdown of thermal plants and other factors.

- TEPCO Energy Partners will offer households points based on electricity saved. The points can be converted to e-money and used for purchases. The firm will send an email to households on the evening before power shortages to request a cut in usage.

- Tohoku Electric will offer points worth up to ¥30,000 to users whose consumption for one month decreases by 5% or more compared to the same month of the previous year.

Kyushu Electric pulls out of LNG power project in eastern Japan

(Nikkei Asia, June 14)

- Kyushu Electric Power will withdraw from its partnership with Tokyo Gas to build a 1.95 GW, LNG-fired power plant planned for Chiba Prefecture.

- The company says soaring fuel prices indicates that the investment won’t pay off.

- Nevertheless, Tokyo Gas will go ahead with the plant because it believes the project can open new opportunities with its own large-scale electrical power supply.

- In order to reach decarbonization goals, Tokyo Gas is considering hydrogen to meet part of the plant’s fuel needs.

- CONTEXT: The electric power industry struggles to be profitable. Japan’s 10 major electric utilities benefit from a government program that allows them to pass on increases in fuel costs by raising electricity prices, but within certain limits. Still, high fuel costs have led seven of the 10 companies to hit the limit of what they’re allowed to pass on to consumers.

Mihama reactor to restart ahead of schedule

(Reuters Japan, June 10)

- Kansai Electric, which operates the Mihama NPP (Fukui Prefecture) will restart Unit 3’s reactor in August, two months earlier than planned.

- KEPCO cited energy shortages as the reason for the change.

Tokyo Gas retains rank as biggest power retailer outside major electricity utilities

(Gas Energy News, June 13)

- The Agency for Natural Resources and Energy released February 2022 electricity sales for retailers. Tokyo Gas was first among new market entrants since liberalization in 2016; total sales were 1,406 million kWh, up 16% YoY. The gas firm was also first last year.

- Second place went to Ennet with 1,397 million kWh, up 28% YoY. In third place was ENEOS, up 19% YoY to 868 million kWh.

- In the high-voltage categories, Ennet topped the list. Tokyo Gas led in the low-voltage category, followed by SB Power and Osaka Gas.

Mitsubishi consortium plans 910 MW offshore wind project in Akita area

(New Energy Business News, June 14)

- Four companies led by Mitsubishi Corp Energy Solutions released the Environmental Assessment Methodology for a 910 MW offshore wind power project off the Coast of Yurihonjo City, Akita Prefecture. Construction is planned to start in April 2029.

- The project area is designated as a promotion area, and covers 13,040 hectares that would hold 65 wind turbines. Commercial operation is expected to start in December 2030. The foundation will be a landing-type, 1,600-ton self-elevating work barge.

- CONTEXT: The Mitsubishi consortium won the Yurihonjo area auction in December 2021, with a bid for an 819 MW development and a power price of ¥11.99/ kWh.

Green Power Invest to develop a 630 MW offshore wind

(New Energy Business News, June 17)

- The MoE submitted its opinion on the Environmental Assessment Consideration Statement for a 630 MW offshore wind project off the coast of Isumi City, Chiba Prefecture, planned by Green Power Investment. The opinion requests that the impact on seaweed beds and marine life be avoided or minimized.

- The project will install up to 45 wind turbines on 8,431 ha off the coast of Isumi City. Construction will start in 2029, and operation in 2032.

Fukushima prefecture explores potential for new geothermal binary power projects

(New Energy Business News, June 14)

- Geothermal Technology Development Co. was tapped to do a feasibility study at a geothermal binary power project at Fukushima Prefecture hot spring. The study will run until March 15, 2023.

TEPCO renewable power and Mitsui Oil to test new geothermal power technology

(Company Statement, June 13)

- TEPCO Renewable Power and Mitsui Oil Exploration will employ a new heat recovery technology in geothermal power.

- Unlike conventional geothermal power generation, which extracts hot water and steam from the ground to generate electricity, the new technology is designed to recover only the heat by forming a loop of wells in the hot underground rock layer and circulating water and other substances from the surface.

- This method does not require creating fractures that allow water to pass through, thus thereby reducing the difficulty of exploration, the lead time to development, and the environmental impact.

- The two companies plan to test the technology as soon as 2025.

Kansai Electric plans 92 MW wind farm in Hokkaido area

(New Energy Business News, June 13)

- Kansai Electric plans a 92 MW wind farm near Otaru, Hokkaido.

- The Environmental Assessment Consideration Report lists an area of 2,267 hectares near Otaru City.

- 22 wind turbines will be installed. Construction will be 36 months.

TAKEAWAY: This is at least the third wind power project planned by the utility in the Hokkaido area, with several near to each other. It will be interesting to see how Kansai Electric secures grid access in an area under Hokkaido Electric’s influence.

J-Power plans wind power project in Kochi area

(New Energy Business News, June 15)

- J-Power released the Environmental Impact Assessment Brief for a 50.6 MW wind power project around Kunimi Mountain, Kochi Prefecture. Operation is expected to start in March 2028.

- The project area is about 391 ha around Kami City, Motoyama Town, Nagaoka County, and Otoyo Town, Nagaoka County. 21 wind turbines will be deployed. Construction is from June 2023 to March 2028.

- Eurus Energy’ Eurus Otoyo Wind Farm is located 4.4 km northeast of the site.

- SIDE DEVELOPMENT:

J-Power to drill wells to search for new geothermal resources in Miyagi area

(Kankyo Business, June 16)- J-Power started a large-diameter well drilling survey in the Takahinatazan area of Osaki City, Miyagi Prefecture, to search for new geothermal power generation sites. The survey period is from June to March 2025.

- The survey is supported by JOGMEC and follows successful tests with smaller wells.

Invernergy plans to develop wind farm in Iwate area

(New Energy Business News, June 16)

- Invenergy plans to develop a 220 MW wind farm near Ninohe City, Iwate Prefecture.

- The project will be connected to the same transmission line at two locations in Ichinohe Town and Ninohe City. The project will cover about 1,400 ha, with up to 36 wind turbines installed. Construction will take about four years.

Itochu unit to co-fire coal plants with woody biomass

(Kankyo Business, June 10)

- In autumn 2022, Itochu Enex will do a woody biomass co-firing test at a coal-fired power plant operated by subsidiary Hofu Energy Service in the Yamaguchi Prefecture.

- The company will use “black pellets” or semi-carbonized wood pellets, which can be co-fired with coal to reduce emissions. The co-firing rate will vary from 2.5% to 10%, with the amount rising based on operating performance.

Idemitsu starts up 73 MW of solar in California

(Denki Shimbun, June 16)

- A unit of Idemitsu Kosan has built and started operating a 73 MW solar plant in California, U.S.. Idemitsu Kosan inked a long-term power purchase agreement with a local power company.

- CONTEXT: This is the fourth solar power plant that Idemitsu Kosan owns in the U.S. With the new plant, and Japanese facilities, the company now has 700 MW of solar capacity installed globally.

Vena Energy, Shikoku Electric and Toho Gas partner on an offshore wind project

(Kensetsu Tsushin Shimbun, June 13)

- Vena Energy, Shikoku Electric, and Toho Gas launched a consortium to promote an offshore wind power project in the Sea of Japan off the Aomori Prefecture coast (south side). It started procedures based on the Environmental Impact Assessment Law.

Windmills interfering with military radar

(Chugoku Shimbun, June 11)

- Wind turbines can interfere with military radar used by Japan’s Self Defense Force to warn of missile strikes.

- While details are unavailable, the government has to date turned down or forced the amendment of over 10 wind farm proposals.

Finland’s largest wind farm goes online

(Denki Shimbun, June 17)

- Kansai Electric said the Piiparinmaki wind farm, Finland’s largest onshore wind farm, has begun generating electricity.

- KEPCO owns 15% of the 210 MW farm, with KEPCO’s share of total generation capacity amounting to 30 MW.

Will Japan’s nuclear stations make a comeback?

(International Environment and Energy Institute, June 14)

- CONTEXT: This is an opinion piece by IEEE chief researcher Takeuchi Junko.

- The Ukraine crisis and divestment from fossil fuels means Japan could soon face energy shortages.

- Even though pumped hydro reservoirs virtually dried up on Jan. 6 amidst cold weather, the government maintains that Japan’s electricity grid has sufficient capacity. However, had the cold weather continued for one more day, some subscribers would have definitely lost power.

- As the process of restarting an idle nuclear power plant can take several months, there is a need for urgent debate about the future role of nuclear energy before it is too late.

NEWS: OIL, GAS & MINING

Asian LNG prices hit two-month high on mounting supply woes

(Bloomberg, June 17)

- Natural gas supply disruptions around the globe pushed Asian prices to their highest level in two months, threatening to further strain economies and accelerate inflation.

- Asian spot LNG prices last week rose above $30 per Mmbtu for the first time since April, the highest for this time of year, and a roughly 50% jump in the last month.

- Competition for LNG cargoes between Europe and Asia is intensifying.

TAKEAWAY: See the Analysis section for a detailed look at Japan’s LNG supply situation.

Japan’s Idemitsu to slash oil refining capacity as cars go electric

(Nikkei Asia, June 14)

- Idemitsu Kosan, Japan’s second-largest oil wholesaler, will shut its refinery in Yamaguchi Prefecture by April 2024.

- The rise of more fuel-efficient vehicles has cut demand for gasoline.

- The Yamaguchi refinery accounts for 13% of Idemitsu’s total refining capacity.

- Idemitsu will consider converting the plant into a base for next-generation energy sources such as hydrogen and ammonia.

- CONTEXT: With fuel efficiency and electrification improving, demand for gasoline is decreasing. According to the Petroleum Association of Japan, the country’s crude oil processing capacity as of the end of March 2021 was 3,457,800 barrels per day — a 35% decrease over the last 20 years. Japan’s refineries are aging and smaller than those of South Korea and other neighboring countries, and their export competitiveness is not high.

TAKEAWAY: At a time when many other countries, like the U.S., are suddenly short of oil refining capacity, Japan continues a steady reduction of domestic output. If the trend away from gasoline and diesel vehicles to electric and hybrid continues, then this makes sense. The outlook for fuels in other transport sectors such as shipping and aviation also points to lower crude oil demand in the future. While the risk remains of the transition slowing down, another factor that Japanese oil refineries have to consider is the declining population. The big question for the oil refining companies is what place they can carve out in the new energy landscape.

Enechange invests in US nickel-zinc battery developer

(Company Statement, June 16)

- Enechange will invest in U.S.-based ZincFive, a developer of a high-power nickel-zinc battery. The investment was made through Japan Energy Fund’s (JEF) Decarbonized Tech Fund managed by Japan Energy Capital.

- ZincFive’s financing round includes funding from OGCI Climate Investments, among other current and new investors.

Automakers seek to slash use of rare earths in Evs

(Nikkei X-Trend, June 14)

- Automakers have revived efforts to eliminate or cut down on the use of rare earths in EV motors. The industry is concerned that their EV strategies do not match the recent sharp rises in raw material prices and a shortage of supply.

- Rare earth’s supply is unevenly distributed. China accounts for the bulk, posing geopolitical risks.

- Suppliers are split on whether to develop motors that don’t use rare earths at all, or simply seek reducing their use in permanent magnet motors. Raw material supply can’t keep up with demand and EV sales targets will be affected, said an automaker executive.

May crude oil imports up 27%, LNG 16%, coal 7%; import values soar on prices, forex

(Customs Data, June 16)

- Japan’s May crude oil imports were 12 million kiloliters, up 26.7% YoY; LNG 5.8 million tons, up 16.3%; and thermal coal 8.5 million tons, up 7.1%. Crude oil import value soared to ¥1 trillion, up 147.2%; LNG ¥601 billion, up 154.7%; and thermal coal ¥327 billion, up 249.9%. The import values surged due to higher commodity prices and the weaker yen against the U.S. dollar.

LNG stocks rise to 2.31 million tons

(METI Data, June 15)

- LNG stocks stood at 2.31 million tons as of June 12, up from 2.14 million tons a week earlier. The end-June stocks last year were 2.04 million tons. The five-year average of end-June stocks is 1.95 million tons.

ANALYSIS

BY JOHN VAROLI

Wary of Russia LNG Supply Risk, Japan Looks at Options Elsewhere

Within 10 years, all of Japan’s current contracts for LNG from Russia will expire. The longest of these, set for 24 years, will end during 2031, though volumes will start to drop five years prior to that. Unless the supply deals are renewed.

How Japan proceeds regarding continued ownership of its Russian LNG assets is a complex issue. There currently isn’t a solution, and bar any major agitations either from allies or the Kremlin, it’s not a situation that will find resolution any time soon.

Japan needs a Plan B should Russian LNG supplies stop becoming an option either in the short or the longer term. The political action of recent months suggests that this Plan B amounts to sponsoring growth in LNG exports from the U.S.

An accident at one of the key U.S. LNG export hubs, however, has put a dent in that plan. Neither is it the first major setback Japan has received in recent years when seeking new volumes of LNG from around the world.

Strategists in Tokyo know that Plans C, D and probably several others are needed if Japan is to enjoy the luxury of options around its LNG future and to safeguard the country’s energy security.

Japan’s LNG Setbacks

| Country | Project Details | Issues |

| Mozambique | TotalEnergies leads the $20 billion development of a 13.12 million ton / year projects; Mitsui and JOGMEC have a 20%; Japan’s state and private banks are due to co-finance $14.4 billion in investments; JERA, Tokyo Gas and Tohoku Electric are among the LNG buyers | The project was due to start exports in 2024 until attacks by Islamic State terrorists led to a suspension of all work in April 2021. Subcontractors had only started to return recently, but fresh attacks by militant groups occurred this month. |

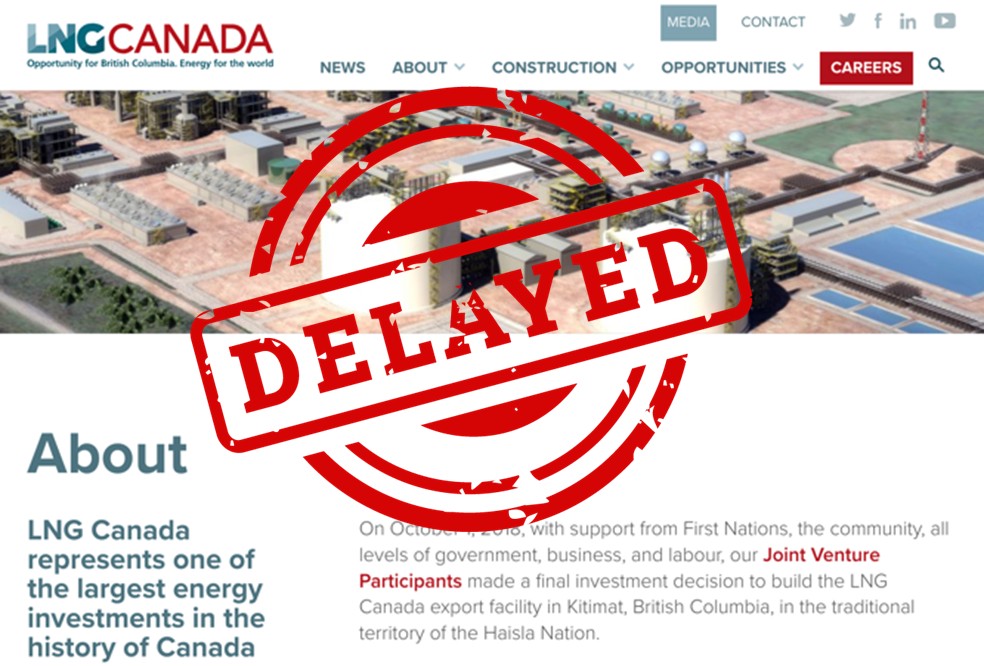

| Canada | Shell leads the $30 billion LNG Canada project, which was due to start LNG exports to Asia in early 2024; Mitsubishi Corp. has a 15% stake; JERA and Tokyo Gas are among the contracted buyers from Canada LNG | Dispute over costs of a feedgas pipeline threatened to delay competition;Deliveries are already pushed back into 2025 |

| Indonesia | The Abadi LNG project is based on an INPEX discovery and is slated to produce 9.5 million tons / year; INPEX owns 65% of the project and Shell the rest, with initial plans for a production start in the latter 2020s | Shell has announced plans to exit the venture and in May this year, INPEX revealed it would push back even the FID stage to the close of this decade, casting doubt on the viability of the development |

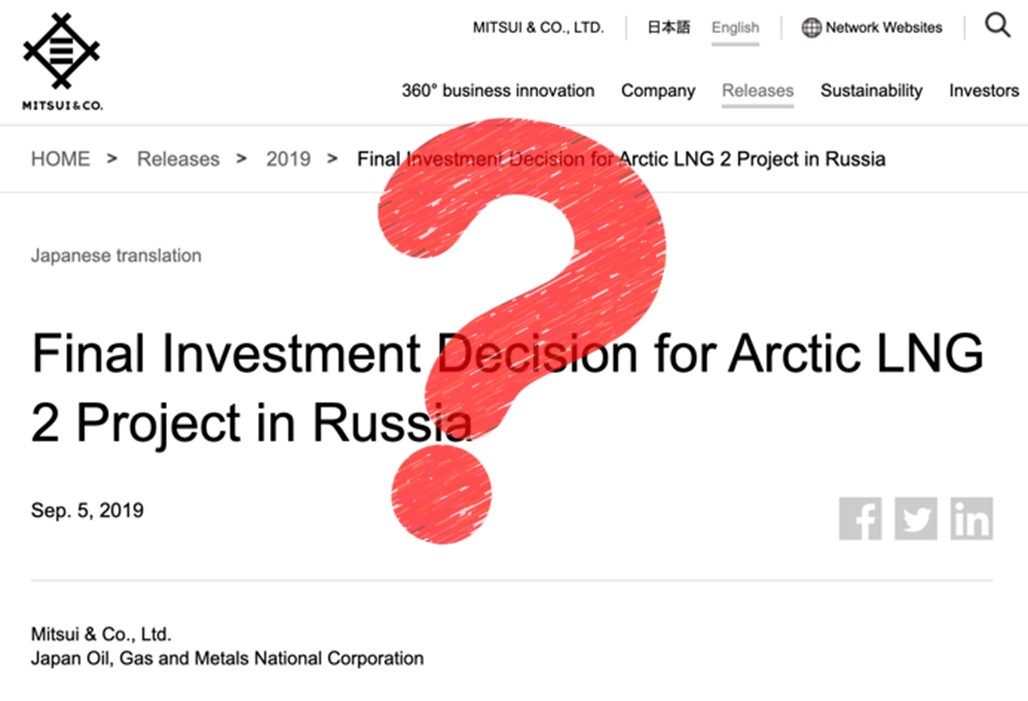

| Russia | In addition to the producing Sakhalin I and Sakhalin II sites, Japan has invested in the development of the $23 billion Arctic LNG 2 project, which was originally due to start exporting in 2023; Mitsui and JOGMEC combined have a 10% stake; Japanese private banks were due to be among the major financiers and power utilities among the LNG buyers | Japan Bank for International Cooperation has suspended its loan to the project and most other foreign financing is now frozen. Reports say the number of workers at the site has dropped rapidly. The 2023 schedule is now in flux. |

Time for a change

In the past few years, the global push for decarbonization led Japan to cut its own outlook for LNG usage over the coming decade. Still, the country remains one of the top two buyers in the world and with China’s economy stilted by lockdowns this year, Japan is once again the world’s top buyer.

Russia’s invasion of Ukraine and the sanctions that followed have not prevented Japan from procuring LNG from its northern neighbor. However, in line with G7 allies, Japan has committed to phasing out purchases of oil and coal from Russia. Some want Japan to go further and eradicate all Russian energy imports, and while Prime Minister Kishida and METI have held steadfast in maintaining a status quo regarding LNG, the uneasy truce may not last. The threat of Moscow kicking out Japanese investors from the operating Sakhalin II LNG project, voiced by the chair of Russian Parliament only last month, is just one of the risks to an unraveling.

With that in mind, President Joe Biden and the U.S. government have been keen to offer Tokyo an alternative LNG supply. After entering the White House on a green agenda, the Biden Administration has performed a sudden and unexpected softening in attitude towards LNG, seeing the need to punish Russia as more important.

In a May 23 statement, Biden and Kishida emphasized “the significant role U.S. Liquid Natural Gas plays in alleviating global supply constraints and welcomed investment by U.S. industry to increase oil and natural gas production.”

These words were widely welcomed and endorsed at Reuters’ “Global Energy Transition 2022” conference last week in Brooklyn, New York. Top global energy executives spoke, and there was a sense of relief that natural gas is back in the political establishment’s good graces. However, many energy executives cautioned that the political establishment has to cease its wild love-hate fluctuations on gas, because it’s difficult to plan and invest amid such uncertainty.

For its part, leaders in Tokyo are eager to finance and debt-guarantee LNG export capacity expansion. Preference will go to Japan-linked projects, but it would be a win almost irrespective of where the LNG is sold. Either way avoids a costly and unproductive tussle between European and Asian buyers for the few available LNG cargos in the current market.

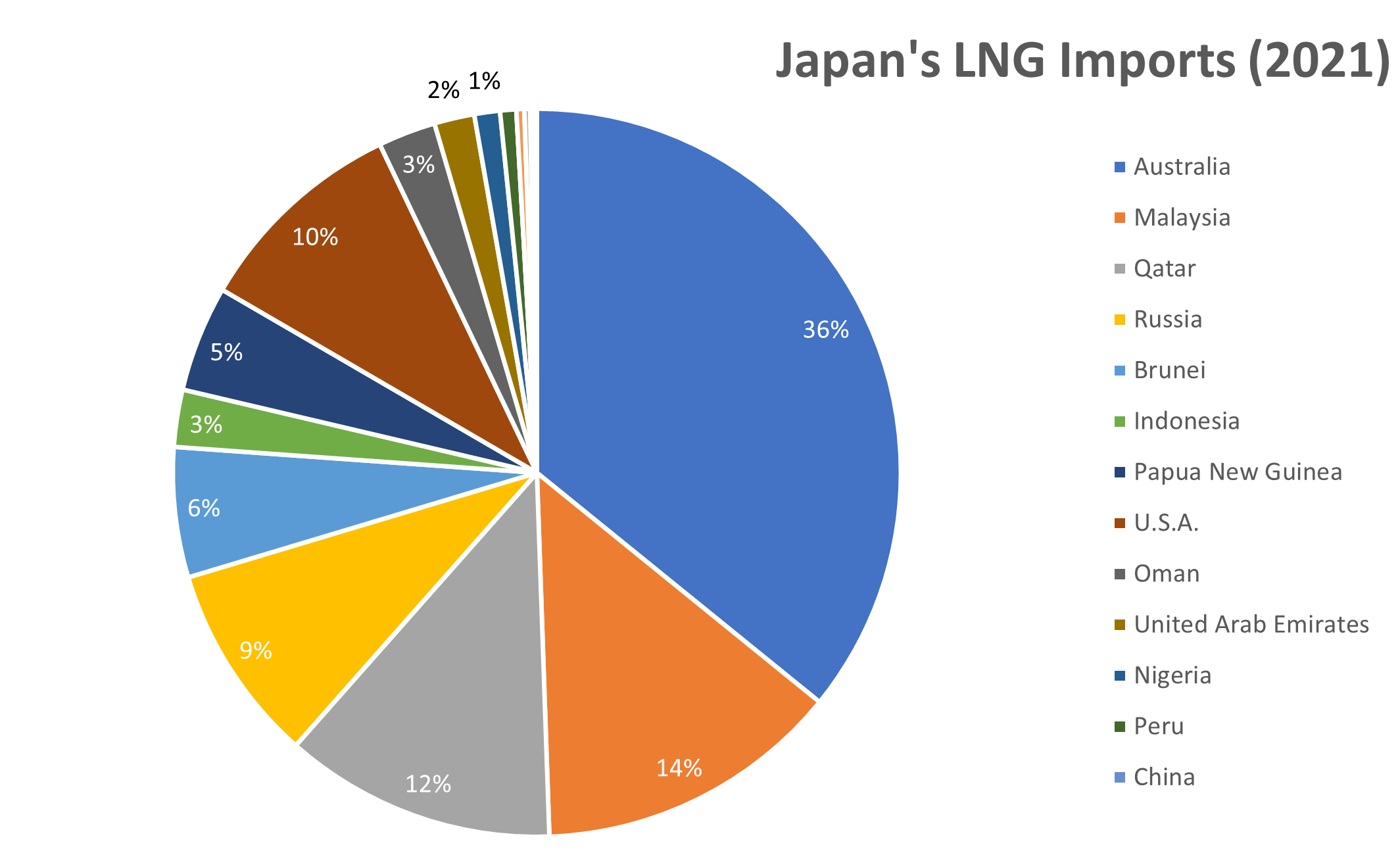

Source: Customs Data

America to the rescue

There are nearly a dozen LNG projects in the works in the Gulf of Mexico area, and Japan is keen to be a major beneficiary of this new supply.

By 2026, the U.S. plans to build LNG liquefaction capacity of 220 million tons per annum (mtpa), and expansion projects of existing facilities will add 30.3 mtpa. That’s 57% of the global total of LNG liquefaction capacity additions planned between 2022 and 2026, according to analytics firm GlobalData.

“The plans of several European countries and Japan to reduce their dependence on Russian gas post Ukraine invasion would further boost liquefaction developments in the U.S.,” said Himani Pant Pandey, an oil and gas analyst at GlobalData

The U.S. Energy Information Administration says that U.S. LNG exports will surpass 11 billion cubic feet per day (bcfd) by the end of 2022; which is roughly 22% of global LNG demand, according to Goldman Sachs.

In fact, the U.S. is on its way to surpassing the world’s top two LNG producers — Australia and Qatar. For example, Houston-based Cheniere Energy, the largest U.S. LNG exporter, has signed numerous long-term deals in the past few months.

Boosting investment in U.S. LNG

On top of the Russian LNG contracts expiring within 10 years, other Japanese LNG supply deals are also close to maturity. Last December, JERA allowed 5.5 million tons of Qatari contracts to expire, seeking to find alternatives with less onerous terms around delivery and resale.

This situation gives the U.S. a good opportunity not only to take over the 9% of Japan’s market that is currently held by the Russian-origin LNG, but seek other gains. Unlike Qatari terms, for example, U.S. sellers tend to allow flexible pricing mechanisms that are not linked to crude oil. Also, U.S. LNG doesn’t have a destination clause, allowing Japanese buyers the right to resell to anyone.

The government in Tokyo has even hinted that it is ready to boost investment in existing U.S. projects through state-owned Japan Oil, Gas and Metals National Corp. (JOGMEC). Japan-backed U.S. projects include the Cameron LNG development in Louisiana and Freeport LNG in Texas.

Another is Venture Global LNG, which recently released financing details for its $13 billion export facility, also in Louisiana. Sumitomo Mitsui is one of banks financing it.

Black swan(s)

One of the largest expansion projects that Japan hoped to promote in the U.S., however, has suffered a setback. Earlier this month there was a fire at the Freeport facility, which together with Cameron and one more project are due to account for the bulk of the export expansion.

Initially, Freeport LNG saw a three week pause to exports. The latest assessment says its terminal will require at least three months to restart, and only then, partially.

What the incident underlines for the buyers in Japan is the need for diversity of sources. After all, that principle has long been the basis of Japan’s energy security, and an offer from the U.S. to underwrite any shortfall from Russian LNG exports cannot be the only solution, no matter how neatly it looks on paper.

In just the last two years, LNG market disruptions have included a lack of available ships; the blocking of key canals due to bottlenecks and a grounded tanker; natural disasters; sudden temperature changes; war; and unexpected drops in output from other energy sources such as hydro, wind and solar. All these can disrupt delivery even from the most reliable seller.

In public, Japan will talk up the potential of U.S. LNG. In private, there will be a mad dash to secure at least a few other options, just in case.

ANALYSIS

BY MAYUMI WATANABE

Paper Ethanol: A Bioethanol Game Changer?

In recent years Japan has been tepid on bioethanol, with annual consumption of only about 800,000 kiloliters, most of it imported from Brazil. To put things into perspective, that’s just 20% of India’s total consumption.

Even more indicative of the fuel’s lack of popularity, Japan’s local production is negligible – about several thousand kiloliters annually. In fact, so small that the government doesn’t even collect data on it.

Fifteen years ago, however, bioethanol was all the rage, with national and local governments, as well as the agricultural sector, eager to cut emissions, increase farm income and promote ecotourism. Those dreams, however, went bust due to production inefficiency. Many projects were abandoned.

Even recently, Nagano City dropped a bioethanol plan from its biomass strategy. The company behind the project went bankrupt. Despite all these setbacks, there are new signs that give reason to think that bioethanol has a future in Japan.

Japan has over supply of scrap paper

The organic fuel is getting a second lease on life as businesses scramble to build their own energy supplies. One of the most interesting concepts is the use of scrap paper to produce bioethanol that is cellulose-based, replacing crops that conflict with the food chain.

Cellulose contained in paper is converted into glucose, and then further to ethanol by fermentation. Japanese national and local governments are happy to see major companies now venturing into this niche. Until recently, paper ethanol was solely the domain of small recyclers but they lacked the financial muscles to scale it up.

Collecting scrap paper in Japan is relatively easy. The country produces mountains of it, in fact, between 18-22 million tons collected nationwide each year. Of that figure, 16-18 million tons are reused as paper and other products. The balance, around 2-5 million tons, is exported mainly to Asia.

In 2008, the government set a strategy to promote biofuels, urging oil refineries and automakers to cooperate. After a push from METI minister Amari Akira to revamp biofuel production technologies, oil refineries have started to see biofuel as opportunities rather than simply about lessening fossil fuel demand.

For example, to develop “secondary bioethanol” technology using cellulose ethanol, ENEOS has partnered with Oji Paper, and Cosmo Oil with Biomaterial in Tokyo Co and Sanyu Plant Service.

From 2014 to 2019, the projects received funding from New Energy and Industrial Technology Development Organization (NEDO), which said that while it’s common to reuse corn and sugarcane wastes for secondary production, no country has succeeded in the reuse of wood products. This is now precisely where Japan stands a chance.

Last year, ENEOS made moves to commercialize cellulose ethanol production, and the company is now partnering with Toppan Printing to research a joint paper ethanol production launch. The keys to successful secondary paper ethanol production are finding the right combination of the types of cellulose feed, glucose, yeast and fermentation environment, and building systems for mass production.

The project brings together ENEOS’ knowledge of cellulose feed combinations, and Toppan’s experience in separating, filtering and processing scrap paper into the suitable cellulose feedstock. If feasibility studies prove successful, they’ll launch paper-ethanol production in 2027.

Meanwhile, Sumitomo Mitsui Financial Group is supporting Green Earth Institute’s paper ethanol plan. GEI collects shredded paper from businesses, turns it into bioethanol and further to clinical-grade sanitary alcohol, which is returned to the paper suppliers. Other important players include Biomaterial in Tokyo Co. that runs a 3,000 kl/year bioethanol production plant. This company produces bioplastics as well.

Source: “cane_field_pylon” by CIAT International Center for

Tropical Agriculture is licensed under CC BY-SA 2.0

Lessons from the boom and bust

While several companies have had to shutter their operations, at the same time, more and more bioethanol plants are being repurposed to produce food-grade alcohol. What lessons have been learned for emerging players?

Past bioethanol products were focused on opposite ends of Japan – Okinawa Islands in the south, and Hokkaido in the north. Okinawa was producing sugarcane, and biofuel was a strong option to cut transport emissions since the islands didn’t have trains.

In 2005, with the Environment Ministry’s backing, Miyakojima Island in the Okinawa area launched a bioethanol project, and Asahi Breweries followed in 2006 on Iejima Island, in the same prefecture. Miyakojima production grew to 6,000 kl/month, which is 10% of the island’s gasoline consumption.

However, the project was plagued by high running costs, notably for sugarcane waste disposal. The key to success is feed supply stability, production and energy efficiency, cost control, and environmental sustainability. The Okinawa projects failed due to high operational costs and sustainability issues.

Up north, Hokkaido produces sugar beets, and the Ministry of Agriculture, Forestry and Fisheries (MAFF) has backed local bioethanol projects using the red root. However, Hokkaido Bioethanol, which launched a 15,000 kl/year production, closed its business in 2015.

MAFF attributed Hokkaido’s failures also to high operational costs of over ¥200/liter, twice the target price of ¥80-100/liter, and unstable beets supplies. Beet production fell due to bad weather. Global grain price hikes limited availability of off-grade wheat supplies that could have replaced the beets.

Another factor to consider is that Japan has resisted genetically engineered crops with stronger resilience to climate changes and bearing molecule structures optimal for ethanol production. In comparison, the U.S. bioethanol industry grew partly due to rapid adaptation of genetically modified crops.

However, biotech regulations are gradually easing in Japan and since 2019 it has been possible to grow genome-edited crops under regular government reviews. Nevertheless, farming communities have blocked efforts to plant new varieties, claiming they were akin to radiation contamination, which leads to consumer panic over any farm products from the area.

The strength of paper ethanol is stable local feedstock supply. There are challenges, however, such as separating out the unqualified feed. Developing the optimal yeast for fermentation, and treating waste water and residue after the ethanol extraction also require solutions.

Toppan Printing and its partner are working on a “continuous production process” to address the waste issue. If the Toppan-ENEOS joint venture is successful, then it will not only be a game changer in bioethanol, but it will create a robust industry that METI will be compelled to closely monitor.

GLOBAL VIEW

BY JOHN VAROLI

Below are some of last week’s most important international energy developments monitored by the Japan NRG team because of their potential to impact energy supply and demand, as well as prices. We see the following as relevant to Japanese and international energy investors.

Australia/ Renewable energy

BP will buy 40.5% of the Asian Renewable Energy Hub in Western Australia. At a cost of $30 billion, the project will develop 26 GW of solar and wind power, equivalent to 33% of the country’s total generating capacity. Green hydrogen production is expected to total 1.6 million tons a year.

Canada/ Oil deal

BP decided to quit the Canadian oil sands, selling its 50% stake in the Sunrise oil project in northern Alberta to Calgary-based Cenovus Energy. The deal is valued at $466 million.

China/ Natural gas

Gas supplies from Russia’s Gazprom increased by 67% in the first five months of this year. In total in 2021, Russia exported 16.5 bcm of gas to China. The gas was sent to China via the Power of Siberia pipeline that launched in 2019.

Germany/ Gas infrastructure

Berlin is working with German banks to build a rescue loan package worth as much as €10 billion for Gazprom Germania, the subsidiary of the Russian gas giant seized by the German state last month. A new company will be formed called Securing Energy for Europe GmbH.

India/ Green hydrogen

TotalEnergies acquired a 25% stake in renewables company Adani New Industries with the goal of creating the world’s largest green hydrogen ecosystem. ANIL plans to invest about $50 billion in green hydrogen during the next 10 years. Phase 1 calls for developing green hydrogen production of 1 million tons a year before 2030.

Nigeria/ Bribery case

JPMorgan Chase won a $1.7 billion High Court lawsuit brought by the Nigerian state over payments to a former minister. The case centers on transfers from a government account to Malabu Oil and Gas, a Nigerian company controlled by Dan Etete, a former Oil Minister.

Russia/ gas

Gazprom will make more cuts in gas supplies via the Nord Stream 1 pipeline to Europe. Germany’s economy minister described the move as political and economic warfare. Gazprom, however, blames delays getting Siemens Energy equipment that is undergoing maintenance in Canada.

UK/ Oil merger

Legal and General Investment Management (LGIM), the UK’s biggest asset manager, has “strong reservations” about Capricorn Energy’s proposed £1.4 billion merger with rival Tullow Oil, saying there’s “no clear strategic rationale”. Other major investors also said the deal heavily favors Tullow’s shareholders.

UK/ Prices at the pump

The country’s watchdog, Competition and Markets Authority, will investigate competition in the retail fuel market as prices soar. Last week the average cost of filling a 55-liter family car reached £100, up from £71 a year ago.

U.S./ Natural gas

Freeport LNG, one of the world’s largest LNG export terminals, will be offline for at least 90 days, following an explosion last week. The company hopes to return to full service in late 2022. U.S. natural gas futures plummeted and European prices surged on the news. In other gas news, billionaire-founder Harold Hamm offered to take shale producer Continental Resources private at a $25 billion value. This would be the biggest shale sector deal since the surge in natural gas prices this year.

U.S./ Oil production

The White House has had little success convincing the oil industry to raise production, now at about 11.6 million b/d. Pre-pandemic, that figure was almost 13 million b/d. The U.S. Energy Information Administration expects to reach 11.9 million b/d by year’s end.

U.S./ Rare earths processing

The Department of Defense signed a $120 million deal with Australia’s Lynas Rare Earths to build a domestic rare earths separation facility in Texas, as part of efforts to counter China, which has almost 90% of global refining of rare earths and more than 50% of rare earths mining, according to the IEA.

2022 EVENTS CALENDAR

A selection of domestic and international events we believe will have an impact on Japanese energy

| January | OPEC quarterly meeting;JCCP Petroleum Conference – Tokyo;

EU Taxonomy Climate Delegated Act activates; Regional Comprehensive Economic Partnership (RCEP) Trade Agreement that includes ASEAN countries, China and Japan activates; Indonesia to temporarily ban coal exports for one month; Regional bloc developments: Cambodia assumes presidency of ASEAN; Thailand assumes presidency of APEC; Germany assumes presidency of G7; France assumes presidency of EU; Indonesia assumes presidency of G20; and Senegal assumes presidency of African Union; Japan-U.S. two-plus-two meeting; Japan’s parliament convenes on Jan. 17 for 150 days; Prime Minister Kishida visits Australia (tentative) |

| February | Chinese New Year (Jan. 31 to Feb. 6);Beijing Winter Olympics;

South Korea joins RCEP trade agreement |

| March | Renewable Energy Institute annual conference;Smart Energy Week – Tokyo;

Japan Atomic Industrial Forum annual conference – Tokyo; World Hydrogen Summit – Netherlands; EU New strategy on international energy engagement published; End of 2021/22 Japanese Fiscal Year; South Korean presidential election |

| April | Japan Energy Summit – Tokyo;MARPOL Convention on Emissions reductions for containerships and LNG carriers activates;

Japan Feed-in-Premium system commences as Energy Resilience Act takes effect; Launch of Prime Section of Japan Stock Exchange with TFCD climate reporting requirement; Convention on Biological Diversity Conference for post-2020 biodiversity framework – China; Elections: French presidential election; Hungarian general election |

| May | World Natural Gas Conference WCG2022 – South Korea;Elections: Australian general election; Philippines general and presidential elections |

| June | Happo-Noshiro offshore wind project auction closes;Annual IEA Global Conference on Energy Efficiency – Denmark;

UNEP Environment Day, Environment Ministers Meeting – Sweden; G7 meeting – Germany |

| July | Japan to finalize economic security policies as part of natl. security strategy review;China connects to grid 2nd 200 MW SMR at Shidao Bay Nuclear Plant, Shandong;

Czech Republic assumes presidency of EU; Elections: Japan’s Upper House Elections; Indian presidential election |

| August | Japan: Africa (TICAD 8) Summit – Tunisia;Kenyan general election |

| September | IPCC to release Assessment and Synthesis Report;Clean Energy Ministerial and the Mission Innovation Summit – Pittsburg, U.S.;

Japan LNG Producer/Consumer Conference – Tokyo; IMF/World Bank annual meetings – Washington; Annual UN General Assembly meetings; METI to set safety standards for ammonia and hydrogen-fired power plants; End of 1H FY2022 Fiscal Year in Japan; Swedish general election |

| October | EU Review of CO2 emission standards for heavy-duty vehicles published;Chinese Communist Party 20th quinquennial National Party Congress;

G20 Meeting – Bali, Indonesia; Innovation for Cool Earth TCFD & Annual Forums – Tokyo; Elections: Okinawa gubernational election; Brazilian presidential election; |

| November | COP27 – Egypt;U.S. mid-term elections;

Soccer World Cup – Qatar; |

| December | Germany to eliminate nuclear power from energy mix;Happo-Noshiro offshore wind project auction result released;

Japan submits revised 2030 CO2 reduction goal following Glasgow’s COP26; Japan-Canada Annual Energy Forum (tentative); Tesla expected to achieve 1.3 million EV deliveries for full year 2022 |

Disclaimer

This communication has been prepared for information purposes only, is confidential and may be legally privileged. This is a subscription-only service and is directed at those who have expressly asked K.K. Yuri Group or one of its representatives to be added to the mailing list. This document may not be onwardly circulated or reproduced without prior written consent from Yuri Group, which retains all copyright to the content of this report.

Yuri Group is not registered as an investment advisor in any jurisdiction. Our research and all the content express our opinions, which are generally based on available public information, field studies and own analysis. Content is limited to general comment upon general political, economic and market issues, asset classes and types of investments. The report and all of its content does not constitute a recommendation or solicitation to buy, sell, subscribe for or underwrite any product or physical commodity, or a financial instrument.

The information contained in this report is obtained from sources believed to be reliable and in good faith. No representation or warranty is made that it is accurate or complete. Opinions and views expressed are subject to change without notice, as are prices and availability, which are indicative only. There is no obligation to notify recipients of any changes to this data or to do so in the future. No responsibility is accepted for the use of or reliance on the information provided. In no circumstances will Yuri Group be liable for any indirect or direct loss, or consequential loss or damages arising from the use of, any inability to use, or any inaccuracy in the information.

K.K. Yuri Group: Oonoya Building 8F, Yotsuya 1-18, Shinjuku-ku, Tokyo, Japan, 160-0004.