JAPAN NRG WEEKLY

FEBRUARY 3, 2025

ANALYSIS

THE FUTURE OF JAPAN’S THERMAL POWER PLANTS

- To run or not to run: this is the dilemma facing Japan’s utilities as they weigh the future of their aging thermal power plants.

- With stricter environmental regulations and decarbonization, the once straightforward decision of whether to switch on more baseload generation is now more complex.

- By the end of the decade, a carbon levy and mandatory emissions caps will require utilities either to cut emissions or to purchase offset credits.

ENERGY JOBS IN JAPAN: 2025 OUTLOOK

- The surge in renewable energy demand creates more job opportunities with developers, offtakers, market advisors, lenders and brokerage firms that need talent who can originate, negotiate, structure and price PPA agreements.

- We review which job positions will have the top opportunities this year across key energy sectors.

NEWS

- PM Ishiba takes tactical approach with Trump, seeks to deepen Asia ties to secure resources

- Japan considers offering Trump support for $44 bln Alaska gas pipeline

- Record capacity market contract value amid rising concerns over electricity supply

- TOCOM electricity futures trading volume wanes

- New power providers gain traction, but competition remains intense

- MODEC approval for offshore ammonia facility

- Idemitsu, JERA to do hydrogen study for Chiba

- Hulic to invest ¥100 billion in storage batteries

- Toshiba, Chubu Electric to develop rock-based thermal energy storage

- Amazon signs PPAs in new solar projects

WIND POWER AND OTHER RENEWABLES

- Govt to revise guidelines for offshore wind tenders

- Nippon Steel to produce floating foundations for offshore wind

- Yokohama to explore offshore wind power on coast

- IEA report on global nuclear energy

- China tests Fukushima seawater

- JAPC to send spent nuclear fuel to interim storage

- ADNOC signs $450 mln LNG deal with JERA

- METI meets with Australian officials to discuss LNG and coal supply

CARBON CAPTURE & SYNTHETIC FUELS

- Cosmo Group firm to supply SAF to DHL

- Itochu and Mitsubishi to work on mineral carbonization tech

ASIA PACIFIC REVIEW

- This column provides a brief overview of the region’s main energy events from the past week

EVENTS

| Feb 11-14 | India Energy Week @ New Delhi, India |

| Mid-Feb | METI to update draft of 7th Strategic Energy Plan |

| Feb 19-21 | Smart Energy Week 2025 @ Tokyo Big Sight |

| Mar 5 | “REvision2025” International Symposium hosted by Renewable Energy Institute @ Tokyo, Japan |

JAPAN NRG WEEKLY

PUBLISHER

K. K. Yuri Group

Editorial Team

Yuriy Humber (Editor-in-Chief)

John Varoli (Senior Editor, Americas)

Kyoko Fukuda (Japan)

Magdalena Osumi (Japan

Filippo Pedretti (Japan)

Tim Young (Japan)

Tetsuji Tomita (Japan)

Regular Contributors

Chisaki Watanabe (Japan)

Takehiro Masutomo (Japan)

Mayumi Watanabe (Japan)

SUBSCRIPTIONS & ADVERTISING

Japan NRG offers individual, corporate and academic subscription plans. Basic details are our website or write to subscriptions@japan-nrg.com

For marketing, advertising, or collaboration opportunities, contact sales@japan-nrg.com For all other inquiries, write to info@japan-nrg.com

OFTEN-USED ACRONYMS

METI | The Ministry of Economy, Trade and Industry | mmbtu | Million British Thermal Units |

MoE | Ministry of Environment | mb/d | Million barrels per day |

ANRE | Agency for Natural Resources and Energy | mtoe | Million Tons of Oil Equivalent |

NEDO | New Energy and Industrial Technology Development Organization | kWh | Kilowatt hours (electricity generation volume) |

TEPCO | Tokyo Electric Power Company | FIT | Feed-in Tariff |

KEPCO | Kansai Electric Power Company | FIP | Feed-in Premium |

EPCO | Electric Power Company | SAF | Sustainable Aviation Fuel |

JCC | Japan Crude Cocktail | NPP | Nuclear power plant |

JKM | Japan Korea Market, the Platt’s LNG benchmark | JOGMEC | Japan Organization for Metals and Energy Security |

CCUS | Carbon Capture, Utilization and Storage | ||

OCCTO | Organization for Cross-regional Coordination of Transmission Operators | ||

NRA | Nuclear Regulation Authority | ||

GX | Green Transformation |

NEWS: GENERAL POLICY AND TRENDS

PM Ishiba takes tactical approach with Trump, seeks to deepen Asia ties for resources

(Nikkei, Jan 30)

- PM Ishiba is preparing for his first meeting with President Trump, which will be on Feb 7; energy diplomacy will be at the forefront.

- Trump seeks to boost energy exports, cementing U.S.’s status as the world’s top oil and gas producer. Japan sources over 60% of its LNG from Australia, Malaysia, and Russia, but imported 8% from the U.S. in 2023. Increasing supplies of U.S. shale gas aligns with Ishiba’s strategy to bolster energy security.

- Ishiba is also deepening energy ties in Asia. His recent SE Asia tour firmed up Malaysia’s commitment to LNG supply, and cooperation in CCUS and hydrogen.

- He also agreed with Indonesia on resource and infrastructure cooperation, including a geothermal project under the Asia Zero Emission Community (AZEC).

- Equally, Ishiba is expanding Japan’s presence in Central Asia, a region rich in uranium, oil, gas, and rare metals critical for electronics.

- CONTEXT: Ishiba is positioning Japan as a key AI and energy player. Seeking insight into Trump’s priorities, he consulted with SoftBank CEO Son Masayoshi, who recently won favor with Trump after announcing a $500 billion AI investment.

TAKEAWAY: Ishiba’s visit to the U.S. appears to be a tactical move to maintain amicable ties. However, Ishiba reportedly passed up the chance to meet with Trump before his inauguration and is known for lacking diplomatic experience. Ishiba’s focus on resource diplomacy aims to engage with the Trump Administration on more business-like terms, while shoring up Japan’s security and influence on the broader regional stage.

- SIDE DEVELOPMENT:

- Japan considers supporting $44 bln Alaska gas pipeline project

(Reuters, Jan 31)- Japan is weighing potential support for a $44 billion gas pipeline project in Alaska as part of efforts to maintain favorable trade relations with the U.S. and avoid tariffs.

- PM Ishiba may discuss the project with Trump when they meet, though Japan remains skeptical of the project’s commercial viability due to cost concerns.

- Tokyo may offer exploratory commitments alongside other trade concessions, such as increased U.S. LNG purchases and investment in U.S. defense and manufacturing, to address the $56 billion trade deficit.

- The project could help Japan diversify away from Russian LNG supply. Several U.S. current and former officials have advised Japan to offer an increase in LNG purchases and the Alaska project investment.

- CONTEXT: The project to build an LNG facility in Alaska was first considered years ago, but was shelved due to high infrastructure costs. In 2022, Mitsubishi agreed with state-owned Alaska Gasline Development Corp to assess the feasibility of using local gas deposits to produce ammonia, but there has since been no update on this plan. The project does, however, have legal approval.

TAKEAWAY: Softbank’s Son Masayoshi has shown that the way to win Trump’s approval is through mega-projects; and so, PM Ishiba seeks a similar coup. Unlike Son, however, the PM cannot compel Japanese private firms to engage, and without generous state guarantees businesses will assess the Alaska project based on its economics. Should Trump show interest in investment from Japan, it’s likely that a multi-year feasibility study will follow, buying Tokyo stakeholders time. Ishiba’s goal will be to avoid the extreme outcomes: one-sided concessions or Trump losing interest in dealing with Tokyo. Japanese analysts fear Trump might bypass Japan and negotiate security matters directly with China.

Govt to submit five energy and environmental bills to the Diet

(Denki Shimbun, Jan 27)

- The govt will submit five energy and environmental bills to the Diet, seeking a legal framework for the GX-ETS (carbon emissions trading system) starting in FY2026.

- Companies emitting over 100,000 tons of CO2 a year will have to participate. The bill also outlines a fossil fuel surcharge starting FY2028.

- Other issues to be addressed are:

- Creating a coordination mechanism for offshore wind base ports; to allow temporary use by other companies in case of emergencies

- Simplifying initial procedures for replacing onshore wind turbines and addressing transparency issues; (this will be done by allowing the environment minister to disclose EIA documents with operator consent)

- Imposing stricter regulations on copper scrap dealers, including mandatory registration, identity verification, and penalties; (there will be penalties for unauthorized possession of cable-cutting tools)

- Reintroducing a bill to expand offshore wind development in the Exclusive Economic Zone (EEZ); (it failed in the previous Diet session)

- The government is also considering a law to promote solar panel recycling, given the expected surge in panel waste from the 2030s.

- SIDE DEVELOPMENT:

- METI to launch new power system reform discussions, submit bill to Diet

(Government statement, Jan 27)- In April, METI will establish a new panel to discuss revisions to the power system, focusing on investment incentives and retail market regulations.

- The reform plan, presented by METI’s advisory committee, aims to facilitate power generation investment and improve electricity market mechanisms through three key areas: long-term supply security, price index formation, and short-term trading.

- The govt may amend the Electricity Business Act if necessary, with legislative discussions expected within the year for potential submission to the Diet in 2026.

- Public consultation will conclude by late March, after which formal recommendations will be finalized.

METI unveils report for energy transition roadmap for construction machinery

(Government statement, Jan 31)

- METI issued an interim report with guidelines for clean energy transition focusing on construction machinery.

- The 114-page document envisions a maximum adoption scenation, an aspirational goal rather than a mandatory requirement, that would allow flexibility for adjustments based on market trends and industry conditions.

- It has been drafted based on electrification targets in the U.S. and France, and the current domestic market for electric construction machinery.

- Key challenges faced by the sector today include:

- developing charging infrastructure at construction sites;

- advancing collaborative technology development;

- clarifying regulatory applications related to powertrain changes.

- To address these issues, a research committee was formed with stakeholders from both the supply side (manufacturers) and demand side (users and rental businesses). METI will continue discussions with the private sector, together with MLIT and MoE.

- CONTEXT: In November last year, an expert working group on the nation’s energy transition also highlighted the importance of decarbonizing construction machinery. Based on these discussions, the FY2024 supplementary budget includes a subsidy program to support the introduction of ‘GX construction machinery’.

Mitsubishi Corp expands decarbonization fund, targets 25 investments by 2029

(Nikkei, Jan 27)

- With investments from 17 businesses – from Japan, Singapore, and South Korea – Mitsubishi Corp and Mitsubishi UFJ Bank have increased the assets of their specialist decarbonization fund to about ¥115 billion.

- The Marunouchi Climate Tech Growth Fund, which is overseen by Marunouchi Innovation Partners, has already invested ¥10 billion in four U.S. firms and plans to invest ¥100 billion in around 25 companies by October 2029. It focuses on renewable energy, battery storage, and decarbonization technologies.

- Current investments include Amogy (hydrogen from ammonia), Boston Metal (low-carbon steel), Furbo Energy (geothermal power), and Infinitum Electric (energy-efficient motors).

- CONTEXT: Trading house Mitsubishi owns over 90% of Marunouchi Innovation Partners, with 4.9% held by MUFJ.

TAKEAWAY: The number of domestic private funds that invest specifically in cleantech and related clean energy companies remains small, with this Mitsubishi-led vehicle among the largest in the sector. In addition, several state-backed funds exist, such as the public-private Japan Green Investment Corp for Carbon Neutrality (JICN), but the latter invests and provides loans at the project level.

- SIDE DEVELOPMENT:

- Japan announces new regulation on JCM credits

- (Government statement, Jan 31)

- Japan announced new regulations on JCM (Joint Crediting Mechanism) credits, as part of the revised Climate Change Countermeasures Act. These measures aim to strengthen the JCM system and corporate overseas expansion.

- The regulations establish procedures for issuing and managing JCM credits. They include electronic applications and certification of verification bodies.

- The new rules take effect in April.

NEWS: ELECTRICITY MARKETS

Record capacity market contract value amid rising concerns over electricity supply

(Company statement, Jan 29)

- The 2024 capacity market auction for FY2028 saw a 40.8% increase in total contract value, reaching ¥1.85 trillion, the highest ever recorded. The average price/ kW surged to ¥11,134, more than three times the ¥3,287 in 2023.

- The awarded capacity was 166.21 GW, split into four regional blocks. For the first time, Chubu was set as an independent pricing zone.

- The highest price was in Hokkaido-Tohoku-Tokyo (¥14,812/ kW), while Hokuriku-Shikoku-Chugoku-Kansai had the lowest (¥8,785/ kW). The settlement prices for Hokkaido-Tohoku-Tokyo and Kyushu were close to the upper limit.

- Dispatchable power sources accounted for 31.9% in Hokkaido-Tokyo but only 4.5% in Kyushu, showing regional differences. Nuclear power contributions increased by 428 MW, reaching 12.04 GW in total.

- Tokyo had twice as much capacity (54 GW) as the next-biggest, Kansai (27.5 GW).

TAKEAWAY: Capacity prices are high and look set to remain so partly due to rising EPC costs to build new facilities and concerns about energy shortages, especially in terms of non-fossil generation.

- SIDE DEVELOPMENT:

- TOCOM electricity futures trading dropped in December

(Denki Shimbun, Jan 29)- In December, electricity futures trading volume on the TOCOM fell 72.7% MoM to 56.6 GWh; this followed a surge in large off-market transactions in November.

- Despite the decline, demand for annual contracts extended into FY2025, with some power retailers fixing prices for a full year amid ongoing wholesale negotiations.

- Overnight trading was active, comprising 74% of off-market trades, reflecting market focus on LNG price movements.

New power providers gain traction, but competition remains intense

(Japan NRG, Jan 29)

- Recent data on the state of electricity retail shows that power consumption in October 2024 was 65.61 TWh, down 13.36% MoM, but a 3.77% increase YoY, according to the Energy Information Center.

- The share of sales conducted by shin denryoku, or new market entrants, as opposed to the major power utilities (EPCOs), was 19.27% of total demand, up 20.21% YoY.

- The number of active retailers increased from 505 in August to 518 in September, a net gain of 13 companies. Among these were Okayama Gas, Marubeni, and Green Power Retailing. Companies that dropped out of the active list include HTB Energy and Tohoku Electric Energy Trading.

- Tokyo Gas remained the market leader with 1.42 TWh sold, followed by Ennet (0.86 TWh) and Osaka Gas (0.79 TWh). Climbers in the top 10 retailers by sales were CD Energy Direct and Haruen.

JEPX to review transmission rights, may expand trading with six new products

(Organization statement, Jan 24)

- JEPX began reviewing transmission rights, which compensate for price differences between market areas; and might add six new products, including two for flows into the Chubu region.

- A study group, co-led by JEPX and METI, aims to finalize the issue ahead of a transition to a new system in FY2026.

- The proposed products stem from an analysis of April 2023–March 2024 price gaps, with some exceeding ¥1/ kWh, particularly for flows into Chubu.

- The review will also address potential price misalignments and the risk of traders using the system for profit rather than its intended hedging function.

OCCTO considers mandatory bidding in balancing market

(Organization statements, Jan 27)

- OCCTO is reviewing partial mandatory balancing market bidding, aligning potential implementation with the transition to day-ahead trading for all products in FY2026.

- A recent expert panel discussion clarified key points, including bidding constraints and pumped storage operations, with the govt set to decide on implementation.

- A survey of market participants identified six broad categories of bidding constraints, including equipment, fuel, and workforce limitations; some may justify exemptions.

- Market participants may be required to bid all available capacity at market opening, with pumped storage reserves adjusted based on actual water levels.

Tohoku Electric’s VP to become president

(Nikkei, Jan 27)

- Tohoku Electric will promote executive VP Ishiyama Kazuhiro to president, effective April 1. Current President Higuchi Kojiro will become chairman.

- Ishiyama has focused on Tohoku Electric’s business strategy development, overseeing corporate operations and leading the group’s ESG management initiatives.

NEWS: HYDROGEN

MODEC, first Japanese firm approved to build offshore ammonia production facility

(Company statement, Nikkei, Jan 30)

- Mitsui Ocean Development & Engineering (MODEC) secured Approval in Principle from the American Bureau of Shipping for a floating production, storage and offloading system (FPSO) to produce ‘blue’ ammonia from excess methane at offshore oil fields. This gas is currently injected into reservoirs and has no special use.

- As much as 90% of the emissions can be captured, according to MODEC. Each FPSO is expected to produce around 800,000 tons of ammonia annually, on par with large onshore plants, and might be put into use as early as 2030.

- CONTEXT: The global blue ammonia market might reach $7.7 billion by 2030.

Idemitsu, JERA among firms involved in hydrogen study for Chiba

(Government statement, Jan 28)

- A feasibility study seeks to establish a hydrogen supply hub in the Keiyo Coastal Industrial Complex, involving 12 companies including Idemitsu Kosan, AGC, Osaka International Petroleum Refining, Cosmo Oil, JFE Steel, JERA, etc. The study, running from FY2024 to FY2025, is supported by Chiba Pref.

- The study will estimate local hydrogen, ammonia, e-methane, and synthetic fuel demand from 2035 to 2050, and to develop an efficient supply chain. This will include receiving terminals, storage facilities, and distribution networks.

Chemical major Resonac to recycle plastics to produce ammonia

(Company statements, Jan 20 and Jan 30)

- Chemical manufacturer Resonac unveiled a business model for recycling plastics and textiles into CO2, hydrogen, and chemical raw materials such as acrylonitrile and ammonia. These will then be transformed into various end products.

- The recycling process involves gasifying plastics and other materials at high temperatures and breaking them down to the molecular level, at which point hydrogen and CO2 can be extracted. The hydrogen is used for power generation in fuel cells, which are installed at a hotel in Kawasaki City.

- CONTEXT: Resonac was formed in a 2023 merger between Showa Denko and what used to be Hitachi Chemical. It claims the world’s oldest gasification chemical plant at its Kawasaki site, able to process about 1 mln tons of plastic a year.

TAKEAWAY: Japan NRG covered the “hydrogen hotel” in question in our May 22, 2023, issue. It is based near Resonac’s Kawasaki site and receives hydrogen by pipeline. Since then, at least one other hotel has pledged to switch some power to hydrogen fuel cells. While these examples are few, they show how sectors adjacent to hydrogen or ammonia manufacturing sites can utilize these fuels without heavy infrastructure investments.

UBE to exit ammonia production ahead of schedule by 2028

(Company statement, Jan 28)

- As part of a larger corporate reorganization, UBE will stop producing ammonia by March 2028, more than two years ahead of schedule.

- The company’s financial results will be impacted by a ¥10 billion writedown on its Ube Chemical Plant in Yamaguchi Pref.

- CONTEXT: The move is motivated by weakening market conditions, including the overproduction of resin raw materials by Chinese producers, which lowers the profitability of basic chemicals and ammonia manufacturing in Japan.

Obayashi successfully transports and utilizes green hydrogen in Fiji

(Company statement, Jan 28)

- Construction major Obayashi, in partnership with Halcyon and Fiji Gas, successfully transported green hydrogen produced in New Zealand to Fiji for power generation, marking the first time that NZ-produced hydrogen was exported.

- The hydrogen was used as fuel for a co-firing power generator at Fiji Gas’s LPG storage facility, successfully supplying electricity to the grid.

NEWS: SOLAR AND BATTERIES

Hulic enters storage battery business with ¥100 billion investment

(Company statement, Nikkei, Jan 28)

- Hulic, a major real estate firm, plans to invest ¥100 billion by 2034 to build battery storage facilities to store excess renewable energy, such as solar power.

- By 2025, Hulic will establish sites in three locations, (Shizuoka and Chiba Prefs) to power about 250 properties (offices, shopping centers) with 100% renewable energy.

- Starting 2029, the firm will sell surplus power in the electricity market and plans to use the FIP program to profit from selling excess power.

- CONTEXT: Real estate giants Tokyu Fudosan and Mitsui Fudosan are also entering the sector. Mitsui Fudosan is considering operating BESS with TEPCO Energy Partner, while Tokyu Fudosan is working with Itochu and PowerX to develop a grid-scale battery site in Saitama Pref.

TAKEAWAY: Battery storage is expected to play a key role in balancing supply and demand in Japan, especially given that the cost of Li-ion batteries is decreasing. Real estate firms have an advantage in securing land and connecting to power grids, giving them an advantage in the BESS market.

Toshiba, Chubu Electric to develop rock-based thermal energy storage

(Nikkei, Jan 30)

- Toshiba Energy Systems & Solutions, along with Chubu Electric, Shin Tokai Paper, and Shimada City plan to commercialize rock-based thermal energy storage.

- The approach leverages the natural properties of rocks — heating up quickly and cooling down slowly – to store and release heat energy, acting as a natural battery.

- The system will have a heat capacity equivalent to 10 MWh. The installation will include a large rectangular tank (4m high, 11m wide, 4m deep) filled with rocks, heated up to 600°C (1,112°F) within an hour.

- In 2026, a demo will be held at a Shin Tokai Paper factory in Shimada City.

- The tech’s advantages over conventional batteries are:

- Unlike Li-ion batteries, rocks can be used indefinitely,

- The system does not need scarce and pricey minerals like cobalt and nickel;

- The estimated cost is about half that of battery storage systems.

TAKEAWAY: Sustainable, large-scale energy storage is the holy grail for all non-fossil energy systems. Siemens launched a large-scale demo plant for rock-based thermal power in Germany in 2019. Some U.S. experts believe that non-traditional power storage is poised for a big year, especially due to its low cost. Japan’s project also has a compact footprint compared to similar tests overseas.

Amazon signs PPAs as part of investment in new solar projects

(Company statement, Jan 29)

- Amazon will invest in four new large-scale solar power plants in Japan.

- With these additions, Amazon’s involvement in renewable energy capacity in Japan will more than double from 101 MW in 2023, to 211 MW in 2024.

- The projects include:

- 35 MWac (44 MWdc) solar PV plant in Fukushima City, operated by EDP Renewables Japan;

- Two 10 MWac solar power plants in Hokkaido, with Hexa one of the generators. The company hasn’t disclosed details;

- The deals will be based on PPA; operations set to begin by late 2026.

- CONTEXT: Amazon has now a total of 25 renewables projects in Japan, including nine off-site solar and wind farms and 16 on-site rooftop solar projects. Amazon is ranked as the top corporate purchaser of renewable energy globally for the fifth year in a row. It’s also the largest corporate purchaser of renewables to date in Japan.

Mitsubishi Electric unveils samples of 8th-generation chip modules

(Company statement, Jan 14)

- Mitsubishi Electric will offer samples of its new power semiconductor modules designed for renewables power systems; for instance, for solar power generation.

- The “Industrial LV100 Type 1.2kV IGBT Module” features the 8th-generation IGBT, which reduces power loss by around 15% compared to previous products.

- The module retains the optimized terminal layout of previous models, making it easier to connect multiple power chips in parallel.

- CONTEXT: Power semiconductor modules for renewable energy systems are critical components in power conversion devices such as inverters. Mitsubishi Electric’s latest innovation is expected to help address the demand for lower energy consumption and higher output.

NEWS: WIND POWER AND OTHER RENEWABLES

Govt revises guidelines for offshore wind tenders

(Government statement, Jan 29)

- METI and MLIT revised operational guidelines for the public tender system for offshore wind power projects in maritime areas.

- The revision follows deliberations and public consultations to ensure the completion of offshore wind power investments. The changes aim to provide a “more resilient and competitive framework” for offshore wind power development.

- The key points changed are:

- Enhanced risk scenario assessment;

- Clarification of conditions for major product plan changes;

- Revised price evaluation to balance competition and project viability;

- Standardized centralized site surveys to ensure project completion;

- Additional modifications on evaluation speed, deposit systems, and price adjustment schemes will be detailed in separate guidelines for each area.

- CONTEXT: Due to inflation and currency fluctuations, offshore wind projects worldwide have faced disruptions. Since September, METI and MLIT have held multiple talks with developers and experts to find solutions.

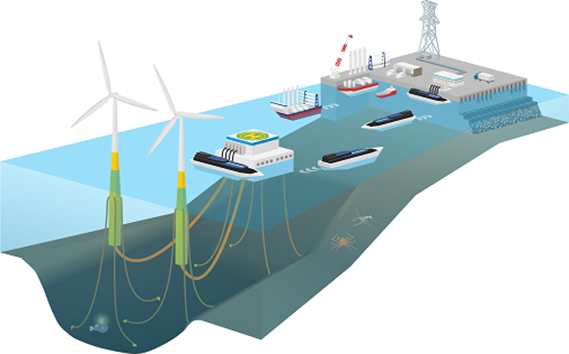

Nippon Steel to produce floating foundations for offshore wind

(Company statement, Jan 27)

- Nippon Steel Engineering is investing in large-scale equipment, including one of Japan’s largest cranes, at its plant in Kitakyushu City, Fukuoka Pref, to support the construction of floating offshore wind turbine foundations.

- The company seeks to be able to manufacture 20–30 floating foundations per year by 2030, hoping to drive Japan’s offshore wind market forward.

- The project was recently selected for METI’s GX Supply Chain Development Support Program. Investment will be ¥12.79 billion, of which ¥4.27 billion will be subsidized.

The Kitakyushu plant during construction of jacket-type foundations

Yokohama to research offshore wind power potential along coast

(Municipal government statement, Jan 24)

- Yokohama City, TEPCO Power Grid, Offshore Power Grid (a subsidiary of PowerX), construction firm Toda, and MUFG Bank inked an MoU to study methods for supplying electricity from offshore wind.

- Yokohama City will explore local industrial collaboration in its coastal area for green power supply and offshore wind industrialization. TEPCO PG will seek to establish power supply hubs to manage demand-supply fluctuations; Toda will leverage its expertise in floating offshore wind for power plant construction.

- CONTEXT: Large-scale commercial floating wind farms, including those in the exclusive economic zone (EEZ), are seen as a solution for further expansion of renewables. However, only about 10% of Japan’s EEZ has depths under 300 meters, the limit for conventional transmission methods. Electric transport ships, equipped with onboard batteries, might serve as an alternative to transmission lines. Offshore Power Grid plans to launch its first such vessel, Power Ark 100, by 2027.

MoE urges RWE to address environmental issues in offshore wind farm

(Government statement, Jan 30)

- The MoE minister requested RWE Renewables Japan to review its plans for the Hiyama Offshore Wind Power Project in Hokkaido.

- In an official opinion the minister recommended to:

- Ensure that wind turbines are sufficiently distanced from residential areas to minimize or avoid negative impact;

- Conduct surveys and forecasts, and implement conservation measures to minimize or avoid impact on birds, other wildlife, on seaweed beds and marine life caused by water turbidity during construction;

- Conduct on-site surveys and take measures to minimize or avoid negative impact on scenic views.

- The 1.68 GW project, jointly proposed by KEPCO and RWE Renewables Japan, spans Yakumo Town, Esashi Town, Kaminokuni Town and Setana Town.

- The firms plan to use up to 120 turbines; 14 to 24 MW capacity each.

Itochu invests in wind farm under construction in U.S.

(Company statement, Jan 27)

- Itochu said its U.S.-based subsidiary, Tyr Energy, will invest in the Bowman Wind farm being built in North Dakota.

- The 208 MW wind farm will begin commercial operations in late 2025. This will be Itochu’s seventh wind farm in the U.S.

- CONTEXT: President Trump gave an executive order to temporarily halt leasing and permitting for wind farms on public lands, but Itochu says the wind farm won’t be affected by the order since it already has all the necessary permits.

Citizen groups petition Hokkaido to halt Tokyu Fudosan wind farm

(Sankei Shimbun, Jan 24)

- Two citizen groups opposed to wind power submitted over 1,300 signatures to the Hokkaido govt, Ishikari City, and MoE to halt work on four wind farms. The projects include real estate firm Tokyu Fudosan’s 91.5 MW project.

- The citizens cite health concerns about the effects of low-frequency noise, threats to birds, and the local scenery.

- CONTEXT: In recent years wind power projects (both onshore and offshore) in Hokkaido have faced growing public pushback.

Sojitz acquires major stake in energy efficient HVAC provider in Australia

(Company statement, Jan 30)

- Trading house Sojitz has acquired a 70% stake in Climatech Group, a New South Wales-based HVAC provider through its subsidiary Ellis Air.

- The deal will strengthen Sojitz’s position as a leading HVAC contractor in Australia.

- CONTEXT: Sojitz first entered the energy efficiency market in the U.S. in 2021 and Australia in 2023 by acquiring Ellis Air. The Australian HVAC market is projected to grow 6% annually, reaching ¥7.4 trillion by 2033.

NEWS: UNCLEAR ENERGY

IEA releases report on global nuclear energy

(Agency statement, Jan 28)

- IEA issued ”The Path to a New Era for Nuclear Energy,” which lists Japan as the most experienced in restarting nuclear reactors.

- Other countries face greater challenges in restarting reactors due to political or market reasons, especially in regard to reactor maintenance.

- The report also discusses the back-end costs of nuclear energy – reprocessing spent fuel, disposing of high-level radioactive waste, and decommissioning. In Japan, these costs are covered by private utilities-operators that must pay fees to state-authorized organizations for reprocessing, decommissioning management, etc.

- CONTEXT: Reopening a reactor can cost billions of dollars, regardless of its size or age. It may involve significant technical difficulties, especially if dismantling has begun.

China tests of Fukushima seawater find no harmful levels

(South China Morning Post, Jan 23)

- China’s tests of seawater near Fukushima NPP found no unusual levels of radioactive nuclides. It raises hopes that Beijing may lift its ban on Japanese seafood imports.

- The samples, collected in October under international supervision, showed no negative impact on marine life. But, Chinese officials said that more independent testing is needed to lift the ban.

- CONTEXT: China imposed the ban in August 2023 when Japan began releasing treated radioactive water into the ocean.

TAKEAWAY: Signs of a potential shift in China’s policy emerged in September when Tokyo agreed to international monitoring. The new findings could ease diplomatic tensions. They are also likely to be directly correlated to political developments, with PM Ishiba and his government warming to China ties in recent months.

- SIDE DEVELOPMENT:

- JAEA detects new elements in melted fuel debris from Fukushima

- (Organization statement, Jan 30)

- The Japan Atomic Energy Agency (JAEA) said it detected new elements in the melted fuel debris collected from Unit 2 of Fukushima Daiichi NPP in November.

- In addition to uranium, the analysis found silicon, calcium, and magnesium – elements likely originating from seawater used for cooling after the 2011 meltdown.

- Further detailed analysis will continue over the next six months to a year.

JAPC to send spent nuclear fuel to Mutsu interim storage

(Nikkei, Jan 31)

- Japan Atomic Power Co (JAPC) will send spent nuclear fuel from its NPPs to the interim storage facility in Mutsu City, starting FY2027.

- JAPC seeks to restart Tsuruga Unit 2 and Tokai No. 2 NPP. It will transfer spent fuel stored at these facilities.

- CONTEXT: The Mutsu interim storage facility is operated by Recyclable-Fuel Storage Company, launched in November and has so far stored fuel from TEPCO’s Kashiwazaki-Kariwa NPP. TEPCO also announced a three-year transportation plan; two fuel containers will be sent in FY2025, and five in FY2026 and FY2027 each.

Niigata and federal govt set evacuation routes for Kashiwazaki-Kariwa NPP

(Nikkei, Jan 29)

- Niigata Pref and the federal govt agreed on priority evacuation routes in case of an accident at Kashiwazaki-Kariwa NPP. The plan focuses on six radial evacuation routes that extend beyond the 30-km UPZ (Urgent Protective Zone).

- Upgrades include reinforcement of bridges, slope stabilization, and road widening.

- CONTEXT: The restart of the facility remains in the balance. Just last week an emergency communication device malfunctioned, causing Unit 7 to violate operational safety regulation limits. This was the third such incident in the last three months.

Tohoku Electric might build an unloading port facility for Tomari NPP

(Company statement, Jan 31)

- Tohoku Electric might build an unloading facility near Tomari NPP, to prevent fuel transport vessels from entering the plant’s own port. This would reduce the risk of drifting in case of a tsunami and damaging protective seawalls.

- The unloading facility will be built in Tomari Village.

- CONTEXT: The fuel transport vessels include spent fuel transport ships (~5,000 tons), low-level radioactive waste transport ships (~4,500 tons), and new fuel transport ships (~2,200 tons).

Miyagi Pref, Onagawa and Ishinomaki conduct inspection at Onagawa NPP

(Nikkei, Jan 30)

- Miyagi Pref, Onagawa Town, and Ishinomaki City inspected Tohoku Electric’s Onagawa NPP and found no issues. Reviewed were the operation of Unit 2, responses to past incidents, and Unit 1 decommissioning.

- CONTEXT: Preparations for transferring spent nuclear fuel from Unit 1 to Unit 3 began on Jan 14, with completion expected by March 2028. The full decommissioning of Unit 1 is set for completion by March 2054.

NEWS: TRADITIONAL FUELS

ADNOC Gas signs $450 mln LNG deal with JERA

(Company statement, Jan 27)

- ADNOC Gas inked a three-year, $450 million LNG supply deal with JERA Global Markets. The LNG will be sourced from the Das Island facility.

- This agreement builds upon a similar 2023 supply agreement.

- CONTEXT: Located in the Persian Gulf, the Das Island facility has been supplying LNG to Japanese energy companies for 48 years. It’s the third longest operating LNG production facility globally; its annual production is 6 mtpa. ADNOC owns 70%; Mitsui – 15%; BP – 10%; TotalEnergies – 5%.

- SIDE DEVELOPMENT:

- METI minister meets with Australian officials on LNG and coal supply

- (Government statement, Jan 29)

- METI’s minister Muto met with Madeleine King, the Minister for Resources and Northern Australia to discuss cooperation in the resource and energy sectors.

- Topics included ensuring a stable supply of LNG and coal, and a reliable investment environment, as well as supply chains for critical minerals.

Toho Gas appoints Yamazaki as new president

(Nikkei, Jan 30)

- Toho Gas appointed Yamazaki Satoshi as president; he will focus on decarbonization and new business development. The current president, Masuda Nobuyuki, will become chairman.

- CONTEXT: The leadership change comes as the company prepares for its new mid-term management plan starting in FY2026.

TAKEAWAY: Masuda focused on renewable energy but Yamasaki said he’ll maintain the core gas business while expanding into electricity and agriculture. Toho Gas’s April–Dec 2024 financial results showed that 70% of operating profit came from gas, which remains vulnerable to LNG price fluctuations. Strengthening earnings stability is a key challenge.

LNG stocks down 6.9% from previous week, flat YoY

(Government data, Jan 29)

- As of Jan 26, the LNG stocks of 10 power utilities were 2.15 Mt, down 6.9% from the previous week (2.31 Mt); this is the same as late January 2024 (2.15 Mt), but 9.7% up from the 5-year average of 1.96 Mt.

- CONTEXT: Late January to early Feb is the coldest in the Tokyo area, but so far there’s no hint of snow.

December Oil/ Gas/ Coal trade statistics and annual review

(Government data, Jan 30)

Imports | Volume | YoY | Value (Yen) | YoY |

Crude oil | 14.3 million kiloliters | 0.6% | 1,046 billion | -11.6% |

LNG | 6.3 million tons | -2.1% | 601.7 billion | -8.3% |

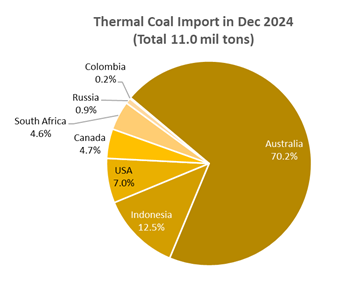

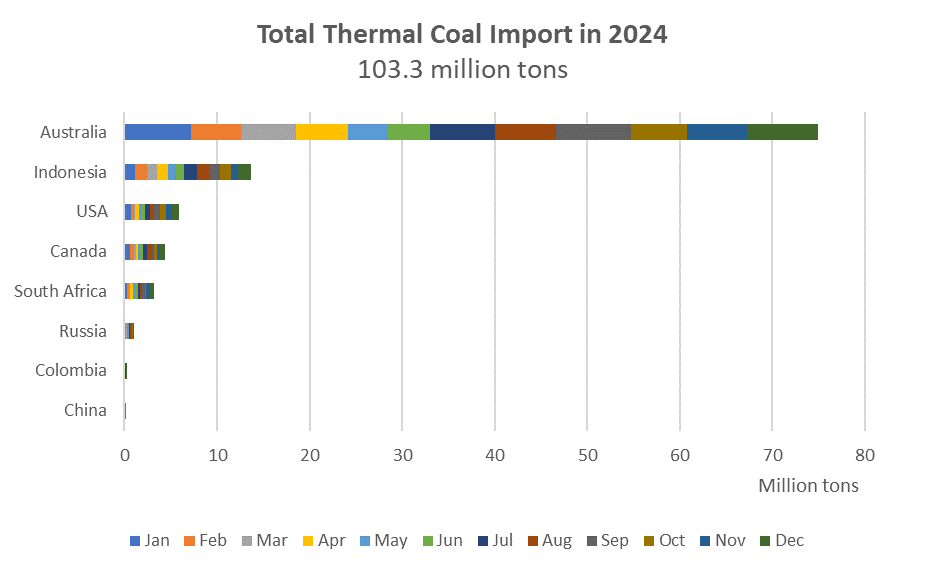

Thermal coal | 11 million tons | 13.0% | 253.3 billion | 4.7% |

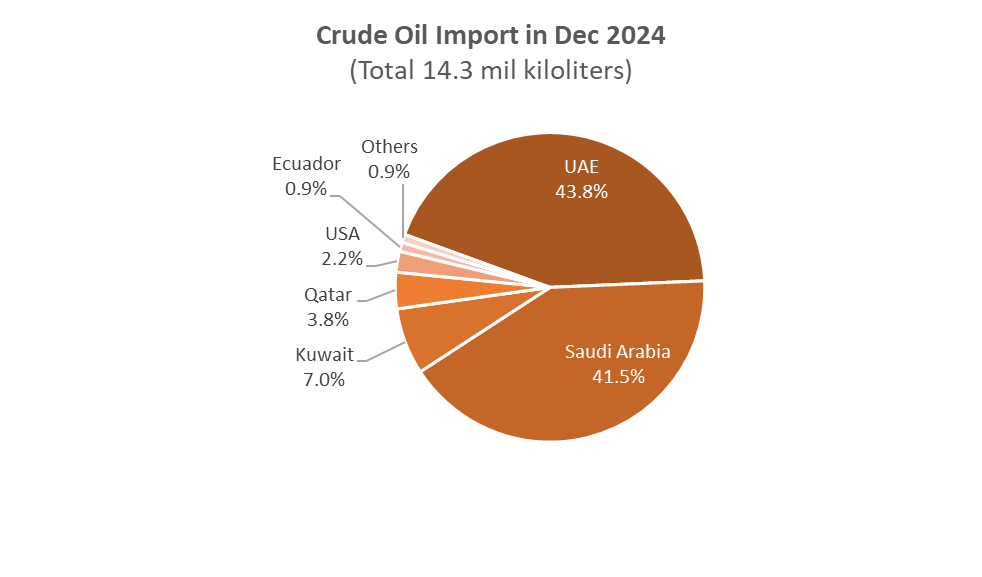

- Japan imported 14.3 mln kiloliters of crude oil in December, up 40.7% over November, and 0.6% YoY. As usual, more than 95% of the total crude oil imports came from the Middle East. Typically, the import volume in December is the highest compared to the rest of the months in preparation for the winter.

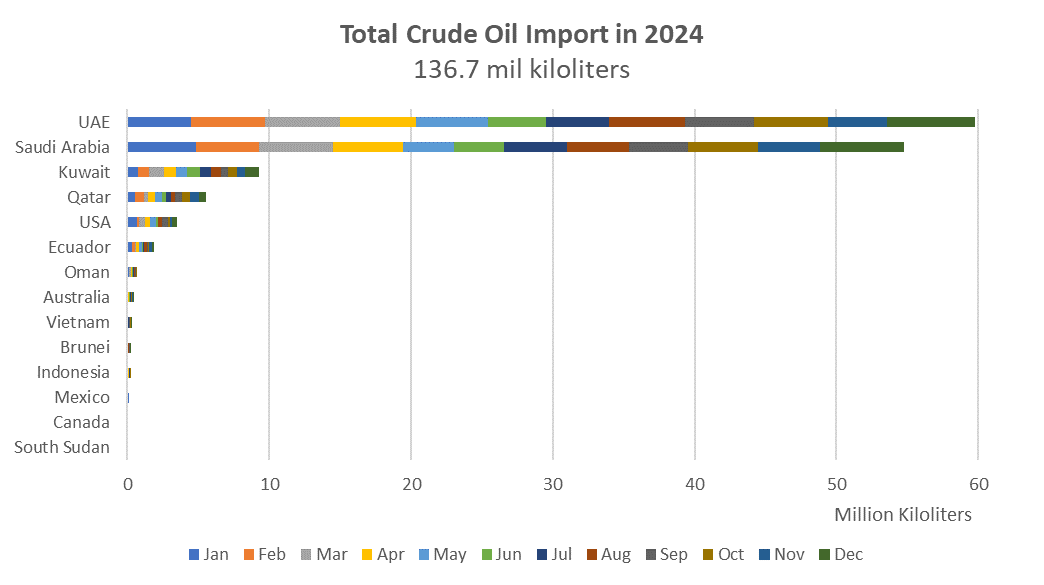

- In 2024, Japan imported a total of 136.7 mln kiloliters of crude oil, which was 7.3% less YoY (147.6 mln kiloliters). Unlike 2023, UAE became the top supplier (total 59.8 mln kiloliters) surpassing Saudi Arabia (54.7 mln kiloliters). More than 90% of crude oil supply was from Middle Eastern countries.

- The total value of crude oil in 2024 totaled ¥10,870 billion, down 3.7% YoY. This is in large part due to the USD-Yen foreign exchange.

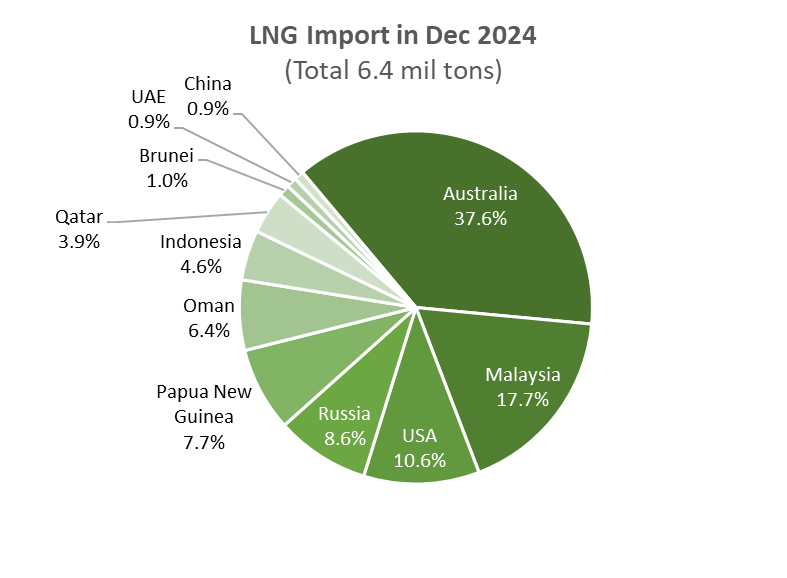

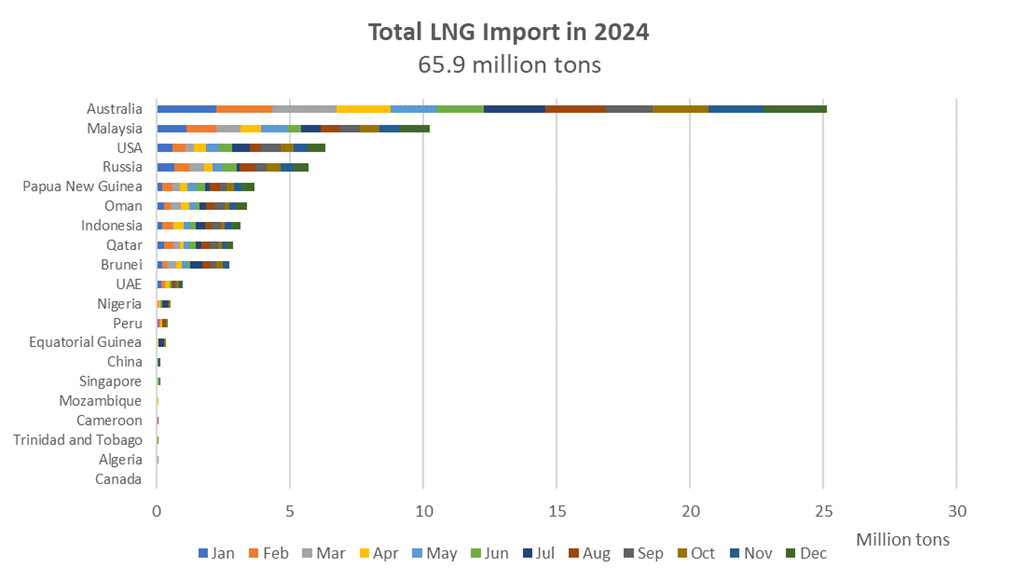

- LNG imports in December totaled 6.4 Mt, up 26% over November (5 Mt) but down 2.1% YoY. In 2024, Japan tried to secure LNG from more countries to hedge risks; these included Singapore, Mozambique, Trinidad and Tobago, Algeria, and Canada; but the total volume remained under 100,000 tons.

- Total LNG imports in 2024 was 65.9 Mt, down 0.4% over 2023. Total value was ¥65,891 million, down 4.4% YoY. The weak yen to the USD had a small impact since Japan imported in currencies such as Australian dollars. Australia was top supplier, with a nearly 40% share (25.1 Mt), followed by Malaysia, 16% (10.2 Mt).

- Thermal coal imports in December increased to 11 Mt, up 29.1% MoM, and up 13% YoY. Helped by mild weather in October and November, thermal coal imports were relatively low, but electricity demand for heating pushed it up.

- In 2024, total thermal coal imports were 103.3 million tons, up 1.7% YoY. Total value was ¥2.45 billion, down 29.3% YoY, indicating that prices dropped during the year; also, Japan dealt with suppliers in currencies other than USD. Australia supplied 70% (74.9 Mt) of thermal coal; Indonesia, 13.2% (13.6 Mt). Thermal coal imports might continue to drop in coming years as Japan seeks to reduce the number of coal-fired thermal power plants.

NEWS: CARBON CAPTURE & SYNTHETIC FUELS

Cosmo Group firm to supply SAF to DHL

(Company statement, Jan 28)

- Cosmo Oil Marketing, a Cosmo Energy subsidiary, will supply sustainable aviation fuel (SAF) to DHL Express.

- This marks the first sale of the SAF that Cosmo HD is mass-producing domestically. Starting April, Cosmo HD will also supply SAF to major airlines ANA and JAL.

- This is DHL’s first purchase of SAF in Asia, and will blend it with conventional jet fuel for use in international scheduled cargo flights.

- CONTEXT: Cosmo HD produces SAF at its Sakai City refinery, Osaka Pref, using UCO sourced from restaurants. The plant was completed in December, with an annual SAF production capacity of 30,000 kiloliters.

J-OIL MILLS produces SAF from non-edible subtropical plants

(Company statement, Jan 29)

- Oils and fats producer J-OIL MILLS, has made Sustainable Aviation Fuel (SAF) using oil extracted from non-edible subtropical plants – Alexandrian laurel (Calophyllum inophyllum) and Pongamia (Pongamia pinnata).

- These plants are easily accessible — they grow in Okinawa and Southeast Asia, and are commonly used as roadside trees.

- The produced SAF meets the international quality standard ASTM D7566 Annex A2.

- CONTEXT: Japan aims to replace 10% of jet fuel with SAF by 2030. The most scalable SAF source is used cooking oil, but its domestic supply (140,000 kL/ year) falls short of demand. This project may help diversify SAF feedstocks.

Itochu inks MoC with Mitsubishi Cement for mineral carbonation tech

(Company statement, Jan 29)

- Itochu inked a MoC with Mitsubishi UBE Cement and Australia’s MCi Carbon on the manufacturing of carbon-embodied products.

- MCi’s technology combines CO2 with waste materials to produce cement alternatives. Waste material is concrete, steel slag, and serpentinite.

- MCi has built a demo plant in Newcastle, Australia capable of processing over 1,000 tons of CO2 a year, with plans for a large-scale facility in Austria by 2028.

- CONTEXT: Mitsubishi UBE Cement, Japan’s second-largest cement producer, has also invested in MCi. The three companies aim to establish a production plant in Japan and build a supply chain for commercialization.

ANALYSIS

BY TETSUJI TOMITA

The Future of Japan’s Thermal Power Plants: A Precarious Balancing Act

To run or not to run: this is the dilemma facing Japan’s utilities as they weigh the future of their aging thermal power plants. With stricter environmental regulations and ambitious decarbonization targets, the once straightforward decision of whether to switch on more baseload generation has become far more complex.

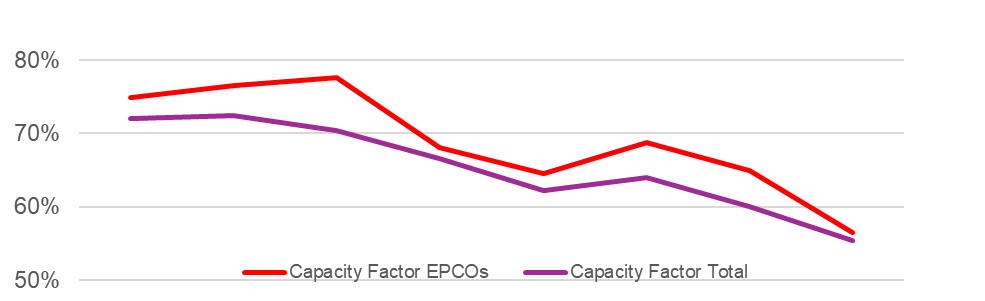

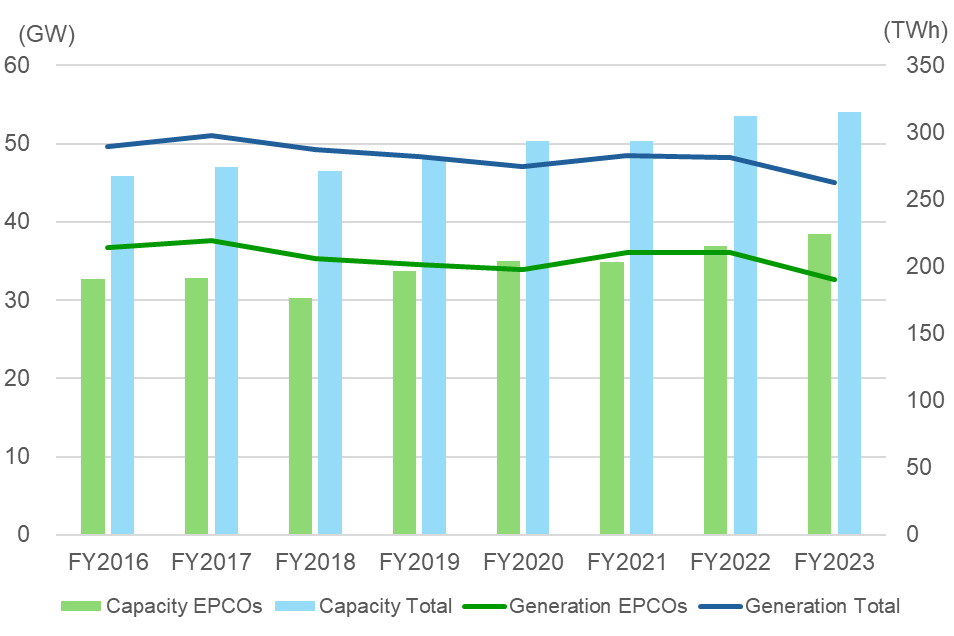

Utilization rates at coal-fired power plants of major utilities, also known as EPCOs, have dropped below 60% from close to 80% in FY2018. And while the total installed capacity of coal stations has inched higher, and is unlikely to drop in the coming decade, how much the utilities rely on those units looks set to decline further.

EPCOs are now exploring seasonal shutdowns and reduced operations to stay within state-mandated emissions limits, a shift that underscores the changing economics of thermal power. From the coming fiscal year, there will also be a cap on the run rate of less-efficient coal-fired power plants.

Until a decade ago, Japan’s power generation landscape was dictated by straightforward calculations: forecast electricity demand, procure fuel, maintain plants, and pass on costs to consumers through regulated tariffs. However, the liberalization of Japan’s electricity market in 2016 ushered in a new era of cost competition, leading to the closure of many older and less efficient thermal power plants.

The introduction of state-mandated emissions targets has further complicated matters. Starting in fiscal year (FY) 2026, major emitters will face legal obligations to report their carbon footprints and demonstrate reductions. By the end of the decade, a carbon levy and mandatory emissions caps will require utilities either to cut emissions or to purchase offset credits. These policies are already reshaping operational strategies.

Thermal power: Essential but controversial

Thermal power plants, which account for about 70% of Japan’s electricity generation, play a critical role in ensuring grid stability. They provide balancing power to compensate for the variability of renewables and help maintain frequency and voltage stability. However, they are also Japan’s largest source of greenhouse gas (GHG) emissions.

As utilities pivot toward decarbonization, the operational hours of coal-fired plants have declined, and many are being phased out.

The capacity factor, or run rate of coal-fired power plants operated by EPCOs fell to 56.6% in FY2023, the latest year for which all data is available. That percentage is even lower when the coal plants operated by other companies, such as big industrial firms with captive power stations, are taken into account.

Power capacity, generation, and capacity factors for coal-fired power plants

Still, progress in phasing out coal-power generation has been slow. Energy supply concerns have delayed the retirement of inefficient plants, which continue to serve as a backup during emergencies. METI has even asked utilities to alert the ministry before announcing further plant closures in order to avoid capacity shortages in certain regions.

Environmental assessments and operational restrictions

The Environmental Impact Assessment (EIA) system requires utilities to assess and disclose the environmental consequences of their generation projects. For thermal power plants, the EIAs cover air and water pollution, noise, and GHG emissions. Compliance often necessitates operational restrictions, including limits on emissions and output.

Major utilities participating in Japan’s wholesale electricity market (JEPX) face additional pressures. Regulators mandate that utilities with dominant market positions offer surplus power at prices reflecting marginal costs. However, there have been instances where utilities have withheld power from the market to comply with emissions limits specified in EIAs. Such self-restrictions are permissible, provided they occur during periods of low demand to avoid distorting market prices.

JERA, Japan’s largest power generation company, offers a glimpse into the industry’s evolving strategies. The company plans to idle several coal-fired plants during spring and autumn – seasons of lower electricity demand – to reduce emissions. For example, later this year operations at its Taketoyo Thermal Power Plant in Aichi Prefecture will be scaled back.

The Taketoyo facility initially tried to lower its carbon footprint by adding biomass as a second fuel. However, a fire in 2024 forced JERA to reduce the biomass co-firing ratio, thus raising the volume of CO2 emitted per kilowatt hour. As a result, the plant’s operating rate will now be curtailed so that it can meet EIA requirements.

Challenges in securing thermal power capacity

Japan’s electricity demand is poised to change significantly over the next decade. While residential demand is expected to decline due to population shrinkage, and energy efficiency gains are expected, industrial demand is projected to rise, driven by data center expansion and semiconductor manufacturing.

Advances in Chinese and other nation’s AI technologies notwithstanding, domestic data centers are seen as imperative to creating “the world’s most AI-friendly country”, according to government strategy.

The rollout of clean energy capacity will need to occur even faster, not just to reduce the nation’s CO2 footprint but also to cover the declining contribution of the thermal stations.

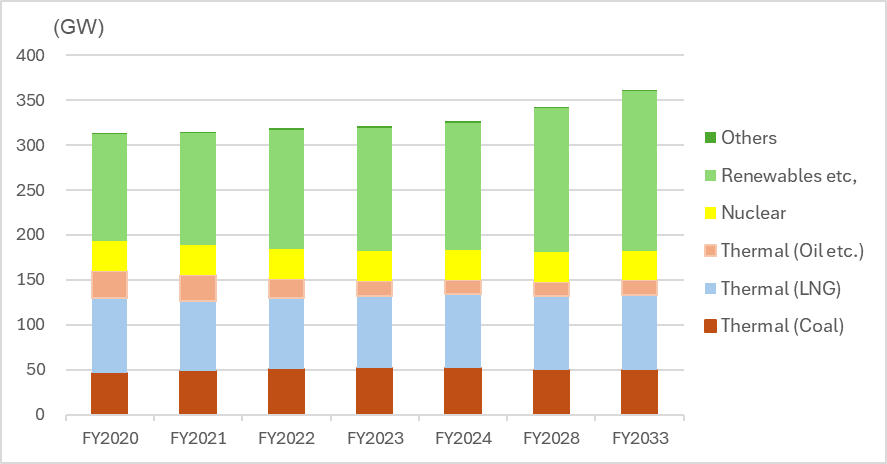

Current plans show, according to OCCTO, that domestic thermal power capacity is set to decline slightly after 2025. Plans for new thermal power plants are outpaced by closures, with notable reductions in coal-fired capacity. For instance, by 2030, J-Power plans to retire five coal-fired plants – amounting to 2.7 GW, or 30% of its domestic thermal capacity. The company aims to replace these plants with facilities capable of co-firing clean-burning fuels or employing integrated coal gasification combined cycle (IGCC) technology.

Trends in Power Capacity

Market mechanisms and policy shifts

To accelerate the phase-out of inefficient coal-fired plants, Japan’s capacity market imposes strict efficiency standards. Starting in FY2025, coal plants with an energy efficiency below 42% will face annual capacity factor limits of 50% or less. Violations will incur penalties of up to 20% of the contract value.

To ensure there is sufficient baseload capacity in its place, METI has tried to incentivize new construction through several sets of capacity auctions. Within the LTDA capacity auction, for example, there is a category to support the building of new LNG-fired plants. The scheme, launched in 2024, promised to subsidize up to 6 GW of new gas-fired capacity over the course of three auction rounds. METI ended up awarding subsidies to LNG plants with 5.8 GW in total capacity in just the first round.

As a result, an additional 2.2 GW of subsidies for the LNG category were set aside in the second round of LTDA, which is under way as of last month.

The new LNG capacity will take time to get built. Yet gaps in supply are starting to appear already.

To ensure utilities keep their older thermal plants available at least as an emergency backup, METI introduced a special reserve power supply auction. It offers payment for thermal plants with capacities of over 100 MW to be available for standby in case of emergency. However, the initial auction in 2024 failed to attract bidders, as plant operators deemed the financial returns inadequate. METI is now revising the scheme.

The long-term outlook

Japan’s energy mix is undergoing a fundamental transformation and by 2040 renewables are expected to be the dominant source of power. Still, even then, the share of thermal power in the nation’s mix is forecast at 40%. The impact of low-carbon fuels such as hydrogen and ammonia is hard to estimate.

This means that in the coming few years, the government and utilities will be in a push-pull situation and power supply volatility may increase. Officials will demand both energy supply and low emissions, and utilities will need to choose their options with several criteria in mind. Meanwhile, power markets will be sending their own signals to generators.

ANALYSIS

BY ANDREW STATTER

Energy Jobs in Japan: 2025 Outlook

In the past 12 years, Japan’s renewable energy sector has grown rapidly, driven by policy changes after the Fukushima incident and strong incentives. Renewables now account for about 25% of Japan’s energy mix, with over 75 GW of installed capacity.

December saw the outline for the 7th Strategic Energy Plan, which outlines an increase in renewable capacity to 40-50% of the energy mix by 2040. Nuclear power is also slated to increase, certainly through reactor restarts, though also encouraging replacement reactors on existing sites and potential new buildout.

As opposed to the previous plan released in 2021, which was prior to key global events such as Russia’s invasion of Ukraine and the Israel-Hamas conflicts, as well as the rapid rise of energy hungry AI and data centers, the current plan predicts an increase in overall energy consumption. This has led to a sudden embrace of nuclear power.

Last October, Shigeru Ishiba became Japan’s new Prime Minister. A longtime advocate for renewable energy and decarbonization, in his first speech he mentioned that energy demand will rise due to AI and digitalization, even before the new Strategic Energy Plan is released.

Despite Donald Trump’s re-election to office in the U.S., and close U.S.-Japan ties, the key factors of increasing energy demand and importance on energy security for Japan point in the direction of a growing, further diversified and distributed energy market for Japan. Let’s look at our outlook for the job market in key sectors for 2025.

PPA demand Increase

Corporate Power Purchase Agreements (CPPAs) are growing in Japan, driven by strong private sector demand for green energy. Last year, Shizen Energy signed CPPAs with Microsoft and Google for 30 MW each, while Invenergy secured a 60 MW virtual PPA with Honda for its Hokkaido wind farm. Eku Energy and Tokyo Gas also set up the first tolling agreement for a 30 MW BESS project in Kyushu. PPA deal sizes are increasing, with Vena Energy signing a 72 MW PPA with Yahoo/LINE for a single project.

This surge in demand is creating more job opportunities in the energy market, with developers, offtakers, market advisors, lenders and brokerage firms all clamoring for talent who can originate, negotiate, structure and price CPPA agreements.

Japan’s power markets is the place to be

Japan, the third-largest national energy market globally, is seeing significant growth in power market trading, driven by increased volumes on the European Energy Exchange (EEX), which saw almost a fourfold rise last year. Global players like InCommodities, BP, Citadel, Engie, and Japanese megabank MUFG have entered the market, alongside a rise in physical power trading on JEPX, spot trading, and algorithmic trading.

This surge in activity is creating more opportunities for traders, analysts, and risk professionals, as demand for expertise in managing market volatility, trading strategies, and risk management grows. While Japan’s market isn’t as volatile as Australia’s, the larger capacity and attractive growth potential make it a key focus for global players.

Slow and steady despite headwinds, offshore wind

Despite challenges in the global offshore wind sector, including auction delays and high-profile market exits, the number of projects set for construction by 2030 is steadily increasing, creating significant job opportunities.

Following a delay over Round 1’s uproar over accusations of unfair practices, the Round 2 auction had four projects totaling 1.8 GW, with a diverse range of winners, including major trading houses, EPCOs, and foreign firms like RWE and Iberdrola. Round 3 results are now out, with the new combo of JERA+BP involved in both Akita and Yamagata projects.

Additionally, new promotion zones in Akita, Hokkaido, and Wakayama are advancing, with Wakayama’s floating offshore wind zone marking a key development. Floating wind is seen as crucial to unlocking Japan’s vast offshore wind potential, possibly able to generate hundreds of GW of power from the country’s Exclusive Economic Zone (EEZ).

While rising raw material and supply chain costs continue to present challenges, the long-term outlook remains positive, with increasing projects expected to drive job growth across construction, manufacturing, and project management roles in the offshore wind industry.

Solar, smaller and more distributed with local growth expected

During the FiT boom of the mid-2010s, generous subsidies led to questionable large-scale solar projects, often built on mountainsides, displacing thousands of trees and habitats, while incurring high civil engineering costs. With FiT prices for solar now below ¥8/ kWh, and CPPA prices driven by market forces, such projects are no longer economically viable or considered environmentally acceptable. Though large scale projects are still under development, they’re increasingly scarce and competed over, which relates to a plateau in the number of career opportunities in mega-solar.

Meanwhile, distributed solar is gaining momentum. The trend of aggregating numerous small-scale (<2MW) plants and installing on-site solar for commercial and industrial customers is growing rapidly. Carports, rooftops, small onsite installations as well as agri-solar plants for crops that need higher shade, such as matcha tea, are increasing. This is more of a market for domestic players rather than large multinational developers, hence we see the solar increase becoming more distributed over the country and less internationalized than over the past decade.

Big battery boom comes to Japan

Last summer, renewable generators, particularly in Kyushu and Chugoku faced frustration, with curtailment rates reaching up to 50% in some areas. This has spurred the development of BESS assets to absorb excess power, which has attracted a number of new market players.

While financing pure merchant BESS projects remains challenging, and tolling agreements are still emerging, the LTDA is driving short-term growth, with 30 projects receiving subsidies in 2024, split between Japanese and foreign developers, and a planned doubling of BESS allocations in 2025. More recently, 27 projects received subsidies through the Sustainable Open Innovation Initiative that will continue to add more flexible capacity in the coming years.

As many BESS players are active in PV solar and other power generation projects, the demand for talent in land acquisition, project development, and project management is growing but not at the rate of a market built from scratch. Rather, specific demand in electrical engineering, energy procurement and market expertise creates more opportunities for experienced professionals.

What about things that burn?

Last year, the Japanese government announced a ¥3 trillion fund to develop the hydrogen supply chain, including a cost-for-difference (CfD) mechanism to subsidize the gap between production and market prices, similar to the UK’s model for scaling costly new technologies. In Japan, low-carbon hydrogen includes both green and blue hydrogen.

LNG is clearly going to be a major part of Japan’s energy mix for the foreseeable future due to increasing demand, and a long ramp of renewables, nuclear restarts and hydrogen/ammonia technologies reaching levels suitable for commercial scale deployment.

This is an area where we see demand for talent plateauing, as LNG or other hydrocarbon skilled professionals will have the opportunity to transfer to H2/ NH3 related jobs within the large Japanese trading and engineering firms that operate across both fossil and clean-burning fuels.

Andrew Statter is a Partner at Titan GreenTech, an executive recruitment agency focused on the clean energy space.

ASIA ENERGY REVIEW

BY JOHN VAROLI

A brief overview of the region’s main energy events from the past week

Australia / Clean energy investments

As President Trump works to roll back many Biden-era clean energy policies, Australia’s renewable industry hopes to attract investments allocated for the U.S., said Richie Merzian, CEO of Clean Energy Investor Group. Biden’s IRA drew global investment into the U.S. renewables market. Now, with uncertainty surrounding the future of IRA funding under Trump, Merzian sees potential for Australia to attract some redirected investment.

China / Renewables

Chinese companies installed a record 24 GW of energy capacity in Belt & Road countries in 2024, doubling the figure over 2023 and the highest level of investment since the initiative was launched in 2013. According to Wood Mackenzie, 52% of the projects were renewables, which includes 8 GW of solar power and 5 GW of hydroelectric power. Solar energy made up 67% of clean energy capacity added in 2024.

Green hydrogen

Around 83% of the low carbon hydrogen capacity to go online in 2030 is expected to come from green hydrogen plants, reported GlobalData. The remainder will come from blue hydrogen, whilst purple and turquoise hydrogen capacities are anticipated to be miniscule. Only about 2% of the total expected by 2030 is currently operational.

India / Coal imports

India lowered imports of thermal coal by over 5.5 Mt in 2024 over 2023, according to Kpler. But India’s total coal-fired power generation hit new highs last year; lower imports mean that higher volumes of domestic coal were burned for power instead.

India / Renewables

Reliance Power appointed Neeraj Parakh as its CEO, subject to the approval of board members. The appointment took effect on Jan 20 and runs for three years.

Indonesia / Coal

Indonesia said that the U.S. plans to scrap a coal climate plan as Trump promotes policies to foster fossil fuels production and consumption. The two countries are part of the Just Energy Transition Partnership.

Malaysia / Oil

Over the next three years to 2027, Petronas aims to increase Malaysia’s oil and gas production by about 18% to 2 million barrels of oil equivalent per day (boepd). As of 2024, Malaysia’s oil and gas output has averaged 1.7 million boepd.

Sri Lanka / Energy development

The World Bank will support Sri Lanka in the development of various sectors, including energy, with plans to finance three key projects totaling $200 million.

South Korea / Microgrids

Scientists from Incheon National University have developed a new optimization model to improve microgrid operation in response to unexpected changes in power supply and demand. The enhanced model boosts the efficiency and reliability of microgrids and also offers scalable solutions.

Disclaimer

This communication has been prepared for information purposes only, is confidential and may be legally privileged. This is a subscription-only service and is directed at those who have expressly asked K.K. Yuri Group or one of its representatives to be added to the mailing list. This document may not be onwardly circulated or reproduced without prior written consent from Yuri Group, which retains all copyright to the content of this report.

Yuri Group is not registered as an investment advisor in any jurisdiction. Our research and all the content express our opinions, which are generally based on available public information, field studies and own analysis. Content is limited to general comment upon general political, economic and market issues, asset classes and types of investments. The report and all of its content does not constitute a recommendation or solicitation to buy, sell, subscribe for or underwrite any product or physical commodity, or a financial instrument.

The information contained in this report is obtained from sources believed to be reliable and in good faith. No representation or warranty is made that it is accurate or complete. Opinions and views expressed are subject to change without notice, as are prices and availability, which are indicative only. There is no obligation to notify recipients of any changes to this data or to do so in the future. No responsibility is accepted for the use of or reliance on the information provided. In no circumstances will Yuri Group be liable for any indirect or direct loss, or consequential loss or damages arising from the use of, any inability to use, or any inaccuracy in the information.

K.K. Yuri Group: Hulic Ochanomizu Bldg. 3F, 2-3-11, Surugadai, Kanda, Chiyoda-ku, Tokyo, Japan, 101-0062.