JAPAN NRG WEEKLY

AUG. 14, 2023

JAPAN NRG WEEKLY

Aug. 14, 2023

NEWS

TOP

- Anti-wind mayor elected in Miyagi Pref

- Japan to release treated Fukushima water in late Aug/ early Sept

- Toshiba’s tender begins with a Japan consortium led by private equity firm JIP bidding about ¥2 trillion

- June’s electricity futures market volumes decline

ENERGY TRANSITION & POLICY

- Four EPCOs submit improvement plan to METI over cartel issue

- METI presents policy proposal at industrial council meeting

- Engineering major JGC issues ¥10 billion green bond

- Toyo Engineering strikes license deal with KBR for ammonia to hydrogen cracking

- NR-Power launches pilot VPP with decentralized security system

- Idemitsu, Hatch Blue to explore carbon opportunities

- Mitsui extends JV with Celanese for methanol production

ELECTRICITY MARKETS

- Power futures trading volumes drop on EEX and TOCOM in June

- Clean Energy Connect: ¥12 billion for offsite corporate PPA

- IPP share of retail power sales drops to 17.7%

- Kyushu Electric: High-voltage customers to face market prices

- KEPCO’s Takahama NPP Unit 2 to restart mid-September

- Toyota Tsusho builds solar plant in Benin, first for Japan in Africa

- Renewable Japan acquired solar power station in Spain

OIL, GAS & MINING

- Namibia rare earth plan to be formed with JOGMEC

- Sumitomo inks deal with Woodside on gas projects and decarbonization

- Japan, Angola ink investment protection agreement

ANALYSIS

HOKKAIDO’S SILICON VALLEY HINGES ON

ENERGY ADJUSTMENTS

Semiconductor firm Rapidus plans a factory in Japan’s northernmost region, which offers vast amounts of land at a low price and a cool climate suitable for manufacturing. However, to create a chip manufacturing hub from scratch it will also have to be powered by clean energy. Can Hokkaido turn into the next Silicon Valley in tandem with developing its clean energy infrastructure?

ENERGY JOBS IN JAPAN:

CONTRACT Vs PERMANENT HIRING

As the energy market changes and grows, the talent shortage is clearly apparent. For firms new to Japan and uncertain about project volume and staffing needs, as well as companies with a fluctuating workload, employing temporary contract workers can be an attractive solution. Like many things in Japan, however, from the business culture to square watermelons, contract employment is not quite the same as in many other countries.

GLOBAL VIEW

A wrap of top energy news from around the world.

EVENTS SCHEDULE

A selection of events to keep an eye on in 2023.

JAPAN NRG WEEKLY

PUBLISHER

K. K. Yuri Group

Events

Editorial Team

Yuriy Humber (Editor-in-Chief)

John Varoli (Senior Editor, Americas)

Mayumi Watanabe (Japan)

Wilfried Goossens (Events, global)

Kyoko Fukuda (Japan)

Filippo Pedretti (Japan)

Regular Contributors

Chisaki Watanabe (Japan)

Takehiro Masutomo (Japan)

SUBSCRIPTIONS & ADVERTISING

Japan NRG offers individual, corporate and academic subscription plans. Basic details are our website or write to subscriptions@japan-nrg.com

For marketing, advertising, or collaboration opportunities, contact sales@japan-nrg.com For all other inquiries, write to info@japan-nrg.com

OFTEN USED ACRONYMS

| METI | The Ministry of Economy, Trade and Industry | mmbtu | Million British Thermal Units | |

| MoE | Ministry of Environment | mb/d | Million barrels per day | |

| ANRE | Agency for Natural Resources and Energy | mtoe | Million Tons of Oil Equivalent | |

| NEDO | New Energy and Industrial Technology Development Organization | kWh | Kilowatt hours (electricity generation volume) | |

| TEPCO | Tokyo Electric Power Company | FIT | Feed-in Tariff | |

| KEPCO | Kansai Electric Power Company | FIP | Feed-in Premium | |

| EPCO | Electric Power Company | SAF | Sustainable Aviation Fuel | |

| JCC | Japan Crude Cocktail | NPP | Nuclear power plant | |

| JKM | Japan Korea Market, the Platt’s LNG benchmark | JOGMEC | Japan Organization for Metals and Energy Security | |

| CCUS | Carbon Capture, Utilization and Storage | |||

| OCCTO | Organization for Cross-regional Coordination of Transmission Operators | |||

| NRA | Nuclear Regulation Authority | |||

| GX | Green Transformation |

NEWS: ENERGY TRANSITION & POLICY

Anti-wind mayor elected in Miyagi Pref

(Government statement, Aug 7)

- Voters in the Kami Township of Miyagi Pref elected Ishiyama Keiki, a former ruling party lawmaker who has called for cancellation of wind projects in the town.

- CONTEXT: In June, residents filed an injunction against the incumbent mayor, alleging that he signed an unfair property lease with an operator planning a 42 MW wind project. The project is owned by ENEOS and Tohoku Electric.

TAKEAWAY: Pressures on renewables projects are mounting in Miyagi Pref. On July 19, the local govt and the Ministry of Internal Affairs and Communications discussed a new tax on renewables operators clearing forest areas in the prefecture. There will be more elections in the next three months in municipalities where wind projects are dividing communities. At this moment, the main complaints locally seem to be directed at onshore wind developments.

| Elections | Wind projects | Election dates |

| Matsushima Town Mayor | Miyagi Pref is promoting the coastal area as an offshore wind zone. | Aug 27 |

| Shichigahama Town Mayor | Aug 27 | |

| Shiogama City Mayor | Aug 27 | |

| Taiwa Town Mayor | 60 MW Taiwa Wind (Eurus Energy) | Oct 1 |

| Onagawa Town Mayor | 50 MW Onagawa Ishinomaki Wind Farm (Orix) | Oct 22 |

Japan to release treated Fukushima water in late Aug/ early Sept

(Japan NRG, Aug 7)

- Japan plans the release of treated radioactive water from the Fukushima NPP into the sea in late August or early Sept; a final decision will be made after PM Kishida returns from a trilateral summit with the U.S. and South Korea next week.

- Kishida will explain the discharge plan to President Biden and South Korean President Yoon on Aug 18.

- Kishida will meet with relevant ministers upon returning home on Aug 20 to determine the specific date of the water release.

- SIDE DEVELOPMENT:

Japan to test seafood daily for tritium following Fukushima water release

(Nikkei Asia, Aug 11)- Japan plans to test seafood daily for tritium following the release of treated water from the Fukushima Daiichi NPP. The Fisheries Agency will conduct the tests near the plant and publish results within two days.

- Initial pre-release testing showed no detectable tritium concentrations. The frequency of testing will be evaluated after two months, based on detection results.

- Seafood from the area within a 10-km radius of the plant is not currently supplied for human consumption. The agency previously conducted comprehensive tests, which found tritium concentrations below detectable levels.

Four EPCOs submit improvement plan to METI over cartel issue

(Jiji, Aug 10)

- Kansai Electric (KEPCO), Chugoku Electric, Kyushu Electric, and Kyuden Mirai Energy submitted improvement plans to METI over a suspected sales cartel.

- In July, METI issued improvement orders to these companies and Chubu Electric, citing frequent and prolonged information exchange on sales strategies that negatively impacted the electricity market’s development.

- The improvement plans include creating manuals for communication with other utilities to prevent cartels and strengthening audit functions through external experts.

- In late March, the Japan Fair Trade Commission ordered Chubu Electric, Chugoku Electric, and Kyushu Electric to pay more than ¥100 billion in fines for violating antitrust laws. KEPCO, which self-reported the violation, was not fined.

- Chubu Electric, Chugoku Electric, and Kyushu Electric will contest the fines.

METI presents FY2024 policy proposal at industrial council meeting

(Denki Shimbun Aug 7)

- METI unveiled proposals for FY2024’s economic and industrial policies during a General Assembly of the Industrial Structure Council that’s chaired by Tokura Masakazu of the Japan Business Federation (Keidanren), and serves as an advisory body to METI.

- METI reaffirmed Fukushima’s recovery as a top priority and emphasized goals such as the GX and ensuring stable energy supply.

- Support for renewables includes measures in the fields of perovskite solar cells and floating offshore wind power.

- Efforts towards decarbonization involve expanding hydrogen and ammonia usage while creating a supportive regulatory framework for industrial growth. The strategy also outlines gradual expansion of the “GX League,” a carbon credits trading platform overseen by METI, and the realization of international initiatives like the Asia Zero Emission Community (AZEC).

- During the assembly, Kokubun Bunya, a Committee Member and Chairman of Marubeni, noted that there is a projected surge in electricity demand due to digitalization. He highlighted the importance of grid enhancement and nuclear power plant restarts. On nuclear energy, he stressed the necessity of thorough discussions on matters like Small Modular Reactors (SMRs) introduction.

Used cooking oil supplies decrease in FY2022 as restaurants cut oil consumption

(Japan NRG, Aug 9)

- Used cooking oil (UCO) supplies decreased in FY2022 as restaurants and households cut oil consumption to save costs, according to the Japan Federation of UC Oil Business Cooperation Associations.

- In FY2022, 380,000 tons of UCO were generated, down 5% from 400,000 tons a year earlier. Out of the 380,000 tons, 360,000 tons were collected. The collected amount was also down 5% from a year ago.

- 120,000 tons were exported, flat from last year.

- UCO export prices in June softened to ¥159.2/kg from an all time high of ¥199.1/kg in Oct last year. The EU, which had been the biggest UCO buyer, has cut imports on concerns over “fake UCO” from China.

UCO consumption breakdown

| FY2022 | FY2021 | |

| Exports | 32% | 31% |

| Livestock feed | 49% | 51% |

| Industrial chemicals | 12% | 13% |

| Domestic fuel | 4% | 2% |

| Unrecyclable grade | 3% | 3% |

- CONTEXT: Japan’s UCO demand will potentially rise above 2.3 million tons/year as over 1.5 million tons/year are required for sustainable aviation fuel. In an effort to increase its supplies, oil collection from households through local municipality offices and supermarket chains, as well as recovering oil from wastewater, have been strengthened since 2017.

TAKEAWAY: The UCO classification changed to industrial feedstock from industrial waste recently, allowing market entry from retail and other businesses that do not have waste treatment licenses. High UCO prices driven by strong export demand is another strong incentive to collect the oil. The UCO export price was ¥70.4/kg in April 2021 before the EU demand boom.

- SIDE DEVELOPMENT:

Ito-Yokado collects used cooking oil from Tokyo households

(Company statement, Aug 3)- Ito-Yokado supermarket began collecting used cooking oil (UCO) from households in Tokyo, partnering with ENEOS, Seven & I Group, 7-Eleven Japan, Nomura Jimusho, Yoshikawa Oil, etc. The UCO will be processed into SAF and other products.

- ENEOS and Nomura Jimusho will provide consumers with dedicated returnable bottles that can be repeatedly used to collect UCO. Yoshikawa Oil will process and refine the UCO and supply it to ENEOS to produce SAF.

- CONTEXT: Demand for UCO has been increasing, to be used in SAF production. Several companies seek ways to collect UCO routinely from food industries and restaurant chains. But UCO from households has not yet been included and is often discarded. Once this experimental plan works well, Seven & I hopes to expand the measures to its 22,800-store network in Japan.

JGC issues ¥10 billion green bond

(Company statement, Aug 9)

- Engineering major JGC HD will issue its first green bond in September, for a total of ¥10 billion; the funds will be invested in production of SAF from used cooking oil, to develop polymerization technology with CO2 and micro-orgasms, as well as production facilities for high-efficiency and high output power modules for EVs.

- Nomura, SMBC, Daiwa, and Mizuho Securities will be lead managing underwriters, and the structuring agent will be Nomura Securities.

Toyo strikes license deal with KBR for ammonia to hydrogen cracking

(Company Statement, Denki Shimbun, Aug 4)

- Toyo Engineering agreed with KELLOGG BROWN & ROOT LLC of the U.S. to use the latter’s licensed technology to convert (crack) ammonia into hydrogen. The two signed an MoU.

- KBR has an estimated 50% global market share in ammonia to hydrogen cracking technologies, while Toyo Engineering has worked with the U.S. company for over 50 years in EPC contracts.

- The two partners will promote their end product to clients encompassing power utilities that use hydrogen-firing gas turbines and firms supplying hydrogen to fuel cell vehicles (FCV).

- With KBR’s license, Toyo Engineering hopes to start commercial scale operation of ammonia-to-hydrogen cracking by 2027.

- CONTEXT: Ammonia is easier to transport and store compared to hydrogen, but contains hydrogen bonds.

NR-Power Lab to launch pilot VPP with world’s first decentralized security system

(Japan NRG, Aug 9)

- In 2024, NR-Power Lab plans a pilot virtual power plant (VPP) with the world’s first decentralized power source identification system; with commercialization in 2026.

- Developed by CollaboGate Japan, this system is a type of blockchain to authenticate individual power sources by issuing IDs. This is expected to reduce cyber security costs that inflate as the number of power sources and users increase.

- The VPP consists of CollaboGate Japan’s ID platform, Sassor’s AI-based energy forecast and management systems, storage batteries and other devices. Hokkaido Electric, a user of NGK’s sodium sulfide storage batteries, will join as an observer.

- The project locations will likely be in Hokkaido or the Kanto area.

- CONTEXT: NR-Power Lab is a JV of NGK Insulators and Ricoh focusing on VPPs.

TAKEAWAY: VPPs raise energy efficiency by balancing supply with demand, and bundling small varied power sources in an area. They’re getting more traction as it becomes more difficult to launch large renewables projects in Japan. However, they could be exposed to higher cybersecurity risks as power sources diversify. Also, security system costs rise as operator liabilities, as defined in METI guidelines, expand.

Idemitsu, Hatch Blue to explore carbon opportunities

(Company statement, Aug 7)

- Idemitsu Kosan and U.S.-based blue carbon investor Hatch Blue agreed to explore ocean-based carbon capture opportunities in Japan. Idemitsu will also invest in Hatch’s Blue Revolution Fund.

- CONTEXT: Japan launched the J Blue Credit system in 2020, covering carbon that’s incorporated into marine ecosystems, such as seagrass. A total of 21 projects were awarded “blue” offset credits to date.

TAKEAWAY: The biggest “blue” carbon development in Japan so far is Sumitomo Corp’s Hirono Town Seaweed Project (Iwate Pref) that earned credits equivalent to 3,106 tons of CO2. Japan’s blue carbon potential is estimated at 4-5 million tons/ year, according to the Ministry of Land, Infrastructure, Transport and Tourism.

Mitsui extends JV with Celanese for methanol production

(Nikkan Kogyo, Aug 8)

- Mitsui extended until 2045 its JV with chemical company Celanese (U.S.) that produces low-carbon methanol from captured CO2 at a Texas plant.

- Annual production capacity will grow by 130,000 tons to around 1.63 million tons; the upgraded facilities will incorporate up to 180,000 tons of recovered CO2 per year.

- Fairway Methanol uses natural gas and CO2 from nearby factories as raw materials.

- CONTEXT: In July, Mitsui also invested in Kasso MidCo, a Danish company producing low-carbon methanol with renewable energy-derived electricity and biomass-derived CO2.

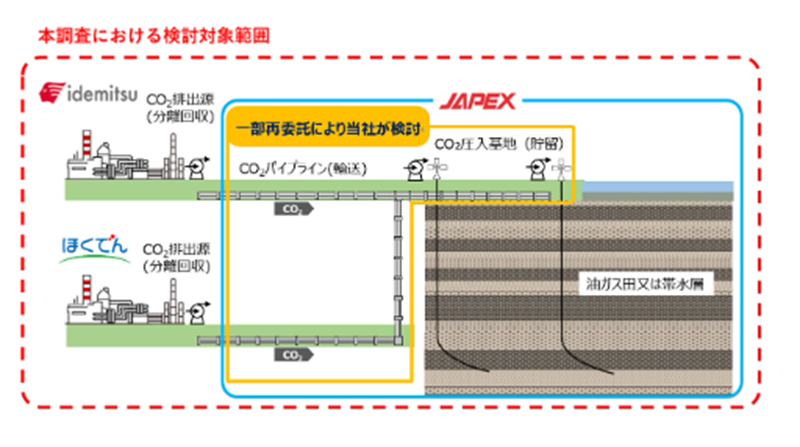

JFE Engineering awarded CO2 pipeline injection at Tomakomai CCS

(Company statement, Aug 9)

- JAPEX chose JFE Engineering to transport CO2 through a pipeline and design a CO2 injection station. This JOGMEC project researches carbon capture and storage in Tomakomai, Hokkaido; Idemitsu and Hokkaido Electric Power are also involved.

- JAPEX asked JFE to handle R&D of CO2 transportation and storage for the project (see yellow box below).

- JFE is a major pipeline builder and has experience of injecting CO2 deep underground.

Skylark HD opens its first zero-emission restaurant in Tokyo

(Company statement, Aug 8)

- Skylark HD opened a new “Gusto” brand restaurant in Higashi Murayama equipped with roof-top solar. It claims to use CO2-free electricity and “carbon-neutral” city gas.

- The roof-top solar can provide 30% of the restaurant’s energy. The remainder will be sourced from CD Energy Direct with non-fossil certification.

- CONTEXT: Skylark has over 2,900 restaurants across Japan under different brands such as Bamiyan, Syabu-yo, Jonathan’s, Yumean, and Gusto. Once this trial is successful, Skylark says it will push other restaurants in its group to embrace zero-emission measures.

Eurus Energy was CO2-free in 2022

(Company statement, Aug 9)

- Eurus Energy group posted zero CO2 emissions in FY2022, a third year in a row with such results.

- Eurus has 50 offices and 45 operational wind and solar power stations in Japan.

- All these facilities sourced electricity from 100% renewables sources, qualifying for non-fossil fuel certification.

NEWS: POWER MARKETS

Toshiba takeover begins with JIP consortium bid worth about ¥2 trillion

(Company statement, various media, Aug 7)

- Toshiba announced a tender offer by a consortium led by private equity firm Japan Industrial Partners (JIP). The offer is ¥4,620 per share and it’s valid for 30 business days until Sept 20. The offer will be deemed successful if more than two-thirds of the voting rights of total shares are tendered.

- Following a successful offer, Toshiba will undergo a period of delisting and aim for growth under the leadership of the JIP consortium. The total value of the offer for Toshiba is about ¥2 trillion.

- The consortium is led by JIP, but includes a number of major Japanese industrial companies, some of which have business relations or wish to pursue joint opportunities with Toshiba. These include ORIX, ROHM, and NGK Insulators. It’s anticipated that Chubu Electric will also participate.

- CONTEXT: After a series of management and financial scandals, Toshiba in 2017 raised new capital from a number of activist funds, which have subsequently called on the company to take drastic measures to revamp its business. In part due to a difference of opinions between Toshiba stakeholders, the company has decided to delist and then restructure.

TAKEAWAY: Toshiba is one of Japan’s main companies in the energy industry, involved in everything from R&D of new-gen solar cells, hydrogen systems, power generation plants, VPPs and the cleanup at the Fukushima Daiichi NPP site. The company has been hampered in recent years with shareholder disputes and operating and financial scandals, but its restructuring is expected to play a big role in a number of energy fields, including nuclear. The government has not given up on the idea of creating a national leader in nuclear tech on the basis of several companies and Toshiba could play a role there.

Power futures trading volumes drop on EEX and TOCOM in June

(Japan NRG, Denki Shimbun, Aug 8)

- In June, the power futures trading volumes dropped both on the EEX and the TOCOM platforms.

- EEX saw its trading volume decline by 28.7% compared to the previous month to 984.84 GWh. This is the first time the volume dipped below 1,000 GWh since December 2022.

- Trading on JPX’s TOCOM platform decreased by 54.6% compared to the previous month, reaching 99.28 GWh. This significant drop is in part due to the highs reached in May, which posted the second-highest monthly trading volume since the market’s inception.

- A restraint in spot electricity price increases and volatility likely contributed to lower hedging demand. This was most pronounced in the East Area Baseload contracts.

- While trading volumes decreased, open interest (positions that have not been offset by opposite trades) increased by 9.4% from the previous month, reaching 411.75 GWh, the highest in at least five months and the third-highest ever.

TAKEAWAY: For a historical overview of futures market volumes, please see our monthly Data Book report, published in the first few days of each month.

Clean Energy Connect financed ¥12 billion for offsite corporate PPA projects

(Company statement, Aug 4)

- Clean Energy Connect secured ¥12 billion from SBI Shinsei Bank and Japan Green Investment (JICN) to finance plans to develop non-FIT (feed-in-tariff) low-voltage solar power generation.

- The goal is to build 700 sites for offsite corporate PPAs.

- Clients of Clean Energy Connects are members of the RE100 and are eager to introduce clean energy to achieve decarbonization goals.

IPP share of retail power sales drops to 17.7%

(Government data, Aug 8)

- As of March, independent power providers (IPP) had 17.7% share of the power retail market, falling 21.3% YoY.

- IPPs had a 23.8% share of low-voltage services for consumers and small businesses; 18.7% of high-voltage services and 6.8% of ultra-high voltage services for industry.

- As of March, there were 721 power retailers.

- SIDE DEVELOPMENT:

ANRE’s suggestions to improve competition

(Government statement, Aug 8)- ANRE summarized discussions to prevent former regional power monopolies, (EPCOs), from accessing customer data of IPPs connecting to their networks.

- Proposed measures include separating the EPCOs from IPPs, and conducting third-party reviews to ensure that IPP data is protected; keeping access records of sensitive data and reviewing them regularly.

- As far as the idea to fully separate the power transmission arm of EPCOs from their groups, ANRE said it’s not realistic because it possibly violates constitutional asset rights [of EPCOs]. There may be problems during emergencies; and securing investment will be more difficult as separate entities.

Kyushu Electric: High-voltage customers to face market prices from FY2024

(Denki Shimbun, Aug 8)

- Kyushu Electric introduced a new standard menu for high-voltage and above power contracts that reflects price fluctuations in the wholesale power market.

- Effective from Oct 1, this will incorporate monthly market price fluctuations due to sourcing a certain amount of electricity from the wholesale (spot) market.

- Existing high-voltage customers will switch to pricing that reflects market price fluctuations from FY2024.

- This move is expected to accommodate most of Kyushu Electric’s customers, including those seeking a final guarantee of supply from Kyushu Electric’s transmission and distribution uni, as well as those wishing to switch from new electricity providers.

METI launches panel to oversee new balancing market design

(Denki Shimbun, Aug 10)

- The Energy Agency and regional organizations began the detailed design of a new balancing market that would merge trades in kilowatt-hours (electricity) and delta kilowatts (supply-demand adjustment), offering a product for a week before actual supply/demand through to the day-before.

- This initiative was discussed at an expert meeting held by METI, which is also closely monitoring progress in unifying the central supply instruction system that’s been undertaken by power transmission and distribution companies.

- The ministry’s goal is to confirm the new market plan, conduct a cost-benefit analysis, and assess its validity within about a year. This would allow for the operational launch of the market no earlier than FY2028.

- CONTEXT: The rationale for the new market is that it would be more efficient at utilizing various power sources and it will need to take into consideration not only generation itself but the time and cost of starting electricity plants.

KEPCO’s Takahama NPP Unit 2 to restart on Sept 15

(Asahi Shimbun, Aug 8)

- After 47 years of operation, KEPCO’s Takahama NPP’s Unit 2 began loading fuel into its reactor. If all goes well, the NPP restarts on Sept 15 after a 12-year hiatus.

- Since the Fukushima disaster, this is the first time KEPCO operates all seven of its prefecture-based NPPs at full capacity.

- The reactor has met post-Fukushima regulations and became Japan’s third unit to operate for over 40 years, after Mihama NPP Unit 3 and Takahama NPP Unit 1.

- CONTEXT: Unit 2 began operating in 1975. It secured approval for extended operation in 2016.

Toyota Tsusho to build 25 MW solar plant in Benin, first for Japan in Africa

(Company statement, Aug 10)

- Toyota Tsusho and Beninese Electricity Production Co will build a 25 MW solar power plant in Benin. This is Japan’s first major renewables project in West Africa.

- The 25 MW solar plant, built with Germany’s RMT, will be completed in 2024.

- CONTEXT: Toyota Tsusho has experience with renewables in Africa, including a large geothermal power plant in Kenya and a wind project in Egypt. Benin has a plan to develop renewables, aiming to install 150 MW of solar capacity by 2026.

- SIDE DEVELOPMENT:

Renewable Japan acquired solar power station in Spain

(Company statement, Aug 7)- Renewable Japan acquired the 5.4 MW Quinanos Solar Power station via its 100% subsidiary, RJ Euro-development The station has been in operation since Feb 2022.

- In 2022, RJ acquired the 21.6 MW Socovos Power Station and the 8 MW Torrijos Power Station, both in Spain.

JRE submitted a new Hokkaido wind power plan

(Company statement, Aug 8)

- Japan Renewable Energy (JRE) sent its environmental assessment plan to METI for the Imakane Setana Wind Power Project in Hokkaido. The document is available for public reviewing from Aug 8 to Sep 7.

- JRE plans to build a 129 MW onshore wind station with 30 turbines (each 4.3 MW) in the towns of Imakane, Setana, and Yakumo located in southwest Hokkaido. Construction starts in 2030; operations in 2033.

- CONTEXT: In Setana and nearby, three wind farms are already in operation (total 63 MW). Nine more projects are planned and currently under review (total 2.7 GW).

- Capacities vary from 12 KW to 1 GW, and are developed by JRE, J-Power, J-Wind, Invenergy Wind, Cosmo Eco Power, and Renova/ Mitsubishi Material.

- SIDE DEVELOPMENT:

Eurus Energy plans to replace wind power station in Kagoshima

(Company statement, Aug 10)- Eurus Energy submitted to METI its plan to replace Kihoku Wind Power Station in Kagoshima, (Kagoshima Pref), and Kaya, Tarumi, and Kirishima cities.

- Currently, the Kihoku station has 16 wind turbines, to be replaced by six 4.3 MW turbines, with a total 20.8 MW generation capacity.

Marubeni, Chubu Electric and Terras Energy complete biomass power plant in Aichi Pref

(Company statement, Aug 9)

- Marubeni, Chubu Electric, and Terras Energy began operations at the Aichi Gamagori Biomass Power Plant in Gamagori Town, Aichi Pref.

- This 50 MW capacity biomass power facility employs woody biomass as its fuel source and will yield about 340 GWh of electricity annually.

Balmuda starts testing small-scale wind turbines

(Company statement, Aug 7)

- Balmuda, a kitchen appliances maker, will test small-scale wind turbines starting in the fall. Dr Chuji Arakawa, Vice President of the World Wind Energy Association and honorary professor of Tokyo University, will be senior advisor.

- Balmuda has been exploring energy projects since it launched an electric fan, “DC GreenFan”, in 2010 that consumes only 10% of electricity compared to similar products by developing special blade designs.

- Balmuda’s multi-blade turbine scales up the blades that were originally designed for DC GreenFan in order to create small (less than 1 meter in diameter) but powerful wind turbines.

NEWS: OIL, GAS & MINING

Namibia rare earth plan to be formed with JOGMEC

(Government statement, Aug 8)

- On Aug 8, METI and Namibia’s Ministry of Mines and Energy agreed to expand bilateral mining sector cooperation, especially for rare earth metals. The agreement was made during the METI minister’s visit to the country.

- JOGMEC will help in writing the plan. Next year, the countries plan to hold an event in Japan that’s focused on Namibia’s mining prospects.

- The countries also discussed collaborating on clean hydrogen production.

- CONTEXT: This may mark the start of a new era in Japan’s engagement in Africa’s mining sector, which hitherto has been focused on opportunities in South Africa.

Major Japanese rare metal investments in Africa

| Company | Country | From | Project name | Minerals |

| Sumitomo Corp. | Madagascar | 2005 | Ambatovy | Nickel/cobalt |

| Nippon Denko | South Africa | 2013 | Kudamane | Manganese ore |

| Sumitomo Corp. | South Africa | 2013 | Assmang | Manganese, iron, and chrome ore |

| Hanwa | South Africa | 2019 | Waterberg | Platinum group metals |

| Withdrawn | ||||

| Nippon Denko | South Africa | 2002-2017 | SAJ Vanadium | Vanadium |

Sumitomo inks deal with Woodside on gas projects and decarbonization

(Company statement, Aug 8)

- Sumitomo inked agreements with Woodside Energy in Australia.

- For $500 million, Sumitomo will acquire a 10% stake in the offshore Scarborough gas field, and will install a floating production unit with multiple wells for gas extraction.

- Sumitomo and Woodside will also collaborate on new energy projects, such as ammonia, hydrogen, CCS, forestry, and carbon management technology.

Japan, Angola ink investment protection agreement

(Government statement, Aug 9)

- Japan and Angola signed an agreement to protect Japanese investments in the country.

- Angola is the sixth African country to sign an investment agreement with Japan.

- CONTEXT: Japan’s trade ties with Angola have room to grow. In 2022, Japan imported 157,963 kiloliters (1.1 million barrels) of crude oil and just 62,344 tons of LNG

LNG stocks fall for fourth week, running to 1.87 mln tons

(Government data, Aug 9)

- LNG stocks of 10 power utilities stood at 1.87 million tons as of August 6, down 2.6% from 1.92 million tons a week earlier, and falling for four weeks running. The July 30 stocks were first reported at 1.93 million tons, but METI corrected the figure.

- The 1.87 million tons were the lowest since 1.76 million tons on April 17 last year.

- The end-August stocks last year were 2.75 million tons. The five-year average for this time of year was 2 million tons.

ANALYSIS

BY MASUTOMO TAKEHIRO

Hokkaido’s Silicon Valley Dream Hinges On Energy Adjustment

Can Hokkaido turn into the next Silicon Valley? The state-backed semiconductor firm Rapidus unveiled a plan to establish a factory in Japan’s northernmost region, which offers vast amounts of land at a low price and a cool climate suitable for manufacturing. However, there are mounting challenges to overcome, including energy-related ones.

Founded in August last year, Rapidus aims to quickly become a top player in the semiconductor sector, (Rapidus meaning “swift” in Latin). The Tokyo-based firm was formed with a modest investment of ¥7.3 billion from eight prominent Japanese companies, including Toyota, NTT, Sony, SoftBank, Kioxia, Denso, NEC, and Mitsubishi UFJ Bank. Additionally, Rapidus has received ¥70 billion in government subsidies, with METI potentially injecting an additional ¥300 billion.

Rapidus envisions creating a “Hokkaido Valley” stretching from Ishikari, a new hub for data centers, to Tomakomai, a major port on the Pacific coast. It will encompass Sapporo, a city of two million, and Chitose, the area around the main international airport for Hokkaido. The establishment of a new cutting-edge chip factory should lure makers of production equipment and materials to the area, further boosting the local economy. Coupled with TSMC’s preparation for chip production in Kumamoto, the Hokkaido initiative is expected to complement Japan’s overall semiconductor strategy.

The key thing to keep in mind is that semiconductor manufacturing is one of the world’s most energy intensive industrial processes. It has also traditionally been one of the most polluting, with chip foundries running mainly on baseload thermal power. The main buyers of chips, however, are the world’s top tech companies such as Apple and Google, which have announced commitments to a net-zero supply chain by the end of this decade. That means that the Rapidus project will not only need to create a world-leading chip manufacturing hub almost from scratch. It will also have to be powered by clean energy.

The conditions could help spur a major rollout of renewables in the Hokkaido area.

Govt announces formation of Team Sapporo-Hokkaido to promote clean energy in the region

BACKGROUND

In June this year, Hokkaido Prefecture and Sapporo City created a “Team Sapporo-Hokkaido”, composed of 21 companies including Hokkaido Electric, Hokkaido Gas, financial companies, etc., to act as a local arm of the national GX (green transformation) strategy. This is the first such regional GX hub and shows the importance that PM Kishida’s government has attached to the industrial potential of Hokkaido and its ability to act as a magnet for new clean energy developments, including in financing.

A very rapid timeline

Rapidus is slated to begin construction on the Chitose site in September, aiming to have an early test line for two-nanometer (2nm) advanced chip in 2025, followed by full-scale production in 2027. The president of Rapidus, Koike Atsuyoshi, an ex-Hitachi executive, stated in a recent interview that the company plans three to four manufacturing facilities on the site.

Such a quick development would be almost impossible to conduct with Japan’s resources alone. That’s why this project is founded on a broad collaboration between Japan, the U.S., and the EU. IBM will act as the main developer of the advanced 2nm chips. Rapidus staff have already started to travel to the Albany Nanotech Complex, IBM’s semiconductor research facility in New York. Also, Rapidus and the Belgian research institute, IMEC, announced their long-term collaboration, with the former seeking guidance on extreme ultraviolet (EUV) lithography, a vital technology for semiconductor manufacturing.

On the financial front, Rapidus would require an investment of ¥2 trillion for the prototype launch by 2025, and an additional ¥3 trillion by 2027 for full-scale production. However, it remains unclear who will shoulder this burden. Rapidus intends to pursue an IPO eventually.

During a semiconductor sector event in 2022, Prime Minister Kishida made a surprise appearance and stressed the importance of the chip industry in supporting domestic industries sustainably. Furthermore, he recently promised to provide “necessary support” to Rapidus.

Nonetheless, skepticism about the project’s success remains. Despite maintaining a significant share of the semiconductor manufacturing equipment and materials industries, Japan is considered to be 20 years behind in terms of cutting-edge chip production. There are questions regarding who will develop the new technologies, how IBM’s lack of manufacturing input will be compensated for, whether a broad range of highly skilled personnel can be acquired, and the lack of specific customers beyond automotive manufacturers.

Rapidus says it will adopt a new business model called Rapid and Unified Manufacturing Service, (RUMS), wherein they handle all aspects of chip production, from design to manufacturing and implementation, based on customer semiconductor product plans.

Still, despite the company’s frequent use of flashy new terms, its business model is ambiguous.

Powering the revolution

To produce semiconductors a large amount of stable electricity supply is needed. Environmentally conscious firms such as Microsoft and Apple demand fully green energy sources for chip production, which means Rapidus cannot rely on the current backbone of Japan’s energy system – the fleet of coal and gas-fired power stations.

In this regard, Hokkaido is well-positioned. Among Japan’s 47 prefectures, it boasts one of the highest potentials for renewable energy. On the Sea of Japan side, strong winds throughout the year make it optimal for offshore wind power generation. The government has already selected five locations, including off the coast of Ishikari and Hiyama, as “promising areas” for renewable energy development. Construction of a mid-size 112 MW offshore wind power farm off the coast of Ishikari began in July.

Onshore wind power is also promising. Half of the national potential for onshore wind capacity is concentrated in Hokkaido. The nation’s top wind power player, Eurus Energy, is developing one of Japan’s largest onshore power generation facilities (47.5 MW) in the prefecture.

Small and medium-scale hydropower generation is also feasible, while the flat lands of the island make Hokkaido suitable for utility scale solar despite its northern location.

Hokkaido Governor Suzuki set a 2050 net-zero emissions target for the prefecture even before then PM Suga made it a national pledge in late 2020.

Turning this green energy potential into reality won’t be straightforward. Similar to other regions in Japan, opposition to renewable energy facilities has emerged in various areas of Hokkaido due to concerns about the impact on landscape and nature. A recent onshore wind project planned by trading house Sojitz in Otaru City was canceled for that very reason.

Hokkaido Electric is also closely watching Rapidus, having established a dedicated organization to provide it with energy supply services. While it is unclear how much energy Rapidus will consume, by 2027 the local utility hopes to be able to finally switch on its Tomari Nuclear Power Plant, which has been dogged by regulator inspections for about ten years.

President Saito Susumu noted in a recent media interview: “Of course, we will procure renewable energy and increase the amount. We will also promote nuclear power (to Rapidus).” The utility currently holds 1.79 GW of renewable energy capacity, mainly in hydropower. But renewables accounted for only 14% of its total electricity sales in FY2021.

A catalyst for change

Even with a substantial increase in renewable energy generation, the demand for electricity in Hokkaido remains low. Most green power projects to date have imagined the buildout of new power lines to connect Hokkaido with the mainland, especially with the Tokyo metropolitan area that houses most of the population and industry.

The government has plans to build an undersea grid system that would cater to new offshore wind farms east and north of Hokkaido. The plan was approved by PM Kishida-led GX Implementation Council in December 2022, which set a completion target for 2030.

According to the undersea grid plan, transmission lines able to carry 4 GW of power capacity would stretch from the Sea of Japan side and a further 2 GW of lines would lie on the Pacific side. However, the distance between Hokkaido and Tokyo is over 1,000 kilometers and the cost and logistics of such an overtaking are expected to be challenging. Current estimates suggest at least two to four trillion yen would need to be put aside.

In addition, a strong buildout of storage batteries would also be required to balance out the variable generation from wind farms, according to Hokkaido Electric.

With such cost comes also the challenge of apportioning payment. Many fear that ultimately the costs will be passed on to consumers, packaged as a necessary green premium.

A way to lower the infrastructure investments would be to bring energy intensive industries closer to the source of electricity generation. Which explains why in recent overseas trips, Japanese officials have offered Middle East and Indian counterparts the idea of investing both in clean energy and semiconductor developments at home.

Politics

The announcement of Rapidus’ expansion into Hokkaido came two months before the local gubernatorial election, essentially providing tailwinds to the incumbent Governor Suzuki. Former Prime Minister Suga praised him during a campaign rally, highlighting his success in “attracting an advanced semiconductor manufacturer’s factory using his youth and proactive attitude”.

At the age of only 42, Governor Suzuki has had an unusual political career, having risen from a Tokyo Metropolitan Government official to be elected mayor of the bankrupt city of Yubari. He is expected to have a promising future probably in central politics and is also an alumnus of the same university as Suga. Amid the waning popularity of Prime Minister Kishida, Suga’s influence seems to be reviving. How national politics plays out in Japan’s political hub of Nagatacho may affect the progress of this ambitious project in the long term.

Hokkaido’s Silicon Valley dream is still at a nascent stage. But with so many political, geopolitical and economic considerations on the line, it is likely to amass the energy to succeed.

ENERGY JOBS IN JAPAN

BY ANDREW STATTER

Contract vs Permanent Hiring

As the energy market changes and grows, the talent shortage is clearly apparent. For firms new to Japan and uncertain about project volume and staffing needs, as well as companies with a fluctuating workload, employing temporary contract workers can be an attractive solution. Like many things in Japan, however, from the business culture to square watermelons, contract employment is not quite the same as in many other countries.

The image of contract workers

Japanese society places a high value on stability. This directly impacts one’s ability to borrow money, gain access to higher class rental apartments, and approval from fathers for their daughter’s hand in marriage!

Working in a reputable, stable, well-known firm typically holds more weight than the individual’s income. For example, a lender will assess both the individual and their employer, and possibly refuse credit based on the latter’s reputation and status, or the length of employment and overall work conditions.

Compared to countries such as the UK or the U.S. that have a robust market for freelancers who choose projects that satisfy their interest or pay over permanent work, Japan has a rather tepid freelancer community. There are exceptions, in particular in the tech space, where software developers, SAP experts, etc, have increasingly turned to freelancing due to project-based work. In general, however, visa challenges make it difficult for Japan to build a strong base of foreign highly-skilled freelancers.

Non-Japanese citizens that wish to work either require visa sponsorship from an employer or a spouse, both of which require permanent commitments. The other option is to set up your own firm in Japan and apply for a business visa, the requirements of which include sinking a sizable amount of capital into the entity or hiring two full-time staff.

Temporary recruitment agencies, however, are very active in Japan. Adecco, Recruit and other major players have large pools of talent who are outsourced as contract (haken) staff. This cadre is good for operational roles in organizations, where lower degrees of training are required and where staff can be replaced quickly and relatively easily. Administration, customer service, order management, and bookkeeping are examples of functions that can be outsourced in Japan without much trouble .

When highly specialized skills are required, whether it be a particular path of engineering, financial modeling, commercial negotiations, etc, then the contract worker option tends to fall short. Though some candidates are available, they’re rarely the best in the market.

Employers in Japan can be quite critical of those who have taken contract work in the past. In the eyes of many human resource departments, those who took a contract position must have done so because they couldn’t secure permanent employment. Often, contractors are seen as ‘job hoppers’ by companies, and therefore struggle to transition from contractor status to a permanent employee.

When to use contractors

Senior hires

Most Japanese companies cease full-time employment at 60 years old, and even start winding down their career at 55. A select few progress to the highest echelons of the business and compete for C-suite roles, but for most of the older employees, the last few years will see them take on roles of lower responsibility and remuneration to make way for the next wave. This is a product of the seniority system embedded in Japanese business culture, leaving veteran staff that either didn’t wish to or could not secure top management positions declining rather than gaining social status around retirement age.

As many smaller or multinational companies recognise, many of these experienced talents have a wealth of value. Their depth of knowledge and network can bring credibility to a foreign firm when it engages with local stakeholders, business partners, financiers, etc. Often, these professionals are motivated by the contribution they can make, and therefore can be hired on direct, fixed-term or rolling contracts as (keiyakushain). These are somewhat different from outsourced contract workers (hakenshain).

In lieu of a probationary period

Your permanent employment contract likely has a probation period, usually 3 or 6 months that allows you to assess performance and let the worker go if needed. The problem is that all employment contracts are superseded by Japanese labor law, which gives full protection to the employee after two weeks. Offering an initial contract with an option to full-time employment gives you security to assess performance, and either extend the contract, let the employee leave, or switch to full-time employment without getting caught in a legal bind.

The catch is that you are offloading the risk onto the shoulders of the employee, and in a stability valued market such as Japan, this can put your offer at a competitive disadvantage if that candidate is in demand from multiple organizations.

Times are changing, slowly

Though not as far advanced as European or U.S. markets, diversity and inclusion initiatives are on the rise in Japan, which has traditionally been male-dominated in upper management and highly technical areas. In the past, it was common for women to give up their careers in favor of bearing children and shifting into family life. These days however, an increasing number of female professionals take on contract work during the early years of raising a family. This allows them to diversify and broaden their skill sets, and then jump back into full-time employment as home responsibilities change. Work-from-home and hybrid setups precipitated by Covid have certainly been a factor in accelerating this.

Secondarily, there’s an increasing number of professionals taking on post-graduate studies mid-career and paying for them from their own pocket so as not to be tied to company clawback schemes that can extend for years after graduation. Many of these aspiring young professionals will take on contract work during their study to build up experience and increase their market value upon graduation. Often, these more ambitiously minded individuals are open to fixed-term commitments that pay well and offer more flexibility to utilize their newfound knowledge.

Will Japan soon see a numerous, highly-skilled, flexible and mobile freelance workforce that’s willing to work on a project-by-project basis? Probably not, but the current generation of younger workers are certainly breaking free from the shackles of societal and company expectations that have been deeply ingrained for decades.

GLOBAL VIEW

BY JOHN VAROLI

Below are some of last week’s most important international energy developments monitored by the Japan NRG team because of their potential to impact energy supply and demand, as well as prices. We see the following as relevant to Japanese and international energy investors.

Australia/ LNG

Two LNG producers held talks with unions to try to stave off a strike that could disrupt global supplies. The three LNG sites, owned by Woodside Energy and Chevron, account for 10% of global supply and half of Australia’s LNG output.

Canada/ LNG

Tourmaline Oil Corp joined Rockies LNG, a group of producers working on the 12 mmt Ksi Lisims project on British Columbia’s coast. Rockies LNG’s members produce 5.6 billion cfpd, about a third of Canada’s output. Texas-based Western LNG also is involved.

EU/ Energy crisis

E.ON, Europe’s biggest operator of energy networks, said the continent’s energy crisis will continue. CEO Leonhard Birnbaum said: “We must continue to work on the issue of austerity. This is the best way to ensure affordability for customers and also to achieve competitiveness of our society and our economy.”

EU/ gas prices

Gas prices on the Title Transfer Facility, the European benchmark, rose to €43 per MW/h, up from €30 on Aug 8. The increase was triggered by reports of a possible strike at LNG plants in Australia.

France/ power markets

Thanks to its nuclear capacity, in the first half of this year France surpassed Sweden to become Europe’s top power exporter; however, Germany has moved from exporter to importer. France’s total power exports amounted to 17.6 TW/h, mostly flowing to the UK and Italy.

Germany/ Wind power

Siemens Energy expects a €4.5 billion loss this year, struggling to fix its ailing wind turbine business. The company had previously predicted losses for 2023 that would exceed last year’s €712 million loss by a “low triple-digit-million”.

India/ Oil demand

Consumption of petroleum products in the world’s third-largest crude importer increased 10%, to about 223 million tons in 2022/ 2023. Higher demand was due to strong economic growth, an increase in vehicle sales, and growing industrialization and urbanization.

Poland/ Oil pipeline

After detecting a leak last week, national pipeline operator PERN halted pumping through a section of the Druzhba pipeline that connects Russia to Europe. It expects flows to resume this coming week. PERN said there was no indication that a third party had caused the leak.

UK/ Wind power

The govt will struggle to attract new offshore wind projects under its current auction round due to recent sharp cost increases for developers, said Mads Nipper, CEO of Ørsted, the world’s largest offshore developer. He added that the maximum electricity price was not high enough to offset wind companies’ rising costs.

U.S./ Carbon removal

The Energy Dept is awarding up to $1.2 billion for two projects in Texas that will directly remove CO2 from the air; this would be the largest investment ever in engineered carbon removal. Once fully operational, it will scale up to remove 30 mmt/ year.

2023 EVENTS CALENDAR

A selection of domestic and international events we believe will have an impact on Japanese energy

Disclaimer

This communication has been prepared for information purposes only, is confidential and may be legally privileged. This is a subscription-only service and is directed at those who have expressly asked K.K. Yuri Group or one of its representatives to be added to the mailing list. This document may not be onwardly circulated or reproduced without prior written consent from Yuri Group, which retains all copyright to the content of this report.

Yuri Group is not registered as an investment advisor in any jurisdiction. Our research and all the content express our opinions, which are generally based on available public information, field studies and own analysis. Content is limited to general comment upon general political, economic and market issues, asset classes and types of investments. The report and all of its content does not constitute a recommendation or solicitation to buy, sell, subscribe for or underwrite any product or physical commodity, or a financial instrument.

The information contained in this report is obtained from sources believed to be reliable and in good faith. No representation or warranty is made that it is accurate or complete. Opinions and views expressed are subject to change without notice, as are prices and availability, which are indicative only. There is no obligation to notify recipients of any changes to this data or to do so in the future. No responsibility is accepted for the use of or reliance on the information provided. In no circumstances will Yuri Group be liable for any indirect or direct loss, or consequential loss or damages arising from the use of, any inability to use, or any inaccuracy in the information.

K.K. Yuri Group: Hulic Ochanomizu Bldg. 3F, 2-3-11, Surugadai, Kanda, Chiyoda-ku, Tokyo, Japan, 101-0062.